Posted originally on May 1, 2024 By Martin Armstrong

I do not agree with Donald Trump’s view of the Federal Reserve. I speak on behalf of sound economic policies that benefit the people. I do not blindly support a political candidate for the sake of being on the right side. Now, I criticized Trump during his presidency for constantly pressuring the central bank to lower interest rates. There are rumors swirling that Trump, if elected, would set the price of interest rates himself without the advice of the Federal Reserve. While this may be an extreme side of the rumor, Trump and every other president would like more power over the Federal Reserve — BAD IDEA!

What we must keep in mind is that the Federal Reserve’s original design, which lasted for about one year, was brilliant. The classic banking model involved borrowing from depositors on a demand basis and lending long-term, making a profit on the spread in interest rates, such as for business loans and mortgages. This was relationship banking, not today’s transactional banking model.

This was fractional banking insofar as about 8% of the money needed to remain free to service demand requirements. The crisis comes during an economic contraction when people run to the bank for a loss of confidence and demand to withdraw their funds. This results in the value of cash rising in purchasing power compared to assets, so asset values collapse.

The idea of “elastic money” was to increase the supply of cash during such a crisis to meet the demand for withdrawals and that would offset the need to sell assets by calling in long-term debts. By increasing the money supply on a temporary basis, the Fed could offset the contraction in theory smoothing out the business cycle.

This was a brilliant scheme. However, it has been Congress, and not the Fed, that corrupted that mechanism. The banks technically owned the Fed as this was supposed to save the taxpayer money. The banks should contribute to their own bailout fund. Furthermore, the Fed’s design was also about buying in corporate paper when banks would not lend money. This was a mechanism used to offset rising unemployment if corporations could not fund their operations. They supplemented this by the management of regional interest rates to balance the domestic economy. Each branch of the Fed could raise or lower their local interest rate autonomously to attract capital when there was a local shortage or deflect capital when there was too much.

Congress began to manipulate the Federal Reserve for their own self-interest when World War I broke out on April 6, 1917. The alteration to the design of the Fed was to direct it to buy government bonds, not corporate. In this first step, they never reverse this decree after the war. They removed the brilliant design to stimulate the economy directly by purchasing corporate paper during a recession. In the last 2007-2009 crisis, the government wrote a check to TARP and hoped that the banks would lend money, but they did not. Removing this first pillar of the independent Fed distorted the entire system. It then made little sense for bankers to own shares in an entity that was no longer privately controlled.

Banks became traders during the 1929 Boom-Bust Cycle. Goldman Sachs became deeply involved in the bull market, establishing numerous trusts and mergers. Goldman Sachs expanded the leverage going right into the eye of the storm that was about to hit starting on September 3, 1929. The crash wipes our 70% of Goldman’s entire market.

The Glass-Steagall Act, also known as the Banking Act of 1933 (48 Stat. 162), was passed by Congress in 1933 and prohibited commercial banks from engaging in the investment business. Around 5,000 banks failed during the Great Depression largely because banks sold trusts and foreign sovereign government bonds to the public in small denominations. Bill Clinton later repealed Glass-Steagall and handed the power back over to the bankers. Disaster strikes every time the government tries to manipulate the free market.

People believe the Fed has the power to create money out of thin air, yet never explain why the Fed was given that power. You cannot have a fixed money supply as the population increases, then you end up with DEFLATION, which is the rise in the value of money. You can double the money supply, but if the people hoard it, as they tend to do during private waves when the public loses all trust in government, you will never create inflation. There was a huge contraction in the velocity of money during the Great Depression for this very reason.

The Biden Administration, as has the Trump Administration, has come after the Fed. Politicians merely want the economy to appear strong under their reign and fail to see the long-term impact of policies. Politicians have no knowledge of economics or the insight to run the Fed. Not to mention that law does not permit Washington to bark orders at the Fed, although Washington does oversee the Fed and can force the central bank to change its policies to align with government spending or repel debt buyers.

Trump is a borrower, not a lender. His bankruptcies were the result of the business cycle and he leverages himself to the hilt so when the recession comes, he gets in trouble and when it is booming he claims to be a fantastic investor. But he is no trader. He could have hedged the business cycle but did not.

Chairman Jerome Powell and Trump clashed repeatedly. Not so coincidentally, Powell and numerous Fed bank presidents have their terms expiring in 2028 – a key year, as indicated by our models. The Biden Administration has already driven the economy off a cliff. The central bank is merely trying to heal an already injured economy with a limited medical kit.

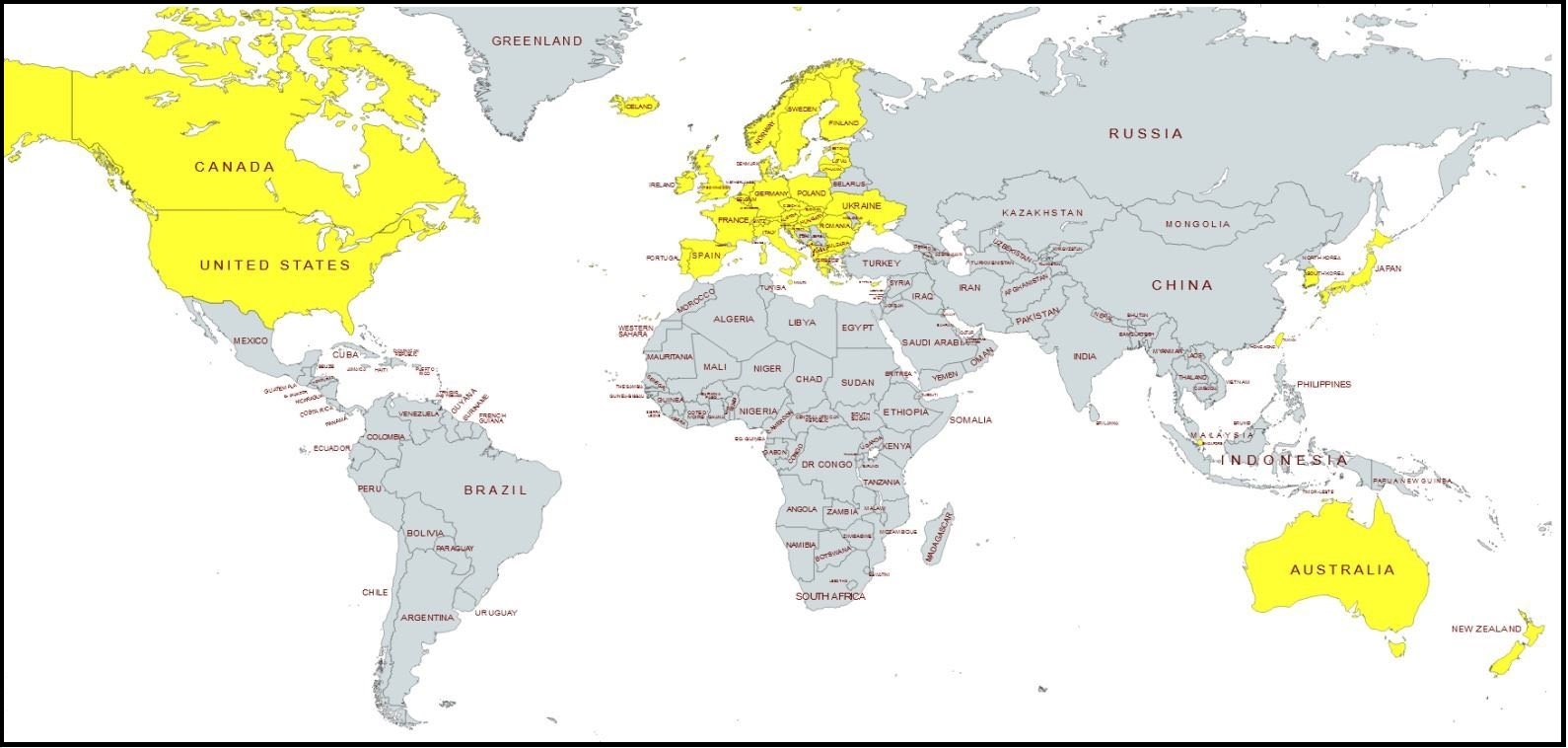

The Fed is INDEPENDENT and will not be bullied by Biden or Trump. The Fed understands that it has become the world’s central bank and its actions in raising rates have had a far greater impact externally particularly in emerging markets because so many other nations issue their debt in US dollars.