Posted originally on the CTH on March 10, 2023 | Sundance

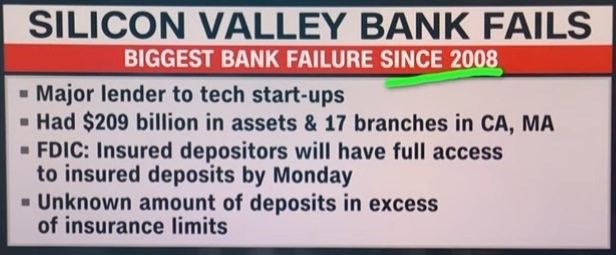

SVB is Silicon Valley Bank, the almost exclusive banking network for Venture Capitalists (VC), tech sector start-ups and tech industry holding accounts. 48 hours ago, SVB was a “grade A” Moodys rating. As of tonight, they are insolvent.

“All told, customers withdrew a staggering $42 billion of deposits by the end of Thursday, according to a California regulatory filing. […] “The precipitous deposit withdrawal has caused the Bank to be incapable of paying its obligations as they come due,” the California financial regulator stated. “The bank is now insolvent.” (link)

Now, as ridiculous as this sounds outside Silicon Valley, the powers that be are concerned about a ‘contagion‘ effect, and openly discussing the need for a taxpayer funded bailout. Blood-boiling doesn’t even begin to describe the sensation.

Let the Silicon Valley companies who started with the funds from the bank sell some of their capitalization on the market and finance the bailout themselves. After all, this is one interconnected system of lenders, borrowers and investors. This is not a crisis for the guy making their catered lunches, mowing their lawns, or washing their clothes.

♦The system. A tech guy/gal has an idea or product. Venture Capitalists (VC) organize the funding for the idea/product and go to SVB for money to start the company. The bank funds the startup and takes an equity position in the company. The VC brokers the deal, takes payment and also takes an equity position. The company launches and if successful builds a multi-billion enterprise. If they IPO (most do) then shares of the company are sold and the value of the company rises with the increased stock purchasing.

The shares of the company are capital. The shares can be sold to create funds that can support SVB. If SVB needs funds, let the networked companies sell some of their capital and fund the bank that generated their venture. They do not need outside ‘bailouts’. That’s just the way I look at it.

Listening to some voices saying the guy who mows the lawn of the tech company executive has a responsibility to ‘bailout’ the bank that created the wealth for the tech company executive, is just, well, another absurd example of how corrupt this entire financial system has become. Sorry, but this beyond annoys me.

CALIFORNIA – Regulators shuttered SVB Friday and seized its deposits in the largest U.S. banking failure since the 2008 financial crisis and the second-largest ever. The company’s downward spiral began late Wednesday, when it surprised investors with news that it needed to raise $2.25 billion to shore up its balance sheet. What followed was the rapid collapse of a highly-respected bank that had grown alongside its technology clients.

Even now, as the dust begins to settle on the second bank wind-down announced this week, members of the VC community are lamenting the role that other investors played in SVB’s demise.

“This was a hysteria-induced bank run caused by VCs,” Ryan Falvey, a fintech investor at Restive Ventures, told CNBC. “This is going to go down as one of the ultimate cases of an industry cutting its nose off to spite its face.”

The episode is the latest fallout from the Federal Reserve’s actions to stem inflation with its most aggressive rate hiking campaign in four decades. The ramifications could be far-reaching, with concerns that startups may be unable to pay employees in coming days, venture investors may struggle to raise funds, and an already-battered sector could face a deeper malaise.

The roots of SVB’s collapse stem from dislocations spurred by higher rates. As startup clients withdrew deposits to keep their companies afloat in a chilly environment for IPOs and private fundraising, SVB found itself short on capital. It had been forced to sell all of its available-for-sale bonds at a $1.8 billion loss, the bank said late Wednesday.

The sudden need for fresh capital, coming on the heels of the collapse of crypto-focused Silvergate bank, sparked another wave of deposit withdrawals Thursday as VCs instructed their portfolio companies to move funds, according to people with knowledge of the matter. The concern: a bank run at SVB could pose an existential threat to startups who couldn’t tap their deposits. (read more)

.