Armstrong Economics Blog/America’s Economic History

Re-Posted Feb 1, 2020 by Martin Armstrong

Armstrong on Bloomberg in Canada on the ECM Turn

Armstrong Economics Blog/Armstrong in the Media

Re-Posted Jan 25, 2020 by Martin Armstrong

I will do mainstream media interviews outside the USA. I have just done yesterday a TV appearance on BNN Bloomberg in Canada. These are typically very short interviews so it is hard to get a lot into two 7 minute segments. Nevertheless, I gave it my best sho

Australia – The Most Aggressive Tax Authority in the World?

Armstrong Economics Blog/The Hunt for Taxes

Re-Posted Jan 24, 2020 by Martin Armstrong

Australia has been perhaps the most aggressive tax authority in the world. They are certainly competing to be #1. Besides stalking children to see where they go to school, and then demanded the school reveal how the parents pay the tuition, now they are going after insurance companies demanding to know what assets people are insuring.

The Australian Taxation Office’s new scheme is hunting money and assets to seize and tax. They are demanding the last five years’ worth of insurance policy information from more than 30 insurance companies. They are searching for “lifestyle assets” of the rich who they clearly hate with a passion. They are demanding details on clients who own yachts, any boats, fine art, thoroughbred horses, high-value cars and aircraft. They have targeted around 350,000 taxpayers.

This is the world we live in — “1984” has just been late to arrive. It makes you really understand the entire principle behind Atlas Shrugged.

Will Governments Respond Globally or Just Act Independently?

Armstrong Economivs Blog/Banking Crisis

Re-Posted Jan 24, 2020 by Martin Armstrong

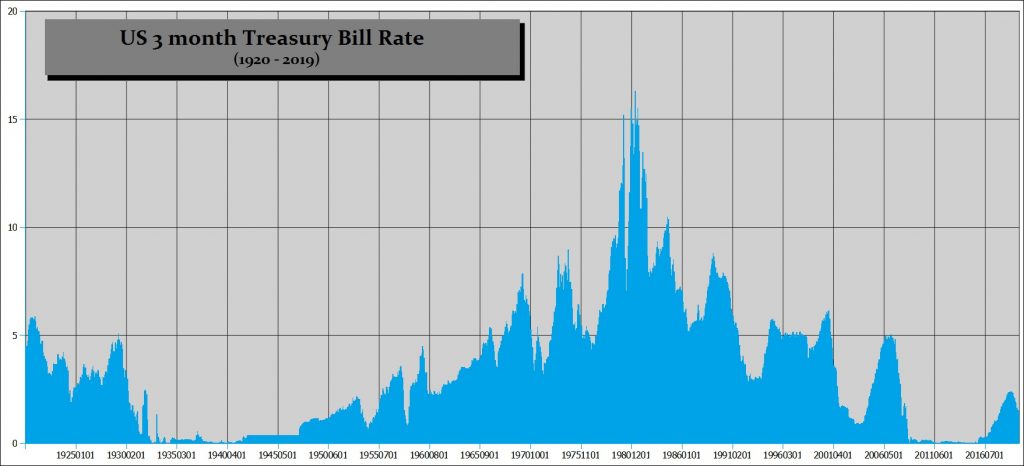

QUESTION: Is there any comparison to be made between the current suppression of interest rates by the Fed and its suppression of interest rates in the 1920s? With sovereign defaults on the horizon, it seems that history could be repeating itself.

RK

ANSWER: The Fed’s attempt to lower rates in 1927 to help Europe backfired. It sent capital rushing out of Europe and into the US share market as well as real estate. The Fed had to then abandon its international policy and focus on domestic policy objectives. That will most likely take place again. Despite this crisis becoming a global contagion, each country will defend itself and adopt its own measures independently. That is where the risk will truly lie because politicians are used to running on promises of power. They are not ready to surrender domestic policy objectives for international ones. I suspect we will need such a crisis before we can understand we are all connected

Interest Rates and the Great Global Crisis

Armstrong Economics Blog/Interest Rates

Re-Posted Jan 22, 2020 by Martin Armstrong

COMMENT: I attended your 2016 WEC and I thought you would be wrong that interest rates would rise and the whole big bang thing. Rates have risen only in the US, the pension crisis is clearly unfolding, and states have been going bust. Now there is the Repo Crisis and I did buy the report. I will return to the WEC this year. I realize that you are able to forecast long-term trends that nobody else can even see. Here in Australia, my God, it seems like the government has become occupied by Nazis who were also hunting money.

Good on ya!

PD

REPLY: Yes, most people have no idea that Hitler had passed similar laws that made it illegal to have a bank account outside the country. That prompted Switzerland to adopt its secrecy laws. Western governments are doing exactly as Hitler did. Oh yes, he killed a lot of Jews and others. But make no mistake about it, that was not just hatred. It was profitable. Hitler confiscated all their assets and then harvested even the gold in their teeth.

Just scan history and you will see a pattern. Henry VIII created the Church of England but confiscated all the assets of the Catholic Church. Constantine the Great adopted Christianity as the major religion and then confiscated the assets of the pagan temples. The only leader who confiscated assets of the Church without pretending he was adopting another religion was Napoleon. The Spanish Inquisition persecuted people, including the Jews and Arabs. However, that was also profitable for they confiscated their assets.

The rule of law in England at the time of the American Revolution had 240 felonies. The penalty was death so there too the king confiscated all your assets and threw your family out on the street. Just follow the money. Now they call it criminal to hide money from the government. It is money laundering to put cash in a safe deposit box — read the fine print — it can be confiscated! The criminal law is far too often used for the financial gain of the state.

As everyone knows, I turned out to be an institutional adviser. Consequently, the model that I developed had to be able to forecast the trend of all time levels. It was critical to be able to provide a reliable forecast out for 10 years when truly planning strategy for multinational corporations. That is why we had over $2.5 trillion under contract when the US national debt was just $6 trillion. We were by far the largest international adviser in the world.

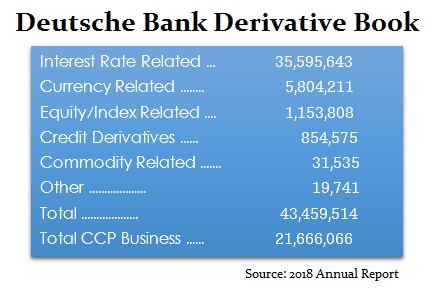

The disparity in the rates between the USA and those in Japan and Europe are all part of the crisis in both liquidity as well as international banking. The vast majority of derivatives out there are interest rate related. Europe has a major, major, major problem. An uptick in interest rates will be devastating in so many ways. It will not only cause major losses for the ECB portfolio of bonds with over $12 trillion in negative-yielding bonds, but then you have the derivatives market.

On top of that, to make derivatives safer, after 2007 the government insisted that all derivatives had to go through a central counterparty clearing house (CCP) agent. As you can see, the 2018 annual report showed that Deutsche Bank also acts as a CCP to which it guarantees another €21.6 trillion Euros of exposure.

This experiment with negative interest rates has created a nightmare from which we are desperately afraid to wake up because it could be very real.

Shanghai

This year we are holding three World Economic Conference events — Shanghai in May, Frankfurt in June, and then Orlando in November. Each will be focused on the local region within the scope of the global context. Many people have indicated they want to go to Shanghai and kick the tires personally. You can apply for a visa and then visit Beijing and the Great Wall as well as the Forbidden City. They are spectacular things to see while you can.

This year we are holding three World Economic Conference events — Shanghai in May, Frankfurt in June, and then Orlando in November. Each will be focused on the local region within the scope of the global context. Many people have indicated they want to go to Shanghai and kick the tires personally. You can apply for a visa and then visit Beijing and the Great Wall as well as the Forbidden City. They are spectacular things to see while you can.

You do not need a visa to visit Shanghai if you have an ongoing ticket to another city, not just a return. So fly to Shanghai, then to Hong Kong, and home. I believe you are allowed to stay for up to 7 days on that basis. Make sure you check yourself because things change. So if you want to see Beijing, just apply for a visa. It’s not a big deal.

The Frankfurt WEC will focus on the crisis in Europe. The Orlando WEC will be naturally focused on the world economy and we will have the results of the 2020 election in the USA by that time.

There will be special tickets for those attending all three events or just two.

West Virginia & the Separatist Movement

Armstrong Economics Blog/Rule of Law

Re-Posted Jan 21, 2020 by Martin Armstrong

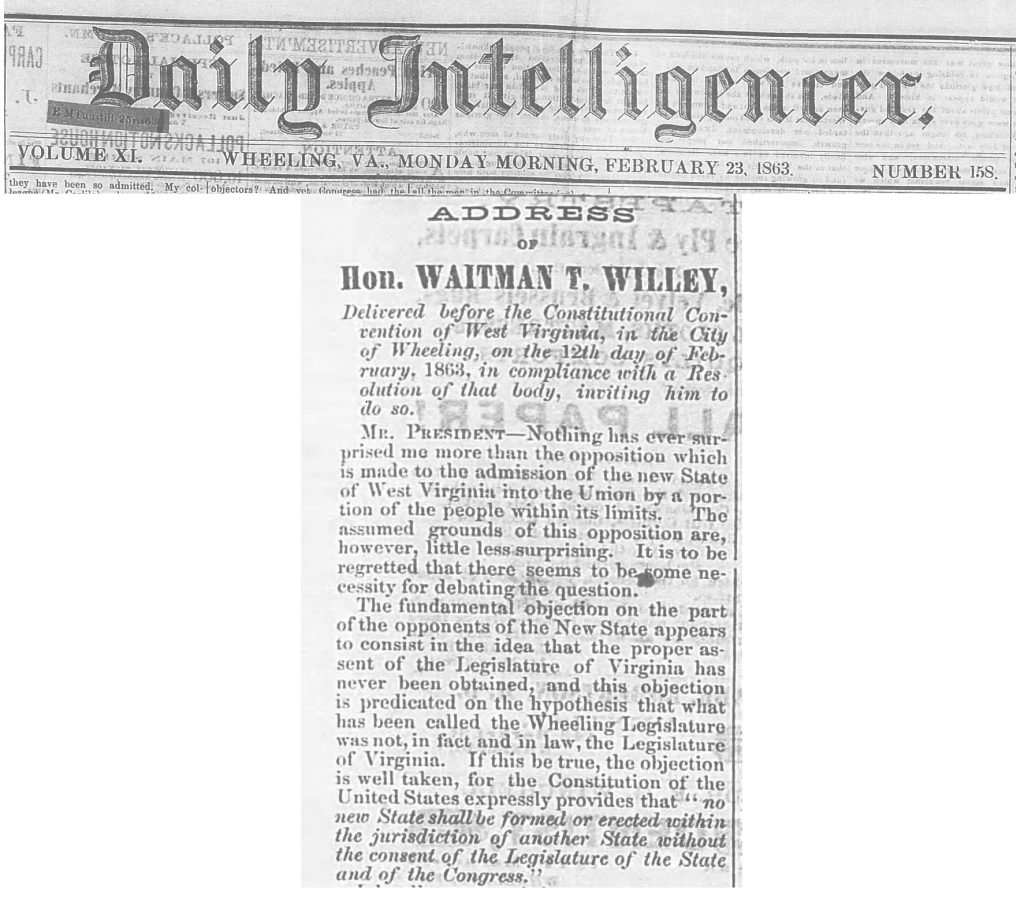

There is a new separatist movement forming in Virginia over the proposed gun laws. This new separatist movement taking place is in a state that already separated into two back in 1863 which some question whether it was lawfully carried out back then.

US Constitution: Article IV: Section 3

New States may be admitted by the Congress into this Union; but no new State shall be formed or erected within the Jurisdiction of any other State; nor any State be formed by the Junction of two or more States, or Parts of States, without the Consent of the Legislatures of the States concerned as well as of the Congress.

The interesting question was that since Virginia moved and joined the Confederate States, was their consent still required if they did not regard themselves to still be a state of the union? Hence, West Virginia was formed during the American Civil War (1861–1865) and is actually the only state to form by seceding from a Confederate state. The western part of the state of Virginia (1776–1863), was deeply against the views of the rest of Virginia over slavery. The population of West Virginia moved to separate from Virginia and was formalized by admittance to the Union as a new state in 1863.

Today, we have yet another rising separatist movement within Virginia as a result of House Resolution 8 which was introduced on January 14, 2020. This provides for an election to be had, pending approval of the General Assembly of the Commonwealth of Virginia, and a majority of qualified citizens voting upon the proposition prior to August 1, 2020, for the admission of certain counties and independent cities of the Commonwealth of Virginia to be admitted to the State of West Virginia as constituent counties, under the provisions of Article VI, Section 11 of the Constitution of West Virginia. The Legislature of West Virginia separated over the differences which had grown between the counties of Western Virginia and the government at Richmond, of the Commonwealth of Virginia. They concluded that they were irretrievably divided and therefore they formed a new State of West Virginia.

The Trans-Allegheny portions of Virginia perceived that they suffered under an inequitable measure of taxation by which they bore a disproportionate share of the tax burden in the state which is often a common complaint under socialism. They have argued that the Trans-Allegheny region has been denied its equitable share of representation in the government prejudiced by a large number of people demanding benefits from Richmond.

The realization that when the majority demands benefits from those who produce, much like Rand’s Atlas Shrugged, then the majority can impose tyranny upon the minority and thus government no longer becomes the unbiased arbitrator within society. The neglect for the interests of many of the remaining counties of the Commonwealth of Virginia is at the heart of this rising separatist movement.

More recently, the government at Richmond has adopted the restraint upon the rights guaranteed under the Second Amendment of the United States Constitution to the citizens of that Commonwealth. In the months since Democrats took control of Virginia’s government for the first time in over two decades, over 100 localities across Virginia have passed resolutions declaring themselves “Second Amendment Sanctuaries,” stating that they’re opposed to any bills which would restrict Second Amendment rights.

There is rising tension in Virginia ever since the Democrats took control of the State

The Coming Crisis – What to Watch?

Armstrong Economics Blog/Banking Crisis

Re-Posted Jan 20, 2020 by Martin Armstrong

QUESTION: Dear Martin – We owe your respect for what you are doing and I wanna say thanks for educating your followers like me. With the issue of this growing international crisis, are you able to provide ideas on what the triggers maybe when it begins to come out of the surface? What can we observe to identify the beginning, EU Bonds – you mentioned IGOV – the currency, what else? I guess all of your followers are highly interested in that.

Many thanks,

JH

ANSWER: The first was the inverted yield curve which led many to think we were heading into a recession last summer. Then the Repo Crisis hit and despite being touted as just a fluke due to taxes, after more than three months the Fed cannot get out of providing liquidity without stepping back and allowing the free markets to raise short-term rates.

The liquidity crisis has spread even to Japan. Here the Bank of Japan has stood up and announced it would buy government bonds without any limitation trying to also prevent interest rates from rising.

The ECB will have to deal with the whole negative interest rate crisis they have created. They will be forced to allow rates to rise or all member states will have to agree to allow the ECB to adopt the same policies as in Japan — buy all government debt without limit.

Keep an eye on Europe. I do not see any way of avoiding this crisis. Politicians are too busy with other things. The free market will push rates higher and the central banks will be unable to prevent the rise in rates ahead.

Stop Shaming People! TikTok’s Nurse Holly Slammed for Abstinence Advice

Capital Flows & the Next ECM

Armstrong Economics Blog/Capital Flow

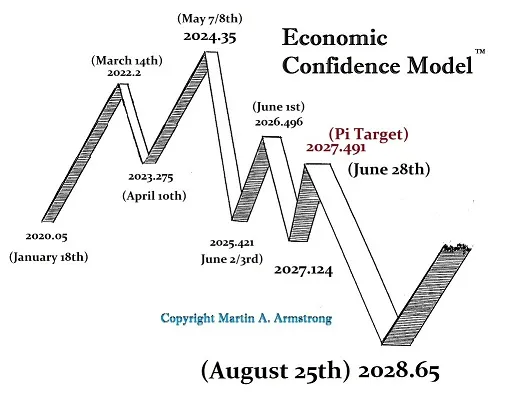

Re-Posted Jan 16, 2020 by Martin Armstrong

QUESTION: Sir,

You have advised us to avoid sovereign debt after the ECM date. I imagine that the crisis will affect nations unequally. It seems obvious that money would leave bonds in the more challenged, negative rate countries (EU and Japan). Might these flows come into US Treasuries, thereby stabilizing US rates, at least short-term? Could this be a trading opportunity (long) in our Treasuries? Thank you.

PK

ANSWER: So far, it appears that the capital flows will continue pointing to the USA going into 2022. Thereafter, we should expect a change in that trend in the same position of the ECM, which created the 1987 Crash also due to a capital flight from the dollar

Tax Proposals Rising in California Again

Armstrong Economics Blog/The Hunt for Taxes

Re-Posted Jan 16, 2020 by Martin Armstrong

Back in 2008, a California Socialist activist was gathering signatures in an attempt to impose a state wealth tax on the ballot that would have imposed a new 35% income surtax on top of the Federal income tax. He realized that people would flee the state, so the solution was to impose an exit tax, seizing 55% of assets exceeding $20 million that anyone possessed seeking to leave the state. On top of all of that, the proposed money raised would then buy controlling shares in large corporations operating in the state.

California is going broke and raising the income tax may present a problem. First, they are seeking to overrule Proposition 13 from 1978 which prohibited raising property tax rates. They are cleverly looking to overrule it by claiming that they should be allowed to raise taxes on business properties. That will open the door to raise property taxes on any property owned by a trust or any corporate structure. But the real concern is if the people vote for that on the 2020 ballot, the wording can be vague enough to allow property taxes to rise in economic difficulties.

Secondly, there is a proposal to introduce a wealth tax, which would circumvent the entire Proposition 13. This is just being talked about behind the curtain and would not be on the ballot in 2020. It is a proposed workaround because they cannot possibly reform and cut their own pensions