COMMENT: Marty, you have made many unbelievable forecasts in so many markets around the world. But your forecast that we would see a liquidity crisis after Labor Day and dollar hoarding is at the top of the list. There is nobody who saw this coming. Your computer can see things nobody can. Looking forward to Orlando this year. Two more board members are coming because of this forecast.

Amazing!

PVB

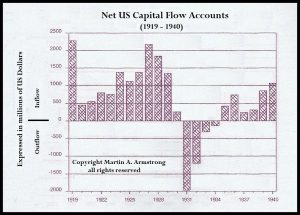

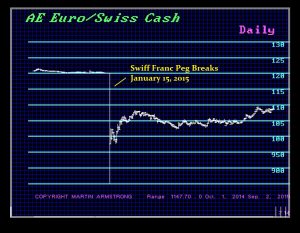

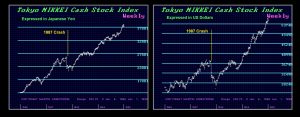

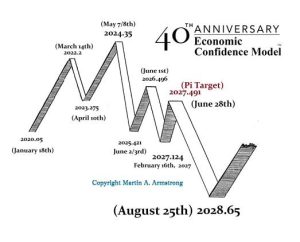

REPLY: This is what I have been saying. You cannot forecast something you have never witnessed that has not taken place before. It takes a computer with a vast database to see things unfold according to historical patterns, but in markets that event has never existed before.

We have a liquidity crisis unfolding because of massive uncertainty. In October, Draghi leaves and Lagarde enters who believes the answer is to eliminate cash. This is causing dollar hoarding and there are more $100 bills in circulation now with 70% of the physical money supply being hoarded OUTSIDE the USA. Even Australia is hunting money aggressively. They are even proposing nano-chips in $50 bills and up to track hoarding. So smart Australian’s won’t hoard A$ — they will use foreign currencies. Dah?

I mean what I say that the central banks areTRAPPED!!!!! People have NO IDEA what we face. The system is unraveling but not even those in government have understood how it was interwoven to begin with. This is all part of how we are heading into a major Monetary Crisis Cycle and I fear they will misunderstand it once again and create more stupid laws that will bring the entire house of cards down by the time we reach 2032.

I mean what I say that the central banks areTRAPPED!!!!! People have NO IDEA what we face. The system is unraveling but not even those in government have understood how it was interwoven to begin with. This is all part of how we are heading into a major Monetary Crisis Cycle and I fear they will misunderstand it once again and create more stupid laws that will bring the entire house of cards down by the time we reach 2032.

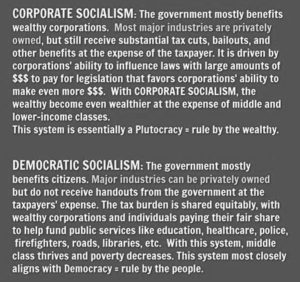

If you just play out what has taken place in socialism, there will be $400 trillion of unfunded liabilities by the time we get to 2032. That cannot be dealt with and I suspect we will see more authoritarian usurpation down the line. This is also why I have stated, my fear is NOT Trump, it is what comes AFTER Trump!

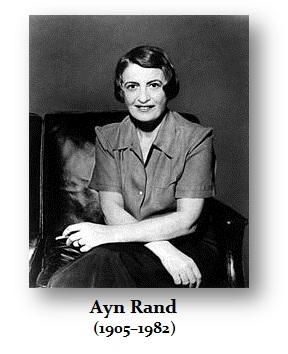

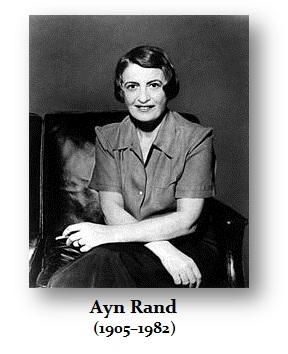

Governments have functioned on vote for me and I will rob someone else for you legally with a pen. This is how ALL Republics die. The very purpose of civilization was that coming together created a synergy that was beneficial for all. When government has always turned against one class for the benefit of another, the purpose of civilization ceases to exist and you revert back to separatism. Read “Atlas Shrugged.” When that was published, all the socialists hated it.

“When you see that in order to produce, you need to obtain permission from men who produce nothing; when you see that money is flowing to those who deal not in goods, but in favors; when you see that men get rich more easily by graft than by work, and your laws no longer protect you against them, but protect them against you. . . you may know that your society is doomed.”

“Atlas Shrugged” – Ayn Rand

- p. 413 ; Francisco d’Anconia to Bertram Scudder

They say it is wrong to discriminate for race, religion, sex, or sexual orientation. But it’s OK to discriminate against anyone who disagrees with those in power or those with socialistic agendas if they have material wealth above average. This type of discrimination is perfectly fine because it suits their agenda. They cannot survive without trying to live off of other people’s money. What happens when the productive class refuses to produce? When “Atlas Shrugged,” it all comes crashing down.

They say it is wrong to discriminate for race, religion, sex, or sexual orientation. But it’s OK to discriminate against anyone who disagrees with those in power or those with socialistic agendas if they have material wealth above average. This type of discrimination is perfectly fine because it suits their agenda. They cannot survive without trying to live off of other people’s money. What happens when the productive class refuses to produce? When “Atlas Shrugged,” it all comes crashing down.

Do you know that when Ayn Rand published that book, she received the worst reviews ever. The press was socialistic agreeing with FDR. Despite having the press trying to prevent people from reading it, fearing the book would be against their socialistic philosophy, “Atlas Shrugged” has been ranked as #2 in the most influential books just behind the Bible. People like Bernie Sanders and Elizabeth Warren refuse to listen. They want to create utopia for themselves, convert the productive class into slaves, and expect them to work without enjoying the fruits of their own labor.

So buckle up. We are going to witness things many never even thought were possible. This may be the real confrontation between good & evil.