Armstrong Economics Blog/ECM

Re-Posted Aug 13, 2019 by Martin Armstrong

There is a very Dark Cloud hovering over the world economy and at the center of this cloud lies not just Europe, but Germany – the strongest economy holding up all of Europe. The German manufacturing sector is in freefall. Trump will be blamed calling this the result of his Trade War. It is probably too late to get him to even understand that his advisers are old-school and completely wrong with respect to trade. Their obsession with currency movements is what they taught back in school during the 1930s. My advice to China, let the yuan float and Trump will quickly see that China has been supporting its currency, not suppressing it.

Manufacturing indicators have deteriorated globally, yet in a very disproportionate manner. Trump will be blamed for this and his badgering the Fed to lower interest rates is also a fool’s game. Nobody looks at the elderly who were told to save for retirement and you will live off the interest. Their house values were undermined in the 2007-2009 New York Banker’s Mortgage-Backed scam that blew up the world economy from which we have been unable to fully recover. The younger generation cannot afford to buy a house as they are saddled with student loans thanks to the Clintons for degrees that are worthless as 65% cannot find jobs in what they have degrees for these days.

Manufacturing indicators have deteriorated globally, yet in a very disproportionate manner. Trump will be blamed for this and his badgering the Fed to lower interest rates is also a fool’s game. Nobody looks at the elderly who were told to save for retirement and you will live off the interest. Their house values were undermined in the 2007-2009 New York Banker’s Mortgage-Backed scam that blew up the world economy from which we have been unable to fully recover. The younger generation cannot afford to buy a house as they are saddled with student loans thanks to the Clintons for degrees that are worthless as 65% cannot find jobs in what they have degrees for these days.

The insanity of those in power knows no boundary when it comes to stupidity around the world. All they have is interest rates and after more than 10 years of excessively low to negative interest rates failing to stimulate the economy in Europe, what do they do? They argue that all physical money must be eliminated because people are hoarding cash and thus defeat their lower interest rates policy. The IMF recommends confiscating all cash and then driving interest rates deeply negative to force recovery. They remain ignorant that they have destroyed the retirement of the elderly now, as well as the those who have yet retired because they command pension funds must invest in government bonds to various percentages ensuring that pensions will collapse as well.

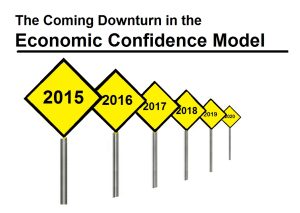

Manufacturing has been contracting compared to the service sector even on a global basis. The financial markets have appeared to be disconnected from the underlying economic trends because capital smells a very big rat. Capital has been shifting toward preservation rather than how much profit can it make today. Even the 10-year 3-month interest rates in the USA have tipped into the inverted yield curve confusing many that this is a sign of impending doom. They fail to read the tea leaves that capital is looking for a place to just park. Traditionally, inverted yield curves take place during recessions and we are in one globally heading into a major low come January 2020.

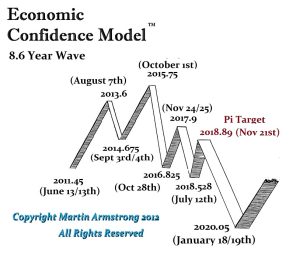

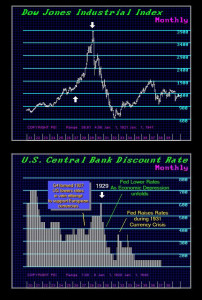

The Economic Confidence Model (ECM) has been on point despite the fact that schools warn you cannot forecast the business cycle yet the ECM has proven them wrong for decades. This particular cycle is exceptional. The central banks outside the USA have single-handedly destroyed their bond markets with Quantitative Easing. They are trapped and cannot allow interest rates to now rise to normal levels as they have kept the various governments on life-support.

The Economic Confidence Model (ECM) has been on point despite the fact that schools warn you cannot forecast the business cycle yet the ECM has proven them wrong for decades. This particular cycle is exceptional. The central banks outside the USA have single-handedly destroyed their bond markets with Quantitative Easing. They are trapped and cannot allow interest rates to now rise to normal levels as they have kept the various governments on life-support.

While central banks have tried to “stimulate” the economy, federal, state, and local governments are in dire need of money and have been raising taxes and increasing enforcement. Government pensions are wiping out budgets in Europe, America, and Japan. The forces of the central banks have been directly opposed by the political fiscal side of government.

We are facing a very Dark Financial Storm from which there is no escape. There is no advice being given to so many governments to avoid this crisis and waking up next year to this error will be too late. There will be nothing that can be done to put it all back together and live happily ever after. Welcome to the reality we face. At least this will make for a very interesting WEC. Make no mistake about it. They will lay all the blame on Trump and attribute this to trade rather than finance.

Can the US Government Really Force the Dollar Lower?

Armstrong Economics Blog/Capital Flow

Re-Posted Aug 12, 2019 by Martin Armstrong

QUESTION: Hi Martin, What tools do the US have to TRY and manipulate their dollar lower (other than cutting interest rates) and in your opinion would they be successful? How much do they have in the Exchange Stabilization Fund? Do they have a defense plan to limit and control capital flows coming in?

Thanks,

RM

ANSWER: They lack any power to prevent a dollar rally. The Exchange Stabilization Fund (ESF) is a U.S. Department of Treasury emergency reserve fund that includes holdings of U.S. dollars (USD), other foreign currencies, and special drawing rights (SDR) funds. The financial statement of the ESF can be accessed at “Reports” or “Finances and Operations.” However, all previous attempts at manipulating currencies have ended in disaster. Yes, the U.S. could put capital controls to block capital coming in, but they would destroy the world economy if they even attempted such a hair-brain idea.

Lowering interest rates will not help for if capital fears survival elsewhere, the level of interest rates will mean nothing. Just look at the creation of the G5 at the Plaza Accord. The market had already turned so their manipulation was already in the direction of the decline. When the dollar fell too far and the other members complained, they then held the Louvre Accord. The markets saw them as incompetent and the dollar continued its cyclical decline on schedule.

Therefore, I have yet to find any period in history where there has been a coordinated effort that has ever succeeded.

Why Gold Stocks Rallied During the Great Depression

Armstrong Economics Blog/Gold

Re-Posted Aug 12, 2019 by Martin Armstrong

QUESTION: Hi Marty

Can you enlighten us on what happened back in history to gold mining shares in terms of why shares did not collapse during the crash of 1929 compared to what happened to mine shares in 2008?

What happened to the shares held by the public in 1933 when FDR confiscated gold?

So you were safe holding the shares!

GG

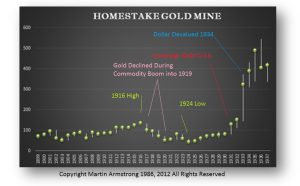

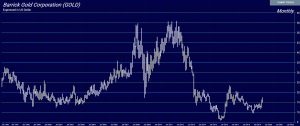

ANSWER: You must realize that gold was money under the gold standard. You can see how it declined following the commodity rally during World War I and eventually bottomed in 1924. During the Great Depression, cash was king and as such Homestake rallied into 1930, but then began to break out with the Monetary Crisis in 1931. The sharp rise came in 1934 with the devaluation of the dollar. Therefore, any comparison to modern times is irrelevant since we are not on a gold standard. Gold now responds in the opposite direction of the currency.

A Boy Learns About Taxes

Is Buffett Just Wrong?

Armstrong Economics Blog/Stock Indicies

Re-Posted Aug 9, 2019 by Martin Armstrong

QUESTION: Warren Buffet has been a value investor and has only been interested in profits. You have explained that the trends shift and profits will yield to capital preservation. Would you say that Buffett is just wrong on his views?

JV

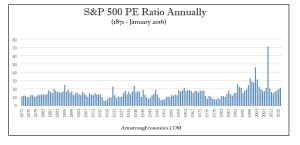

ANSWER: There is absolutely no relationship you will EVER discover that remains constant if you are looking at ratios between markets like silver, gold, or price earning ratios. The peak in the PE Ratio on the S&P 500 took place at the bottom in 2009, reflecting the shift from corporate profits to capital preservation. The classic question that arises is always fixed on the profit perspective rather than capital preservation. So people ask, “Can corporate profits keep booming by growing faster than the economy?”

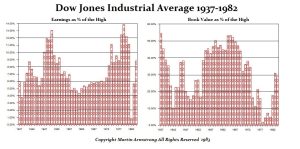

Back in the 1980s, I was getting blamed for creating the takeover boom because I was admittedly advising a number of the takeover players. I was also showing these charts at seminars back then. The book value of companies bottomed in 1977 and it was clear that you could buy a company, sell off its assets, and more than double your money. Markets move to extremes on both sides, and in the 1980s the share market was EXTREMELY undervalued.

There are people calling for a major crash because they argue that profits are detached from the reality of the overall economy, which has been propelling stock prices higher which has introduced a dynamic that is presenting a huge danger to the market. This is predicated on the presumption that the normal ebb and flow of markets demand a correction to realign equity values back to their traditional share of GDP. This thinking fails to understand that at times capital is NOT LOOKING to make a profit, but just to park money for preservation.

These same people who have missed the rally claim that the S&P 500’s fantastic performance since late 2016 has been exclusively about earnings. They NEVER look outside the country nor do they even look outside that single domestic perspective. They do not look at the world economy as a whole, and as such, they are completely dead wrong and attribute everything to one-sided domestic analysis.

That said, the answer to your question is Buffett wrong? The answer is YES!!!!! His little nitch was good from the ’80s for the market was UNDERVALUED and as such being a “value investor” was appropriate for that time period. The markets have shifted to capital preservation, which has also inspired the corporate buy-backs. Value Investing is now fading. Capital is shifting because of currency, risk in other countries, and none of this has to do with simplistic earnings.

Welcome to the new trend of Country Risk. You have to now keep your eye on all the balls flying around. This is not a game of baseball with a single pitche

The Money-Class is Always the First to Respond

Armstrong Economics Blog/ECM

Posted Aug 8, 2019 by Martin Armstrong

QUESTION: Dear Mr. Armstrong,

reading your blog daily I am wondering how much and what exactly has to change in the peoples’ minds apart from the global changes that will manifest through all that is in alignment according to cycles that you have presented to the world. You are one of the few people, but there are also few people that read your blog, so there is still the masses. I am mean, there is a cycle to the collective consciousness for sure but also according to what you write about history it usually culminates in some riots and/or even revolution. If you have the time, would you enlighten us to how we “grow” from an active and conscious collective (individuals in a Society) into a complacent and disgruntled one?

The spark that wakes up the majority of people up is what I am curious about.

Many thanks!

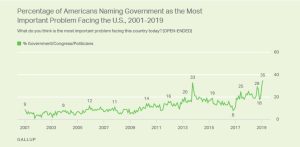

ANSWER: Economics is always the spark. It would not be simply because I write this blog that the world will wake up. The readership is by no means that extensive. The issue is self-interest. A recent Gallup Poll stated that about 35% of the people believe that government is the problem. We stand on the threshold of when the money-class (institutional) are beginning to realize that the central banks are trapped and that they lack the power to manipulate the economy. That is the readership here. As they begin to move, that impacts other aspects of the economy and the average person will then respond out of their self-interest.

What comes first is the collapse of confidence in the money-class. As that shifts, then we see the markets respond and it will be the free markets that apply the pressure for the political changes ahead.

Pay Off Mortgages or Invest Cash?

Armstrong Economics Blog/Opinion

Re-Posted Aug 8, 2019 by Martin Armstrong

QUESTION:

I moved from calif. and bought a home in Nevada but I took a loan on the home instead

of paying it off.

My question should I pay off the house or invest the money.

With what is coming I am confused on this issue.

TM

ANSWER: If you have a FIXED mortgage, do not pay it off. If it is at an old high rate then you should refinance. Cash will be better served in liquid markets when the time comes, not tied up in a property that you may not be able to sell when banks stop issuing mortgages

An Environmental Economist to Take the Head of the IMF

Armstrong Economics Blog/Politics

Re-Posted Aug 7, 2019 by Martin Armstrong

QUESTION: Mr. Armstrong; You had once written the Christine Lagarde was only a lawyer and she was really put in the role of the IMF chief by Obama. What do you have to comment on this new Bulgarian selection? DO you know her?

HU

ANSWER: Kristalina Georgieva will probably take over the International Monetary Fund (IMF). At least this Bulgarian is an economist, and she has banking experience whereas Christine LaGarde did not. Georgieva is currently chief executive of the World Bank. I do not know her personally, although we probably shook hands yet nothing more.

Georgieva was considered back in 2016 for the post of the UN Secretary General, but was passed over for the Portuguese António Guterres. For the IMF, Georgieva was the candidate of France and of some Eastern European states. Germany and others were backing the former Dutch Finance Minister Jeroen Dijsselbloem. This time the French won.

If we look at Georgieva background, she does hold a doctorate in economics and research at the London School of Economics and at the Massachusetts Institute of Technology (MIT). From 1993 to 2010 she worked at the World Bank. She headed the Environmental Department of Washington Bank and, in the meantime, her representative office in Moscow. In 2010 she moved to Brussels becoming a Commissioner as Europe’s top development aid worker.

When Jean-Claude Juncker took over the Presidency of the Commission in 2014, he made Georgieva Vice-President in charge of the budget. Georgieva had been involved in a major restructuring at the World Bank turning it greener. We should keep in mind that Georgieva wrote her doctoral thesis on “Environmental Policy and Economic Growth in the US.”

Can the Fed really Control the Economy?

Armstrong Economics Blog/Central Banks

Re-Posted Aug 7, 2019 by Martin Armstrong

QUESTION: This whirligig talk of whether the Fed cuts rates by 25 or 50 basis points is carnival-level absurdity. Does the Fed have the “pretense of knowledge,” as F.A. Hayek, said, that they can regulate the economy like turning up or down the thermostat? I know you don’t agree with this, Martin, but then, Wall St. trades on daily sentiment not ideology.

TM

ANSWER: I understand the theory, but where it is seriously flawed is the idea that people will borrow simply because you lower rates. More than 10 years of Quantitative Easing, which has failed, answers that question. The way the Fed was originally designed allowed it to stimulate the economy by purchasing corporate paper directly, which placed it in a better management position. Buying only government paper from banks who in turn hoard the money fails. As Larry Summers admitted, they have NEVER been able to predict a recession even once.

The Fed lowered rates during every recession to no avail just as the ECB has moved to negative rates without success. The central banks are trapped and they are quietly asking for help from the politicians which will never happen.

Forecasting the Broad Trend for Non-Investors

Armstrong Economics Blog/Forecasts

Re-Posted Aug 6, 2019 by Martin Armstrong

QUESTION: Hello,

about your recent post ‘The Sum of All our Economic Fears’… i understand you will give some advices to investors how to trade difficult times that lie ahead in 2020 and beyond. What i wonder is what we, non investors but just ordinary people who does have only house or the apartment they live in and day job, what we should do and what we can expect regarding crisis that’s coming our way. (many non investors are reading your blog, just for the love of knowledge, i’m sure you are aware of that)

Thank you for your time.

MR

ANSWER: The basic level of Socrates is designed for the non-investor who needs a broader outlook rather than short-term buy and sell strategies. I fully intend to make sure that information is available for the general public. The NY bankers have always wanted to shut down our forecasting, for they want people to only listen to their forecasts which are always self-serving. I will make every effort to ensure that this forecasts of Socrates will be available to the general public because we need not opinion and hype, but objectivity.