Armstrong Economics Blog/America’s Economic History

Re-Posted Feb 1, 2020 by Martin Armstrong

The Euro v Pound

Armstrong Economics Blog/BRITAIN

Re-Posted Jan 31, 2020 by Martin Armstrong

Despite all the yelling and threats on top of forecasts that Britain will fall apart without the EU, the markets do not reflect such a doomsday outlook. We do see 2021 and 2023 as important targets for turning points. The critical level will still remain at the 8250 level. If that is breached, then the political crisis in the EU will begin. The departure of Britain will leave a major hole in the budget of the EU which wants to fund its own army. As pressure rises on other members to chip in more money and raise taxes on their citizens even further, the European Project will remain a serious threat to the entire world economy.

Nigel Farage on the Meaning of Brexit

Armstrong Economics Blog/BRITAIN

Re-Posted Jan 31, 2020 by Martin Armstrong

Nigel Farage’s Final Appearance in the EU Parliament

Armstrong Economics Blog/BRITAIN

Re-Posted Jan 31, 2020 by Martin Armstrong

Brexit Day Has Arrived!

Armstrong Economics Blog/BRITAIN

Posted Jan 31, 2020 by Martin Armstrong

Welcome to Brexit Day! The British Mint is issuing a new 50 pence coin to mark leaving the EU at last. High-profile figures are already pledging to boycott the new coin. Alastair Campbell will boycott the coin because the slogan opposes his core beliefs. Philip Pullman will as well because, he says, it is missing an Oxford comma. These two people reflect the decline and fall of democracy. They simply refuse to accept the majority vote.

Of course, those who were in the “Remain” camp used every foul label they could find in the Oxford dictionary to desperately dehumanize those who voted to leave. The main label that stuck was to call them “racists” when the immigrants pouring from Merkel’s fatal mistake were claiming to be Muslim, which is a religion and not a race.

The “Remain” camp was even striking their own coins and selling them on eBay. These show the Queen holding her head when in fact the behind-the-curtain view was that she very much agreed with getting out of the EU.

Theresa May was a career politician who personally wanted to REMAIN. She negotiated half-heartedly and that was reflected in her abysmal management of the government.

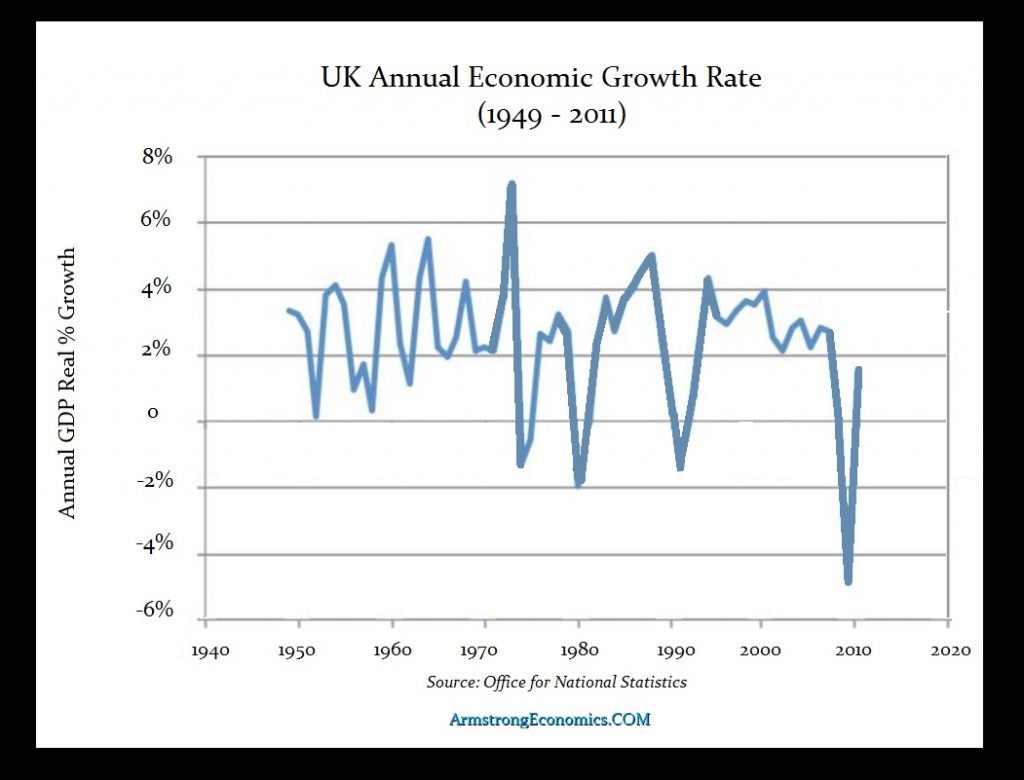

The most interesting aspect to demonstrate just how corrupt the politicians were in Britain who kept arguing to REMAIN was the fact that they were supporting their personal power and careers. All someone had to do was chart the government’s own statistics that proved Britain’s economic growth has declined ever since Britain joined the EU back in 1973. The continental Europeans in government have always resented the British, for without them they would be speaking German today. That has always left a resentful taste in their mouths. It’s kind of like how they say the best way to get rid of a friend is to lend them money.

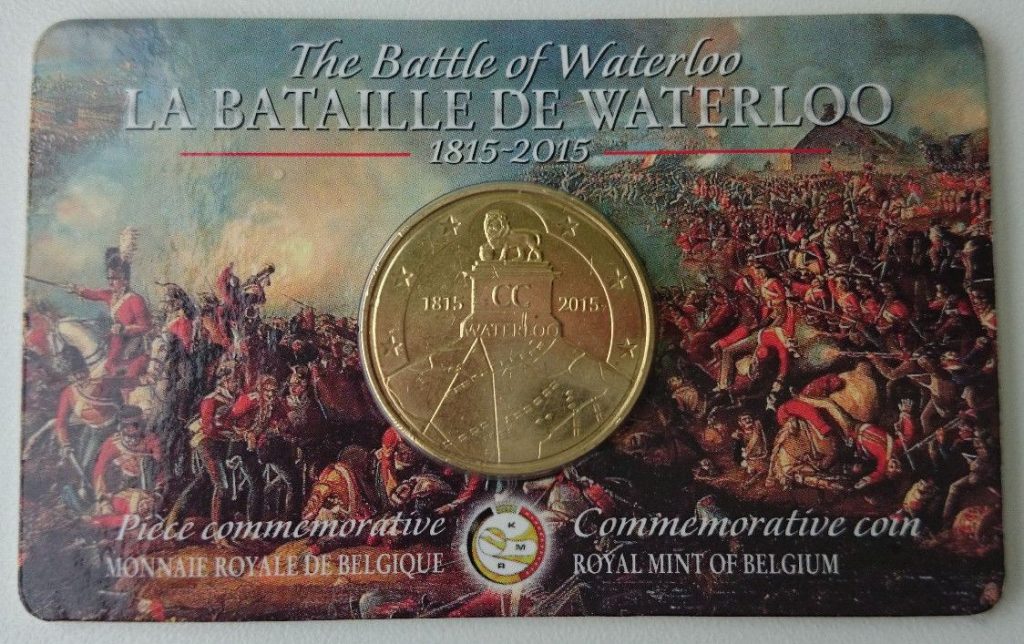

There will always be that resentment toward Britain. The French demanded that no EU member should issue coins that commemorated the defeat of Napoleon. There was a commemorative issue of coins, but they were not allowed to circulate pursuant to the demand of the French to join the euro. Resentments linger in Europe and always will. It is ingrained within the culture of so many hundreds of years of conflicts and war. The creation of the euro will never change history

Armstrong on Bloomberg in Canada on the ECM Turn

Armstrong Economics Blog/Armstrong in the Media

Re-Posted Jan 25, 2020 by Martin Armstrong

I will do mainstream media interviews outside the USA. I have just done yesterday a TV appearance on BNN Bloomberg in Canada. These are typically very short interviews so it is hard to get a lot into two 7 minute segments. Nevertheless, I gave it my best sho

Australia – The Most Aggressive Tax Authority in the World?

Armstrong Economics Blog/The Hunt for Taxes

Re-Posted Jan 24, 2020 by Martin Armstrong

Australia has been perhaps the most aggressive tax authority in the world. They are certainly competing to be #1. Besides stalking children to see where they go to school, and then demanded the school reveal how the parents pay the tuition, now they are going after insurance companies demanding to know what assets people are insuring.

The Australian Taxation Office’s new scheme is hunting money and assets to seize and tax. They are demanding the last five years’ worth of insurance policy information from more than 30 insurance companies. They are searching for “lifestyle assets” of the rich who they clearly hate with a passion. They are demanding details on clients who own yachts, any boats, fine art, thoroughbred horses, high-value cars and aircraft. They have targeted around 350,000 taxpayers.

This is the world we live in — “1984” has just been late to arrive. It makes you really understand the entire principle behind Atlas Shrugged.

Will Governments Respond Globally or Just Act Independently?

Armstrong Economivs Blog/Banking Crisis

Re-Posted Jan 24, 2020 by Martin Armstrong

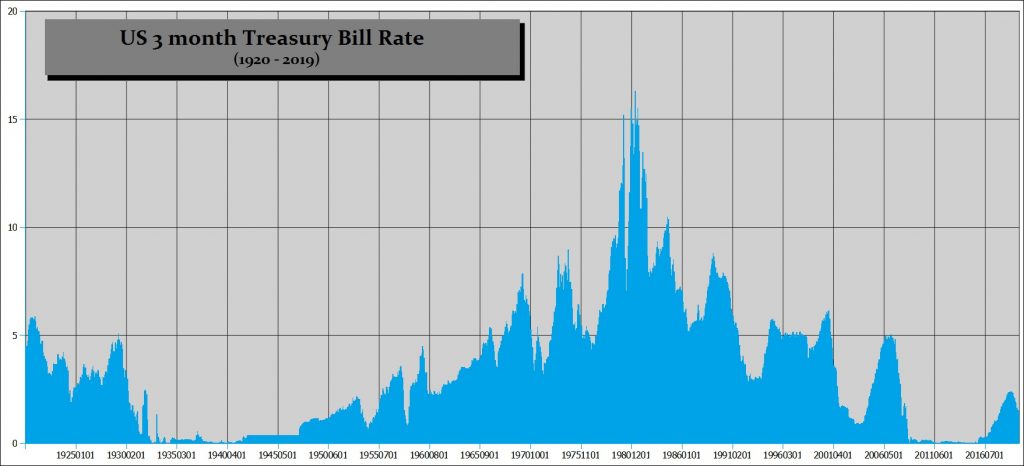

QUESTION: Is there any comparison to be made between the current suppression of interest rates by the Fed and its suppression of interest rates in the 1920s? With sovereign defaults on the horizon, it seems that history could be repeating itself.

RK

ANSWER: The Fed’s attempt to lower rates in 1927 to help Europe backfired. It sent capital rushing out of Europe and into the US share market as well as real estate. The Fed had to then abandon its international policy and focus on domestic policy objectives. That will most likely take place again. Despite this crisis becoming a global contagion, each country will defend itself and adopt its own measures independently. That is where the risk will truly lie because politicians are used to running on promises of power. They are not ready to surrender domestic policy objectives for international ones. I suspect we will need such a crisis before we can understand we are all connected

Interest Rates and the Great Global Crisis

Armstrong Economics Blog/Interest Rates

Re-Posted Jan 22, 2020 by Martin Armstrong

COMMENT: I attended your 2016 WEC and I thought you would be wrong that interest rates would rise and the whole big bang thing. Rates have risen only in the US, the pension crisis is clearly unfolding, and states have been going bust. Now there is the Repo Crisis and I did buy the report. I will return to the WEC this year. I realize that you are able to forecast long-term trends that nobody else can even see. Here in Australia, my God, it seems like the government has become occupied by Nazis who were also hunting money.

Good on ya!

PD

REPLY: Yes, most people have no idea that Hitler had passed similar laws that made it illegal to have a bank account outside the country. That prompted Switzerland to adopt its secrecy laws. Western governments are doing exactly as Hitler did. Oh yes, he killed a lot of Jews and others. But make no mistake about it, that was not just hatred. It was profitable. Hitler confiscated all their assets and then harvested even the gold in their teeth.

Just scan history and you will see a pattern. Henry VIII created the Church of England but confiscated all the assets of the Catholic Church. Constantine the Great adopted Christianity as the major religion and then confiscated the assets of the pagan temples. The only leader who confiscated assets of the Church without pretending he was adopting another religion was Napoleon. The Spanish Inquisition persecuted people, including the Jews and Arabs. However, that was also profitable for they confiscated their assets.

The rule of law in England at the time of the American Revolution had 240 felonies. The penalty was death so there too the king confiscated all your assets and threw your family out on the street. Just follow the money. Now they call it criminal to hide money from the government. It is money laundering to put cash in a safe deposit box — read the fine print — it can be confiscated! The criminal law is far too often used for the financial gain of the state.

As everyone knows, I turned out to be an institutional adviser. Consequently, the model that I developed had to be able to forecast the trend of all time levels. It was critical to be able to provide a reliable forecast out for 10 years when truly planning strategy for multinational corporations. That is why we had over $2.5 trillion under contract when the US national debt was just $6 trillion. We were by far the largest international adviser in the world.

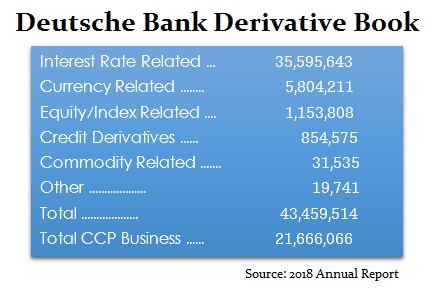

The disparity in the rates between the USA and those in Japan and Europe are all part of the crisis in both liquidity as well as international banking. The vast majority of derivatives out there are interest rate related. Europe has a major, major, major problem. An uptick in interest rates will be devastating in so many ways. It will not only cause major losses for the ECB portfolio of bonds with over $12 trillion in negative-yielding bonds, but then you have the derivatives market.

On top of that, to make derivatives safer, after 2007 the government insisted that all derivatives had to go through a central counterparty clearing house (CCP) agent. As you can see, the 2018 annual report showed that Deutsche Bank also acts as a CCP to which it guarantees another €21.6 trillion Euros of exposure.

This experiment with negative interest rates has created a nightmare from which we are desperately afraid to wake up because it could be very real.

Shanghai

This year we are holding three World Economic Conference events — Shanghai in May, Frankfurt in June, and then Orlando in November. Each will be focused on the local region within the scope of the global context. Many people have indicated they want to go to Shanghai and kick the tires personally. You can apply for a visa and then visit Beijing and the Great Wall as well as the Forbidden City. They are spectacular things to see while you can.

This year we are holding three World Economic Conference events — Shanghai in May, Frankfurt in June, and then Orlando in November. Each will be focused on the local region within the scope of the global context. Many people have indicated they want to go to Shanghai and kick the tires personally. You can apply for a visa and then visit Beijing and the Great Wall as well as the Forbidden City. They are spectacular things to see while you can.

You do not need a visa to visit Shanghai if you have an ongoing ticket to another city, not just a return. So fly to Shanghai, then to Hong Kong, and home. I believe you are allowed to stay for up to 7 days on that basis. Make sure you check yourself because things change. So if you want to see Beijing, just apply for a visa. It’s not a big deal.

The Frankfurt WEC will focus on the crisis in Europe. The Orlando WEC will be naturally focused on the world economy and we will have the results of the 2020 election in the USA by that time.

There will be special tickets for those attending all three events or just two.

The Coming Crisis – What to Watch?

Armstrong Economics Blog/Banking Crisis

Re-Posted Jan 20, 2020 by Martin Armstrong

QUESTION: Dear Martin – We owe your respect for what you are doing and I wanna say thanks for educating your followers like me. With the issue of this growing international crisis, are you able to provide ideas on what the triggers maybe when it begins to come out of the surface? What can we observe to identify the beginning, EU Bonds – you mentioned IGOV – the currency, what else? I guess all of your followers are highly interested in that.

Many thanks,

JH

ANSWER: The first was the inverted yield curve which led many to think we were heading into a recession last summer. Then the Repo Crisis hit and despite being touted as just a fluke due to taxes, after more than three months the Fed cannot get out of providing liquidity without stepping back and allowing the free markets to raise short-term rates.

The liquidity crisis has spread even to Japan. Here the Bank of Japan has stood up and announced it would buy government bonds without any limitation trying to also prevent interest rates from rising.

The ECB will have to deal with the whole negative interest rate crisis they have created. They will be forced to allow rates to rise or all member states will have to agree to allow the ECB to adopt the same policies as in Japan — buy all government debt without limit.

Keep an eye on Europe. I do not see any way of avoiding this crisis. Politicians are too busy with other things. The free market will push rates higher and the central banks will be unable to prevent the rise in rates ahead.