Armstrong Economics Blog/USD $

Re-Posted Nov 7, 2019 by Martin Armstrong

QUESTION: Marty, you said at the conference the efforts to overthrow the dollar as the reserve currency have failed and it will take the Monetary Crisis Cycle to accomplish that. Now that Lagarde is in the ECB, will she aid that overthrow to be replaced by the IMF’s SDR?

It was a fantastic conference this year.

FG

ANSWER: The US has abused the role of the dollar in world commerce by imposing sanctions on places like Iran. These sanctions are supported by enforcement using the dollar. The US has weaponized the dollar in this respect. About 90% of international debt is denominated in dollars. Foreign countries issue their debt in dollars to eliminate FOREX risk in order to sell it globally. Both Putin and Xi want to find an alternative to the dollar. It has been the role of the dollar that drives Putin to dethrone the dollar.

There is NO ALTERNATIVE to the dollar — PERIOD!!!!! The stupid Negative Interest Rates on the euro undermined the euro as a possible reserve currency. It has been dumped internationally, which nobody wants to talk about. In discussions with major central banks and key international banks, nobody wants the euro. Negative Interest Rateshave killed the euro as a viable currency for exchange purposes. The EU President Juncker has said that it is “absurd” that Europe has to pay for its energy imports in dollars. He has failed to understand that it is their own fault, for the structurally defective euro lacks a central national debt and forces everyone to look at each member state independently in the same manner that applies to state debt in the USA. That lack of a national debt where capital can park has been the fatal flaw behind the euro. Then add the stupidity of Negative Interest Rates and you get a currency that dressed up for Halloween, but is by no means a real reserve currency.

There is NO ALTERNATIVE to the dollar — PERIOD!!!!! The stupid Negative Interest Rates on the euro undermined the euro as a possible reserve currency. It has been dumped internationally, which nobody wants to talk about. In discussions with major central banks and key international banks, nobody wants the euro. Negative Interest Rateshave killed the euro as a viable currency for exchange purposes. The EU President Juncker has said that it is “absurd” that Europe has to pay for its energy imports in dollars. He has failed to understand that it is their own fault, for the structurally defective euro lacks a central national debt and forces everyone to look at each member state independently in the same manner that applies to state debt in the USA. That lack of a national debt where capital can park has been the fatal flaw behind the euro. Then add the stupidity of Negative Interest Rates and you get a currency that dressed up for Halloween, but is by no means a real reserve currency.

China has given up on trying to fight the dollar. They realize that all the yelling and screaming is pointless. The yuan accounts for only 4% of international transactions. The key for China is to use the yuan in loans to build its road of trade globally. Their greatest hope will be for the Monetary Crisis Cycle to undermine the dollar in the year ahead. That combined with the neo-cons trying to weaponize the dollar will be the ultimate means to dethrone the dollar

Negative Interest Rates is the Way to Kill a Reserve Currency

Armstrong Economics Blog/Euro €

Posted Nov 6, 2019 by Martin Armstrong

Christine Lagarde said back in August that the European Central Bank still had room to cut rates if needed. However, she added that this could pose a challenge to financial stability in Europe. More and more banks are passing on the negative interest rates to depositors and this is undermining the elderly and pensions. From a broader view, this policy of negative interest rates has undermined the euro even as a reserve currency. Nobody wants it in their books. It is like it has the plague. I cannot express how serious this policy of negative interest rates has been. It has been the cure to eliminate the euro as a reserve currency. If the US wants to kill the dollar, just adopt negative interest rates and watch how it plummets.

I believe you may see Lagarde try to unravel this mess created by Draghi.

Europe Moving to Worldwide Income Tax & International Wealth Tax

Armstrong Economics Blog/The Hunt for Taxes

Re-Posted Nov 6, 2019 by Martin Armstrong

QUESTION: As I understand you’re writings, the € is not a good currency to be in. I’m South African and stay in the Netherlands for 13 years now. I’ve been following you’re advice not to be in €’s and therefore I only have a house here that can be seen as a € investment. I still have an equity portefeulje in South Africa with a 70% exposure to rand-denominated offshore investments(global, with a big USA component). I am however experiencing 2 problems now: 1 The Netherlands tax on worldwide income: not just the growth on the investment portefeulje, but the whole portefeulje! The result: growth on the investment portefeulje are lost due to the taxation in the Netherlands. 1.2% of all the capital are taken and tax at 30%. From 2022 it will be 5.4% at 33%. 2 The instability in South Africa and push for socialism put me at risk to lose the investment portefeulje. The law is very vague, but actually indicates that “stuff”can be taken if it’s in the best interest of the people and country. It only takes the wrong government … From 1 March 2020 South Africa also wants to tax on worldwide income and if your tax rate is lower than 45%, you will pay the difference to South Africa.

Where do you go to keep you’re hard, earned money safe from governments? I’m thinking about selling a large portion of the investment portefeulje and opening bank accounts in Norway, Sweden, Switzerland just to keep money safe till after the market crash, and then to invest again into the equity market. I also remember that you’ve said that the bank guarantee would only be for x1 €100 000 and not for every €100 000 that you keep in European banks. The European bail-inns are also a big risk. Do you have any other suggestions? By the way: gold is also taxed here in the Netherlands(not just on the gains)

RG

ANSWER: The ONLY place for a European to have a bank account right now is the United States. The list of countries that will report on what you are doing (CRS= Common Reporting Standard) and what you have is as follows:

As of 2018, the signing nations to avoid are:

Albania, Andorra, Antigua and Barbuda, Aruba, Australia, Austria, The Bahamas, Bahrain, Belize, Brazil, Brunei Darussalam, Canada, Chile, China, Cook Islands, Costa Rica, Dominica, Ghana, Grenada, Hong Kong (China), Indonesia, Israel, Japan, Kuwait, Lebanon, Marshall Islands, Macao (China), Malaysia, Mauritius, Monaco, Nauru, New Zealand, Pakistan, Panama, Qatar, Russia, Saint Kitts and Nevis, Samoa, Saint Lucia, Saint Vincent and the Grenadines, Saudi Arabia, Singapore, Sint Maarten, Switzerland, Turkey, United Arab Emirates, Uruguay, Vanuatu

You will notice that the United States and Thailand are two notable exceptions. Right now, they are the only places that are safe for a European. Scandinavia is not on the list, but Sweden has committed to join the CRS. There is a serious risk in Scandinavia.

Make no mistake about it. Europe is looking to also tax worldwide income. The Netherlands has a worldwide income tax form. The top income tax bracket in the Netherlands is 51.95%, plus there is a 30% flat tax on investment income. If you have a residential property in the Netherlands, you must be careful. The Netherlands tax courts look to whether there are “durable” ties of a personal nature with the Netherlands. That excludes pure business, but ties of a personal nature such as the maintenance of a residential property play a more defining role. Residence abroad does not, by itself, exclude the possibility of being considered a tax resident in the Netherlands.

Europeans MUST realize that Worldwide Income Tax is just around the corner. If you have substantial wealth, you may want to look at getting another citizenship. It is going to get much worse there in Europe between now and 2032. You will find the push to impose a wealth tax is fully underway. Switzerland already has an International Wealth Tax which is a levy on the total value of personal assets, including bank deposits, real estate, assets in insurance and pension plans, ownership of unincorporated businesses, financial securities, and personal trusts. You have to declare everything you own around the entire world. Then, because Switzerland is part of the CRS, they will share that with every other country. Typically, liabilities (primarily mortgages and other loans) are deducted from an individual’s wealth.

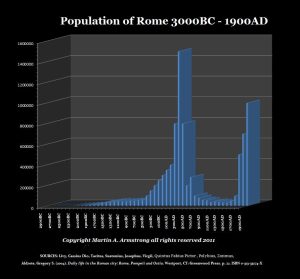

As we move toward 2032, the unfunded liabilities will explode and governments will become EXTREMELY Draconian and impose both the Worldwide Income Tax and the International Wealth Tax. There is no hope; this trend leads only to the destruction of Western Culture. They are only concerned about what is immediately in front of their nose. Be mentally prepared to simply walk away from fixed assets as was the case when Rome collapsed.

Manipulating the World Economy

Armstrong Economics Blog/Reports and DVDs

Re-Posted Nov 5, 2019 by Martin Armstrong

COMMENT: I just finished “Manipulating the World Economy.” What a wonderful book and actually a gift to those of us who attended the October conference. I hope you will soon publish this book for all the public to read.

JL

REPLY: It is going off to the printers within the next week. We hope to have it ready for Christmas. I really did try to make it the most comprehensive book on the subject matter. I was asked to write it because there was nothing out there to combat the Modern Monetary Theory, and those such a Thomas Piketty who advocate seizing the wealth of anyone who has more than he does.

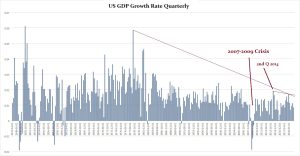

US Economy Soft – But Holding

Armstrong Economics Blog/Economics

Re-Posted Nov 5, 2019 by Martin Armstrong

COMMENT: I find it interesting how the rest of the world is declining and Socrates forecast that the US economy would be only slightly weak going into January 2020. It is interesting how it picks up the major differences. They are blind to the trend. You bring together the world. Thank you for that and there will always be idiots who cannot comprehend the trend and think Warren Buffet is a great investor when he was just a buy and hold no different than Trump. They both made money simply because of the inflationary asset trend since 1985.

Great forecast

KL

REPLY: The US economy was not poised for a major recession that everyone was forecasting because of the China trade dispute. It is softer, yes, but it is really holding up the entire world economy. The third quarter GDP was still up 0.8% whereas the prior quarter was up 1.1%. So yes, it was a slight decline. But we do not show a major economic decline in the USA.

As long as stocks have been in a bull market since 1985, then buy and hold works. But they lose in downtrends. Everyone forgets that. The year 2008 was the worse year Buffett had in 44 years. Most people cannot hold through such declines. This is why institutions have used us for decades. They cannot buy and sell like short-term investors. They need to know when to flip a major portfolio. Truly smart value investors hedge. That eliminates the risk of having to declare bankruptcy during the declines.

Norway – the Confusion in Trend

Armstrong Economics Blog/Scandinavia

Re-Posted Nov 5, 2019 by Martin Armstrong

QUESTION: Dear Mr. Armstrong.

Does Socrates have an explanation of what is happening to the Norwegian Kroner? All the financial newspapers and banks here in Norway are scratching their heads and don’t have an explanation of why it’s devaluating against the Euro and Dollar. The central bank of Norway has an interest rate of 1.50%, while Euro has an interest rate of -0.5%.

BT

ANSWER: Norway’s currency has been declining recently over concerns with regard to the US-China trade dispute given the fact that it is highly exposed to the US-China trade situation. Additionally, the sharp decline in crude oil prices has also impacted the currency given the oil and gas industry accounts for more than 1/20th of Norway’s gross domestic product and about 2/3rds of its exports. Therefore, Norway’s economy has been highly correlated with oil prices.

Nevertheless, in Korona, the price of oil is rising given the decline in the currency (click on the image). The analysis never looks at everything from an international perspective. Your currency is retesting the 2000 high in the dollar.

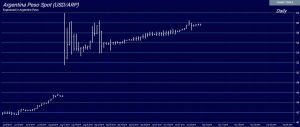

The Two-Tier Currency Rate in Argentina

Armstrong Economics Blog/South America

Re-Posted Nov 4, 2019 by Martin Armstrong

QUESTION: Dear Mr. Armstrong,

Can you please explain how the Contado con Liquidacion exchange rate works in Argentina? It’s now at around 80 pesos per dollar, while the official rate is 58.37. Is it possible for the average person living in Argentina to get the Contado exchange rate? Also, do you have any advice for the new government? https://www.ambito.com/contenidos/dolar-cl.html

Thank you,

JT

ANSWER: The Cotización del dólar Contado con Liquidación exchange rate is a form of a two-tier currency which is a way to buy dollars and move your money out of Argentina. This is an operation that can be performed both with bonds and stocks that are trading within Argentina but also in the United States. There are a number of Argentine stocks that trade in the USA (see list). Smart investors have used this as a vehicle to buy dollars as well as companies. However, the government has imposed a USD $10,000 per month limitation as of September 2nd, 2019.

You or a company can buy public security or share in the local Argentine market that is also listed in New York. The purchase of that bond or share is made with pesos. You then ask the broker to transfer the title or share abroad and once they are received in New York, you can sell them and the proceeds of that sale are then credited in US dollars in your account in the USA. To carry out this type of operation, you need an account in Argentina and an account in the USA which you are obligated to report to the AFIP in Argentina. Therefore, it is a legal way to get your money out of Argentina provided you report your foreign account, but there is a $10,000 per month limitation.

Ever since the election on August 11th, 2019 when Argentina’s currency collapsed along with stock and bond prices not witnessed in 18 years on schedule with the 18-year Monetary Crisis Cycle, the currency has reflected the collapse in international confidence. Voters turned to interventionist economics rejecting President Mauricio Macri and his free-market approach in favor of the opposition. The Argentine peso dropped 30%, to a record low of 65 per one United States dollar, following Alberto Fernández dominated the primary by a 15.5% point margin which was substantially more than local polls expected. Then on October 28th, 2019, Alberto Fernandez became the new President but immediately he faces suggestions that he is a puppet for ex-president Cristina Kirchner. This has led many to assume that she will really be running the country. This is not a great position for confidence in his administration.

When President Cristina Fernández de Kirchner reached her two-term limit in 2015, many believed it was for the best. She was flamboyant and divisive and became the populist Peronist politics. She believed in economic interventionism and was a strong nationalist and to a large extent that underlying position has dominated Argentina for the majority of the past 80 years. Under Argentine election law, a president may serve no more than two consecutive terms. They can run again only after sitting out a term. In the case of Cristina Kirchner, she has reemerged as the running mate rather than the top of the ticket. This is what many now assume Alberto Fernandez is just a puppet. It is hard to imagine that someone has tasted power and is willing to just walk away. Time will tell, but many suspects she will be the real power behind the throne.

Nevertheless, when we look at the chart of the Argentine Peso, we can clearly see that the fall in the Peso began when she left office in 2015. From the average person’s perspective, it is not hard to imagine what the people were voting with her on the ticket as Vice President. From a cyclical perspective, we see that we will have a Panic Cycle and major turning point shaping up in Argentina during 2024 in line with the peak of the next Economic Confidence Model wave.

Major Canadian Company Moving to USA

Armstrong Economics Blog/Canada

Re-Posted Nov 4, 2019 by Martin Armstrong

COMMENT: Here in Canada we just received devastating news this morning that our greatest company/ multinational is leaving & never to return. ENCANA has announced its intention that it is leaving the country of its birth !!

Thank goodness for socialism!! Wonder how public servants will feel who voted for this “ snowboard instructor “ will fell when their social insurance/ pensions get slashed??

DL

REPLY: Yes, ENCANA has switched its domicile from Canada to the USA because of Trump’s tax reform and the insanity of Canadian environmentalists. Don’t worry, when the Democrats get hold of the presidency, they will reverse Trump’s tax reform and drive companies back out of the USA just as Canada is doing up there.

Public v Private Waves in the ECM

Armstrong Economics Blog/ECM

Re-Posted Nov 1, 2019 by Martin Armstrong

QUESTION:

Hi Marty.

I am confused about the nature of the private wave we are currently in versus the public wave beginning in 1932. Does that mean governments will be more predominant in starting in 1932? This seems contrary to your many statements that the governments today are fighting to maintain control.

Thanks,

GP

ANSWER: During the Public Wave that began in 1934 and ended in 1985, the bond market performed at its best and stocks became extremely undervalued. This started to readjust only after the Public Wave ended in 1985. Only during the final wave does the government start to unravel in a Public Wave. In a Private Wave, stock markets outperform bond markets. Here, people lose their faith in government rapidly. By the half-way mark in a Private Wave, the government becomes aggressive because it sees it is losing control of society. This is why governments will become much more aggressive during the last part of this wave into 2032.

Looming Repo Crisis

Armstrong Economics Blog/Banking Crisis

Re-Posted Nov 1, 2019 by Martin Armstrong

QUESTION: Mr. Armstrong; I want to thank you and your staff for a great conference. It was the best ever. Your detailed review of the Repo Crisis demonstrates why mainstream media tries so hard to ignore you while there were more institutions there than at any conference I have ever attended. When the Fed announced its rate cut, not a single journalist asked any question that addressed the liquidity crisis. It is like it did not exist but they seem desperate to cover it up. Do you think the mainstream press is just stupid or are they part of the cover-up to try to hide the liquidity crisis you had forecast at Rome would unfold in September?

JV

ANSWER: It is hard to say how 7 business journalists that cover Wall Street asked questions during the first half-hour yet not a single one asked about the liquidity crisis. It is as if the Fed’s injection into 23 Wall Street securities firms plus one foreign bank in addition to buying up $60 billion a month in Treasury bills from Wall Street dealers has never taken place. It does beg the question are they stupid or deliberately not asking key questions?

The Fed began its Repo loan interventions on September 17th BECAUSE banks no longer trust banks. This liquidity crisis is where the economic stresses will always take place when there is a question as to the security of the players in the market. There have been frightening similarities to the liquidity crisis of 1998 and 2007-2009. Not a single reporter seems to understand what is taking place BECAUSE their domestic sources are also in the dark so they prefer to do Repo with the Fed rather than any other banks.

I am not certain if this is a cover-up. It appears to be more of a complete lack of understanding of what is going on because nobody is talking. We just stand in the middle and have many clients calling in asking questions simply because banks and not talking to banks. Everyone is afraid to talk and thus the press is in the dark.