Tag Archives: Hyperinflation

Stunning Day of Economic Gaslighting – Despite All Positive Data, Corporate Media Cheering For Recession…

August 14, 2019

A “negative yield curve“; a pending “economic recession“. These are the obtuse and ridiculous proclamations of the Mainstream Corporate Media today. So let’s take a moment to discuss how stunningly -intentionally- disconnected they are.

Always remember, there are trillions of dollars at stake; and these media entities have a vested interest in maintaining the Wall Street position, adverse to Main Street USA.

First the “negative yield curve” aspect; where long-term bond rates (returns on investment) are lower than short-term rates (returns). As Reuters proclaims:

“A key bond market metric turned negative for the first time since 2007 on Wednesday, sending stocks tumbling”…

I must admit, I actually started laughing out loud when I first read that proclamation. Allow me to introduce a radical concept in economics: “supply and demand” !

The long-term borrowing rate for return on investment dropped momentarily lower than the short-term borrowing rate of return on investment because massive numbers of foreign investors were rushing to buy long-term U.S. bonds. Wait… what? Yes, a ‘negative yield curve’ is what happens when everyone wants to buy bonds in your long-term economy.

There weren’t enough long-term bonds to fill the demand of those who wanted to purchase them. Ergo, the return rate of interest dropped because there was no need to have an incentive to sell them…. everyone wants them.

So the yield drops, because the U.S. doesn’t need to incentivize the sale… because everyone is lined up to buy them. See how that works?

Do lines of people wrapping all around the world trying to get to the U.S.A Bank and buy U.S. treasury bonds sound like the USA economy (underlying the bond) is weak or in trouble?

It’s OK to laugh out loud.

No, really, it’s ok.

Yes, Alice, it’s true. The financial media would have you believe that customers lined-up around the building to purchase your products means your business is about to close because of a lack of customers. THAT my friends is the stupidity of it.

The U.S.A economy is so strong, so healthy, and forecast to remain so with such intensity, that everyone wants to purchase dollars because it is the world’s highest predicted rate of return for investment….. And somehow the media can spin that into a bad thing.

No, really. That’s the narrative of today.

Now let’s look at the second stupid “A looming recession“:

First, a “recession” is two consecutive quarters of negative GDP growth. That’s how you define a recession. So to start a recession you need need one quarter of negative GDP growth right? Well, duh, it hasn’t happened, and there is not a single economist who is predicting a negative Third Quarter growth rate (July, Aug, Sept., ’19).

First Quarter GDP growth was 3.1%. [Beating all expectations] Second Quarter GDP growth was 2.1%. [Again, beating all expectations]… and somehow the Third Quarter is suddenly going to be negative growth? It’s OK to laugh again.

So how does CNN et al “warn of a looming recession” when there’s not a single economist forecasting a negative GDP for the third quarter? Well, they make shit up that’s how.

Think about it…. if the economy was contracting, people would not be getting hired right? Employers would be laying people off right? Businesses would be selling off assets right? Wages would be dropping right?

Do you see any of these things happening?

No? Why not?

Because it ain’t happening, that’s what !!!

The U.S. economy is not shrinking. Main Street is strong, and getting stronger.

Go back to point #1, would the world be rushing to buy dollars if the U.S. economy was on the precipice of collapse? Think about it.

Now, that said, there are some economies that are shrinking; and they all have something in common. The manufacturing export dependent nations are in trouble because President Trump is starting to limit their access to their most desired customers, the USA. And President Trump is telling companies that operate in those export nations that it would be in their best interests to come to the United States to make their goods.

Germany, the economic engine for the EU, is a manufacturing export dependent nation, and it is contracting. China is a manufacturing export dependent nation and their manufacturing is contracting. But the U.S. is strong, because we are not dependent on exports. In fact the U.S. consumes more than 80 percent of what we produce; we are a self-sustaining economy.

Our U.S. economic strength is why Asian and European investors are rushing to buy dollars (US Bonds); and why the U.S. treasury doesn’t need to provide high yield rates as incentives to buy them (hence the negative yield curve).

Stop me when any of the U.S. economic data has even the slightest implication of a slowdown, or “looming recession”.

Our last jobs report showed 164,000 new jobs created in July (yeah, like two weeks ago). In addition 363,000 people moved from part-time to full-time employment… does that sound like a weak economic outcome? Current blue-collar wage growth is in excess of 3.4%, and current overall U.S. worker income is growing at a rate exceeding 5.4%.

Does any of that sound like what you see just before a “looming recession”?

Every actual data result exceeds expectations.

Every measurable KPI in the U.S. economy beats every forecast.

Show me data that supports this “looming recession” claim. Guess what; you can’t because it is a manufactured bucket of nonsense. Abject stupidity created in the basement of media narrative engineers and pushed into the U.S. mainstream talking points in an effort to create something that doesn’t exist. You know the word for that? “Gaslighting” !

Why?

Why are the financial pundits doing this?

Because the engine for the U.S. economy is the U.S. consumer. The Wall St./Media pundit goal is to erode consumer confidence, instill fear, and hopefully get people to sit on those high wages…. thereby creating a self-fulfilling prophecy.

This my friends is the battle behind Wall Street -vs- Main Street.

There are trillions of dollars at stake.

[You Can Read More Here]

Wealth, Poverty, and Politics

Has the “Smart Money” Entered the US Share Market Yet?

Armstrong Economics Blog/Dow Jones

Re-Posted Aug 14, 2019 by Martin Armstrong

QUESTION: Dear Armstrong,

According to Dow, a bull market has 3 phases, the final being the distribution by the smart money to the public.

You stated that retail is still not participating. Could this be why the market appears to be unable to stop going up? Because the smart money continually fail to entice the dumb to jump in?

Cheers

GF

ANSWER: So far, the “smart money” has been more foreign than domestic. We have not even remotely reached that level where the domestic “smart money” is sticking more than their toe in the water. Just look at the Dow in euros compared to US dollars. The Europeans have been making a fortune buying the dips in the US market on a currency play in addition to the market itself.

World of Central Banks

Armstrong Economics Blog/Central Banks

Re-Posted Aug 14, 2019 by Martin Armstrong

QUESTION: Hello,

you said central bankers attend your conference and it means they know what’s coming.

I guess they talk to governments and I wonder if governments will tell people what’s

coming or they will pretend everything is fine until everyone ‘lose shirt’?

MM

ANSWER: No. Just about every intelligence agency also tunes in. That does NOT mean they listen and do what we advise. They just want to know what we are saying. I was surprised that one central bank openly admitted who they were. They all want to know what is happening, but are not necessarily capable of acting. I do meet directly with some central banks because they know we are global and they need that perspective. When it comes crashing down, we will most likely get the call as it seems we always do. But that does not mean we can fix anything, and at best, getting a call in the middle of a collapse is not ideal, to say the least.

They will always tune in because we are not the lunatic fringe but have substantial clients globally. We have a track record and meet with central banks from Asia to the Middle East. They know we understand the game. This is not about conspiracy theories or crazy proposals. They know we are international and have a wealth of contacts.

Is the Dollar Rally the Same as the Great Depression?

Armstrong Economics Blog/USD $

Re-Posted Aug 13, 2019 by Martin Armstrong

QUESTION: Marty: If I have this correctly, you’ve said the Great Depression of the 1930s was a Global Capital Flow problem set in motion largely by sovereign debt issues that led to a massive capital flight into the dollar which created a tidal wave of deflation. Are we seeing this scenario today?

Cheers, TM

ANSWER: Yes. It is the economic crisis outside the USA that is compelling the dollar to move higher. This is what caused deflation and ultimately forced Roosevelt to devalue the dollar. You can see the dramatic spike and rally in the dollar as Europe defaulted on its debts but the US held.

Economic Storm Trump Will be Blamed For Because of Bad Advisers

Armstrong Economics Blog/ECM

Re-Posted Aug 13, 2019 by Martin Armstrong

There is a very Dark Cloud hovering over the world economy and at the center of this cloud lies not just Europe, but Germany – the strongest economy holding up all of Europe. The German manufacturing sector is in freefall. Trump will be blamed calling this the result of his Trade War. It is probably too late to get him to even understand that his advisers are old-school and completely wrong with respect to trade. Their obsession with currency movements is what they taught back in school during the 1930s. My advice to China, let the yuan float and Trump will quickly see that China has been supporting its currency, not suppressing it.

Manufacturing indicators have deteriorated globally, yet in a very disproportionate manner. Trump will be blamed for this and his badgering the Fed to lower interest rates is also a fool’s game. Nobody looks at the elderly who were told to save for retirement and you will live off the interest. Their house values were undermined in the 2007-2009 New York Banker’s Mortgage-Backed scam that blew up the world economy from which we have been unable to fully recover. The younger generation cannot afford to buy a house as they are saddled with student loans thanks to the Clintons for degrees that are worthless as 65% cannot find jobs in what they have degrees for these days.

Manufacturing indicators have deteriorated globally, yet in a very disproportionate manner. Trump will be blamed for this and his badgering the Fed to lower interest rates is also a fool’s game. Nobody looks at the elderly who were told to save for retirement and you will live off the interest. Their house values were undermined in the 2007-2009 New York Banker’s Mortgage-Backed scam that blew up the world economy from which we have been unable to fully recover. The younger generation cannot afford to buy a house as they are saddled with student loans thanks to the Clintons for degrees that are worthless as 65% cannot find jobs in what they have degrees for these days.

The insanity of those in power knows no boundary when it comes to stupidity around the world. All they have is interest rates and after more than 10 years of excessively low to negative interest rates failing to stimulate the economy in Europe, what do they do? They argue that all physical money must be eliminated because people are hoarding cash and thus defeat their lower interest rates policy. The IMF recommends confiscating all cash and then driving interest rates deeply negative to force recovery. They remain ignorant that they have destroyed the retirement of the elderly now, as well as the those who have yet retired because they command pension funds must invest in government bonds to various percentages ensuring that pensions will collapse as well.

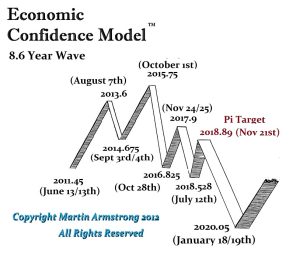

Manufacturing has been contracting compared to the service sector even on a global basis. The financial markets have appeared to be disconnected from the underlying economic trends because capital smells a very big rat. Capital has been shifting toward preservation rather than how much profit can it make today. Even the 10-year 3-month interest rates in the USA have tipped into the inverted yield curve confusing many that this is a sign of impending doom. They fail to read the tea leaves that capital is looking for a place to just park. Traditionally, inverted yield curves take place during recessions and we are in one globally heading into a major low come January 2020.

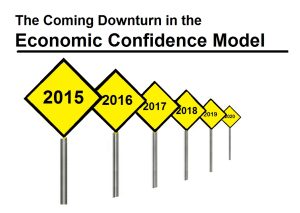

The Economic Confidence Model (ECM) has been on point despite the fact that schools warn you cannot forecast the business cycle yet the ECM has proven them wrong for decades. This particular cycle is exceptional. The central banks outside the USA have single-handedly destroyed their bond markets with Quantitative Easing. They are trapped and cannot allow interest rates to now rise to normal levels as they have kept the various governments on life-support.

The Economic Confidence Model (ECM) has been on point despite the fact that schools warn you cannot forecast the business cycle yet the ECM has proven them wrong for decades. This particular cycle is exceptional. The central banks outside the USA have single-handedly destroyed their bond markets with Quantitative Easing. They are trapped and cannot allow interest rates to now rise to normal levels as they have kept the various governments on life-support.

While central banks have tried to “stimulate” the economy, federal, state, and local governments are in dire need of money and have been raising taxes and increasing enforcement. Government pensions are wiping out budgets in Europe, America, and Japan. The forces of the central banks have been directly opposed by the political fiscal side of government.

We are facing a very Dark Financial Storm from which there is no escape. There is no advice being given to so many governments to avoid this crisis and waking up next year to this error will be too late. There will be nothing that can be done to put it all back together and live happily ever after. Welcome to the reality we face. At least this will make for a very interesting WEC. Make no mistake about it. They will lay all the blame on Trump and attribute this to trade rather than finance.

Can the US Government Really Force the Dollar Lower?

Armstrong Economics Blog/Capital Flow

Re-Posted Aug 12, 2019 by Martin Armstrong

QUESTION: Hi Martin, What tools do the US have to TRY and manipulate their dollar lower (other than cutting interest rates) and in your opinion would they be successful? How much do they have in the Exchange Stabilization Fund? Do they have a defense plan to limit and control capital flows coming in?

Thanks,

RM

ANSWER: They lack any power to prevent a dollar rally. The Exchange Stabilization Fund (ESF) is a U.S. Department of Treasury emergency reserve fund that includes holdings of U.S. dollars (USD), other foreign currencies, and special drawing rights (SDR) funds. The financial statement of the ESF can be accessed at “Reports” or “Finances and Operations.” However, all previous attempts at manipulating currencies have ended in disaster. Yes, the U.S. could put capital controls to block capital coming in, but they would destroy the world economy if they even attempted such a hair-brain idea.

Lowering interest rates will not help for if capital fears survival elsewhere, the level of interest rates will mean nothing. Just look at the creation of the G5 at the Plaza Accord. The market had already turned so their manipulation was already in the direction of the decline. When the dollar fell too far and the other members complained, they then held the Louvre Accord. The markets saw them as incompetent and the dollar continued its cyclical decline on schedule.

Therefore, I have yet to find any period in history where there has been a coordinated effort that has ever succeeded.

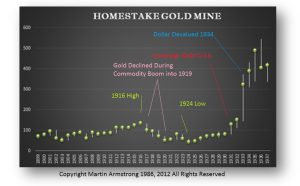

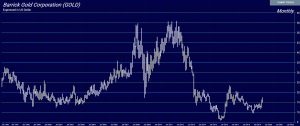

Why Gold Stocks Rallied During the Great Depression

Armstrong Economics Blog/Gold

Re-Posted Aug 12, 2019 by Martin Armstrong

QUESTION: Hi Marty

Can you enlighten us on what happened back in history to gold mining shares in terms of why shares did not collapse during the crash of 1929 compared to what happened to mine shares in 2008?

What happened to the shares held by the public in 1933 when FDR confiscated gold?

So you were safe holding the shares!

GG

ANSWER: You must realize that gold was money under the gold standard. You can see how it declined following the commodity rally during World War I and eventually bottomed in 1924. During the Great Depression, cash was king and as such Homestake rallied into 1930, but then began to break out with the Monetary Crisis in 1931. The sharp rise came in 1934 with the devaluation of the dollar. Therefore, any comparison to modern times is irrelevant since we are not on a gold standard. Gold now responds in the opposite direction of the currency.