Tag Archives: Illinois credit now “Junk”

Why Goldbugs Get Crushed

Armstrong Economics Blog/Gold

Re-Posted Mar 3, 2020 by Martin Armstrong

QUESTION: This is what infuriates those that like gold. All of the shorting. Why? No other sector looks like this. So how is it that gold miners are restricted but no other sector sees shorting to the extent that restrictions are in place??? Gold is $1600 and these stocks traded double this price in 2008 with gold at $800. You ask why “goldbugs” are so angry, this is your answer.

S

ANSWER: For decades, I have watched “The Club” rally the metals and then crash them because the goldbugs treat it as a religion rather than a market. Every rally is touted as, here we go, the world will crash and only gold will survive. The Club uses that sentiment against them all the time for they know it is easy money. When they step back and look at the metals as markets, then they will win. Many other markets have made long-term profits but they are always demonized by the goldbugs. Why? I believe that some of the people promoting gold are the very ones involved in selling it to them. Everything has a cycle. It goes up and goes down. These chants from the goldbugs are not realistic and they cost countless people their life savings as they get sucked in by people who act like used car salesmen.

Short sale restriction is a rule that came out in 2010 and it’s also referred to as the alternate uptick rule, which means that you can only short a stock on an uptick. You will note that there is no such thing as a long buy restriction where you can’t buy a stock as it’s going up.

Inevitably, the goldbugs blame shorts. That is NEVER the case in any crash. The real cause is that you have exhausted the buying. When you run out of buyers, that is when markets become vulnerable. The smart do not short, they sell to take profits. That starts the decline and the hated short-player is blamed but never found.

The short selling rule came in only because of shorting Lehman Brothers. When the shorts turned on Goldman Sachs, they pulled the strings. But those were shorts looking at reality, not speculative. There has NEVER been a discovered mythical short position that causes the entire market to collapse.

I have stated countless times that gold will rally ONLY when the general public perceives there is a crisis with the government. Forget deficits, quantitative easing, and fiat currency. They will never convince the average person to take gold seriously. When you begin to look at the market without emotions and trade them up and down, then you will see the light.

Beatles & the Taxman

Armstrong Economics Blog/The Hunt for Taxes

Re-Posted Feb 28, 2020 by Martin Armstrong

In 1966, George Harrison, who would have been 77 this year, wrote the famous song “Taxman” for the Beatles. Bernie Sanders must have hated this song.

If you drive a car, I’ll tax the street,

If you try to sit, I’ll tax your seat.

If you get too cold I’ll tax the heat,

If you take a walk, I’ll tax your feet.

Don’t ask me what I want it for

If you don’t want to pay some more

‘Cause I’m the taxman, yeah, I’m the taxman.

Now my advice for those who die

Declare the pennies on your eyes

‘Cause I’m the taxman, yeah, I’m the taxman

And you’re working for no one but me.

George Harrison explained why he wrote that song: “I had discovered I was paying a huge amount of money to the taxman. You are so happy that you’ve finally started earning money – and then you find out about tax. In those days we paid 19 shillings and sixpence [96p] out of every pound, and with super-tax and surtax and tax-tax it was ridiculous – a heavy penalty to pay for making money. That was a big turn-off for Britain. Anybody who ever made any money moved to America or somewhere else.”

The US top tax rate in 1963 was 91%, dropping to 70% during 1964-81. The top rate for British taxpayers in the mid-1960s reached 83%. The wealthiest among them paid a 15% super tax on top of that, pushing taxes as high as 98%. The pain came out in the Beatles 1966 song “Taxman.”

The Beatles did not have to pay taxes on income outside of Britain. That was the incentive to make the first American debut in New York on February 7, 1964, on the NBC Ed Sullivan Show

Where to Go in the 12 Years Remaining for a Global Political Crisis

Armstrong Economics Blog/The Hunt for Taxes

Re-Posted Feb 27, 2020 by Martin Armstrong

QUESTION: Hi Martin

I’ve been following your blog for some years now, its the first thing i check why I wake up daily. I feel I get a better perspective of the world around me reading your blogs rather than browsing news sites. There are so many questions on which I would love to hear your opnion. I’m an IT consultant here in the UK and fed up of politicians going after hard working folks. Its always the middle class that gets squeezed between low and high income earners. My question is which country in your opinion is the best amongst the lot where you would move. UK, I feel, will get bad under Boris and taxes have already started to go up. Europe is clearly down and US would also follow suit once Trump is gone. If you had to pick one country in Asia, Europe and Americas and finally in any part of the world, which one would it be? I’m originally from India so would be easier for me to move there. Is it Australia, New Zealand, Switzerland? or there is no place to hide 🙂

Thanks in advance.

R

ANSWER: All governments in the West are going to be raising taxes dramatically. They will NEVER reform and step back. That means they would have to change the very power structure of government. We are looking at the expansion of separatist movements and probably armed conflicts post-2020 into 2032. You will see separatist movements even in the United States. So you have to look at the region and be very specific.

It is very hard to pinpoint a place at this stage in the game. The USA will be better than the other Anglo-Saxon countries, but that may last only until 2024 at best. Southeast Asia will be OK, but keep in mind it has already seen protests against foreigners in places like Singapore.

Bottom line — this is not going well and we are looking at a global political crisis developing over the next 12 years.

The NO BID Evaporation of Wealth

Armstrong Economics Blog/Understanding Cycles

Re-Posted Feb 27, 2020 by Martin Armstrong

COMMENT #1: Marty,

Good morning. I knew you were going to get blamed for having too much “influence”. And then after emailing you about it, I see the comment in the Fake News blog this morning, just too funny!

Can’t these people just try to learn why they were wrong? I always try to learn from my experiences and I’m nobody. I’ve learned more after college through trading experiences and attending your conferences than I ever did in college. They just fed me a bunch of BS that I had to repeat for a good grade, which is why I almost dropped out. I probably had two good professors total in Economics and Finance, they both had real-world experience, go figure!

There will always be haters.

Best,

EM

COMMENT #2: Great article today

One question I can’t answer is when capital flees(whether it’s from virus or Bernie). It’s not flowing back towards Europe or Asia. So is It (mostly)all flowing into US Bond market? Which we know is the worst spot to be as investors flee the public sector.

Two instead of Bernie being the reason for the very large drop in the Dow (and I think he’s a large problem for equity markets). Could It be the Coronavirus will substantially reduce economies all over the world and therefore equity valuations and earnings as well = equity sell-off and into cash?

Regards,

DJCL

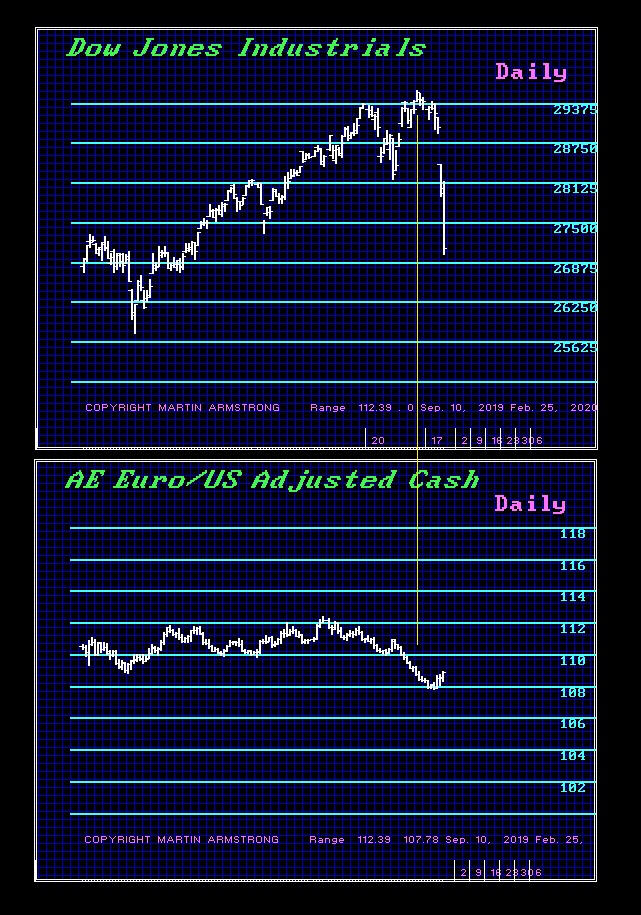

ANSWER: For now, the US debt market is the best in the world and really the only viable one. The comments about capital fleeing just illustrate the fake news. If capital was fleeing the USA, then you would expect to see the currencies move with such a capital flow. That has not been the case. They just make up excuses for they must always apply some reason to every market move.

ANSWER: For now, the US debt market is the best in the world and really the only viable one. The comments about capital fleeing just illustrate the fake news. If capital was fleeing the USA, then you would expect to see the currencies move with such a capital flow. That has not been the case. They just make up excuses for they must always apply some reason to every market move.

When I was called into the 1987 Brady Commission, they too began with the proposition that some mythical person sold the market and they were going to hang them. I explained that every investigation began with that same directive and nobody has ever been found. I asked if they even understood how markets functioned. They said simplistically that you borrow stock from one person and sell it to another. I asked, “Then how does a short ever outnumber the longs?” I had to explain that a crash takes place when people try to sell and there is NO BID. They never understood that. If the majority have already bough and they try to sell, there are no buyers so you get the NO BID and prices fall until you reach a level where there are some bids or shorts are willing to buy back. Value evaporates, it does not flee dollar for dollar.

These people will look at Buffet or Bill Gates and have no idea that their “wealth” is based upon share value — not cash. Bernie stands up and says he will go after the 1% and fails to understand that if he confiscated all their wealth, assuming it was cash, he would not even balance the budget for one year. It would make no difference. But people like Bernie love to point the finger at the rich rather than government because they cannot admit this is the worst management debacle in recorded history.

Value is simply a price quote. If a rare coin is sold for $100,000 at an auction, that does not mean that there were two people willing to pay $100,000 – only one. If another coin comes up for sale it does not guarantee it will bring $100,000. It may bring less if there is just a few months that has gone by or it may bring $200,000 several years later depending on the state of the economy. Value is something that rises and falls depending upon the state of the economy and the demand for cash. It is always a contest between public and private asset

The Pension Crisis Looking to Take Everybody’s Pensions

Armstrong Economics Blog/Australia & Oceania

Re-Posted Feb 26, 2020 by Martin Armstrong

COMMENT: This government [Queensland, Australia] pension scheme has been shaky for a while. Originally it was for government employees only, then spouses were eligible to join, later they include all family members and more recently television ads have promoted the scheme for anyone. Clearly this Ponzi scheme is looking unstable. I am glad I set up my own Self Managed Superannuation Fund and closed my account as soon as I retired. It appears the information was reported from the Australian Financial Review.

Kindest regards,

MF

REPLY: This is precisely what California has been pitching for in Washington. It is a Ponzi scheme and with negative interest rates and central banks trapped, they are blowing up pension funds around the globe. UNDER NO CIRCUMSTANCE should you allow your pension fund to be managed by any government-related entity. They cannot pay government employees so they have sought to suck in everybody else to cover up their losses

Internet Frauds From Hacking Emails to Dating Site Frauds

Armstrong Economics Blog/Corruption

Posted Feb 25, 2020 by Martin Armstrong

The amount of fraud taking place on the internet is in the billions. They will hack your email and then have money wired to Hong Kong. That is a popular destination. One guy lost $450,000 in three days. Then there are the fake nurses who claim to be working for the United Nations seeking love on dating sites. They are naturally on their way home, targeting lonely old men. At the last minute, they get robbed or lose their wallet and ask for hundreds to a couple of thousands to be wired, of course, to Africa. The money probably goes into the vault where some guy in Nigeria has hundreds of millions of dollars, and nobody to leave it to unless you give him your bank details.

The more common frauds on dating sites are girls looking to shake down lonely old men with promises of love. They are ready to hop on a plane at a moment’s notice provided you send them the money to buy the ticket. Others have a broken phone and need you to buy a new iPhone so they can tell you how much they love you. There are also guys conning windows with a whole host of excuses to clean out their bank accounts.

We are all aware of credit card fraud. I had it done to me once in an airport about 20 years ago. A legit company wanted me to read my credit card number over the phone and the guy in the next booth was writing it down. Obviously, I will never read my card over the phone again. The other time, I have no idea how someone was using my card to download music from iTunes. When I called the credit card company, they first tried say I had to call iTunes to have them change my account. I had to get angry and explain I did not have an account at iTunes. They finally reversed three months of charges.

Things have changed and they will change even more. We have to realize that we are moving to digital currencies and the unusual hype that has been spun around this coronavirus is very suspicious. A virus can live on paper for some time. China is disinfecting its paper currency. I would not be surprised that the West are hyping this virus to insane levels to use it as an excuse to eliminate paper currency that will aid tax collections.

If you have a family member, tell them to require approval for any wire from their account. Bank of America has a secure pass where they send an authorization to your phone with a number you must type in to send any wire. If your bank does not have something similar, it may be time to switch. As for those with lonely relatives trying out the internet, tell them to NEVER send money to anyone you have never met face to face. Those two precautions are vital in this new world of online fraud. Use some common sense. If some girl is a nurse working for the UN and everything is stolen, the UN will help her — not you.

International Capital Starting to Fear Bernie Sanders

Armstrong Economics Blog/Politics

Re-Posted Feb 25, 2020 by Martin Armstrong

I have stated before that Marxism/socialism has led to more deaths than all the other justifications for war or killing combined. The Communist movements of Russia, China, and the Revolutions of 1848 combined are far greater than World War I and II and just about every other modern war all counted as one event. There were over 61 million who died because of socialism in the Soviet Union which government claimed was utopia. Then there were 78 million who were killed in China. When we add all the leftist wars against the so-called rich, about 200 million people died. And people are worried about the coronavirus? You better pay more attention to the political war waged behind the headlines.

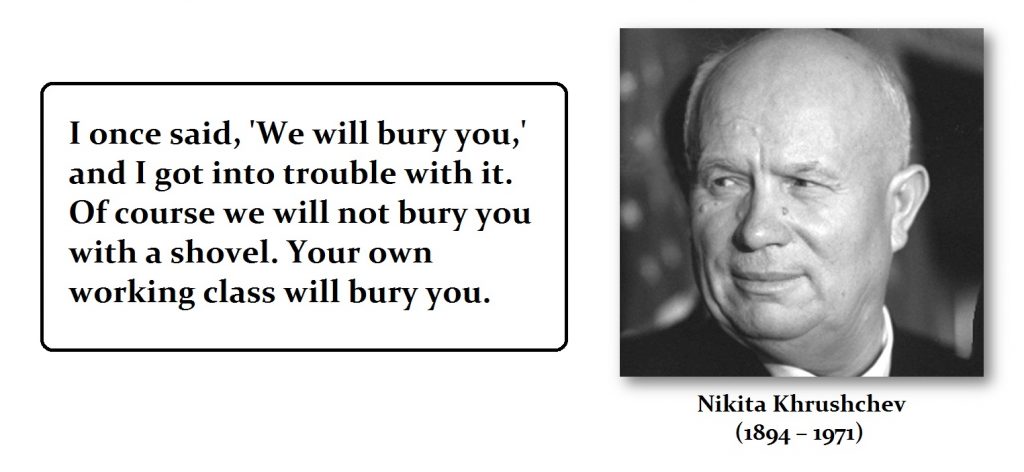

This is what Bernie Sander honestly believes in. He is preaching like Khrushchev himself on the same doctrine of hating the rich. Bernie is oblivious to the bloodshed those ideas have caused. Bernie is naive to preach what he does and thinks this can be accomplished without bloodshed. I DO NOTthink Bernie is an evil person who advocates death. In Nevada, he promised a crowd in Las Vegas of about 2,000 people that he vowed to take on “the corporate elite” and the “whole damn 1%.”

After all, he doesn’t even realize that he is in that 1%. The 99% is defined as an average annual median income of $65,000 or less. Hello! All politicians are in that 1%. Pelosi herself gets a salary of $223,500. So will Bernie champion reducing all politician’s salaries to $65,000 or less? The starting salary for a congressman in Washington is $174,000. Somehow, I do not think Bernie realizes he is the 1%. Maybe all our readers should forward this post to Bernie.

Besides the fact that Bernie is giving heartburn to foreign investors, Bernie is actually helping to turn the US economy down. It has been the foreign investors who have been the buyers of the Dow seeking shelter from the rest of the left-leaning world. The US share market can crash as foreigners sell. They may not be forced to flee to the dollar because they see Trump as the only sane leader in a world of political leaders pandering to the communistic/socialistic left agendas. Nevertheless, foreign investors are starting to get concerned about politics.

While this is the real reason we are starting to get calls from overseas institutions who have become deeply concerned about the chaos in politics globally, there remains a serious risk that capital will move into hibernation until the 2020 elections are over. Of course, the Trump-haters are clueless for they are foaming at the mouth and want a second impeachment trial. They are so blinded by their personal hatred that I do not see the nation ever coming back together as it once was.

I would be deeply concerned that the target on Trump’s back for assassination is growing bigger with each passing month from externally and internally within Washington. The intelligence community would love to see him taken out any way they possibly can. When Kennedy would not go to war in Vietnam, they found a solution. Their patience is running thin once again and they are already spinning stories that Putin will aid Trump to get reelected. That is total nonsense. If I were Putin, I would be praying for Bernie to win for he will defeat the United States faster than anyone and bring Nikita Khrushchev’s prophecy to fulfillment.

I have warned that I do NOT see Trump as any sort of a threat. My concern is what comes AFTERTrump? I do not see the United States remaining very united for very long.

Gold & the Future

Armstrong Economics Blog/Gold

Re-Posted Feb 24, 2020 by Martin Armstrong

QUESTION: Hi Marty

I hear what you are saying about the next gen and Gold vs BTC. To me it begs the question as to how the Next Gen’s look at crypto’s. Is there an argument that they like BTC etc because it is anonymous [mostly] and not part of the ‘system’. If that is the case, what will they think when Govs adopt sovereign crypto’s and outlaw BTC. Will they then look to gold and history?

Tx for all the wisdom,

Best HP

ANSWER: I think we have to draw a line in the sand at 2032-2037. Going into the end of this cycle, we will most likely still have the younger generations listening to people like Bernie who claim the problem is not government, but the rich. That argument has always led to bloodshed. I believe your question whether people will return to gold is more likely post-2032. We are looking at a fundamental change and the end of socialism, which is really just a means to expand government power. It is not only on the left. You have some on the right who want to use the law to enforce their religious beliefs upon others.

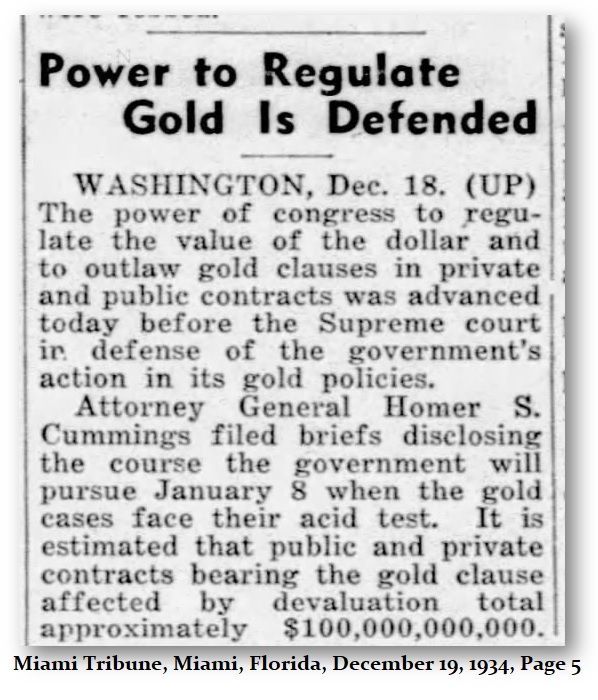

For cryptocurrencies and digital currencies to survive, they need a power grid. We are also facing turmoil as separatist movements expand everywhere. I do not believe that the government will allow private crypotocurrencies. They will outlaw them just as they did with gold in 1934

The Bond Market Crash post 2015.75

Armstrong Economics Blog/Bonds

Re-Posted Feb 24, 2020 by Martin Armstrong

(2018 Interview)

COMMENT: Marty, I had to laugh that someone said you were wrong and the bond market in Europe did not crash. I asked, is there still a bond market when the ECB buys it all? All I got was a dumb look! Are these people really that stupid?

Keep up the good work.

EK

ANSWER: I know. Some people think there has been no bond market crash outside the USA simply because prices have not crashed since the central banks buy all the bonds. I have friends who work in banks. Many are retiring for the bond market no longer exists in Europe. If that is not a crash, then nothing is. They can manipulate the price all they want. But if nobody buys it then there is no free market.