Armstrong Economics Blog/Forecasts

Re-Posted Aug 6, 2019 by Martin Armstrong

QUESTION: Hello,

about your recent post ‘The Sum of All our Economic Fears’… i understand you will give some advices to investors how to trade difficult times that lie ahead in 2020 and beyond. What i wonder is what we, non investors but just ordinary people who does have only house or the apartment they live in and day job, what we should do and what we can expect regarding crisis that’s coming our way. (many non investors are reading your blog, just for the love of knowledge, i’m sure you are aware of that)

Thank you for your time.

MR

ANSWER: The basic level of Socrates is designed for the non-investor who needs a broader outlook rather than short-term buy and sell strategies. I fully intend to make sure that information is available for the general public. The NY bankers have always wanted to shut down our forecasting, for they want people to only listen to their forecasts which are always self-serving. I will make every effort to ensure that this forecasts of Socrates will be available to the general public because we need not opinion and hype, but objectivity.

The Reality of Trade Between USA & China

Armstrong Economic Blog/China

Posted Aug 6, 2019 by Martin Armstrong

We are clearly cascading toward the Monetary Crisis Cycle as the USA wrong accuses China of manipulating its currency for trade advantages. All one needs do is look at the trend of the dollar against other major world currencies and you will quickly see that the trend of the dollar against the yuan is in line with the global trend. This is the problem we face when politicians simply follow the academic view of currencies when they are still teaching Keynesianism based upon fixed exchange rates. About 80% of China’s trade is with the rest of the world other than the United States. One does not lower its currency to impact 20% of its trade at the expense of the rest of the world.

I have written before that I was asked if I would teach at one of the top 10 universities in the world. I was surprised, to say the least. When I asked why would they even ask me the response was even more shocking. They actually said to me over lunch that they “knew” what they were teaching was wrong!. They also said the problem they face is those who have real-world experience are NOT INTERESTED in teaching classes in school. I said I would be glad to do a guest lecture, but I too had no interest in teaching a class every day.

Cina has been doing the exact opposite of what the US is accusing it. They have been supporting their currency and if they stopped and allowed it to float freely, then the US would witness probable new record highs in the dollar which will bring about the crisis we see coming by 2021.

I do not know what it is going to take to get governments to stop this nonsense over currencies. If the dollar was declining against all major currencies and China devalued the yuan counter-global-trend, then there would be an argument. But that is just not the case.

The yuan has been under pressure also because the yuan is too expensive within Asia and manufacture has been migrating to South East Asia. China has become the world’s second-largest economy by GDP (Nominal) and largest by GDP (PPP). When we look at the trade between the USA and China, we must look at goods v services.

- The U.S. goods trade deficit with China was $419.2 billion in 2018, an 11.6% increase ($43.6 billion) over 2017.

- The United States has a services trade surplus of an estimated $41 billion with China in 2018, up 0.8% from 2017.

Yes, we are one of the few rare services who publish our forecasting in China. We fall into the Services Catagory. About 80% of China’s trade is with the rest of the world other than the United States.

- United States: US$479.7 billion (19.2% of total Chinese exports)

- Hong Kong: $303 billion (12.1%)

- Japan: $147.2 billion (5.9%)

- South Korea: $109 billion (4.4%)

- Vietnam: $84 billion (3.4%)

- Germany: $77.9 billion (3.1%)

- India: $76.9 billion (3.1%)

- Netherlands: $73.1 billion (2.9%)

Will Europe See More Deflation, Stagflation, or Inflation?

Armstrong Economics Blog/European Union

Re-Posted Aug 5, 2019 by Martin Armstrong

QUESTION: Dear Martin, am a loyal reader of your blog and many thanks to you for the education. Please, one brief but important question, which keeps me thinking hard these days. I remember your words, inflation should pick up in the next cycle. But, isn’t it the other way round? Isn’t deflation the next thing.

We see inflation everywhere, in all asset classes, home prices, and durable goods. But if the economy declines and the people have no longer so many funds to pay their debt interest rates hey go defensive. And if the stock market declines too, sentiment turns and people become even more defensive. Isn’t this the classic scenario of a deflation period?

Thanks from Europe

RS

ANSWER: I realize that on one hand, it may appear to be asset inflation in Europe, but you must look at the real numbers and then plot them in FOREX. We can see that when we look at the DAX in price, the bounce in US dollars has been less than in euros. In real terms, Europe has been in DEFLATIONbut capital has been shifting into the property market to escape the banking sector. It appears that the low in real terms for Europe may come in 2023. However, the type of inflation we see is cost-push, not demand. So you might call this STAGFLATION, as was the case during the 1970s following the OPEC crisis.

Real-World v Fake Central Bank Interest Rates

Armstrong Economics Blog/Interest Rates

Re-Posted Aug 5, 2019 by Martin Armstrong

QUESTION: Socrates has been forecast that the free market rates are rising but the official central bank rates are still bearish overseas and neutral domestically. Is this the divergence you are forecast with respect to interest rates rising in the real world against the fake central bank rates?

Thank you

See you in Orlando

BF

ANSWER: Yes. I have also warned that the Fed is entertaining the prospect to PEGGING long-term government rates rather than engaging in Quantitative Easing. I have gone into this in detail in the new book about to be released soon. The Fed realizes that Quantitative Easing has failed. They are lobbying behind the curtain to try to get Congress on the side with sharing the burden to support the economy. However, that effort is not being received very well.

You must understand that there is a HUGE gap between real rates and fake rates unfolding. Call your bank and ask them what they will give you for a CD for say even 1 year. You will be lucky to get 2.5%. A car loan will be 4.71% to 5.26% on average. Banks are nearly doubling their money and this is the real-world compared to the fake rates offered by central banks. This is the HUGE gap between real-world and central banks which is expanding. So a forecast of lower rates ONLY applies to the fake rate – not the real-world rates.

Our forecast shows that real-world rates will rise, but the fake central bank rates will remain the same to lower ONLY because the central banks are becoming nearly exclusive buyers of government debt with the exception of pension funds which MUST buy government debt by law.

The Next Lehman Moment – Threat to the Global Economy the Fed Responded to

Armstrong Economics Blog/Reports and DVDs

Re-Posted Aug 4, 2019 by Martin Armstrong

I am seeing an overseas crisis is brewing which many might rename the “Lehman Moment” to something more up to date. Clearly, the stakes are far higher to the world economy than anyone may truly appreciate. We are cascading toward a perfect financial storm. However, this particular storm is exacerbated by the politics of Europe stemming from the structural design of the Euro. There is a major risk to both the European and world economy. All the Quantitative Easing by Draghi at the European Central Bank (ECB) has completely failed and in the process created a systemic risk to the entire world economy – not just the EU. This is why the Federal Reserve (Fed) has lowered interest rates when there was no true justification for the interest rate reduction domestically. The Fed has confirmed that it is indeed the central bank to the world even if it does not like that role. It can no longer place domestic policy objectives over international.

I am rushing to put out a special report on the next “Lehman Moment” for this is going to be extremely critical.

Hayek’s “The Road to Serfdom” – Lawrence H. White

When did Trading Begin? Were Free Markets the Key to the Rise of Empires?

Armstrong Economics Blog/Economics

Re-Posted Aug 2, 2019 by Martin Armstrong

QUESTION: Mr. Armstrong; I figured there is nobody more qualified to answer the question of where and when did markets first begin to trade? Did markets have anything to do with the rise of nations you write about?

KD

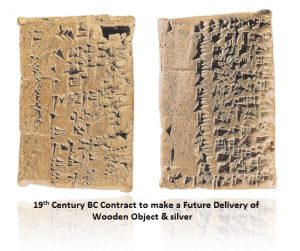

ANSWER: Only those societies that developed financial markets ever rose to greatness. Those who bash markets fail to understand that without them, most people would still be digging for potatoes. The evidence supports the first markets were futures markets which traded in Babylon, at least during the 19th century, since we have futures contracts from that period which have survived. All of the research I have conducted clearly demonstrates that economic growth is linked directly to the expansion of financial markets. Once there is a marketplace, then people will invest and economic growth will expand provided they know that if they needed to raise capital, they can sell their investments. Therefore, my research reveals that it takes CONFIDENCE in order to expand an economy and that translates into liquidity. Just look at this from your own perspective. You will buy a share in some company ONLY because you think you can make a profit. But how is that profit even attainable? The potential for a profit exists ONLY if there is a liquid market.

Agora, Athens

The Athenian economy had a financial marketplace in the Agora. There were bankers as well as insurance companies. Aristotle wrote about the people who made money from money. As the Athenian economy began to expand because of the introduction of financial markets, there was a transition of which Aristotle wrote about in his “Politics.” Aristotle believed that the Athenian economy was changing from what I call the Villa Model (Agricultural) of self-sufficient enclaves to an economy of market-driven incentives which encourage the production of excess for the purpose of trade giving rise to a Market Economy Model. Similarly, this was the same transition period emerging from feudalism. Once a financial marketplace emerges, then people will produce more if there is a marketplace where it can be sold.

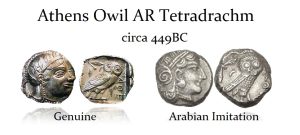

There are academics who have tried to breakdown the Athenian economy with such detail that they could not see the forest while focusing on the bark of just one tree. They read Aristotle’s “Politics” but missed the whole point of his concern — the transformation of Athens into the financial capital of the ancient world which even predated China. Some have argued that the ancient Greek word oikonomiais the root of our modern English word “economy,” but it is not synonymous with our definition of “economy” as we perceive it today. They argue that today “economy” refers to a distinct sphere of human interactions involving the production, distribution, and consumption of goods and services; oikonomia meant “household management” because it was guide written by Xenophon — how to manage your Villa Economy. They then mix in the political system of Greek Democracy and claim family activity was subsumed into traditional social and political institutions. They then go as far as to degrade the Greek monetary system, admitting that they produced and consumed goods, engaged in various forms of exchanges including long-distance trade among nations, and developed monetary systems employing coinage. This is all discounted by many academics arguing that they did not see such activities as being part of a distinct institution which we call the “economy.” I really see these arguments as gibberish where they have had way too much time to think and produce nothing. Instead, they get lost in their own thoughts. They lack a complete knowledge of the monetary history and fail to comprehend that Athens’ coinage was so dominant in the ancient world it was imitated in the north by the Celts, Slavic people, Asians, and even down in Arabia. That would never have taken place if it was so de minimis as they have tried to portray.

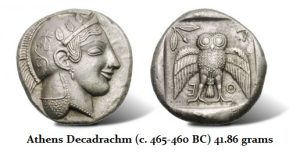

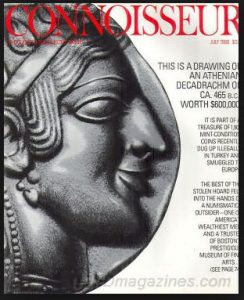

Athens produced the Decadrachm (10 drachmas) with a weight of nearly 42 grams. These coins would have been like 10,000 bills. They are very rare. Again, some academics tried to claim these were merely commemorative issues. They lack sufficient understanding of the world monetary system for these coins have rarely ever been discovered in Greece. Treasure hunters near the village of Elmali in southern Turkey unearthed a trove of ancient coins that included the rarest and most valuable Greek coins ever found. The coins, it said, were smuggled out of Turkey and sold to William I. Koch and two partners. It was the hoard of the century.

Athens produced the Decadrachm (10 drachmas) with a weight of nearly 42 grams. These coins would have been like 10,000 bills. They are very rare. Again, some academics tried to claim these were merely commemorative issues. They lack sufficient understanding of the world monetary system for these coins have rarely ever been discovered in Greece. Treasure hunters near the village of Elmali in southern Turkey unearthed a trove of ancient coins that included the rarest and most valuable Greek coins ever found. The coins, it said, were smuggled out of Turkey and sold to William I. Koch and two partners. It was the hoard of the century.

The Elmali Hoard was discovered around April 1984 containing nearly two thousand ancient Greek and Lycian silver coins. Turkish authorities contacted Interpol seeking international assistance to find and arrest the traffickers. In 1984, the consortium OKS Partners, which included Koch, purchased almost 1,700 of these coins for about $3.2 million. They began to sell the coins in 1987 and that is when the lawsuit was filed. The hoard was eventually returned to Turkey.

The Elmali Hoard was discovered around April 1984 containing nearly two thousand ancient Greek and Lycian silver coins. Turkish authorities contacted Interpol seeking international assistance to find and arrest the traffickers. In 1984, the consortium OKS Partners, which included Koch, purchased almost 1,700 of these coins for about $3.2 million. They began to sell the coins in 1987 and that is when the lawsuit was filed. The hoard was eventually returned to Turkey.

The significance of this hoard establishes that the Athenian Decadrachms were high denomination coins used in international trade. They are not found in Athens, but in ancient port cities around the Mediterranean coast. Some scholars claimed that the Athenian decadrachm is comparable to the more abundantly produced Syracusan decadrachm, which was minted around the same time. However, the Syracuse decadrachm was also minted for celebratory and practical purposes. The Syracuse minted their decadrachms in response to their defeat of the Carthaginians and they attempted to try to argue this was the same reason behind the Athenian decadrachms.

Numismatists have identified 24 separate reverse dies used for one issue of Syracusan decadrachms by created by the artist Euaenetus. This suggests that a minimum original circulation of just this issue would have been between 240,000 and 360,000 coins with a modern survival rate ranging between .08% and .25%. The Athenian decadrachm was used in international trade when they were attaining timber and metals from the Near East. The majority of Athens was composed of farmers who would never have a need for a decadrachm. The decadrachm became obsolete by the time of Pericles and Democracy for Athens was losing its supremacy and lost in war to Sparta. In fact, during the Peloponnesian War (431–404 BC), Athens lost its silver resources and began to issue its coins merely silver plated.

Numismatists have identified 24 separate reverse dies used for one issue of Syracusan decadrachms by created by the artist Euaenetus. This suggests that a minimum original circulation of just this issue would have been between 240,000 and 360,000 coins with a modern survival rate ranging between .08% and .25%. The Athenian decadrachm was used in international trade when they were attaining timber and metals from the Near East. The majority of Athens was composed of farmers who would never have a need for a decadrachm. The decadrachm became obsolete by the time of Pericles and Democracy for Athens was losing its supremacy and lost in war to Sparta. In fact, during the Peloponnesian War (431–404 BC), Athens lost its silver resources and began to issue its coins merely silver plated.

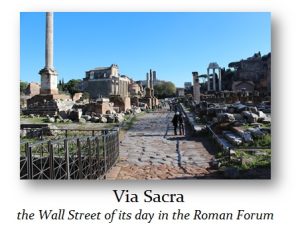

Therefore, both the Athenian and Roman economies began to expand into sophisticated agricultural-based economies only with financial markets. This is how the economies emerged from a Villa Model of self-sufficient enclaves as was also the case in feudal times into a integrated market economy which led to international trade and the birth of Mercantilism. Rome did not have a national debt nor did it possess a central bank. Consequently, there was a deep financial market which would also take place in the Roman forum along the Via Sacra — the Roman version of Wall Street.

Most people assume that the invention of corporations really began with the East India Company since it was the first share to begin trading in the 1500s. However, there were plenty of early examples of markets which were similar to stock markets. Even during the 1100s, France had a system where courretiers de change managed agricultural debts throughout the country on behalf of banks. This can be seen as the first major example of financial exchange because the men effectively traded debts — bonds. Later, the merchants of Venice were credited with trading government securities as early as the 13th century. Post-Dark Age, the first trading in any type of financial marketplace was confined to debt instruments rather than corporate shares.

What is typically overlooked is that the first public corporation concept is truly attributed to also the same man who gave us the word “economics” from the title of his book, “Oikonomikos” meaning actually how to regulate the household – Xenophon (431 – 350 BC). Xenophon was a student of Socrates. He became a mercenary and was the leader of the famous “Ten Thousand” (of recent movie epic). He was opposed to extreme democracy that sentenced Socrates to death. His last writing in 355 BC was his “Ways and Means” that advocated peace rather than war that destroyed the economy (yes, Congress’ committee is named after his work – Ways & Means Committee). Xenophon was not a philosophic intellectual, but rather a practical man of action who wrote from experience.

Xenophon proposed a public corporation for a bank that would be formed by shares subscribed to by all the Athenian people. Commerce was seen as more important than even agriculture. Xenophon proposed a public bank that would lend at interest to expand the economy. He proposed that the profits would be used to pay for public works. During the reign of Augustus (27 BC-14 AD) in Rome, there was such a public loan bank, but not subscribed to by individual members of society. This public bank provided loans to the poor without interest and it was funded by the confiscation of property from those alleged to be criminals, which would include political dissents as well. Collateral was required at twice the amount being borrowed. These types-of public banks aided the purchases of land.

The word “corporation” derives from corpus, the Latin word for body, or a “body of people.” By the time of Justinian (527–565 AD), Roman law recognized a range of corporate entities under the names universitas, corpus or collegium. These included the state itself (the Populus Romanus), municipalities, and such private associations as sponsors of a religious cult, burial clubs, political groups, and guilds of craftsmen or traders. Therefore, these bodies of people commonly had the right to own property and make contracts. They could also receive gifts and legacies, to sue and be sued. They could perform legal acts through representatives as well. Private associations were granted designated privileges and liberties by the emperor and these are the origins of corporations.

Roman knights of the republic did invest in small business and they would receive a share of the profits. These were contracts which could be resold to someone else, but they did not trade on an open exchange. Likewise, senators would also invest in land and gain a portion of the harvest as their return on investment. Trading in shares of corporations really materialized in the 1500s, but the Roman and Greek systems would be more like venture capital and private placements.

Coming Political Change

Armstrong Economics Blog/Politics

Re-Posted Aug 2, 2019 by Martin Armstrong

Cycles of the past

lead to future predictions

By Dinah Wisenberg Brin

The Associated Press Philadelphia

The political upheaval of 1994? They saw it coming two years ahead of time. The devastating Japanese earthquake? They’d been expecting it, albeit a year earlier….President Herbert Hoover … might be pleased with board Chairman Martin Armstrong’s prediction of the extinction of the Democratic Party after 2020.

In late 1992, Armstrong accurately predicted either “a sweeping Republican victory on Capitol Hill” or a victory for a independent party in 1994.

QUESTION: Mr. Armstrong, I found an article from February 21, 1995, in the Associated Press that you had also correctly forecast the elections back in 1994 which became known as the Republican Revolution and warned that the Democratic Party could ride off into the sunset. Your forecast on Trump and BREXIT also show your computer is on to something. Will you be doing the elections in 2020 at the Orlando WEC?

CM

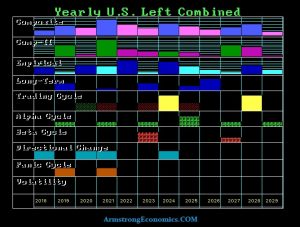

ANSWER: People do not understand that it is not the cycle by itself; it is a reflection of the trend of the whole. The crisis in the Democratic Party is reflected in the turmoil from the Squad of Four who are receiving all the press and painting the Democratic Party as the extreme left. Then you have Bernie Sanders and Elizabeth Warren. They are just not in the center, to say the least. This raises the potential for a major shift in the political system as we saw with Trump wiping out career politicians in the Republic Party. You can see the Array on the Democrats (Combined Senate/House) showed a Panic Cycle in 2019 which gave them the House, but the big turning point will be the 2020 elections with a Panic Cycle due there as the result in 2021.

Yes, we will be doing political forecasts at the WEC.

Did the Fed Begin Secret Bailouts in 2007 Before Anyone Knew of the Pending Crisis?

Armstrong Economics Blog/Central Banks

Re-Posted Jul 30, 2019 by Martin Armstrong

When the GAO report came out on the Quantitative Easing by the Federal Reserve, it uncovered a secret $16 trillion feeding tube from the Fed structured as revolving, low-cost loans to any bank (foreign or domestic) teetering on the edge. Amazingly, the audit showed the Fed started the loans in December 2007 – long before the public knew there was a dangerous financial crisis – and it lasted until at least July 2010.

When the GAO report came out on the Quantitative Easing by the Federal Reserve, it uncovered a secret $16 trillion feeding tube from the Fed structured as revolving, low-cost loans to any bank (foreign or domestic) teetering on the edge. Amazingly, the audit showed the Fed started the loans in December 2007 – long before the public knew there was a dangerous financial crisis – and it lasted until at least July 2010.

In addition to the publicly known support to Bear Stearns from the New York Fed, the GAO audit revealed that the Federal Reserve provided another $853 billion in secret loans to Bear Stearns; $851 billion from its Primary Dealer Credit Facility and $2 billion from its Term Securities Lending Facility. It wasn’t until May 31, 2008, when JPMorgan Chase closed its deal with Bear Stearns. However, the GAO reported that Bear Stearns “was consistently the largest PDCF borrower until June 2008.” The Fed shows that Bear Stearns continued to receive funds until June 23, 2008.

Then by April 2010, that is when Greece had to ask the IMF for a bailout. What is amazing is how no banker was ever charged for the toxic financial waste they created while trading against their own clients.

Brussels to Build a Berlin Wall in Ireland in the event of a Hard BREXIT

Armstrong Economics Blog/BRITAIN

Re-Posted Jul 30, 2019 by Martin Armstrong

COMMENT: You are quite correct Mr. Armstrong. Prime minister Boris Johnson spoke that “no deal” Brexit looks like a surety and the FTSE 100 skyrocketed and the pound took a beating against ALL mostly traded pairs. Indices (excepting for a few) are going to the moon!!

COMMENT: You are quite correct Mr. Armstrong. Prime minister Boris Johnson spoke that “no deal” Brexit looks like a surety and the FTSE 100 skyrocketed and the pound took a beating against ALL mostly traded pairs. Indices (excepting for a few) are going to the moon!!

J.F

REPLY: There are actually suggestions in Brussels I have received a few calls from reliable sources that a hard BREXIT means that Brussels wants to build their version of the Berlin Wall to separate Ireland all for taxes to prevent the free flow of commerce between the Irish people. All of this because of the insanity of their demands on trade. Britain will be so much better off with a hard BREXIT.

In 2018, UK exports to the EU were £289 billion (46% of all UK exports). UK imports from the EU were £345 billion (54% of all UK imports). The share of UK exports accounted for by the EU has generally fallen over time from 55% in 2006 to 43% in 2016, though this increased slightly to 44% in 2017 and 46% in 2018. The numbers are very clear. The UK buys more from the EU than the EU buys from the UK.

A hard BREXIT will allow Britain to enter free trade deals with Asia and the USA which are the more than 50% of its trade balance sheet. The decline in the pound will make British exports even more salable overseas.