Armstrong Economics Blog/Interest Rates Re-Posted Mar 22, 2023 by Martin Armstrong

COMMENT: Marty, it’s refreshing to have Socrates that is totally unbiased. It projected continued rising rates into next year and the Fed just proved its point. It is not backing down.

Thank you. Socrates is very enlightening.

GS

ANSWER: I know there were a lot of talks that surely the Fed had to lower rates and start QE all over again. Most of those sorts of comments have no real experience in markets. They just mouth a lot of hot air. Perhaps instead of putting masks on cows, we should do that on the shills. The Federal Reserve had no choice but to raise interest rates although it was just by a quarter point. Not to do so and the Fed would lose all credibility and the market would then not take them seriously.

You MUST understand that this crisis has unfolded because too many banks were wrapped up in WOKE culture and hired people who were UNQUALIFIED to run risk management. Some were more excited about cross-dressing as a woman and winning the Rainbow award in banking than actually protecting the bank from the risk of rising interest rates.

In a statement released at the conclusion of the meeting, Fed officials acknowledged that recent financial market turmoil is weighing on inflation and the economy, though they expressed confidence in the overall system. “The US banking system is sound and resilient.” They had no choice but to make this statement.

“Recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring and inflation. The extent of these effects is uncertain.”

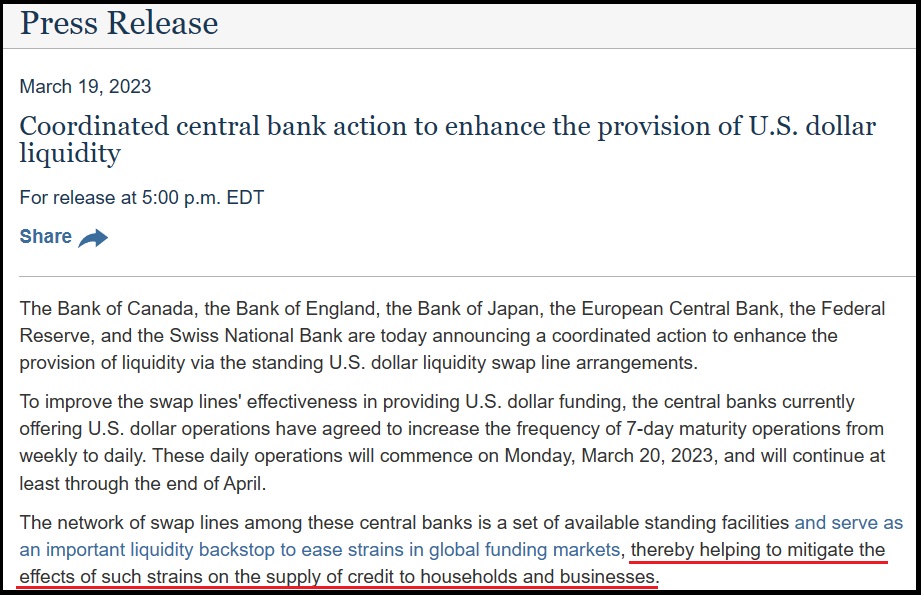

The Fed is saying that their rise in rates will in fact reduce inflation and economic activity. The banks have this yield curve risk and that is different from the 2007-2009 crisis where the debt was based on fraud. Here, the debt is US Treasuries so they are not going bankrupt from that aspect, but it is a liquidity crisis.

If these people who scream loudly but know nothing really about finance keep up the nonsense, they will only add to the uncertainly. This inflation is accelerating thanks to the war.