Posted originally on the conservative tree house on December 15, 2021 | Sundance | 77 Comments

The Commerce Department November retail sales data was release today [DATA HERE] – [DETAIL pdf HERE]. The top line issue is a shocking drop in retail sales for November in key categories that align with previous discussion of inflation spending priorities for all U.S. consumers.

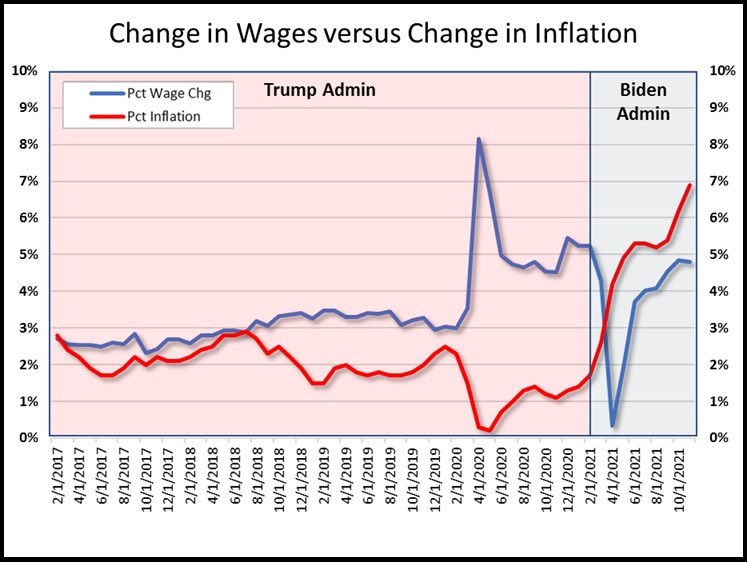

Before getting to the data, one point is critical to remember. The commerce department sales figures are based on dollars spent. This point is important, because the items being purchased have inflation within them. When prices are higher due to inflation, sales figures should be higher due to higher prices. Ex. If there is an 8% increase in retail price, but only a 4% increase in retail sales, that means less stuff is being sold. [Less units sold at a higher price gives the illusion of an increase in sales.]

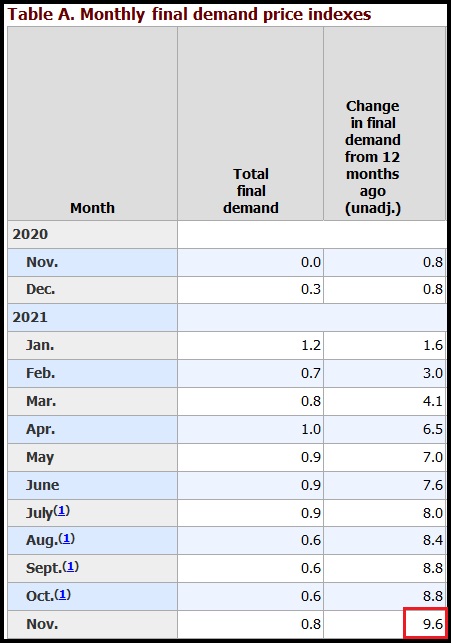

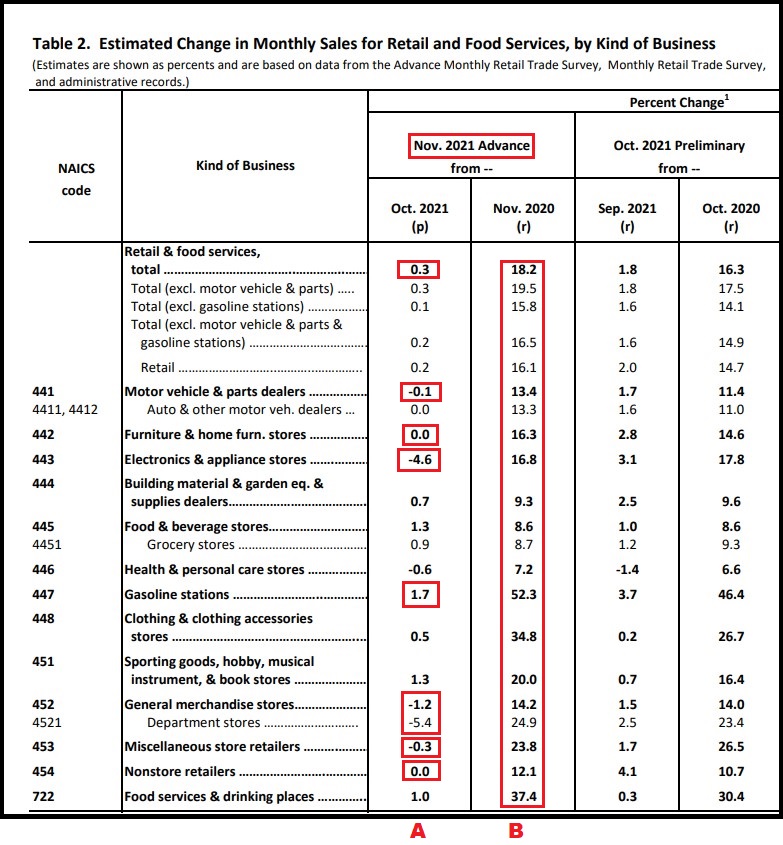

Despite the start of the traditional holiday sales and shopping period, the total sales growth in November was 0.3% over October [Column A]. Factoring in inflation during the same month to month comparison at 0.9%, you can tell that overall in November there was a drop in units sold across the total of retail sales outlets.

A drop in sales at a time when holiday shopping should be taking place is concerning. However, the sales reality aligns with the employment data last week showing a drop of 20,000 workers in the retail sector for November. Put them together, and the picture shows retailers did not need employees, because consumers are not spending.

If we look deeper into the November sales figures, we can see that a contraction in discretionary spending is the primary issue. Electronics (-4.6%), Department Stores (-5.4%) and even online sales at ZERO. We can also see a direct correlation in comparative inflation impact within the sales data for November 2021 when compared to November 2020 [Column B].

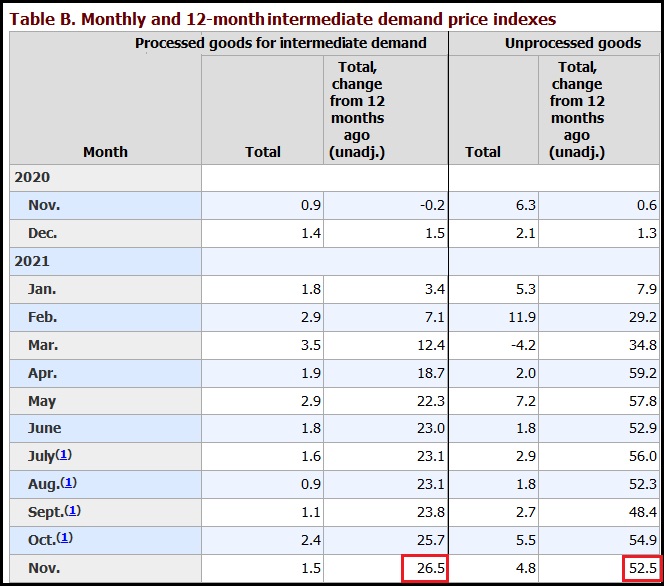

You will note that column B is an almost identical data set to the rate of inflation in those categories. Example: the November 2021 sales data is showing an increase in gasoline station sales of 52.3% over November 2020. That’s because gas prices have gone up 58.1% over the same time period. The increase in sales at gas stations is because inflation is driving sales. [Remember, these comparisons are in dollars being spent.]

A comparison to 2020 for sales dollars in 2021 is useless when you look at the rate of inflation in those categories.

However, to see electronics, department stores, general merchandise and even online sales (Nonstore retailers) showing declines in sales over October, tells us that consumer spending is being squeezed and contracting.

In the electronic sector, sales dropped 4.6 percent versus October. However, the issue is larger. With inflation within the electronics sector around 8 percent (BLS Table-2), a contraction in overall sales of items that cost more means a lot less electronic units are being sold.

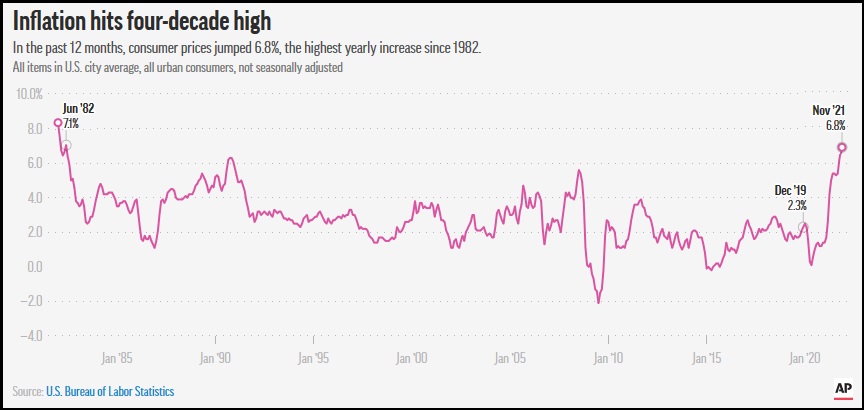

(Bloomberg) “U.S. retail sales rose by less than forecast in November, suggesting that consumers are tempering purchases against a backdrop of the fastest inflation in decades” (more)

Similarly, vehicles overall (new and used) are 20% higher in price this year {BLS DATA} and only achieved a net 13% increase in consumer sales for Nov 2021 -vs- Nov 2020. Far fewer vehicle units are selling.

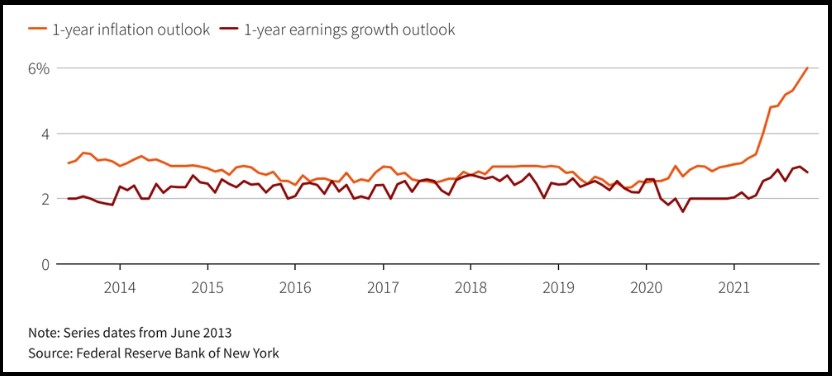

This data should not be surprising to anyone who has been paying attention. Consumers overall, specifically the middle class and working class, are being squeezed hard by food, fuel, housing and energy inflation, and are cutting back their spending this Christmas. The media are blaming the soft sales on COVID and supply chains again, but that’s not really the issue.

WASHINGTON, Dec 15 (Reuters) – U.S. retail sales increased less than expected in November, likely payback after surging in the prior month as Americans started their holiday shopping early to avoid empty shelves.

[…] The modest retail sales gain did not change views that the economy was regaining steam after a slowdown in the third quarter that was triggered by the COVID-19 Delta variant and rampant shortages.

[…] Retail sales rose 0.3% last month after surging 1.8% in October. Sales have now risen for four straight months. They increased 18.2% year-on-year in November. Economists polled by Reuters had forecast retail sales rising 0.8%. Estimates ranged from as low as being unchanged to as high as a 1.5% increase.

[…] The moderation in retail sales, which are mostly goods, was in part due to shortages and higher prices. Receipts at auto dealerships dipped 0.1% after accelerating 1.7% in October. Automobiles remain scarce because of a global semiconductor shortage. Sales at electronics and appliance stores fell 4.6%.

But sales at service stations increased 1.7%, lifted by higher gasoline prices. Receipts at food and beverage stores rose 1.3%, also reflecting rising inflation.

“Food and gas are forcing hard choices for consumers in other areas this holiday season,” said Tim Quinlan, a senior economist at Wells Fargo in Charlotte, North Carolina. “Consumers are no longer the price-takers they were when they were flush with cash from stimulus checks.” (read more)