QUESTION: Why is the US Dollar tanking during this Coronavirus outbreak? Would have thought it was a safe haven. And why is the Japanese Yen increasing? Why is Japan considered a safe haven?

M

ANSWER: This has nothing to do with the Coronavirus. The capital flight began with the concern that Bernie was leading the pack and it appeared that he would be the candidate against Trump. That was the #1 concern of capital and this is why the Dow was the first to peak out reflecting the international political concerns and why we warned of a sharp rally in the Euro. The Coronavirus has been whipped up into a real panic to the point it has seriously impacted the global economy. Even we were forced to cancel our Shanghai WEC and we were holding a special training session in Berlin for Pro Subscribers which also had to be canceled. The jury is still out on the Frankfurt WEC.

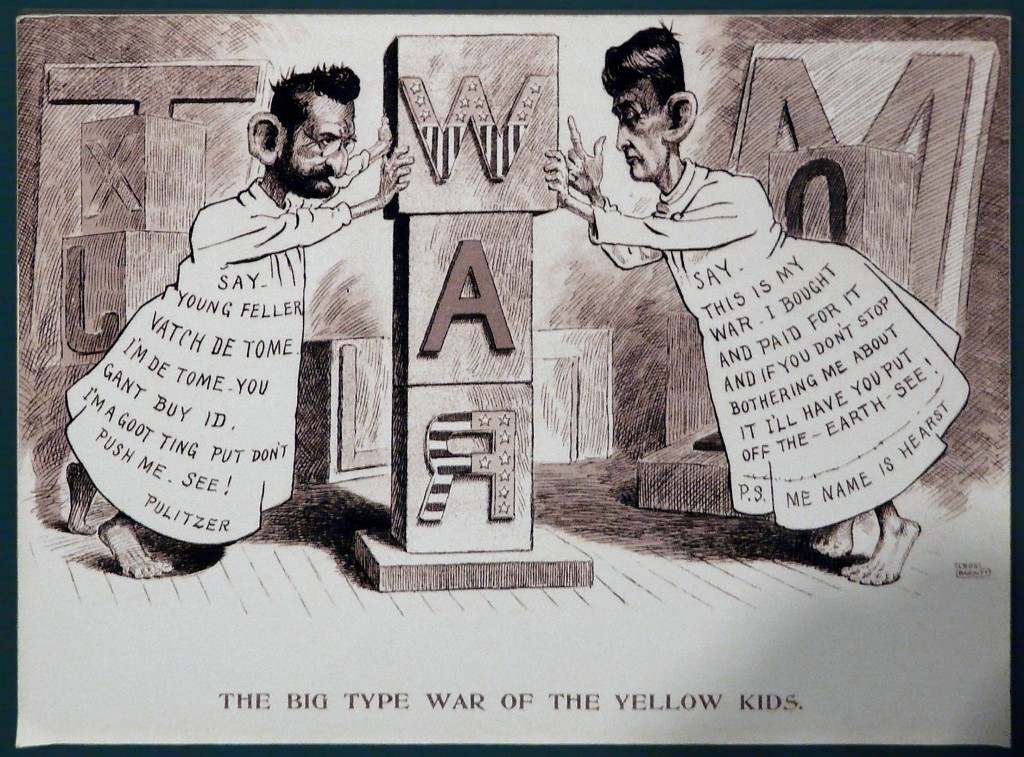

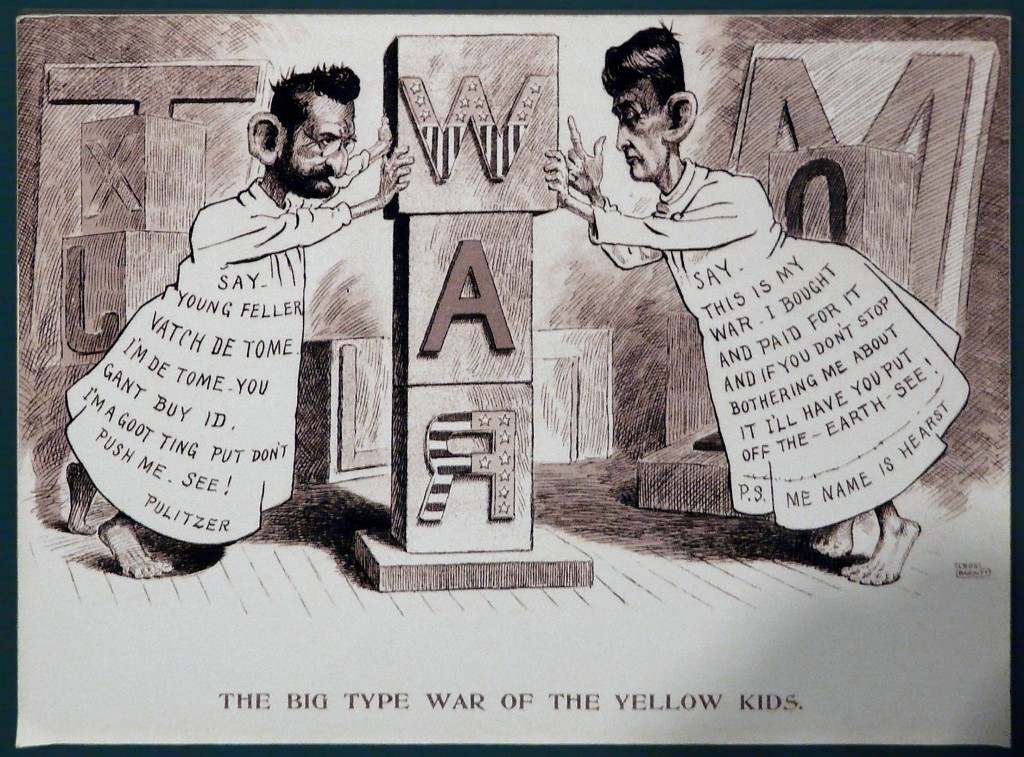

This really seems to be something created by the press like the Spanish American War because of the fake news by Pulitzer and Hearst. They simply wanted to sell newspapers when the sinking of the US ship Maine was never an act of war by the Spanish but an accident. This is why Pulitzer tried to reshape his image after death taking his blood money and creating the Pulitzer Prize. It is ironic that the most prestigious prize in journalism is named by the father of Yellow Journalism.

We really do not have hard evidence to confirm that we are looking at such a major crisis or pandemic concerning the Coronavirus. This may simply subside in April with the normal flu season. We have to cross that bridge when we come to it. But the speculation is unbelievable and the press has scared the hell out of everyone that they are creating a global recession and forcing political change. I get a lot of emails that say I am wrong and 50% of the population will die. I hope I am one of them because I am sick and tired of losing more and more rights with each passing claimed crisis.

In Japan, the Prime Minister is seeking new power to declare the Coronavirus an emergency to give him more dictatorial power. In the US, Trump has asked Congress for emergency spending and seeking a payroll tax cut to help workers. In Italy, the entire country has been put on lockdown. We are looking at really pushing the envelope for governments under the banner of free societies.

Meanwhile, we have others claiming paper money should be terminated because it can spread the Coronavirus. This is becoming reminiscent of the 911 crisis which they used to justify Homeland Security and we all now have TSA inspecting what we have and confiscating cash if you have over $10,000 even on domestic flights. The conspiracy theories can be made up almost on an endless cycle in and of themselves.

Now the market is crashing based on the impact of the Coronavirus insofar as its economic impact. We do expect that the 1st quarter numbers will reflect a recession in may areas. Capital is being pulled back because there is a major liquidity crisis unfolding which has forced the Fed to now expand the availability of money to support the overnight Repo market.

We have a perfect storm of events unfolding which is the prelude to the entire Monetary Crisis and the Mother of All Financial Crises coming directly at us. This is going to be a major financial upheaval that will separate the men from the boys. Those who trade emotionally will not survive. We are looking at major confusion and swings that will get the best of most people.

We ourselves are looking into doing a webinar as an alternative to training sessions we have been doing for pro clients in various places around the world.