Armstrong Economics Blog/Economics

Re-Posted Sep 14, 2019 by Martin Armstrong

I have said this many times, when it comes to understanding interest rates Trump is speaking the standard mantra that people apply when it comes to interest rates. Trump is a borrower, not a lender. His bankruptcies were the result of the business cycle and he leverages himself to the hilt so when the recession comes, he gets in trouble and when it is booming he claims to be a fantastic investor. But he is no trader. He could have hedged the business cycle but did not.

This latest rant that interest rates should be lower illustrates he is a borrower and not a lender. Therefore, he views that lowering interest rates will be bullish when in fact lower interest rates wipe out the savers.

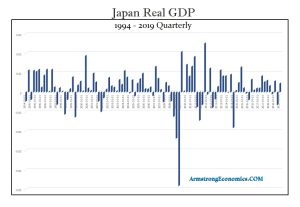

Sorry, I do not agree with this and more than 10-years of low to stupidly low interest rates have FAILED to reverse the economic declines in Europe or Japan. Europe is approaching its 13th year of economic recession. When we look at the German share market, the strongest in Europe, it still has not exceeded the 2000 high on the Price Index. So much for lower interest rates boosting the share market.

Hello President Trump! You better look for some REAL advisers.

Stocks rise with Rising Interest Rates & Falls with Lower Rates

Armstrong Economics Blog/Basic Concepts

Re-Posted Sep 13, 2019 by Martin Armstrong

QUESTION: I mentioned that you said the stock market rallies with rising rates and declines with lower rates to an analyst. He said you were wrong and everyone knows that is not true and President Trump just came out calling on the Fed to lower rates to zero of negative.

You have only showed 1929 as your example. Can you support your argument otherwise?

Skeptical

REPLY: Well skeptical, we need people like you on the opposite side. It is not my job to convince you. Trump is a borrower and only sees the world through his personal experience. The people with savings and pension funds are being wiped out. That is a statement he has made which is HIGHLYdangerous and proves I do not advise Trump which seems to be a Democratic accusation running around.

I do not care what period you look at. This notorious group of “everyone” illustrates that if you tell a lie long enough, you yourself will believe what you are saying. These people constituting everyone just repeat what others say without any verification whatsoever. They even teach this nonsense in school. I had one student who said his professor was teaching the same nonsense.

I fully understand that the talking heads on TV also portray the stock market from the borrower’s viewpoint just as Trump has done. Not everyone borrows and the big money does not. So if people believe what they want to believe. I prefer to assemble the largest possible database, correlate everything, and see how the world REALLY ticks. So believe what you want. There are always two-sides to a market so I fully respect that it is ABSOLUTELY vital that the major be on the wrong side for that is what makes the markets move.

Is it Our Time to Rock & Roll?

Armstrong Economics Blog/ECM

Re-Posted Sep 13, 2019 by Martin Armstrong

QUESTION: Marty,

Sometime you compare today’s financial markets and economy to what was going on in the mid to late 1920s . Woodrow Wilson is even referenced concerning the flight of capital and of course that flight came to the United States.

You also say that the global markets and economy are unlike anything in modern history. I can only assume that you are referring to the artificial bond yields and prices due to central banks buying so much of the sovereign debt.

How is this period that same as the late 1920s and how is it different?

I am a huge fan of your work. Thanks for the blog and for Socrates!

NM

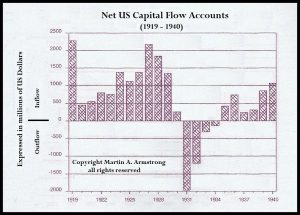

ANSWER: There was a flight of capital to the United States pushing the dollar higher for World War I. Woodrow Wilson was president 1913 – March 4, 1921. Wilson introduced a comprehensive program of domestic legislation at the outset of his administration, something no president had ever done before. Willson took a rather interesting view of tariffs. He argued that the system of high tariffs

“cuts us off from our proper part in the commerce of the world, violates the just principles of taxation, and makes the government a facile instrument in the hands of private interests.”

Tariffs were really an additional tax on consumers which Trump does not understand for he is looking only at jobs which is typical. Tariffs benefits only the producers by rewarding them with a higher income than the free market would provide. However, the other side of the coin on this issue was that Wilson also created the income tax. The Revenue Act of 1913 reduced the average import tariff rates from approximately 40% to about 26% and the revenue shortfall was to be be made up with income taxes.

Wilson created the Federal Reserve in 1913. He also moved for major legislation seeking antitrust legislation to enhance the Sherman Antitrust Act of 1890, which was really a response to the consolidation of railroads. The politicians saw mergers as destroying jobs rather than creating an efficient railway system. Wilson was also against the position that the USA should own colonies, and thus he promoted the independence of the Philippines. From 1914 until early 1917, Wilson’s tried to keep the USA out of the war in Europe. That did not sit well with the hawks in Congress.

All of that said, on the one hand we have Trump against war, as was Wilson, but in favor of tariffs as a tool to win free trade ignoring that they are really a consumer tax and protectionism for overpaid jobs. It was Wilson who told the Fed they had to buy US government bonds to prevent the yield from rising, which is sort of the problem we still have today. The Fed was originally designed to stimulate buying corporate paper directly when banks would not lend. Now the Fed stimulates by supporting government buying bonds from the banks who in turn still do not lend to support the economy in a crisis. The very idea why we needed the Federal Reserve has been completely reversed.

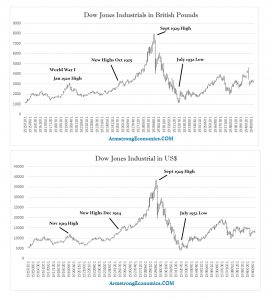

The primary difference today is the debt. The capital shifted into the USA and we see divergences between the highs and lows centered around World War I, whereas the 1929 and 1932 lows take place in both British pounds and dollars. For the World War I commodity boom, the US high was November 1919, whereas the British pound high was January 1920.

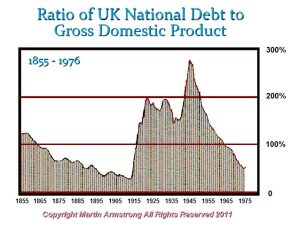

There was a major debt crisis in Europe, but not the United States. This is what wiped out Britain as it lost the crown of the financial capital of the world to the USA. This time, the debt crisis is systemic. The currencies are showing divergences as they did pre-World War I. But we have a socialist crisis whereas Western economies are collapsing unable to fund all the promises, as was the case with Communism in 1989-1991 in China and Russia. The central banks only keep governments on life-support and there is no direct stimulation of the economy. Every lesson from the past has been forgotten. We have put all the eggs in one basket (government) and we have politics in meltdown as republics are collapsing and the left v right is becoming much more intense which will, as always and without exception, lead to violence, civil unrest, separatist movements rising, and could result in revolutions which increases the risk of international war as politicians need a distraction from their failed domestic agenda.

It is just now our turn to rock & roll.

This will make for a very interesting WEC this year in Orlando.

Can Government Prevent a Major Debt Crisis?

Armstrong Economics Blog/Economics

Re-Posted Sep 12, 2019 by Martin Armstrong

QUESTION: Hi Martin

I recently stumped upon a documentary on Netflix about you and your model.

I then went on and watched some YouTube videos.

To me it makes totally sense that taxation does not work, but how can we change it. Do we need to become politicians?

We have a very high tax in Denmark. Base level around 39 percent and top level around 60. So it’s eminent to cajnge this in Denmark.

We have a quite new political party here called Liberal alliance. They promote a flat tax of 40 percent, and I think that makes sense…. But, they had such bad election and are so tiny now, they have no influence.

Everyone say we need taxes to have welfare. So how do we go from 60 to 0 percent in tax without sacrifice our welfare. And how do we convince people that it Wan work….. It will be some very tough months or years once the tax is not flowing to the hospitals etc?

I hope you can elaborate on these things.

DB

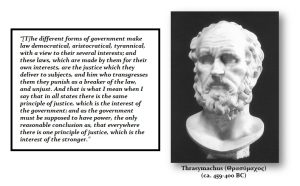

ANSWER: In building the model, I assembled data on everything I could find and then put it all together to see how and what made the world tick. I investigated tax rates to see how civilizations operated. I investigated what types of governments worked best and what always collapsed into oligarchies, then tyrannical entities, before collapsing into dust.

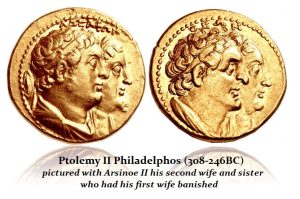

I read many contemporary historians directly rather than the modern interpretation of events, which have NEVER been unbiased. I discovered that inevitably people interpreted the past with a modern context. I found one of the funniest to be when they named the city of Philadelphia after the Greek meaning “brotherly love.” The founders were devoted Christians, and in their view, they loved their brother as they loved themselves. However, the real meaning in Greek meant incest — the brother was fooling around with his sister. Understanding the meaning in which words were used is critical to understanding history. You can NEVER read it in terms of a modern context.

I read many contemporary historians directly rather than the modern interpretation of events, which have NEVER been unbiased. I discovered that inevitably people interpreted the past with a modern context. I found one of the funniest to be when they named the city of Philadelphia after the Greek meaning “brotherly love.” The founders were devoted Christians, and in their view, they loved their brother as they loved themselves. However, the real meaning in Greek meant incest — the brother was fooling around with his sister. Understanding the meaning in which words were used is critical to understanding history. You can NEVER read it in terms of a modern context.

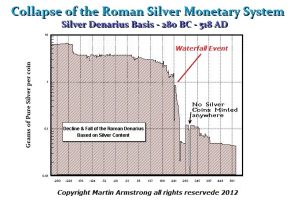

The Romans generally had a 7% tax. They also had welfare. The difference was that they had NOcentral bank and NO national debt. They controlled the mines and simply minted coins to fund the government and its programs. The Romans controlled the mine Rup Tinto in Spain, which they won from Carthage in the Punic War. The amount of silver they mined from that location funded the government for decades.

The debasement began in 64 AD under Nero when Rome experienced the great fire and Nero had to rebuild the city. As the new silver was declining, we find the debasement. It was not an issue of vote for me and I will give you this or that. The debasement begins because the government funded itself with new money and the sources were running dry.

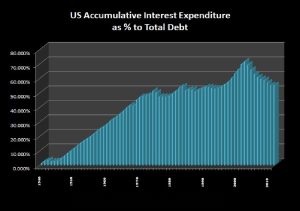

The problem we face is that it would have been far less inflationary to print the money than borrow it. We have a debt crisis that cannot be paid and the accumulative interest expenditures rose to reach at times even 70% of the national debt. Now that they have discovered NEGATIVE interest rates, they think they discovered a new way to tax people indirectly. They think we are too stupid to realize this is even a tax.

But fear not. We are heading into a Monetary Crisis of untold proportions. If the governments do not listen, they will create the biggest civil unrest in all of history. This is the collapse of socialism, for they have promised everything, funded nothing, and cannot keep raising taxes without causing the economy to collapse. This will undermine their entire tax system.

There are ways to deal with this crisis if we have the courage to first admit that we have a crisis. That is step one.

Japan Still Declining into 2021

Armstrong Economics Blog/Japan

Re-Posted Sep 11, 2019 by Martin Armstrong

QUESTION: When I saw your blog saying 2019 will be really crazy and chaotic year for Japan (Feb 2019), I was curious how bad it could be. It is always amazing to see how you and your Socrates turning point manifest in the real world. I was astonished when Japan restricted exports of critical materials used in South Korea’s high-tech semiconductor industry right after G20 Osaka Summit. A trade war is generally initiated by a deficit country. This decision was not only opposite but might lead to devastate their own industry and disrupt the world IT markets. It seems to be a political stance for the upcoming Japan Upper House election but connects further deep into friction between Korea and Japan history. Insane year for Japan indeed, thank you for your great work and efforts providing new perspectives to the world.

Q: With all that sovereign debt how do you see the future of Japan will be?

HJ Kim

ANSWER: Our forecast was covering economics, which then causes political responses. As I previously reported, the Bank of Japan (BOJ) Governor Haruhiko Kuroda publicly stated that it may maintain ultra-low rates for a further period of well over a year. However, he also warned against the idea of propping up the economy through unlimited money or printing to finance government spending.

The Bank of Japan is trapped. Its holdings of the national debt have reached nearly 50%. The BOJ modified its forward guidance or pledge on how it will guide future monetary policy. It stated that current very low interest rates will continue at least until the spring of 2020. Without the BOJ buying government debt, there is ZERO hope that interest rates will rise dramatically and a financial crisis will be in the making. The BOJ will keep rates low for an extended period of time for they have no choice. There is no way out of this nightmare and the real inflationary cycle comes when the majority wake up and realize that the emperor has no clothes, and that means the central bankers worldwide.

There remains a capital flight from Japan and the more they keep these policies up, our model does not show that their economy will recover. We are looking at the absolute low perhaps forming as early and the middle of 2020 but more likely into mid-2021. This will prompt the Monetary Crisis to spark political change.

Is Chicago Doomed?

Armstrong Economics Blog/The Hunt for Taxes

Re-Posted Sep 10, 2019 by Martin Armstrong

COMMENT: Chicago is at it again. The new mayor, Lorie Lightfoot, is proposing a sales tax for high end professional services such as accounting, legal and investment banking. Can you imagine how fast the business district will be vacant!

VL

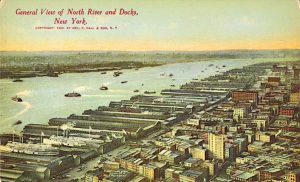

REPLY: Chicago is rather doomed. The teachers wanted to put a tax on all trading in Chicago to pay for their pensions. These people have no concept of competition. Here is a postcard from 1909 showing that New York City was once the biggest port in America. There is NOTHING left because of the unions and corruption. Shipping simply left.

These people have no clue how the economy works. You cannot extort people. They will simply leave

Elizabeth Warren’s Insane Proposals

Armstrong Eonomics Blog/Politics

Re-Posted Sep 9, 2019 by Martin Armstrong

QUESTION: Mr. Armstrong, Elizabeth Warren’s proposal seems to lack any comprehension of the economic impact. She has said: “To put our economy — and our families — on firmer ground, it is essential to reduce household debt both by raising people’s wages and by bringing down their costs. That is the heart of her economic agenda. We can raise incomes by increasing the minimum wage to $15 an hour, strengthening unions, ensuring that women of color get the wages they deserve, and empowering workers to elect at least 40% of board members at big American corporations.” Correct me if I am wrong, but hasn’t this QE been all about getting people to borrow and spend more? Then she wants unions to run the corporations. When that was the case before everything declined as you pointed out New York was once a major port but unions destroyed that. What is your opinion of these proposals?

JG

ANSWER: They are counterproductive. All we hear is raise wages. Why not cut taxes and increase disposable income? The minimum wage has to be reviewed for what it is. Raise it and you will destroy the entry-level jobs that kids fill to get started in life. How about we divide it and make it a “student” or “entry-level” job versus a mature minimum wage? Raise it to $15 and there go the entry-level jobs. There should be two minimum wages – entry level v position. Raise it to $15 and you no longer need a person to take your order. A machine can do it. Entry level jobs are being wiped out because of BENEFITS required so replace a simple job with a machine. The problem is not the wage by itself. The problem is all the regulation with respect to benefits and healthcare. Even the US Post Office hires part-time to avoid benefits.

You are correct that QE and negative interest rates were to force people to borrow and spend. Warren is of course on board with these proposals. What she should look at is restoring usury laws that interest rates on credit cards should be no more than 2x the wholesale bank rate. The poor are hit with high rates. There are homeless people living in old motels paying $50-$75 a day because they have no credit and cannot afford a down-payment for an apartment. They are being exploited by the current system and if we raise the minimum wage we will encourage technology to replace workers. How about we eliminate payroll taxes below $31,200 ($15 an hour) and no benefit requirements. They are either on their parents healthcare thanks to Obamacare up to 26, or they should be on medicaid and that will provide the “healthcare for all” promises.

As far as workers directing boards by 40%, well that is just stupid. If they want a say — buy the stock. This is all about OWNERSHIP, not union labor. Why would people buy stock if the workers make the decisions which will be in their own self-interest? If you say workers get a favored position in buying stock and therefore have a vested interest in the company doing well, then the workers and investors will be on the same side of the table.

This is what politics has come down to. Vote for me and I will create insane laws for you against everyone else.

Fixed Exchange Rates Have Always Caused Major Financial Crises

Armstrong Economics Blog/Economics

Re-Posted Sep 8, 2019 by Martin Armstrong

Margaret Thatcher on the ERM Crisis & why even the euro will f

All Bob’s Money

Armstrong Economics Blog/Politics

Re-Posted Sep 7, 2019 by Martin Armstrong

Currency Which Expires – That’s the Solution – Or Just Cancel it all?

Armstrong Economics Blog/Economics

Re-Posted Sep 6, 2019 by Martin Armstrong

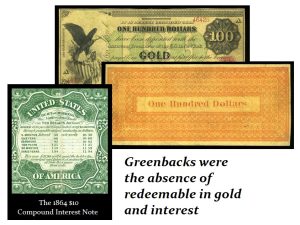

Back during the Great Depression, there were people who theorized that gold hoarding was preventing economic recovery. There is always this same theory that people who save hoarding their money and are not spending it results in the lack of a recovery suppressing demand. This theory has been around for a very long time. It assumes a recovery is always blocked by people hoarding their money and saving for a rainy day.

Back during the American Civil War, the federal government issued paper currency for the first time after the Revolution. Much of this currency paid interest. Some were in the form of virtually circulating bonds with coupons for the interest payments. Some were backed by gold. Others offered a table on the reverse providing a schedule. The interest baring notes remained valid currency, but the interest expired within a specific time period. Hence, one would redeem the note since it would no longer pay interest beyond a specific date.

Back during the American Civil War, the federal government issued paper currency for the first time after the Revolution. Much of this currency paid interest. Some were in the form of virtually circulating bonds with coupons for the interest payments. Some were backed by gold. Others offered a table on the reverse providing a schedule. The interest baring notes remained valid currency, but the interest expired within a specific time period. Hence, one would redeem the note since it would no longer pay interest beyond a specific date.

The rumbling behind the curtain I am hearing is a growing idea of making the currency in Europe simply expire. I have explained before that in Europe currency routinely expires – even in Britain. The United States has never canceled its currency so a note from the Civil War is still legal tender. But that is not the case in Europe.

Europeans are accustomed to having their money simply expire. This is not limited to paper currency. They also cancel the coins. The proposal being whispered in the dark halls of Europe is that perhaps the way to impose negative rates to force people to spend is to just cancel all the currency and authorize only small notes for pocket change. They want everyone to be forced to use bank cards and this is the new theory to revitalize the economy.

The chart patterns for the Euro are about as long-term bearish as one can imagine. The problem facing the world economy is this idea that they can even FORCE people to spend their savings recklessly as the government does. Canceling the euro may be a drastic and desperate step, but it is being proposed as an alternative to deep negative interest rates which have failed to work for more than 10 years. The middle ground proposes a paper currency with expiration dates.

Either way, the risk of a profound dollar rally remains in the wings. The powers behind the curtain desperately want to defeat Trump for they know he would NEVER cancel the American currency. To pull that off, they need a career politician. Joe Biden would be perfect. He might just sign whatever bill is put before him and then take a nap. It is ironic, but there would be a lot of Americans who would wake up and want Trump bank after that one. Joe would be too tired to tweet.

Either way, the risk of a profound dollar rally remains in the wings. The powers behind the curtain desperately want to defeat Trump for they know he would NEVER cancel the American currency. To pull that off, they need a career politician. Joe Biden would be perfect. He might just sign whatever bill is put before him and then take a nap. It is ironic, but there would be a lot of Americans who would wake up and want Trump bank after that one. Joe would be too tired to tweet.