Armstrong Economics Blog/Central Banks

Re-Posted Jul 30, 2019 by Martin Armstrong

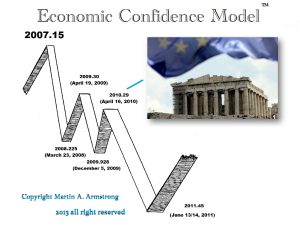

When the GAO report came out on the Quantitative Easing by the Federal Reserve, it uncovered a secret $16 trillion feeding tube from the Fed structured as revolving, low-cost loans to any bank (foreign or domestic) teetering on the edge. Amazingly, the audit showed the Fed started the loans in December 2007 – long before the public knew there was a dangerous financial crisis – and it lasted until at least July 2010.

When the GAO report came out on the Quantitative Easing by the Federal Reserve, it uncovered a secret $16 trillion feeding tube from the Fed structured as revolving, low-cost loans to any bank (foreign or domestic) teetering on the edge. Amazingly, the audit showed the Fed started the loans in December 2007 – long before the public knew there was a dangerous financial crisis – and it lasted until at least July 2010.

In addition to the publicly known support to Bear Stearns from the New York Fed, the GAO audit revealed that the Federal Reserve provided another $853 billion in secret loans to Bear Stearns; $851 billion from its Primary Dealer Credit Facility and $2 billion from its Term Securities Lending Facility. It wasn’t until May 31, 2008, when JPMorgan Chase closed its deal with Bear Stearns. However, the GAO reported that Bear Stearns “was consistently the largest PDCF borrower until June 2008.” The Fed shows that Bear Stearns continued to receive funds until June 23, 2008.

Then by April 2010, that is when Greece had to ask the IMF for a bailout. What is amazing is how no banker was ever charged for the toxic financial waste they created while trading against their own clients.

Brussels to Build a Berlin Wall in Ireland in the event of a Hard BREXIT

Armstrong Economics Blog/BRITAIN

Re-Posted Jul 30, 2019 by Martin Armstrong

COMMENT: You are quite correct Mr. Armstrong. Prime minister Boris Johnson spoke that “no deal” Brexit looks like a surety and the FTSE 100 skyrocketed and the pound took a beating against ALL mostly traded pairs. Indices (excepting for a few) are going to the moon!!

COMMENT: You are quite correct Mr. Armstrong. Prime minister Boris Johnson spoke that “no deal” Brexit looks like a surety and the FTSE 100 skyrocketed and the pound took a beating against ALL mostly traded pairs. Indices (excepting for a few) are going to the moon!!

J.F

REPLY: There are actually suggestions in Brussels I have received a few calls from reliable sources that a hard BREXIT means that Brussels wants to build their version of the Berlin Wall to separate Ireland all for taxes to prevent the free flow of commerce between the Irish people. All of this because of the insanity of their demands on trade. Britain will be so much better off with a hard BREXIT.

In 2018, UK exports to the EU were £289 billion (46% of all UK exports). UK imports from the EU were £345 billion (54% of all UK imports). The share of UK exports accounted for by the EU has generally fallen over time from 55% in 2006 to 43% in 2016, though this increased slightly to 44% in 2017 and 46% in 2018. The numbers are very clear. The UK buys more from the EU than the EU buys from the UK.

A hard BREXIT will allow Britain to enter free trade deals with Asia and the USA which are the more than 50% of its trade balance sheet. The decline in the pound will make British exports even more salable overseas.

The Greatest Fear for Brussels about BREXIT

Armstrong Economics Blog/BRITAIN

Re-Posted Jul 29, 2019 by Martin Armstrong

The entire feud between Britain and Brussels has been over the border in Ireland between north and south. Brussels fears that there will be a free-flow of goods which will circumvent their taxes. The election of Borris Johnson has created a giant nightmare for Brussels. Trump and Johnson will enter a free trade agreement. A hard BREXIT will be the best thing for Britain for it will be free to cut its own trade dealers with the US, China, Japan, and the rest of the non-EU world.

The entire feud between Britain and Brussels has been over the border in Ireland between north and south. Brussels fears that there will be a free-flow of goods which will circumvent their taxes. The election of Borris Johnson has created a giant nightmare for Brussels. Trump and Johnson will enter a free trade agreement. A hard BREXIT will be the best thing for Britain for it will be free to cut its own trade dealers with the US, China, Japan, and the rest of the non-EU world.

The restrictions on trade imposed by Brussels are impossible to manage because all 28 members have a say in any trade deal. This is why the deal with the USA took so long to start with and it became unworkable. Trump offered a free trade deal and France was the one screaming the loudest. Germany cannot cut a deal with the USA because of France and neither could Britain.

A hard BREXIT will change the trade landscape in Europe which will put pressure on Brussels. The more they try to punish Britain, the more they will isolate the European economy for pure power.

Is Inflation Inevitable?

Armstrong Economics Blog/Economics

Posted Jul 27, 2019 by Martin Armstrong

QUESTION: Mr. Armstrong is there any way we can not have inflation. If so how? If not what would you say 5% or more?

S

ANSWER: It all depends on your definition. The type of inflation coming is more STAGFLATIONwhere prices rise due to cost-push (shortages) but there is a declining economic growth. The more familiar inflation is a DEMAND lead event because the economy is booming. Because governments are desperate for money, they keep raising taxes and are increasing enforcement. This trend is DELATIONARY for it reduces disposable income. The INFLATIONARY pressure comes from the rising costs which are set in motion by raising taxes.

Then we add the impact of the climate chaos creating shortages in food and that furthers cost-push inflation. The end result will be the shift from PUBLIC to PRIVATE where people will run away from government debt on all levels and move to tangible assets to survive.

Are Some Property Funds Being Suspended in London?

Armstrong Economics Blog/Real Estate

Re-Posted Jul 25, 2019 by Martin Armstrong

The collapse in property values in London has created a crisis in property funds. M&G Investments blocked withdrawals from its UK property fund as it seeks to distance itself from the troubled manager. Back on June 3, 2019, the asset manager wrote to clients of the M&G UK Property fund to inform them it had placed a temporary restriction on customers from taking out their money for up to six months. Restrictions were also placed on certain withdrawals from the Prudential UK Property fund, which feeds into the M&G fund affected about 65% of customers in the fund. Both funds were only available for long-term institutional investors such as pension funds and the total under management was around £636m in assets while the Prudential Fund had about £50m.

The real estate funds are going to be the worst since they tend to be illiquid.

Europe’s Debt: America’s Crisis – Full Video

President Trump Remarks During Oval Office Swearing-In Ceremony – Defense Secretary Mark T. Esper…

July 23, 2019

This evening President Trump delivered remarks during the swearing-in ceremony for newly appointed Defense Secretary Mark T. Esper. [Video and Transcript] The Senate voted 90-to-8 easily confirming Secretary Esper.

.

[Transcript] – THE PRESIDENT: Well, thank you very much everybody. We have a very important moment in our country’s history, actually. And we had a lot of our great Republican senators in the White House, and I invited them over and many of them wanted to be here. And as you probably heard, the vote just took place, and it was 90 to 8. That’s a vote that we’re not accustomed to, Mark, I have to say that. So congratulations, that’s great.

But I’m honored to be here today for the swearing-in of our new Secretary of Defense, Mark T. Esper. I especially want to thank Justice Samuel Alito — highly respected and a great gentleman, a great man — for joining us to administer the Oath of Office. Thank you very much. Thank you, Sam.

We’re also delighted to welcome several of Secretary Esper’s family members and friends to the White House today, including his mother, Polly. Hi, Polly. (Laughter.) Boy, are you proud of him, Polly? You better believe it. Yeah. (Laughter.) His wife, Leah. Thank you, Leah, very much. And his three children — Luke, John, and Kathryn. Thank you very much. Congratulations, too, most importantly. Congratulations. That’s an incredible thing.

There is no one more qualified to lead the Department of Defense than Mark Esper. A West Point graduate — great student, actually — Secretary Esper served our military for 21 years, including in the Gulf War. He also advanced U.S. national security in government and in private sector, most recently as Secretary of the Army, where he played a critical role training and equipping our armed forces. That’s where I got to know Mark. And there was nobody that did a better job than Mark and there’s nobody that loves it more than Mark. And thank you very much.

He is a recipient of the Bronze Star and Combat Infantryman Badge. He holds a doctorate in public policy from George Washington University and a master of public administration degree from the John F. Kennedy School of Government at Harvard University.

I am confident that he will be an outstanding Secretary of Defense. I have absolutely no doubt about it. He is outstanding in every way. And we’re honored to have you aboard. And I would ask Justice Alito, please, to administer the Oath of Office. Thank you. Thank you, Judge.

(The oath is administered.) (Applause.)

THE PRESIDENT: Would you like to say something?

SECRETARY ESPER: Yes, sir, if I may.

THE PRESIDENT: Please.

SECRETARY ESPER: Well, thank you, Mr. President, for your kind words, for your confidence in me, and for this incredible opportunity. And thank you, Justice Alito, for administering the Oath of Office. I really appreciate you being here this afternoon.

I’d also like to Senate — to thank the Senate Armed Services Committee for its quick action on my nomination and for the strong bipartisan support that I received today from the entire United States Senate.

It is an honor of a lifetime to be appointed Secretary of Defense and to lead the greatest military in history. And I will do so with that same energy and commitment to duty, honor, and country that I have for nearly four decades since my early days at West Point.

Mr. President, it is a privilege for me and for my family to be here with you today. Thank you for your leadership and for your commitment to a strong national defense and to all of our service members. Our military has made tremendous gains in recent years thanks to your leadership and we stand ready today to take on any challenge.

And while our soldiers, sailors, airmen, and Marines stand guard each and every day, we will ensure their families are well taken care of.

On a personal note, I would like to thank my wife, Leah, who has been by my side now for 30 years as a military spouse herself; my children, Luke, John, and Kate; my mother, Polly; my in-laws, Tom and Von; and my sisters who join me here today. And everybody else who has been a steadfast supporter of me over the years.

Again, thank you, Mr. President, for allowing me to serve our great country once again, as Secretary of Defense. Thank you, sir. (Applause.)

THE PRESIDENT: Thank you, Mark. Congratulations.

SECRETARY ESPER: Thank you.

THE PRESIDENT: Fantastic. Proud of you. Come on over here.

SECRETARY ESPER: Okay. Leah?

(A certificate is presented.)

THE PRESIDENT: He’s going to be a great one. Thank you very much.

The Real Adam Smith: Ideas That Changed The World – Full Video

Milton Friedman Speaks – Myths That Conceal Reality

Why Hedge Funds Have Missed the Moves

Armstrong Economics Blog/Dow Jones

Re-Posted Jul 23, 2019 by Martin Armstrong

COMMENT: Well, Ray Dalio was short the market, missed the rally, and lost almost 5% for the first half of the year. Obviously, they don’t use Socrates – lol.

LB

REPLY: I do not advise Bridgewater and I have no idea if they even subscribe to Socrates. But what you have to realize is that a lot of these hedge funds form their strategy based upon opinion for the broader view. When you have a portfolio of that size, you cannot simply trade it back and forth for each move. The question becomes critical as to where to draw the line to realize your broadview strategy is wrong.

REPLY: I do not advise Bridgewater and I have no idea if they even subscribe to Socrates. But what you have to realize is that a lot of these hedge funds form their strategy based upon opinion for the broader view. When you have a portfolio of that size, you cannot simply trade it back and forth for each move. The question becomes critical as to where to draw the line to realize your broadview strategy is wrong.

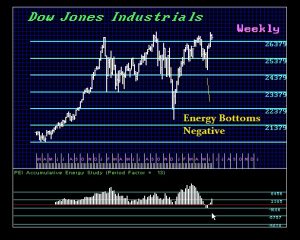

I have stated many times that the trend does NOT begin to shift until you reach the Monthly Level. We saw that in Gold when it finally got through 1362.50 after nearly four years of bouncing off that number. In the case of the Dow Jones Industrials, our hedging models for institutions were long one month from the low and has remained in that position. This is just a hedging model which is either long or short. It at least tends to keep institutions on the right side of the trend for long periods of time.

Aside from the Reversal System, the Energy Model is extremely helpful in identifying the position of the market and if there is a risk of a crash or a rally. The Energy Model turned negative, demonstrating that there was no possibility of a crash as most analysts were forecasting from a gut perspective. A crash would have been possible ONLY if the Energy Model was at a peak. When it is testing the lows or a negative, it is warning that the energy in the market has already dissipated.

We are simply headed into a Monetary Crisis Cycle where the majority of people will never be able to forecast what will unfold from a personal gut perspective. This is not a time for lucky calls. We need objective time-tested analysis that is not clouded by human bias. This is when we need the global approach to let Socrates simply correlate the world to enable us to see the real trends that are in motion. The worst thing you can do is ASSUME you have missed something, as that is typically the kiss of death for investors where they inevitably buy the high or sell the low.