Posted originally on the conservative tree house June 16, 2022 | Sundance

We have been waiting for the non-essential durable goods side of the manufacturing sector to start showing evidence of demand side contraction in consumer purchases. There have been subtle sector-by-sector indicators of consumer spending shifts for several months; however, today we get the direct evidence from Samsung.

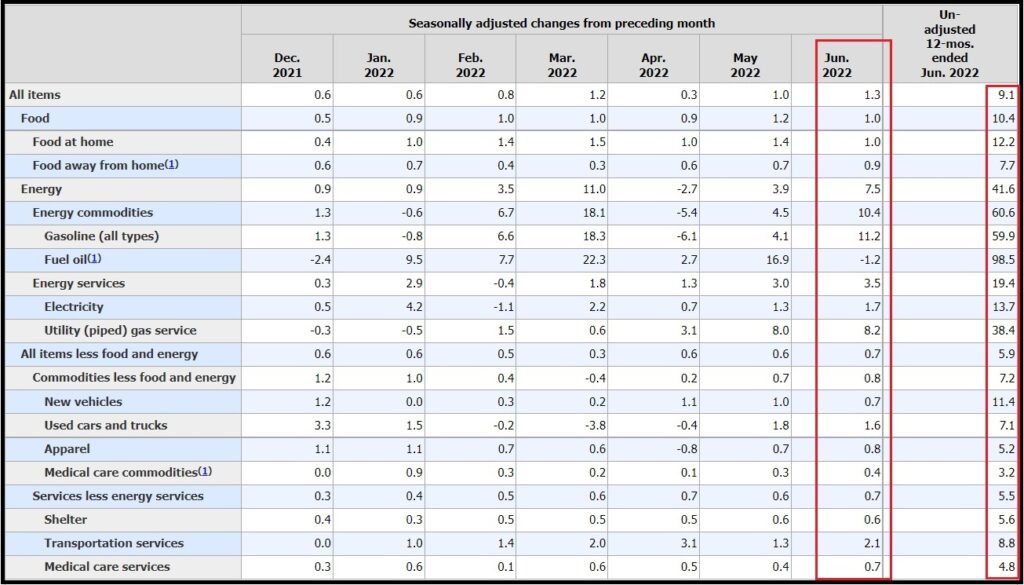

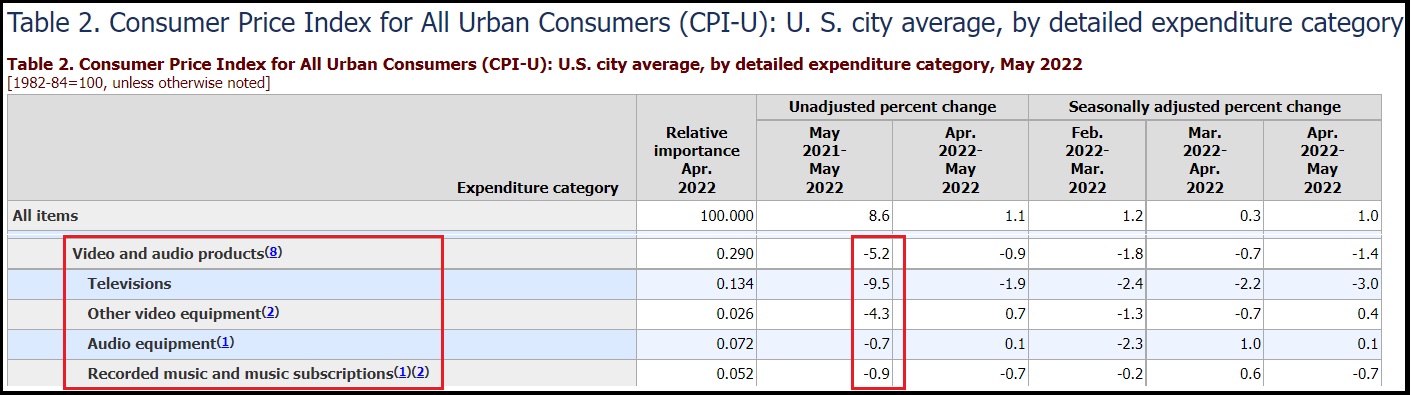

Samsung is one of the leading manufacturers of consumer electronics and products that require chips. For three months the electronics sector has shown background signals that inventory was not moving. One of the more recent indicators of a demand side contraction was the lack of upward price pressure inside the electronics sector. Essentially, consumers are not purchasing the current inventory, so prices are actually dropping in this segment. [SEE TABLE 2, CPI Chart]:

Despite overall inflation of 8.6% within the CPI, deep inside the category indexes you will note that electronic prices are actually dropping. Televisions -9.5%, Video equipment -4.3%, etc. Video and audio products overall dropped in price 1.4% for May, and dropped 5.2% year-over-year.

The supply chain in this sector is lengthy. Meaning inventory builds slowly as consumers stop purchasing in the USA. Retail store inventory turns slow, store inventory climbs, then warehouses inventories climb as stores do not need product. The negative boxcar effect travels back to the manufacturer overseas over the course of several purchase cycles. Eventually, everyone within the sector is telling the supplier we do not need product. Then the manufacturer has to quickly slowdown raw material.

Due to lengthy supply chains, including trans-pacific shipments, the process to stop deliveries in this electronic goods sector is around 90-days before the drop in retail sales reaches the manufacturer to stop production. Here is the announcement from Samsung:

TAIPEI/ SEOUL — Samsung Electronics is temporarily halting new procurement orders and asking multiple suppliers to delay or reduce shipments of components and parts for several weeks due to swelling inventories and global inflation concerns, sources have told Nikkei Asia.

The notification by the South Korean tech titan applies to components for multiple key product lines, including TVs, home appliances and smartphones, four people familiar with the situation said, and the postponement of orders involves a wide range of components across chips, electronics parts and final product packages.

The move by Samsung, the world’s No. 1 smartphone and TV maker and one of the leading home appliance providers, is the latest sign that electronics makers are pessimistic about the economic outlook amid global inflation risks.

Samsung told suppliers that the company needs to closely review its inventory levels of both components and final products to ensure stock on hand is manageable, according to the sources. Two people said the move will last until the end of July. One of the people said shipments from that source’s company have not been completely halted but the volume of the company’s planned shipment to Samsung for July has been slashed by 50%.

Samsung’s inventory assets reached 47.6 trillion won ($36.9 billion) at the end of March, up from 41.4 trillion won in December, according to its first quarter earnings report. The ratio of inventory assets to total assets also jumped to 10.8% from 9.7% during the same period. (read more)

Various Wall Street economists and MSM pundits have stated, erroneously – and many intentionally, there has been no evidence of a demand side contraction. However, CTH reviews of the data have shown exactly the opposite. There are multiple indicators of demand side contraction, including drops in retail sales units that goes all the way back to last holiday season.

Yesterday the U.S. Dept of Commerce released the May retail sales [pdf DATA HERE], showing a 0.3% drop in retail sales for the month.

Retail sales -as measured in units purchased- have been in a contracting position since June of 2021. When the current data shows a drop of -0.3% in May, the actual drop in retail sales is much, much greater. The dept of commerce calculates retail sales in dollars. When prices are 20% higher and sales are low, retailers are selling less stuff (fewer units) at higher prices. This has been the reality of our economy for several months. This is also why productivity has been declining for more than a year.

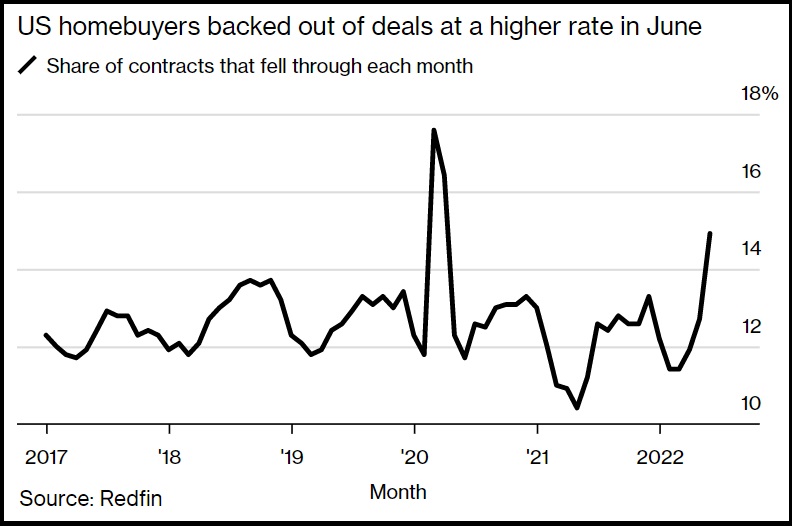

If you take the 8.6% inflation rate (far understated) and an aggregate drop in sales of 0.3% (again, far understated as a measure of inflation), that means consumers are spending limited incomes on critical or essential purchases like housing, food, fuel and energy. Consumers are not purchasing durable goods; people are hunkering down.

Yearly retail sales (May ’21 compared to May ’22) are +8.1%. However, yearly retail inflation for the same period is +8.6%. Again, reflecting that less stuff is being purchased inside the economy at higher prices. If the commerce dept was measuring actual units being purchased, we would be seeing massive drops in sales.

Samsung is reacting to a demand side contraction.