Armstrong Economics Blog/Economics

Re-Posted Mar 20, 2020 by Martin Armstrong

There is no question that the fundamentalists #1 Golden Rule has been when stocks crash, run to bonds. We are entering the collapse in public confidence and this is BEYOND the central banks despite the massive attempts to intervene. Keynesianism is DEAD!!!! We have entered uncharted territory which is the darkest fears of academics for they know nothing about such scenarios. I rushed to try to get Manipulating the World Economy because this was critical given what Socrates was projecting for 2020 and the correction. (3rd edition is at the printers, 2nd edition may still be on eBay).

The bond markets are offering no refuge this time for the flight to quality. The diversification strategies, real value investors, and correlation desks have all lost the most money during this crisis all because the #1 Golden Rule has crumbled and fallen to the ground in a pile of dust. The traditional 60% in shares and 40% in fixed income has collapsed. There has been a worldwide panic to dollars both among institutions as we see in the FX markets, but in the physical world of cash dollars have been vanishing as hoarding skyrockets. There have even been shortages of physical dollars in New York City. Paper dollars have been hard to find in Europe and in many places they are now selling for a premium.

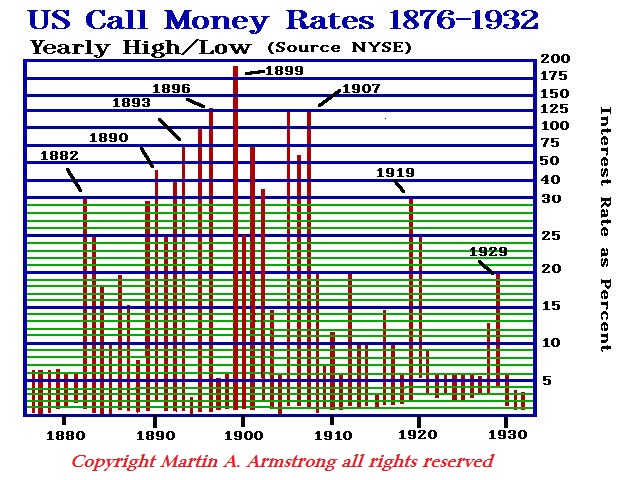

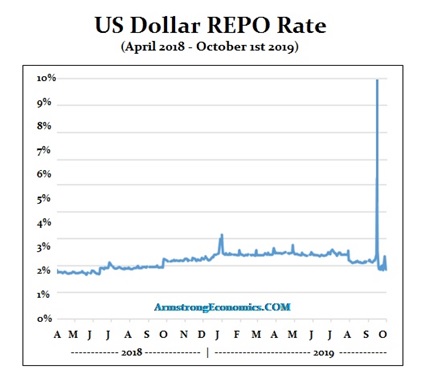

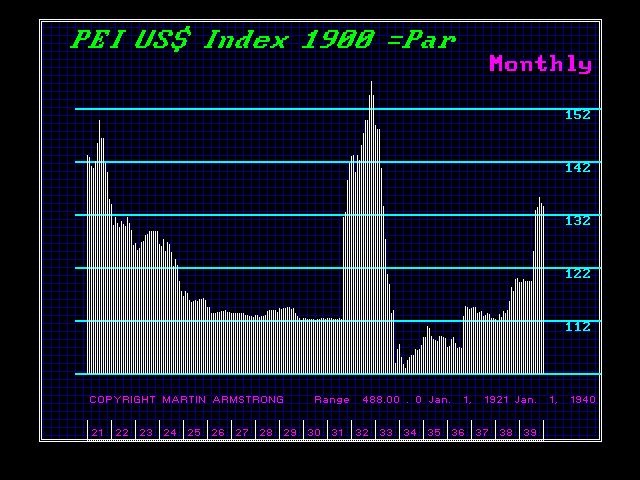

The failure of the bonds to provide the alternative in a stock crash confirms that Keynesian Economics is dead and monetary policy has lost its stimulative power because of this insane negative interest rates. Real rates rise in times of a crisis as illustrated by the call money chart showing dramatic rises in rates pre-Federal Reserve and pre-Keynesian Economics. The central banks have been trying to PREVENTthe rise in short-term rates taking place in the Repo Market since September 2019.

The central banks have been fighting a losing battle against the normal forces of how capital moves during a crisis. During a crisis as this, interest rates rise with the perception of a rise in credit risk. The central banks have been trying to create a bear market in interest rates in the middle of a bull market where rates would instinctively rise

All of those clinging to the Quantity Theory of Money from politicians, analysts, goldbugs, and central bankers, you have to wonder how many times must they all be wrong in assuming an increase in the supply of money must be inflationary. That theory has proven to be suitable for a bedtime story for children. Academics, who has fostered this theory, lack any trading experience. Sorry – all things DO NOT REMAIN EQUAL!

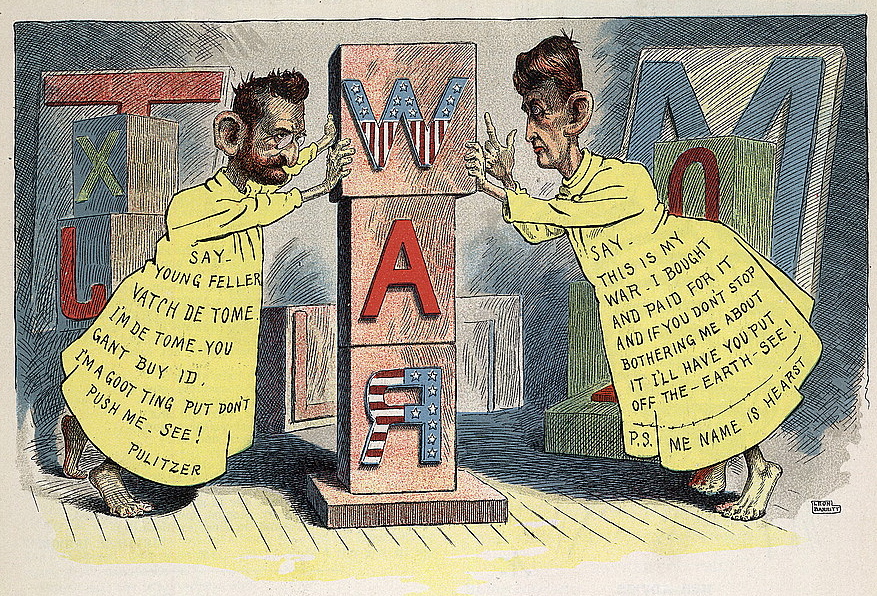

This has not been a market crash sparked by the black swan event using a novel virus that central bankers cannot defend against, this has been an orchestrated overreaction with ulterior motives. There is NO amount of money that can be poured into the economy to reverse the trend as long as people’s confidence in the future has been destroyed by the media. This is no different from how the media created the Spanish American War accusing the Spanish of attacking an American ship that never happened. They name the prize for good journalism after the father of fake news.

This is the destruction of capital formation. The entire Quantity Theory of Money is bogus and has never held up if you simply investigate the history. The old theories of debasing money which led to the start of that theory was during an era when coins were precious metal and they exchanged in value among nations on their metal content. That was the Latin Monetary Union. The same amount of metal established the foreign exchange rate among nations. However, as debasement took place and wars suspended the precious metal standards, money revealed its hidden nature – political power.

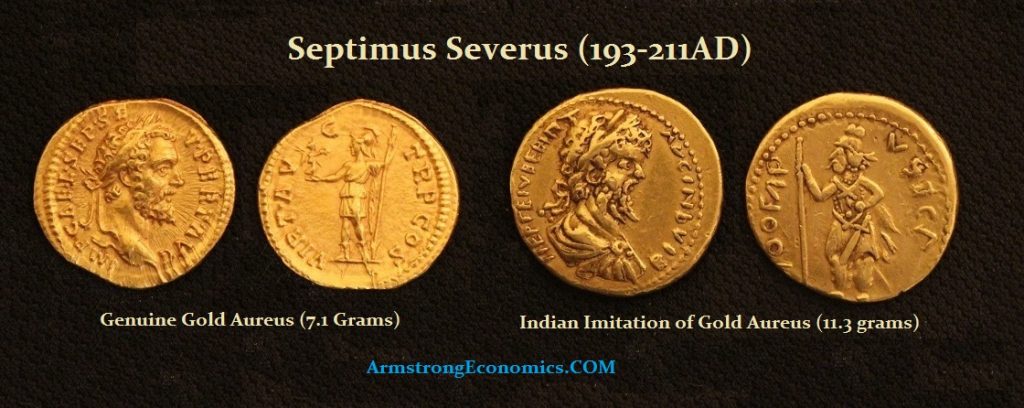

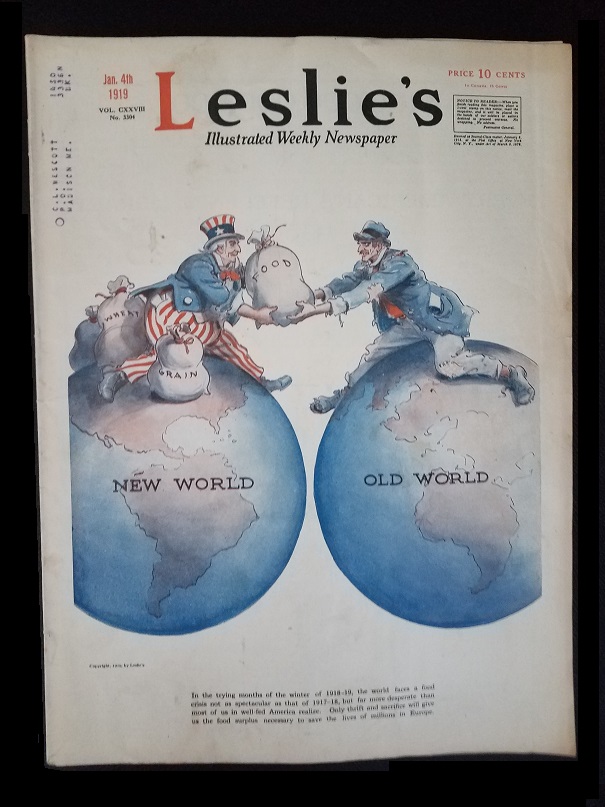

The true nation of money was always international confidence in the government. India would imitate the gold coins of Rome because people trusted the Roman coinage. Gold carried a premium over its metal content based upon political power. The ancient coinage demonstrated that money was NOT the pure intrinsic value of the metal, but the confidence in the political state issuing that coinage.

We find the very same trend 600 years earlier when Athens was the financial capital of the world. Silver was imitated in the form of Athenian Owls, which was the first worldwide currency to appear. Athenian Owls were imitated in Europe to Africa. Once again, these were not counterfeits but imitations. The metal content was some time of an even higher grade. This confirmed that the premium of currency was created by the political stature of the issuer.

This is what we are witnessing right now – the Panic to the Dollar. You must understand that this is a long historical documented reaction. The rush to dollars right now is as old as recorded history. The currency of the dominant financial capital of the world will always trade at a premium in times of crisis.

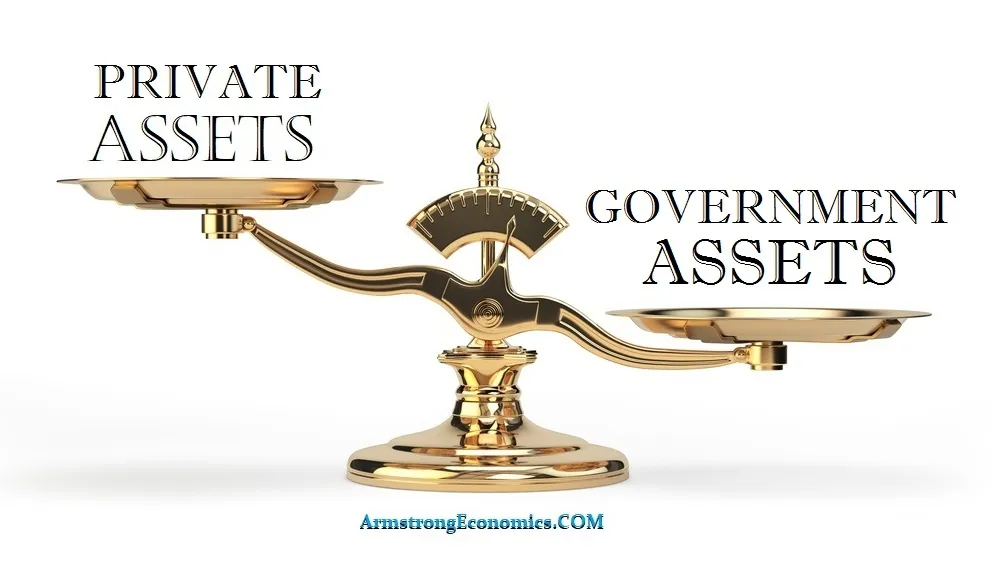

The massive liquidation going on among hedge funds who have never understood the Quantity Theory of Money is taking us into the end game where there is no shelter in bonds, but only cash. The statement of Ray Dalio that “cash is trash” illustrated the arrogance of that philosophy constructed on the false Quantity Theory of Money. The typical flight to quality running to government bonds has failed and the rush is to simply cash.

If you look at the markets and not the headlines, as the U.S. stocks collapsed in panic on Wednesday by 5%, turn to the TLT $17 billion exchange-traded fund that tracked long-dated Treasuries. That very day saw its second-worst day ever in the middle of a panic. That was NOT supposed to happen, according to the Quantity Theory of Money believers. If we simply trade by the numbers and not dogma, we saw both equities and bonds plummet. Those who have been focused on cross-asset correlations, none of this was supposed to be even possible. Even gold plunged alongside equities and government bonds. We entered the new reality where Keynesian Economics has collapsed and there is nothing to replace it.

The staggering losses that will come out this quarter because of the fund managers who have all been based on the Quantity Theory of Money warns that we may yet face the shocking revelation of just how much capital was destroyed. Even those who relied upon a risk-parity index that was supposed to create a diversified systematic strategy as it allocated money based on volatility levels has been blown out of the water. I did a presentation at one of the largest investment houses in the world, and I answered the question if I believed in diversification models. My reply was NO! Why invest in something I expect to lose money in as insurance when I can do the proper analysis and determine where to invest.

While the European Central Bank tried to claim that it had NOT run out of ammo announcing an emergency bond-buying program worth €750 billion euros, all this does is keeps the government on life-support. The greatest risk at this time is to dump money into government debt. Even gold has not proven to be a better option in the long term as hedge funds have lost so much money in other areas, they have been forced to liquidate gold simply to raise cash.

This Keynesian Model of lowering interest rates has completely failed and it has acted counter-trend to how the capital functions in a panic – the top priority becomes credit risk. The closer the yield of fixed moves toward zero, the more negatively skewed bonds become. Bonds have simply become a tremendous risk for they are becoming not a place to hide, but a place to obtain a guaranteed loss. The risk of negative-yielding debt is that their prices will collapse 20%-60% as capital in the free market looks at credit risk and what level of return is necessary to prevent hoarding of cash.