Armstrong Economics Blog/Dow Jones

Re-Posted Jul 23, 2019 by Martin Armstrong

COMMENT: Well, Ray Dalio was short the market, missed the rally, and lost almost 5% for the first half of the year. Obviously, they don’t use Socrates – lol.

LB

REPLY: I do not advise Bridgewater and I have no idea if they even subscribe to Socrates. But what you have to realize is that a lot of these hedge funds form their strategy based upon opinion for the broader view. When you have a portfolio of that size, you cannot simply trade it back and forth for each move. The question becomes critical as to where to draw the line to realize your broadview strategy is wrong.

REPLY: I do not advise Bridgewater and I have no idea if they even subscribe to Socrates. But what you have to realize is that a lot of these hedge funds form their strategy based upon opinion for the broader view. When you have a portfolio of that size, you cannot simply trade it back and forth for each move. The question becomes critical as to where to draw the line to realize your broadview strategy is wrong.

I have stated many times that the trend does NOT begin to shift until you reach the Monthly Level. We saw that in Gold when it finally got through 1362.50 after nearly four years of bouncing off that number. In the case of the Dow Jones Industrials, our hedging models for institutions were long one month from the low and has remained in that position. This is just a hedging model which is either long or short. It at least tends to keep institutions on the right side of the trend for long periods of time.

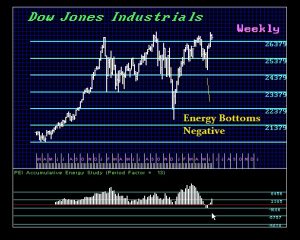

Aside from the Reversal System, the Energy Model is extremely helpful in identifying the position of the market and if there is a risk of a crash or a rally. The Energy Model turned negative, demonstrating that there was no possibility of a crash as most analysts were forecasting from a gut perspective. A crash would have been possible ONLY if the Energy Model was at a peak. When it is testing the lows or a negative, it is warning that the energy in the market has already dissipated.

We are simply headed into a Monetary Crisis Cycle where the majority of people will never be able to forecast what will unfold from a personal gut perspective. This is not a time for lucky calls. We need objective time-tested analysis that is not clouded by human bias. This is when we need the global approach to let Socrates simply correlate the world to enable us to see the real trends that are in motion. The worst thing you can do is ASSUME you have missed something, as that is typically the kiss of death for investors where they inevitably buy the high or sell the low.

France & the New Digital Tax

Armstrong Economics Blog/The Hunt for Taxes

Re-Posted Jul 22, 2019 by Martin Armstrong

The French GAFA tax in an acronym for Google, Apple, Facebook and Amazon which the French government has just passed. They are imposing a 3% tax on all business in France. The US has promised retaliation. This is part of the entire problem the world faces with trade. A lot of people talk about trade wars, but they live in the past. There is something far more serious at stake and that is the digital world and how governments are hungry for taxes to the point that they are threatening the viability of the world economy going forward.

Singapore Economy Turns Down & China Exports Decline

Armstrong Economics Blog/China

Re-Posted Jul 19, 2019 by Martin Armstrong

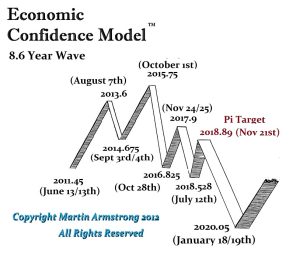

They are calling it an unexpected contraction in Singapore’s economy which is in line with our Economic Confidence Model which bottoms in January 2020. In addition, China’s exports have also declined by 1.3% during June. Gross domestic product in export-reliant Singapore declined by a shocking 3.4% in the second quarter from the previous three months. This was the biggest decline since 2012. Everywhere we look, the world economy is following the Economic Confidence Model perfectly. As stated before, the decline would be felt OUTSIDE the USA far more so than within the domestic economy.

Of course, the blame is being laid on Trump citing his US-China trade war is having an impact on Asia, and that includes Singapore’s latest export figures. Singapore saw exports fall for a second month in a row, this time by 17.3% in the month of June compared to a year ago. The economic growth in Singapore declined by 3.4% from the previous quarter. However, the world economy has been turning down before Trump’s trade war as they are calling it. More than 10 years of Quantitative Easing has been unable to restore economic growth, but why look at trends when you can just bash Trump?

The global economy is still headed down into January 2020. Even if there was no trade war, the trend was set in motion from 2015.75. Within weeks of that turn at the peak of this cycle, Merkel began the refugee crisis which has undermined the confidence in Europe and her unilateral actions impacted all of the EU and has led to much discord. Costs of the refugee crisis have lowered economic growth and these people have not contributed to economic growth to any extent to offset the contraction. The negative interest rates have wiped out savers and force retired people back into the workforce just to stay alive. Meanwhile, governments have increased their taxation and nobody respects the fact that retired people are being forced out of their homes as taxes rise. There is no coordination and nobody will look at the whole.

The Sum of All our Economic Fears

Armstrong Economics Blog/Monetary Reform

Re-Posted Jul 18, 2019 by Martin Armstrong

A lot of people have written in about my comments concerning how the world is completely in a state of global chaos which is why this year I will be providing a continued video update for the 2019 WEC attendees. Those looking at the arrays of many markets are also starting to notice how global markets are correlating on a worldwide basis. Never before have I witnessed such mass correlation around the world which is demonstrating that this is by no means about local issues or the rise and fall of GDP, interest rates, or inflation. We are facing a VERY serious crisis and this is part of the Monetary Crisis Cycle

A lot of people have written in about my comments concerning how the world is completely in a state of global chaos which is why this year I will be providing a continued video update for the 2019 WEC attendees. Those looking at the arrays of many markets are also starting to notice how global markets are correlating on a worldwide basis. Never before have I witnessed such mass correlation around the world which is demonstrating that this is by no means about local issues or the rise and fall of GDP, interest rates, or inflation. We are facing a VERY serious crisis and this is part of the Monetary Crisis Cycle

Attendees of Orlando will receive a special report on the Monetary Crisis Cycle outlining the timing and what we should expect as the years unfold. It is clear that our computer is picking upo this great convergence never before witnessed in financial history. This year’s WEC we will be covering the world to reveal just how we are all connected and how to keep track of this insanity that we are going to embark upon.

This is clearly the sum of all our economic fears.

Agricultural Loans Declining Right on Target

Armstrong Economics Blog/Agriculture

Re-Posted Jul 18, 2019 by Martin Armstrong

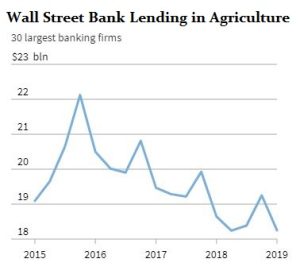

One of the most fascinating observations I have made over my career has been that the banks always lend at the top and contract lending at the bottom in every market. Going into 1980, banks were calling me to ask if I wanted to borrow money. Recently, I got a phone call from my bank asking, once again, if I would be interested in a loan. This to me is merely a confirmation that we are approaching a major turning point.

When I look at lending into the agricultural sector, the big Wall Street banks are once again perfectly in line with the cycle. They peaked in loans to farmers back in 2015, and have been declining ever since going into 2020. Bank lending to the agricultural sector peaked with the ECM and we will see it bottom in 2020. Our model will be correct in forecasting the next wave, which will be a cost-push inflationary wave. As the agricultural sectors come back to life, thanks to shortages, then the bankers will be willing to lend once again. The banks are the PERFECT indicator of how not to run a business. They make decisions emotionally and always get the economy dead wrong (i.e mortgage-backed securities peaked in 2007)

WEC 2019 Orlando – Knockin’ On Heaven’s Door or the Big Fake Out?

Armstrong Economics Blog/World Economic Conference

Re-Posted Jul 17, 2019 by Martin Armstrong

This Year’s WEC is extremely important as we now approach the turn in the Economic Confidence Model come January 2020. There were two critical patterns which were possible – 2020 low and rally thereafter, or a 2020 high with respect to the share markets. Meanwhile, we face the biggest Bond Bubble in the history of civilization and the last time something like that took place, it did not end very nicely for civilization.

This Year’s WEC is extremely important as we now approach the turn in the Economic Confidence Model come January 2020. There were two critical patterns which were possible – 2020 low and rally thereafter, or a 2020 high with respect to the share markets. Meanwhile, we face the biggest Bond Bubble in the history of civilization and the last time something like that took place, it did not end very nicely for civilization.

We are looking at such an important shift this time in the Business Cycle that those attending the WEC this year will also receive ongoing video updates as needed because things are not going to be just a walk in the park. The fact that the Dow has exceeded the 2018 high already, warns that the pattern we face is going to be plagued with a political crisis. Indeed, politics is becoming so polarized, not merely in the United States, but also in Britain, Switzerland, EU, and it is beginning to surface in Asia in Japan and Hong Kong.

The Pi target on the ECM 11/21/2018 was the start of a slingshot where we had to drop sharply, scare the longs, and then rally to new highs. The problem with this pattern is that such moves are more often not sustainable on a broader sense and can warn of trouble ahead depending on who gets sucked into the mix.

The Pi target on the ECM 11/21/2018 was the start of a slingshot where we had to drop sharply, scare the longs, and then rally to new highs. The problem with this pattern is that such moves are more often not sustainable on a broader sense and can warn of trouble ahead depending on who gets sucked into the mix.

We have so many markets at critical junctures as we head into the ECM turning point, this year’s WEC is going to be a critical forecasting event. Most importantly, we have to face not just a Monetary Crisis Cycle which is becoming obvious to everyone as the British pound takes a nosedive, but everything from Energy to Agriculture is in the staging ground for the next ECM along with precious metals.

For these reasons, we have some markets preparing for false breakouts and a critical mass approaching in 2020 on such a global scale. Central Banks (some who have been attending the WEC), are now beginning to lobby the fiscal side trying to warn them of impending doom and how they CANNOT possibly prop-up the world economy this time around. There is also a debate behind the curtain about pegging interest rates (long-term) v Quantitative Easing. We also have a battle brewing over cryptocurrencies as a major push to start eliminating cash in Europe.

Because all of these things are coming together, the attendees of this year’s Orlando WEC will receive ongoing video updates because this is just such a widespread crisis that is impacting every possible corner of the global economy and the ONLY way to survive this is going to be with Socrates because there is ABSOLUTELY no precedent to which we can refer to in history.

There are people calling now for the greatest crash in history, and others are now starting to claim the Dow will test 30,000. The opinions ARE just not going to cut it in this environment. So this year’s WEC will be different, but very critical. So are we Knockin’ On Heaven’s Door or the Big Fake Out as we face the Monetary Crisis Cycle and probably the most polarized political election ever in 2020. So those attending will get ongoing updates as necessary since this is probably the most critical period we face in modern economic-political history.

The Black Hole of Debt

Armstrong Economics Blog/Pension Crisis

Re-Posted Jul 17, 2019 by Martin Armstrong

We are facing a serious collapse in government that appears to be shaping up on the horizon beginning 2021/2022. Take the city of Chicago for example. The city is buried under a mountain of city employee pension debt and it’s impossible to see how their city could possibly survive. There will be a major financial collapse because those in power are also involved in the very same pension scheme so they have no incentive to do what is required to save Chicago — implement major structural reforms.

We are facing a serious collapse in government that appears to be shaping up on the horizon beginning 2021/2022. Take the city of Chicago for example. The city is buried under a mountain of city employee pension debt and it’s impossible to see how their city could possibly survive. There will be a major financial collapse because those in power are also involved in the very same pension scheme so they have no incentive to do what is required to save Chicago — implement major structural reforms.

The total amount of city, county, and state retirement debt Chicagoans are on the hook for amounts to $150 billion, according to Moody’s most recent pension data. If we look at the city’s one million plus households, that means that each household is on the hook for nearly $145,000 to cover government employee pensions. They can forget their own pensions. One-fifth of Chicagoans live in poverty and nearly half of all Chicago households make less than $50,000 a year. There is no possible way to raise taxes to cover these obligations.

Naturally, the politicians want to hunt the rich. If we then look at the households that earn $200,000 and just tax the “rich” we end up with $2 million in obligation per household. We cannot expect government officials to save the day when they too have personal pensions at stake. This story is being repeated around the nation and in Europe. Nobody is willing to address the problem because they have personal pensions on the line.

Central Bankers on Their Knees Pleading with Politicians

Armstrong Economics Blog/Central Banks

Re-Posted Jul 17, 2019 by Martin Armstrong

Our confidential sources are reporting that the Fed, ECB, and BoJ have agreed to lobby politicians in an attempt to warn them that they cannot continue propping up the world economy. The ECB, in particular, has been keeping the EU on life support and they have no room to lower interest rates to try to support their economies any longer. They are beginning to argue that they need help from governments in the rescue effort, which our computer model warns will fail.

Even in China, economic growth has declined to its lowest point since 1990. The slowing global economic growth has pushed the Federal Reserve, European Central Bank, and perhaps even the Bank of Japan to look at more Quantitative Easing. However, the Fed, especially, wants no part of buying government debt. The cries behind the curtain are that monetary policy alone in the coming months cannot support the economy. There is just less room to act with regard to interest rates than in the past. This has been the pitch in Brussels as the ECB is warning politicians they will need to assist if a downturn takes hold

The Great Alignment & 2020

Armstrong Economics Blog/ECM

Re-Posted Jul 16, 2019 by Martin Armstrong

QUESTION: Hi Marty, are the current political events in Hong Kong linked to the turning point for Hong Kong especially with regards to the currency peg?

Thanks for all your work

NC

ANSWER: This turning point in the ECM on January 2020 appears to be the turn in public confidence on a global scale. Much of what I write about from false flags to civil asset forfeitures are all issues that are blending together in undermining the confidence in governments. This next wave should be inflationary. That also means we should be in a position where people lose confidence in government, but the central banks are trapped and the pros are starting to see that as well. With Lagarde replacing Draghi, we will see a shift in confidence in Europe as a whole as well.

The financial market will respond accordingly. This is also why we have gold and equities rising together. I warned that this is what must unfold for the next cycle. I have called this the Great Alignment. These trends are not based upon my personal opinion. That is just not analysis from my perspective. Science is the process of experiment and proof — not conjecture and assumption

The US Treasury Does Have the Constitutional Right to Mint Coins

Armstrong Economics Blog/Regulation

Re-Posted Jul 16, 2019 by Martin Armstrong

QUESTION: Marty, You are wrong. The US Treasury can create the money as the Constitution says it can. Article I, Section 8, Clause 5. The Congress shall have the Power to coin Money, regulate the Value thereof, and of foreign Coin, and fix the Standard of Weights and Measures.

To coin is used as a verb. At the time the Constitution was written, to coin money meant to create or to make money. Today’s Dictionary defines to coin as a verb meaning to make or to invent.

Why did you fail to mention this in your Blog today?

TD

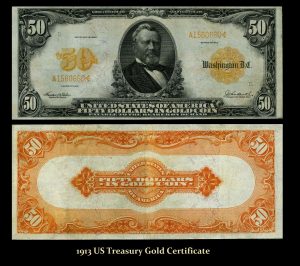

ANSWER: Yes, you are correct. I suppose I was referring to the 99.99% of the money supply rather than the coins put into circulation by the US Treasury. President Nixon only closed the gold window in 1971. He did not demonetize “gold” as money under the Constitution. Yes, technically the US Treasury can coin money, but it coins today’s coins. The Fed does not do that. The coinage it creates is minimal in comparison to the overall scheme of things. Since 1913, the printing of currency has been delegated to the Federal Reserve. Prior to 1913, the Treasury issued the paper currency which was backed by coins.

This was the last issue of paper currency issued by the United States Treasury in 1913, the year that the Federal Reserve Act was passed.

Note that in 1934, the Fed actually issued $10,000 bills