Armstrong Economics Blog/Japan

Re-Posted Sep 2, 2019 by Martin Armstrong

QUESTION: Hi Marty, I come from a golfing family and remember very well the shock when a Japanese investment group bought the Pebble Beach Golf Links, in 1990, for $850 million. The previous October Japanese investors bought the Rockefeller Center, triggering a flurry of Japanese purchases of signature U.S. properties such as Pebble Beach.

Was all this investment caused by The Plaza Accord in 1985, which devalued the USD by 40 percent? Which, as you’ve pointed out, also devalued American assets held by Japanese, igniting a sell-off of American investments and the 1987 crash. With cash repatriated back to Japan, the capital inflows into Japan ran the Nikkei up to its peak, in 1989. Within this late-80s early-90s timeframe, this is when the Japanese made their global malinvestments such as Pebble Beach, which they sold just two years later, in 1992, for $500 million, taking a 42 percent loss. Do I have the correlations and causations correct?

Thanks,

TGM

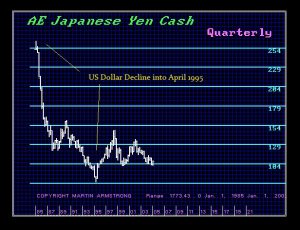

ANSWER: Yes. The Japanese bought US assets at the peak of their markets in 1989. As you can see, the dollar against the yen kept falling into April 1995. Not only did the Japanese lose money on US assets, but they also lost, even more, when they sold them and converted it back to yen on the decline in the dollar.

Currency is EVERYTHING. It dramatically alters the capital flows and can destroy economies because people remain clueless about how foreign exchange markets even function. That should be no surprise since they still teach all the economic theories of the Bretton Woods fixed exchange rate era including Keynesianism.

That is why everyone in the field is self-taught. You cannot get a degree in hedge fund management. Christine Lagarde of the IMF and soon to be head of the European Central Bank is a lawyer with no experience in funds management. People run for president spouting economic promises without the slightest background even in economics. What they teach in school has become ever more irrelevant in the real world. Other than a doctor or lawyer, it is hard to find someone who is working in the field in which they obtained a degree

Gold in Currencies

Armstrong Economics Blog/Foreign Exchange

Re-Posted Sep 2, 2019 by Martin Armstrong

QUESTION: Hello Marty,

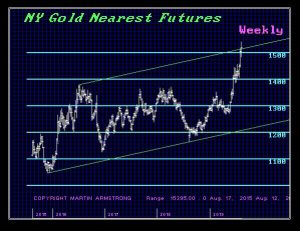

I have a question about Gold & Silver in other currencies – namely GBP.

Accepting your rational, with evidence I must say, that precious metals are a reflection of the confidence people have in their countries currency, you can see from the price of gold & silver in GBP and EURO that leading up to the Brexit referendum until now confirms this. When you look at the ECM for this period – 2015.75 up to 2020.05 – you can see that there are three main waves to it. One wave down from 2015.75 to 2016.825, then three shorter wave from 2016.825 to 2018.89 – single consolidation wave?, then a third wave down from 2018.89 to 2020.05. Gold & Silver rallied, consolidated, then rallied again within this ECM period. Does Gold & Silver have their own internal cycle? Will your upcoming report include content on Gold & Silver in other currencies? The trade in Gold:GBP since the ECM turning point of 2015.75 has been very lucrative

– thanks for your service and opening up Socrates for us.

Regards,

AJ

England.

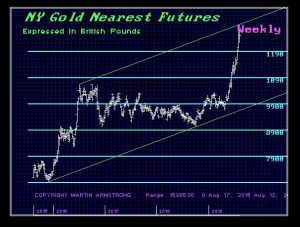

ANSWER: When you plot gold in dollars and pounds, you can see the steepness in the pound. This has been the strength in gold in dollars. It has been the hedge, not against fears of inflation in the USA, but it has risen in the face of the fear of a recession OPPOSITE of its previous relationships. This is all because we are approaching a Monetary Crisis Cycle.

Forecasting gold in dollars is pointless for that will be irrelevant to those in different countries. So yes, our report will be in terms of all the major currencies so people can make the appropriate decision in their own currency.

Why Did United States Enjoy Dramatic Improvements in Living During the Last Century?

Published on Aug 26, 2019

Socialism Does NOT Work | Daniel Hannan | Oxford Union

Fiat Money & Fairy Tales

Armstrong Economics Blog/Politics

Re-Posted Aug 31, 2019 by Martin Armstrong

QUESTION: Mr. Armstrong,

I am trying to find any valid information, without success, to whether there is any truth to a coming Global Currency Reset, a gold treaty purportedly signed by 200+ nations in 2013 written by a Michael C. Cottrell who upon notification by the Chinese elders, aka Golden Dragon, would then release “the codes” into a Quantum Financial System establishing a New Republic to eliminate fiat currency. All this sounds bizarre but I thought if anyone would know, it would be you. Is this all some made up fairy tale? Would you care to comment?

I read your blog daily and then some.

Thank you.

Derek

ANSWER: This is absolute total nonsense. Governments are moving in the opposite direction to eliminate physical money because Keynesianism has collapsed AKA Quantitative Easing. Moreover, end the fiat currency system and you have to end all social programs. You cannot promise everything for everybody and then restrict money. These people have no idea what would happen if they returned to any sort of a fixed exchange rate system.

Bretton Woods failed because politicians will promise the moon to get elected. You cannot have this type of a political system and end fiat money. Elizabeth Warren and Bernie Sanders could offer nothing!

It is far more than merely fiat money. We have to deal with the very core of the issue — political reform. Without that, everything else is indeed a fairy tale.

Hoarding Gold & Dollars in Europe

Armstrong Economics Blog/Gold

Re-Posted Aug 30, 2019 by Martin Armstrong

QUESTION: Marty,

living in Europe where the talk about the elimination of cash is loud I am asking myself what is planned for foreign currencies, e.g. USD, one holds in cash at home? They can´t forbid it because foreign exchange is needed for traveling.

Even when they forbid it, there must be the possibility to change them to the new “national cryptocurrency” at the official exchange rate. So one is still better off here in the EU with USD in cash rather than Euro in cash?

Please share your opinion on this topic as it is important for so many of us here in the EU in the danger of being robbed by Brussel. YOUR BLOG is the ONLY light out there! Thank you for sharing your knowledge with those who are interested. You probably save a lot of lives enabling normal people to prepare.

ANSWER: Yes, you are correct. The USD is being hoarded everywhere. The reason for this is that the US has NEVER canceled its currency, so a $5 bill from 1861 is still valid although it is worth more than 10 times its face value to a collector. Europeans should hoard US dollars. The worst they can do is make it illegal to hold gold or US dollars. I would recommend common circulated US $20 gold coins. You can get away with calling them collector coins in Europe.

Mortgages & Banks when times are bad!

Armstrong Economics Blog/Real Estate

Re-Posted Aug 30, 2019 by Martin Armstrong

QUESTION: Hi Martin.. thanks so much for all your world/economic content and perspective. I was reading a comment you made recently concerning real estate mortgages. In the comments, you suggested carrying a low fixed-rate mortgage rather than paying off the property.

My question is what happens when a financial institution goes bust. You’ve taken out a mortgage on your house and deposited the excess money from the mortgage in your bank account. Doesn’t this expose you to bankruptcy risk? If the bank collapses you could potentially lose what’s not covered by FDIC insurance. In one case the house is paid off and the money is out of the banking system. In the second case, the money is held in the banking system and is at risk. Or am I missing something?

Cheers,

Bob

ANSWER: If you have cash at a bank, then you have the risk of the bank failing. However, if you are the borrower and the bank holds the mortgage, then as long as you are current on your payments it cannot foreclose. It will typically sell its assets to raise cash so your mortgage could be resold to another bank or an investment pool.

The problem you will have in a crisis is that real estate is illiquid. When I was growing up, a friend of my father owned virtually the entire main street in town. I recall talking to him and he said that he bought the entire main street in town back in 1937 because he had cash and bought it for 10% of its 1929 value.

If you borrowed and have the cash on the side, you will be in a far better position to sell liquid assets and buy the house at a discount if the bank is in trouble.

Dollar Contagion & Trump

Armstrong Economics Blog/USD $

Re-Posted Aug 29, 2019 by Martin Armstrong

President Trump just does not understand the dollar. This old school idea that lowering the currency will increase domestic jobs and exports sounds logical, but the value of any currency is determined by the level of international confidence. It is absurd to think you can lower interest rates and the dollar will decline to support more exports. Nobody considered that you then wipe out pensions and force the elderly to work because they cannot live off the interest from the savings.

I really get tired being called into meetings over the same childish one-dimensional theories that it seems only an idiot would believe in. Trump has voiced his dismay over the strong dollar claiming U.S. manufacturers are at a disadvantage. “With substantial Fed Cuts (there is no inflation) and no quantitative tightening, the dollar will make it possible for our companies to win against any competition.” I testified before the House Ways & Means Committee how the greatest deterrent to American exports are TAXES. An American company bidding on a foreign project must pay domestic taxes on worldwide income. A Germany or British company pays taxes ONLY on domestic business — not international. American companies are at a greater disadvantage because of taxes rather than the value of the dollar.

You would think that a child with a calculator could figure this out. Those in power just cannot bring themselves to address the issue because of class warfare is the main argument the Democrats use to inspire people to vote for them. I have been in meetings with Democrats and never will they listen because they do not know how to run for office without inspiring hatred of the rich and blaming them for every failure in their own policies. The only Democrat to ever listen to me was Governor Jim Florio of New Jersey who I debated at Princeton University. I pointed out that the poor and middle class have to pay income taxes and wait for a refund at the end of the year, so you are borrowing from the poor and middle class and cheat them on interest.

You would think that a child with a calculator could figure this out. Those in power just cannot bring themselves to address the issue because of class warfare is the main argument the Democrats use to inspire people to vote for them. I have been in meetings with Democrats and never will they listen because they do not know how to run for office without inspiring hatred of the rich and blaming them for every failure in their own policies. The only Democrat to ever listen to me was Governor Jim Florio of New Jersey who I debated at Princeton University. I pointed out that the poor and middle class have to pay income taxes and wait for a refund at the end of the year, so you are borrowing from the poor and middle class and cheat them on interest.

Many analysts believe the Federal Reserve will yield to the demands for a further rate cut at the September meeting. This is due to the world economy imploding outside the USA not simply because of Trump-bashing the Fed. We live in a world where we are in the midst of a Dollar Contagion that is impacting the entire world because SOCIALISM is collapsing outside the United States first.

Big Bang in Full Motion Set to Collide In a Real Mess

Armstrong Economics Blog/Sovereign Debt Crisis

Re-Posted Aug 29, 2019 by Martin Armstrong

COMMENT: Marty,

The central banks tell us they will lower interest rates, even into negative territory, in order to stimulate the economy through bank lending. YOU tell this is an outdated theory that has NEVER worked and I believe you.

Surely the central banks persist will this excuse not because they think it will work but because they can use the theory as a smokescreen to hide the real reason.

The real reason is, I believe, that they are being leaned-on by politicians to keep rates low or negative because our governments cannot afford to pay higher interest on the massive debts they have accumulated over the decades and have never paid off.

AB

REPLY: You are correct. We warned that when the Economic Confidence Model turned in 2015.75, it would be the beginning of the Sovereign Debt Crisis. Today, the ECB owns 40% of all Eurozone public debt with no end in sight. They have destroyed their bond market. This cycle should collide with the Monetary Crisis Cycle, so we will have some very interesting times ahead.

We must separate the USA from the rest of the world. Europe especially cannot allow official rates to rise without blowing up the entire EU austerity move. The Fed was raising rates because that was the proper policy. He ran into stiff resistance from outside the USA because Europe left its banks with all the toxic bombs and cut rates hoping they would make enough money to cover their losses. This is why Deutsche Bank is in trouble and rumors are flying about HSBC.

But the Fed cannot stand against the entire world. The USA has the ONLY viable bond market. Lowering rates in the USA will also destroy the US bond market and then we are looking at a not so happy ending to the debt crisis.

Private v Public Rate

Armstrong Economics Blog/Interest Rates

Re-Posted Aug 28, 2019 by Martin Armstrong

QUESTION: I am a bit confused. You have forecast that interest rates will rise but official rates will decline. Exactly how does this materialize?

Thank you

GF

ANSWER: People seem to look at just the official interest rates set by the central bank and assume what I am saying is wrong. They have to look at what is really going on in interest rates. We have witnessed the greatest gap between official rates and private rates in history. While deposit rates are virtually zero, car loans which are secured, are at about 4.5% in the United States (up to 9.5% outside the USA). The Bank of America, N.A. prime rate was 5.25% as of August 1st, 2019.

In 1981, the Fed’s Discount Rate for banks was 14% at the peak back in 1981. The Prime Rate peaked at 21.5% at that time. This meant that the Prime Rate was 53.5% above the Fed’s Discount Rate. In August 2019, the Fed’s Discount Rate is 2.75% and the Prime Rate is 5.25% or a 90% markup. The spread between public and private rates has nearly doubled.

Official rates can be manipulated by the central bank for it can control the short-term rates, but not the long-term without instituting some form of capital controls. But they close the free markets in government bonds.

The spread on the private rates v official rates has doubled! I am nor forecasting the superficial trend in manipulated rates by central banks, but the real world rates in the private world. I have stated numerous times, the bankers have NOT passed on the lower interest rates to the people. The spreads have doubled – not declined nor did they even stay the same. If the spread was the same as it was in 1981, then the Prime Rate should be 4.2% instead of 5.25% and a secured car loan should be 3.4% instead of 4.5%.