Posted originally on the CTH on January 29, 2024 | Sundance

While Turkey is a NATO ally, Recep Erdogan strategically refused to participate in the process to ostracize Russia. True to Erdogan’s strategic political interests of being an influence broker, Turkey is the only NATO country that does not participate in the sanctions regime against Russia. Next month Russian President Vladimir Putin will travel to Turkey for diplomatic discussions.

Turkey represents the literal gateway for most Western travel into and out of Russia. However, first things first. Despite the position of Turkey, notice how Hungary receives all the EU admonitions for not supporting the Ukraine side of the conflict, while NATO/EU never criticize Turkey who never even joined the EU/Western sanctions regime. Inside that hypocritical contrast there is a revealing story.

Turkey established themselves as the neutral entity for future brokering negotiations between Russia and Ukraine. Turkey has multiple geopolitical ties to Russia, including the purchase of Russian military equipment. Apparently, despite the severity of the original sanction demand, Western interests -specifically the U.S. government- had no issue with Turkey proactively taking their ‘neutral’ position. Always remember this.

Given all of the domestic headlines in the USA, there is a very good reason for Americans to keep paying attention to all things that happen in the orbit of Russia right now. Many people ponder the issue of a dollar-based central bank digital currency; however, only a few people have paid attention to the self-fulfilling prophecy of the CBDC that was created by the Russian sanctions regime.

Those who ask about the possibility/probability of a dollar-based CBDC, and the possibility of the timeframe therein, should always be referenced back to the Western financial sanctions against Russia. It was that triggering point that put the USA and Western alliance on the irreversible path to the U.S CBDC, and the process is no longer a matter of “if” because the determining issue is no longer (primarily) in U.S. control.

The de-dollarization of half the trade globe, the general cleaving of finance that followed the Russian sanctions (see the efforts of BRICS+), has essentially created a system where major economic nations are trading between themselves in non-dollar-based exchanges. India trades with Russia in Rupes to Rubles. China trades with Russia on old fashioned ledgers of value (due to proximity somewhat of a quasi-bartering system); Iran, Saudi Arabia, Egypt, South Africa and a host of non-Western nations are all in various stages of direct trade in national currency outside the dollar zone.

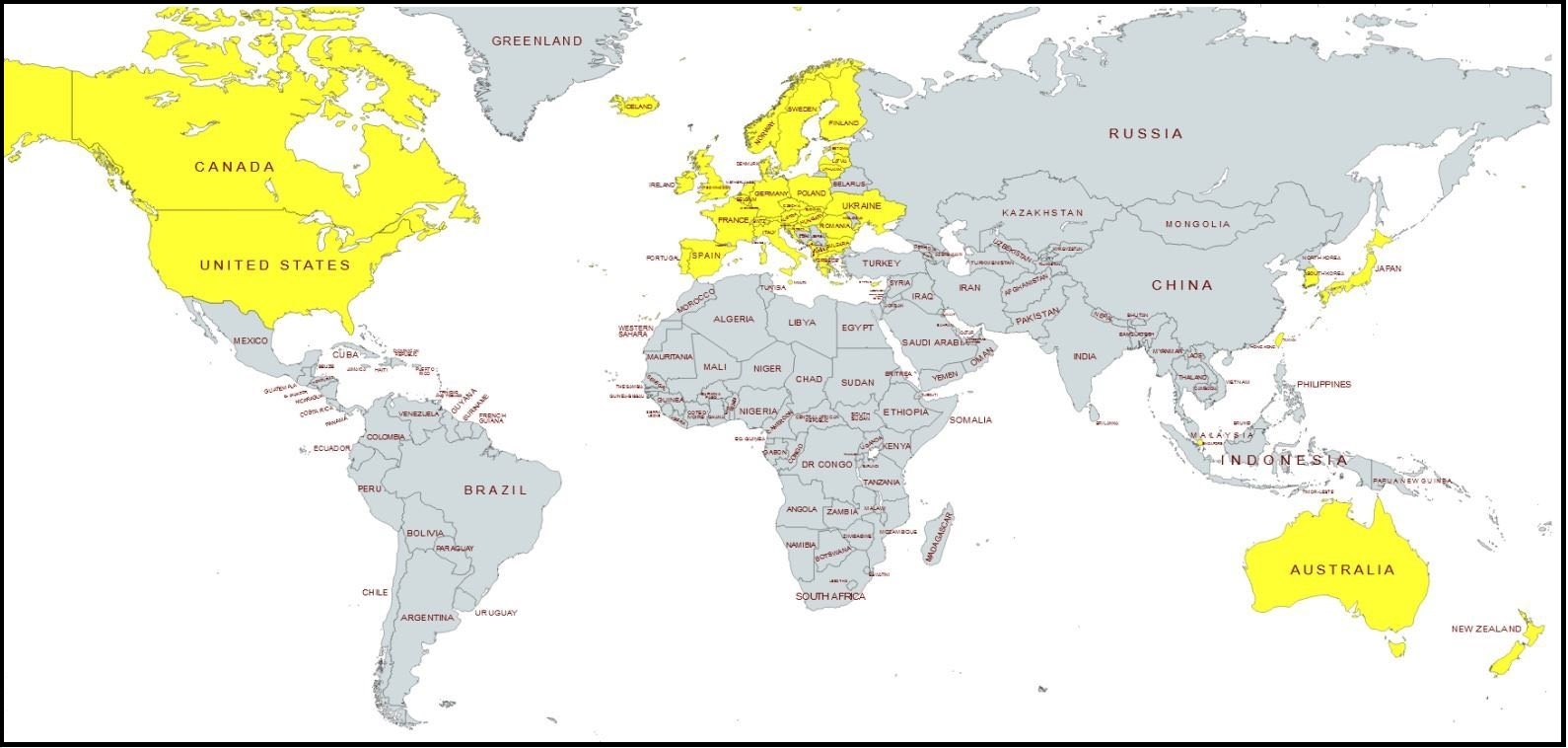

At the core of the issue behind the question of a U.S. or dollar-based Central Bank Digital Currency, you will find this global financial cleaving. Intra-Western trade (USA, Canada, Australia, New Zealand, Japan and the EU) is still done in dollars, and trade done into the Western system is still done in dollars. Ex. if China wants to trade into the USA, they must complete transactions in dollars. However, trade from grey zone to grey zone nation is no longer contingent upon dollars.

Very few people are talking about these new financial trade alternatives. Yet ultimately, this cleaving is likely what will result in a dollar-based U.S CBDC. Remember, the need for alternative trade currencies was triggered in time by the immediacy of the sanctions against Russia. I do not believe the Western financial alliance thought the Russian allies could assemble the alternative so quickly.

If the DoS and CIA truly believed the sanctions would cripple Russia, it’s then likely our institutions vastly underestimated the prior diplomatic talks that preceded those sanctions. As a big picture consequence, no geopolitical issue is as connected to your kitchen table as anything that connects with Russia. So, pay close attention to how Russia is engaged by the rest of the non-Western world (grey zone), and you will get a good idea about the speed and timing of a pending U.S. CBDC.

As soon as the grey zone trade is predicted to take place in non-dollar terms, the U.S CBDC will be fast-tracked. The only way for President Donald Trump to stop the CBDC process would be to immediately end the Russia-Ukraine conflict and subsequently remove the sanctions. [And that might not even work.] As long as there are financial trade blocks based on dollars and who we like, there will be an easy justification for the financial cleaving to continue.

RUSSIA – Russian President Vladimir Putin will visit Turkey next month in a rare foreign trip to a NATO nation, according to a Kremlin announcement on Monday.

Yuri Ushakov, a top adviser to Putin on foreign policy matters, told the Interfax news outlet that “a visit is being prepared.” As to the purpose of the visit, Ushakov added: “I can say that Ukrainian issues will probably be one of the main subjects of negotiations.”

Though a key NATO nation, Turkey and its president, Recep Tayyip Erdoğan, serve as a rare diplomatic bridge between the Kremlin and its Western rivals. Since Russia’s full-scale invasion of Ukraine on February 24, 2022, Ankara has supported Ukraine with military supplies while refusing to join Western sanctions on Moscow.

Turkey has positioned itself as a mediator between the two nations, hosting two rounds of peace talks in Antalya and Istanbul in 2022. Turkey was also key to the Black Sea Grain Initiative that temporarily facilitated the export of agricultural products from southern Ukrainian ports amid Russia’s naval blockade.

Following a phone call with Ukrainian President Volodymyr Zelensky at the beginning of this month, Erdoğan said Ankara remains ready to help “establish lasting peace, stability and prosperity in our region.”

“We have previously acted as a host country for direct talks between the parties to the conflict,” the president said. “We are, as before, ready to do our best in this matter and act as a mediator….Ukraine in order to take joint steps with Russia certainly needs to soften its position.”

Putin last visited a NATO nation in 2020 when he traveled to Germany to meet with then-Chancellor Angela Merkel. His Western travel options have been limited by his war on Ukraine and the arrest warrant issued for him in 2023 by the International Criminal Court over alleged related crimes. (read more)

I really do not like Turkish President Recep Erdogan. His political policy is full of dangerous self-interest (Muslim Brotherhood) and thirst for power (recreation of the Ottoman empire). However, on the issue of ending this Russia-Ukraine conflict, I will admit Erdogan has positioned himself very well.

If Trump wins in November, Erdogan will play a major role in the end of hostilities.

You might even say Erdogan holds the key to eliminating the self-fulfilling prophecy of a US CBDC that Obama/Biden created.