Posted originally on CTH on April 2, 2023 | Sundance

Before getting to the headline, I want to remind you what CTH outlined two years ago about these massive food price increases.

You might remember me saying that processed food prices will increase at a much greater rate than fresh or lesser processed foods. Factually, even organic products (ie. produce) could/would end up less expensive (in relative terms) to the increase in price at your supermarket, as compared to the price increases for the more processed foods.

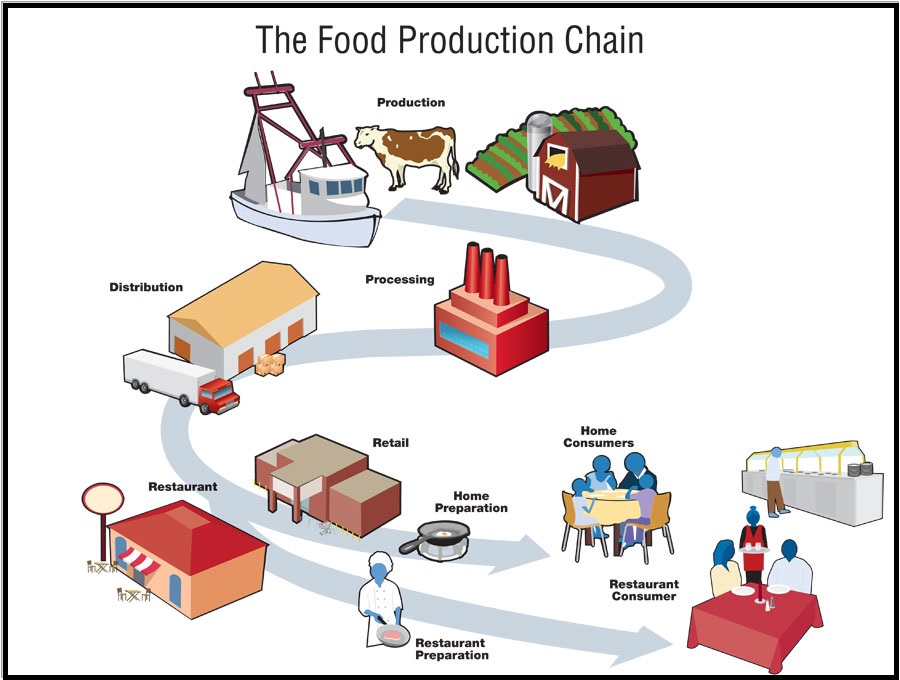

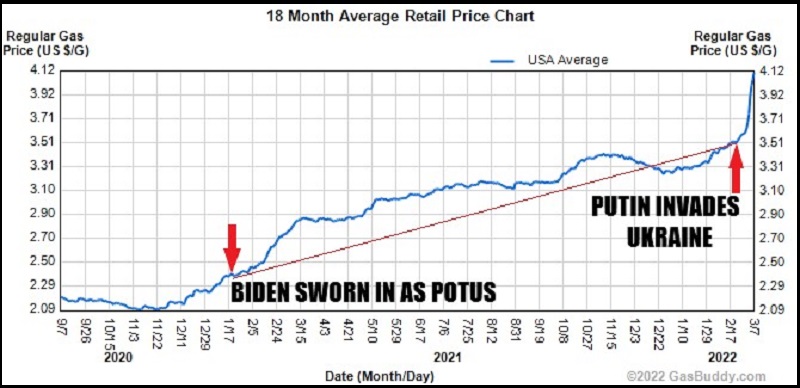

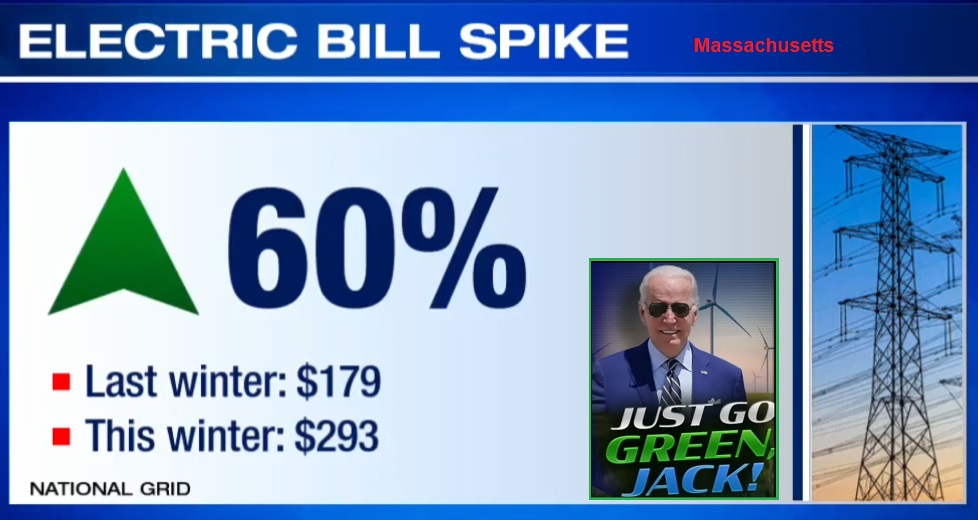

The reason is simple, processed food use more energy; energy prices are skyrocketing; the processing costs (packaging, transportation, freezing, sanitizing, storage, warehousing and distribution etc.), at each step of the processing cycle, in addition to higher labor costs, drive up the end result of the price.

In this energy driven inflationary environment, less processing and handling equals lower overall cost increases from field to fork. More processing, handling, distribution equals higher overall costs. This is simply a supply chain, truism.

Into this issue comes McDonald’s Corp. Last I heard, approximately 85% of McDonald’s business was franchise. The franchise has to purchase the product (food) from the main company. Supply side cost increases in the food are transferred from the company to the franchisee via higher product costs. The restaurant is then forced to raise prices to accommodate their increased costs. A portion of the revenue from sales then flows back to the main company.

It is important to note here, there is a natural disconnect in supply side price increases within the franchise model. The parent company must, must, negotiate the best possible contract terms with the suppliers because the increases in costs are passed directly to the franchise. The parent company doesn’t immediately feel any problem until the revenue from the franchise drops due to the forced raising of retail prices and diminished sales. There is a lag.

McDonald’s is extremely exposed to processed food price increases.

McDonald’s franchises were forced by supply cost increases to raise retail prices. The retail prices were raised into a primary customer base that is already under extreme inflationary pressure. The average McDonald’s customer is exposed to inflation at almost every level of their life.

A typical family of four will now pay between $30 to $40 dollars for a single meal at a McDonald’s restaurant. That is not practical for the customer base. The result is lowered sales at retail, as eating a meal at home becomes the less costly option. The downstream consequence is lower revenue returned to the parent company.

The only way the parent company can offset the supply side costs to the franchisee is to lower overall operating costs. Expenses have to be cut. Advertising budgets reduced. Administration costs reduced. Administrative staffing levels reduced. Supply contracts renegotiated. Packing, warehousing, distribution and all vendor contracts renegotiated, consistently looking for better terms.

(Wall Street Journal) McDonald’s Corp. is temporarily closing its U.S. offices this week as it prepares to inform corporate employees about layoffs undertaken by the burger giant as part of a broader company restructuring.

The Chicago-based fast-food chain said in an internal email last week to U.S. employees and some international staff that they should work from home from Monday through Wednesday so it can deliver staffing decisions virtually. The company, in the message, asked employees to cancel all in-person meetings with vendors and other outside parties at its headquarters.

“During the week of April 3, we will communicate key decisions related to roles and staffing levels across the organization,” the company said in the message viewed by The Wall Street Journal. McDonald’s declined to comment Sunday on the number of employees being laid off.

McDonald’s in January said that it planned to make “difficult” decisions about changes to its corporate staffing levels by April, as part of a broader strategic plan for the burger chain.

Chief Executive Chris Kempczinski said in an interview at the time that he expected to save money as part of the workforce assessment, but said then he didn’t have a set dollar amount or number of jobs he was looking to cut. “Some jobs that are existing today are either going to get moved or those jobs may go away,” Mr. Kempczinski said.

McDonald’s employs more than 150,000 people globally in corporate roles and its owned restaurants, with 70% of them located outside of the U.S., the chain said in February.

McDonald’s in the message acknowledged that the week of April 3 would be a busy one for personal travel, which it said contributed to the decision to deliver the news remotely. Workers who wouldn’t have access to a computer during the week should provide personal contact information to their manager, the company said. (read more)