Armstrong Economics Blog/Socrates

Re-Posted Oct 24, 2019 by Martin Armstrong

QUESTION: Thank you for all your work. I was fortunate to be introduced to you in 1986 by a senior broker while I was working at Drexel, Burnham . Your work saved me, my clients from the ’87 crash.

My question: with Socrates forecast of a shift to China as the new financial power, would it not be worthwhile to begin to identify Chinese companies to invest in that will prosper in the longer term. I recognize that timing of when to establish positions is critical. Thank you.

-BC

ANSWER: We have put all the Chinese stocks on the site since we do have offices there. I have made an effort to bring Socrates into China and our forecasting is available throughout China, which is rare. The government is well aware that our services are written by a computer so they do not have to worry that in paragraph three some line may go against their government.

What we will be introducing next year are filters where the computer will create lists of things that have just elected a reversal on different levels and reflect the gaps to provide a good idea of the next move.

We should have a lot more interesting tools available next year where you can make inquiries like that and the computer will respond. As I have said, my goal is to replace me. I have been coding all my personal experiences as a trader over the years and teaching the computer how I analyze things. At the same time, I have been teaching it how to do the research on its own to enable it to teach me new relationships as they are emerging.

We may be able to accomplish where it can speak to you, but it is a major effort to get it to listen to you over the internet. We have had some people proposing a partnership where someone can develop a stand-alone program that resides on your system (app). This would allow you to talk to Socrates and it will retrieve the information you need.

When that is finished, then we will consider the IPO to keep this going after my expiration date arrives. I hope that one day politics will understand that there are cycles, and if we live in harmony with them instead of fighting them, just maybe we can improve society for all. Like the global warming nonsense which all based upon linear assumptions, politics is also based upon vote for me and I will give you X, Y, and Z even if the business cycle is moving in the opposite directio

Howie Baetjer explains what Communism is!

How is Communism described in theory, and how does it play out in the real world? Join us for our question and answer series with Prof. Howard Baetjer

Release Date

January 8, 2018

Using Other People’s Money

Armstrong Economics Blog/Opinion

Re-Posted Oct 8, 2019 by Martin Armstrong

QUESTION: Mr. Armstrong; You had said you retired from market-making in the precious metals when in the early ’80s people were claiming to sell Krugerrands for spot with delayed delivery. I think they went bust and went to jail if I recall you said back in 1985. Is this the same thing happening in online brokerage with this no commission scheme? How are they making money?

SY

ANSWER: No, it’s not the same. If I remember correctly, it was a firm delaying the delivery of the gold coins by 90 days. They were playing the bear market, assuming gold prices would always be lower based on the fact that the Fed raised interest rates to 14% in 1981. Back then, I was making more money on the float in my account than I was on the gold. The cost on the Krugerrands was spot +4%, so they were making +15% using the money in overnight markets, plus delaying delivery, and they would not buy the coins until the price declined from where they sold them to you. That was pure speculation and I decided I would retire rather than play that game. If I had to speculate to pay salaries it made no sense. They went bust in 1985 and ended up in jail, if I recall, when gold rallied out of the 1985 low and they could not cover all the promises they had made on the coins.

Here we have a similar issue with making money indirectly. Stockbrokers get kickbacks or rebates from the market-makers for steering the business and they make money on the spread between bid and ask. So the retail brokers are still making money that way. But then they also get to use your funds to earn interest. In place of commissions, they make money from charging traders who buy stocks on margin.

Therefore, you have:

- Interest they earn on your money

- Rebates from market-makers

- Interest they charge on margin

This is more legitimate than the gold brokers who were speculating with other people’s money back in the ’80s

Trump’s Polls Not Affected by Impeachment

Armstrong Economics Blog/Politics

Re-Posted Oct 8, 2019 by Martin Armstrong

What is really driving the Democrats crazy is that they still refuse to comprehend why Trump was elected to begin with. He was an anti-career politician. Even the Republicans did not get it. This impeachment nonsense would stick ONLY if the people actually believed that Biden and Hillary were honest and Trump was wrong. But Biden’s son getting hired in Ukraine when Ukraine was seeking aid from the USA just does not look ethical regardless of the situation. Hillary’s emails and her brother getting a contract for a gold mine when he had nothing to do with mining just does not seem honest.

The general polls are showing that this latest scandal is just another trumped-up version of Russiagate against Trump. At the end of the day, they will need 2/3 of the Senate to remove Trump, which they will never get.

They have turned politics into a corrupt sewer and the stench is overwhelming the nation. There is just no return to a normal government that at least functions. From here into 2032, it will only get worse.

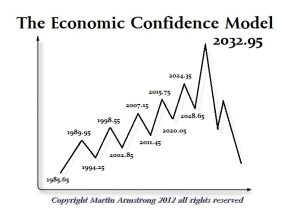

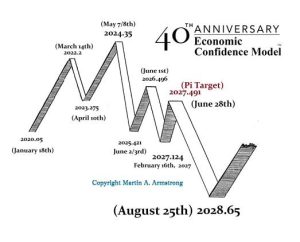

My concern is still what comes AFTER Trump! Our computer projected Trump as the winner long before the candidate was even selected. Our computer projected at the start of this 51.6-year wave (1985.65) that by 2016 the door would open for a possible third party candidate. That meant 2107.05 which was Wednesday, January 18, 2017. Trump was inaugurated on Saturday, January 21, 2017, 12:00 AM GMT+7. So we were close — off by 2.5 days for a forecast made 31.4 years prior ((1985.65 + 31.4) = 2017.05).

Even AOC overthrew a career Democrat they expected to be speaker of the House. She won for the very same reason as Trump — she was the anti-career politician. Those in Washington just do not comprehend that the people are fed up with all their lies and nonsense. This is BY NO MEANS a Republican v Democrat confrontation. We have moved beyond political parties but they do not wish to see it that way for it means having to accept responsibility for all their mismanagement.

You need not even be pro-Trump to see the incompetence in Washington. Instead of solving problems, the Democrats simply oppose whatever Trump does and seek to remove him. They are idiots for even if they regained the White House, the Republicans will do the same to them. Functioning government has ceased to exist. This is exactly what the computer projects into 2032.

From here on out into 2032, the government will get very aggressive because it knows it is losing control. I am very concerned for the government will attempt to seize control and tighten its grip.

Even if we look at the Pi Turning Point on the previous wave that began 1934.05 with Roosevelt confiscating gold, 31.4 years later was 1965.45, and again on Wednesday that week is when Vietnam started to become a warzone. U.S. Secretary of Defense Robert S. McNamara announced in Washington that 22,000 additional American troops were being sent to South Vietnam. The additional deployment would raise the number of U.S. soldiers and officers in South Vietnam to 72,000. That would eventually grow to 9,087,000 military personnel who served on active duty during the Vietnam Era with the peak in troop strength reached 543,482 (April 30, 1968). A total of 58,202 were killed in action with 303,704 wounded.

The Pi target 1913.85 was November 26, 1913. The previous wave that began 1882.45 fell in the middle of the two major acts: the Income Tax passed on October 3, 1913, and the Federal Reserve Act passed on December 23, 1913.

These Pi targets have been rather important political-economic events. Even in Mexico, 1913 was the Mexican Revolution.

Should Americans Hoard Cash?

Armstrong Economics Blog/Economics

Re-Posted Oct 8, 2019 by Martin Armstrong

QUESTION: Martin, I appreciate all the information that you provide and just got done reading about money shortage and hoarding. Would it be good for US citizens to hoard also? Is there any difference in hoarding dollars or gold and silver coins? Thanks for your comments.

DM

ANSWER: In order for gold and silver to be a medium of exchange, it requires the general population to accept that. The older generations know what a silver quarter or a $20 gold coin might be. However, the younger generation does not. Paper dollars will still be best to hoard for every day use until about 2022. At that time, we will have to reassess the climate of the monetary system. There are those videos where people were offered a 10 oz bar of silver of a chocolate bar. They took the chocolate.

Gold and silver should be in coin form. Bars will not be easily used among the average person.

Precious Metals Desk at JP Morgan Criminally Charged

Armstrong Economics Blog/Rule of Law

Re-Posted Oct 7, 2019 by Martin Armstrong

The precious metals Desk at JP Morgan Chase on September 16, 2019, was criminally charged by the U.S. Department of Justice with being a criminal enterprise for approximately eight years in its manipulation of the prices of gold, silver, and other precious metals. The head of that desk and two other precious metals traders were charged with racketeering under the RICO statute which was originally passed to target organized crime.

The Justice Department said that the traders and their co-conspirators “conducted the affairs of the desk through a pattern of racketeering activity, specifically, wire fraud affecting a financial institution and bank fraud.”

Hong Kong & the Continuing Protests

Armstrong Economics Blog/HongKong

Re-Posted Oct 4, 2019 by Martin Armstrong

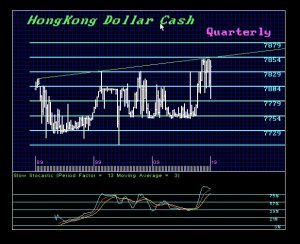

There is no question that the rioting in Hong Kong has been violent as protesters even set cars on fire. Business is very concerned for as this continues, it does threaten the shift of the financial hub to Singapore. We have clients on every side of this issue over here as we have three offices in Asia. So we have the concerns from all sides. There is a fear that if China is forced to send in troops that this may break the peg and result in financial business moving to Singapore. So the stakes are rather high over here.

Tony Tsang, the 18-year-old Hong Kong student protester who was shot in the chest by police at close range as he fought an officer with a metal pipe on Tuesday. He was charged with rioting. He faces a maximum 10-year sentence for assaulting a police officer. Police have urged the government to impose curfews as the violence continues to escalate. China has increased its troop strength on the border and the Hong Kong economy has been taking a nosedive.

The extradition bill that began the protests has been withdrawn. However, that is only one of their five demands. The protesters have also demanded an independent probe into the use of force by police; amnesty for arrested protesters; a halt to categorizing the protests as riots; and the implementation of universal suffrage.

The Hong Kong dollar peg will either break or be allowed to readjust and the two targets appear to be November and January. The ideal targets seem to be 789 and 797. This is when the risk will be at its greatest. Keep in mind that it could come prematurely in October or December. The key weeks ahead for turning points appear to be 10/07, 11/04, 11/18, and 12/02.

The View from Business

COMMENT: Marty, you’ve always been vigilant against biased news from FNF (Fake News Factories.) So I’m hopeful I’ll get an audience in you. In your recent blog “Hong Kong & Risks in Asia” (9/27) you’ve finally used the word “violent” to describe the rioting in my hometown.

As usual, you were the first to call it as it is, but then you hastened to add that the police threw tear gas, as if that had precipitated the violence! I must assume you’ve been fed the same fake news that we get here in the west, even though you’re currently in Asia.

The picture the FNFs painted of Hong Kong is a lonely cry for help. However, the flip side they don’t show is the destruction, business closures, loss of jobs, and fear for life and limb that the rioters have brought upon the silent majority. They’ve set fire to cars, homes, and MTR, shut down the airport, beat up tourists and the elderly, even stormed government offices and destroyed everything inside!

Try that on the White House and watch them drop you like flies! If MY police is faulted for “excessive force” in protecting us the same way, then the only thing “excessive” is the taxes I paid the government. To be sure, most Hong Kong residents would welcome universal suffrage, but we denounce terrorism and wish to restore peace and order. However, with the biased media fanning the fire, I can see civil war within the city of Hong Kong by your 2020 ECM turning point.

In summary, may I point out that in the past 3 to 4 decades, Hong Kong has prospered incredibly with the rise of China, and did so without even a semblance of democracy, under the Brits or under China. But what we did have was peace and order. We really like to have that back now. So if the world honestly wants Hong Kong to have something it deserves but isn’t getting, please stop fanning the fire. Hot heads (on both sides) need time to cool.

REPLY: I am NOT suggesting that the police acted first with tear gas. That was a response to the riots.

Why Did the Dollar Rally Only After the 1929 High?

Armstrong Economics Blog/Capital Flow

Re-Posted Sep 24, 2019 by Martin Armstrong

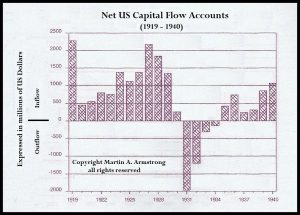

QUESTION: Hello, I am having trouble understanding how capital flows into the US, which helped the Dow double from ’27-29 didn’t move the dollar. Instead, the dollar moved up abruptly when inflows collapsed. It doesn’t make sense to me. Can Marty cover this at the WEC or help me understand in an email or blog response.

Thanks,

Norm

ANSWER: This period was when there was a fixed exchange rate so you will not see the change in the dollar. The capital flows turned out as the crisis took place in Europe and they needed to repatriate capital to cover losses at home.

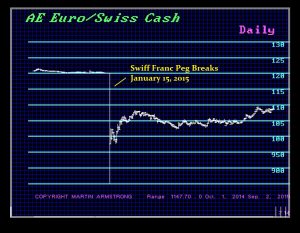

However, 1931 was the Sovereign Debt Default, which meant the fixed exchange rate system collapsed. This is when the dollar really rose for this was the true value of the dollar during the 1920s due to capital inflows, but it was fixed and sort of like what happened with the Swiss peg.

You see the same identical issue with the Swiss franc. The capital inflows were intense as people were buying the Swiss and selling the euro. The capital inflows reflected the move, but the peg was holding. It was that intense capital inflow that broke the peg. The same pattern took place during the 1920s. The capital inflows to the dollar were intense as capital fled Europe due to the war. However, you do not see it in the currency because of the fixed exchange rate. It was this intense inflow that caused the Sovereign Debt Crisis in 1931 and suddenly you see what the dollar would have been in a free market.

I have explained that there is also currency inflation. The tangible assets will rise in a country when the currency declines IF there remains underlying confidence in the nation at large. If not, the tangible assets may rise in hopes of a revolution, which may be bloodless as in Germany 1923, but there must still be confidence in the nation surviving. When there is no confidence as in Communist takeovers in Russia, China, Venezuela, tangible assets will NOT rise.

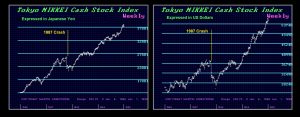

Applying this understand to Japan for the Bubble 1989 top, we see the combination of the rise in the Nikkei in proportion to the decline in the currency which was orchestrated by the Plaza Accord in September 1985. Confidence in Japan was not in question politically. However, the 1987 Crash was a currency move where the fear became whether the dollar would fall another 40%. This caused the Japanese to sell US assets and repatriate their capital home, which then was causing the Nikkei to rise WITH the currency.

If you look closely, you will see that the Nikkei rallied more in US$ than in yen going into the 1989 Bubble top. This is the same pattern currently of how the Dow has rallied from 2009 into 2019 leading the S&P 500 and NASDAQ because it was rising more in euros than in dollars. The 1989 Bubble top in Japan was so severe like 1929 BECAUSE it had attracted capital from around the world which intensified the rally. But when the foreign investors sold, Japan crashed and burned because nobody understood the consequences of capital flows.

Even when the CIA came to us and wanted me to build this model for them and I declined, they understood we invented capital flow analysis and it was the key to the rise and fall of nations.

We All Have Little Bubbles

Armstrong Economics Blog/Training Tools

Re-Posted Sep 23, 2019 by Martin Armstrong

COMMENT: Marty, I love you Man! I was sitting in my office back in April of 2005, reading the WSJ. There was a story where Greenspan declared he would begin raising rates. I was, “thinking out loud” when I said, “Oh Shit!?!?”. The fellow I shared the office with asked, “What’s wrong?”. I proceeded to explain that there would be a crisis (2008/2009). I think the DJIA was somewhere around 7000, then it went to 14000. If only I knew you back then. The first time I read one of your emails where you pointed out that the market goes up when rates go up, I finally got it, almost like a religious conversion, like Paul on the road to Damascus. Rates go up = my bond values go down, so I sell my bonds to end/limit my losses, and I park/invest in stocks. Do I have that right? Dude, you are so right on. When anybody criticizes you, just say “FTB” (Forget That Bitch) or FTSB (Forget Those Stoopid Bitches) or FTBS (Forget That Bull Shit) or just say all of it. Evidently some University did a study about using foul language, they concluded it lowers the pain by up to 30%. It kills me, this just happened, just ten years ago, and people want to argue with you, can’t they simply remember? (Ask a stupid question). You have helped me figure out a ton of stuff,

THANK YOU!!!

God Bless You My Great Brother!!!

REPLY: I don’t angry. I just consider the source. As they say, you can lead a horse to water, but you cannot make it drink. Some people just cannot see outside their little bubble. It is like a trader who cannot understand the thinking process of a non-trader, and likewise the non-trader cannot understand the actions of a trader. Then there is the institutional trader. He has to answer to a board that has no concept of trading and they are supposed to oversee the trading division. They cannot say, “Look, the reversals were elected, the oscillators flipped, or you broke technical resistance or support.” They have to say some logical fundamental explanation to offer the board and then everything is OK.

We all have a little bubble. The most important thing is to ALWAYS try to understand the thinking process of the other groups. I always wrote for just institutions. I have made an effort to try to see the world from the non-trader or professional position in order to be able to write for an audience that does not look at the world from either a trader or institutional pair of eyes

The Dollar Shortage & Liquidity Crisis?

Armstrong Economics Blog/Interest Rates

Re-Posted Sep 23, 2019 by Martin Armstrong

The NY Federal Reserve announced last week that they will continue their repo operation until October 10th, 2019. The repurchase agreements will amount to up to $75 billion per day. Additionally, they plan to offer three two-week repo operations of up to $30 billion each round.

The constant intervention of the Federal Reserve into the REPO market is the result of a global dollar shortage on a monumental scale. There is a liquidity crisis unfolding as CONFIDENCE is collapsing in Europe and Asia. The Federal Reserve has been intervening into the REPO market in a desperate effort to maintain its lower target on interest rates.

I have been warning that about 70% of physical paper dollars is now circulating outside the USA. There are also now more $100 bills in circulation than $1. With the rising pressure outside the USA to eliminate cash in order to confiscate money from their citizens to support the broadening collapse of socialism, there has been a MAJOR panic pushing into the dollar.

Despite the fact that early in 2019 the headlines were that foreign governments were dumping US debt spinning this into stories that the dollar would crash. In reality, selling of US debt at that point in time was an effort to stop the dollar’s rise. However, as the world economy continues to implode going into the bottom of the business cycle as measured by the Economic Confidence Model, exactly the opposite has been taking place. As of July 2019, the foreign holding of US debt rose to $6,630.5 billion up from July 2018 $6,254.4 billion.

(SEE Fed Data: US Debt Foreign Holding July 2019)

The increase from $6.2 trillion to $6.6 trillion is showing the scramble into dollars even on an official level. As more and more US debt is taken up overseas as a hedge against the rising risk of the punitive sanctions of canceling foreign currencies as Christine Lagarde is preparing to take charge of the European Central Bank in October, the panic into the dollar assets is removing US debt from domestic holdings resulting in a LIQUIDITY CRISIS beyond anything you will find in the traditional economic textbooks.

We invented Capital Flows analysis. We have the only real database tracking capital flows historically. There will be numerous people who will now repeat what is written here as if it were their original analysis. Without a database, it is hard to imagine how they can make such claims since this is NOT based upon opinions or reading news headlines.

So welcome to the new world where economic theories are crumbling before our eyes and falling to the floor as dust in a world that no longer exists. We are entering a new period of reality where whatever you thought was happening may prove to be the opposite.