QUESTION: Besides the Bible, there are many clairvoyants who predict that there will be World War III. Your models predict the rise in war tensions. What is your “opinion” about the prospects for a third world war?

JC

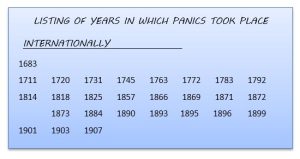

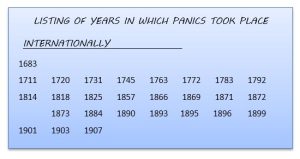

ANSWER: There is no doubt that we are in the process of a rising war cycle. It really appears to be more of a bitter war between leaders once again, as was the case with the last two World Wars. World War I was really about destroying the former Holy Roman Empire which had its seat of power in Vienna. That city was besieged in 1683 when the Ottoman Empire sought to conquer Europe. If you recall, the financial panics I used to discover the Economic Confidence Model began with the Panic of 1683 caused by the invasion of the Ottoman Empire.

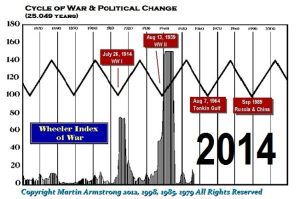

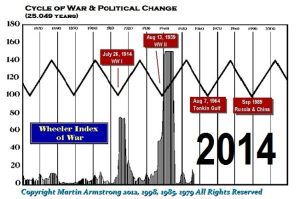

The War Cycle is turning up and we are looking at a possible peak as early as 2027. This is why I have been concerned about the economic crisis in 2021-2022. Once the economy turns down, it will be the fuel for the war.

We must also respect that this particular cycle is the combination of both civil and international unrest. I do not believe we are in a cycle of conquest. Nobody wants to conquer and occupy each other — neither China, Russia, nor the USA. So, on the international level, it appears we are dealing with old grudges. When I have asked why Russia is our enemy since they abandoned communism, the only response I get is that, “Well, they are Russian!” World War I unfolded when the Archduke of Austria was assassinated by a Serb. He was heir to the throne of the old Holy Roman Empire. The French hated Germany for they were defeated under Napoleon. Additionally, in the first Treaty of Versailles in 1871 Germany became an empire at the expense of France. So it was really very much about settling old debts.

World War II was created by the oppression of the German people for the sins of their leaders. That led the German people to turn to Hitler because they were humiliated.

We would classify Napoleon and Hitler as warmongers of conquest. The Russian Revolution in 1917 and that in China led by Mao were class warfares instigated domestically that manifested into revolutions arising from civil unrest.

In Russia, the revolution really began in October 1905 when czarist troops opened fire on a peaceful group of workers marching to the Winter Palace in St. Petersburg to petition their grievances to Czar Nicholas II. Some 500 protestors were massacred on “Bloody Sunday,” setting off months of protest and disorder throughout Russia. It was 8.6 years later that World War I erupted in 1914. This signaled that there would be a rise in tensions 112 years later which would be 2017.

Vladimir Lenin was born in 1870 into a middle-class family in Ulyanovsk, Russia, but when he was a teenager, he became political after his older brother was executed in 1887 for plotting to assassinate Czar Alexander III. When he reached the age of 17, he was expelled from Kazan Imperial University for taking part in an illegal student protest. Then in December 1895, Lenin and the other leaders of the Union were arrested. Lenin was jailed for a year and then exiled to Siberia for three years. Upon his release in 1900, Lenin went to Western Europe. In 1902, he published a pamphlet entitled “What Is to Be Done?” Lenin argued that only a revolution would bring socialism to Russia by force. In 1903, Lenin met with other Russian Marxists in London and established the Russian Social-Democratic Workers’ Party. From the outset, Lenin’s Bolsheviks (Majoritarians) advocated violence and the Mensheviks (Minoritarians) advocated a democratic movement toward socialism. The split became official in the 1912 conference of the Bolshevik Party. If we use this as the start date, then we arrive at 2024 where we may see the sharp rise in tensions on a class warfare foundation worldwide once again. This may mark the culmination of the Marxist-Socialism movement that could end in blood in the streets once again.

Consequently, this World War III is more likely to be a combination of class warfare and settling old scores. The period of concern would be the 2024-2027 time frame from a cyclical perspective (sorry, no visions for I lack the clairvoyant ability).