Posted originally on the conservative tree house on October 14, 2022 | Sundance

You often hear me talk about how financial pundits and economic analysts are disconnected from Main Street. Today we get a prime example of that from the Wall Street Journal.

The topline of the WSJ article is essentially that people are not spending money on anything except essential goods (housing, energy, fuel, food, etc), which is somewhat of a ‘duh tell us something we don’t know‘ type article. However, the analytical part of the article is where you find the insufferable disconnect. Here’s one example:

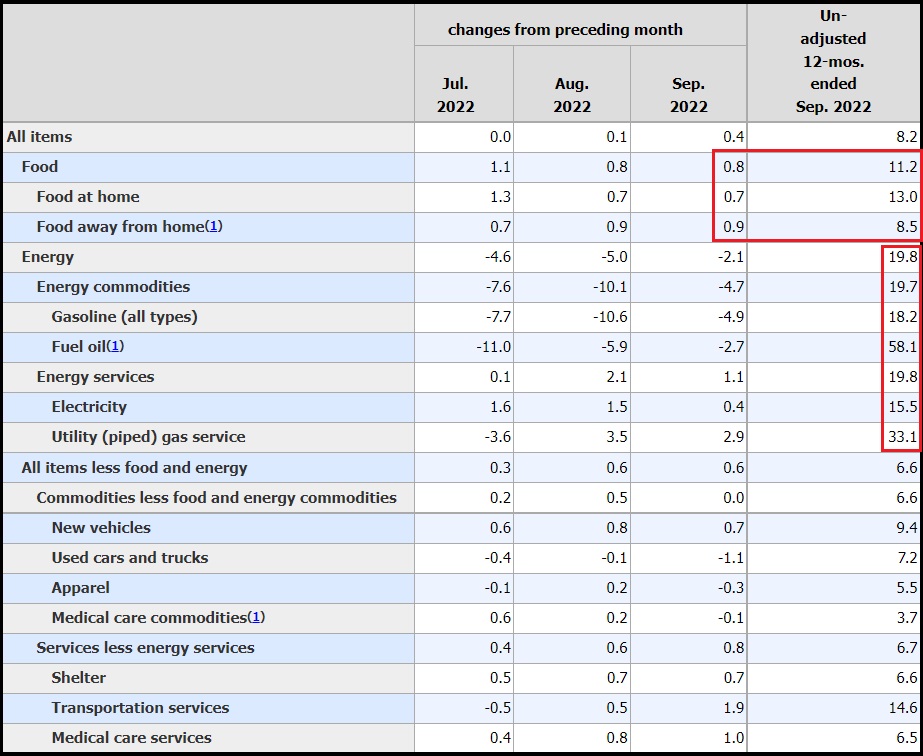

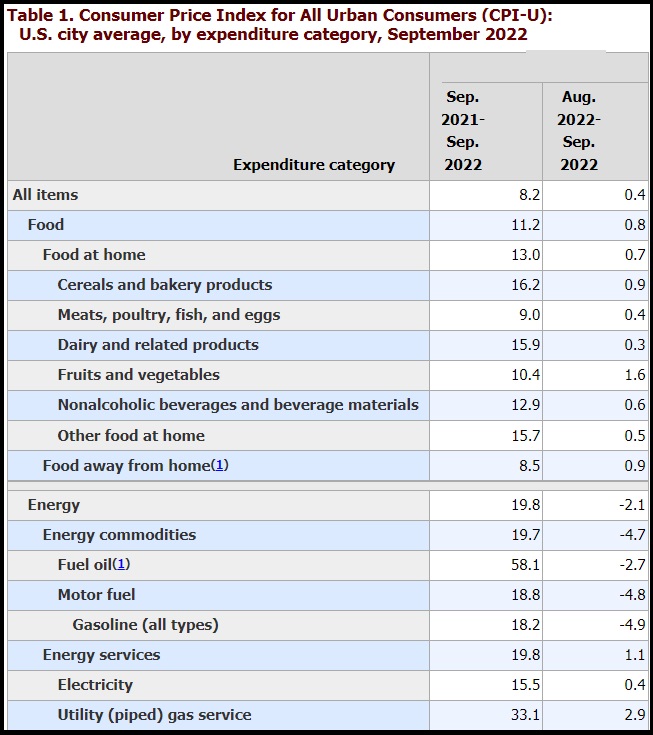

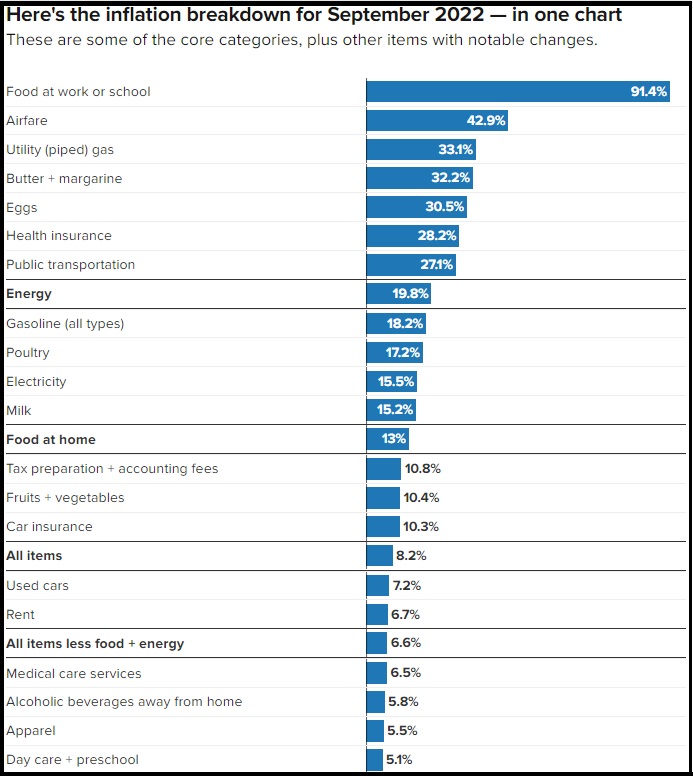

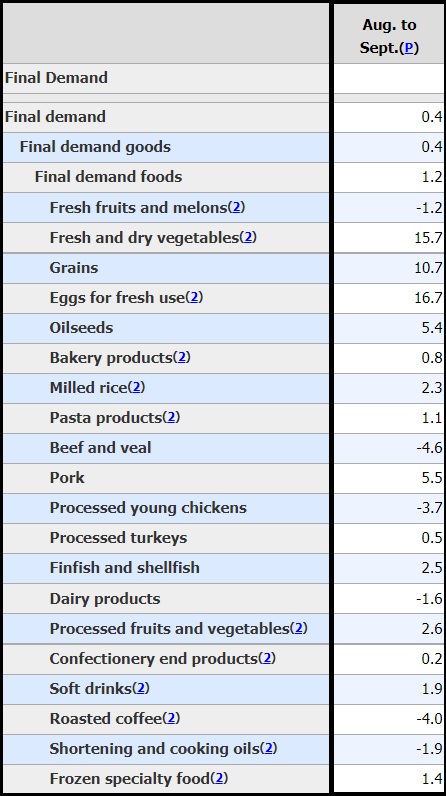

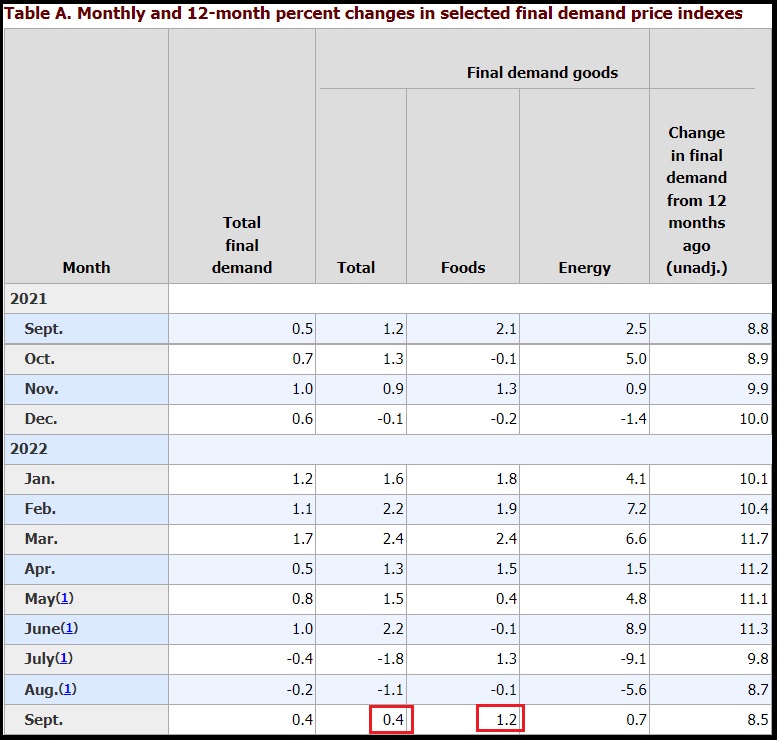

[Data Point 1] “Gasoline prices dropped in September for the third month in a row, falling 4.9% from August.” [Data Point 2] Sales at gasoline stations, a proxy for spending by car owners, declined 1.4% last month.”

If gasoline dropped 4.9% in price, but sales only declined 1.4% that would indicate more physical gasoline was purchased at a lower price than the month before. It’s not a hard concept to understand.

This is a retail sales reality even identified in the article itself, “Unlike many government reports, retail sales aren’t adjusted for inflation, so some swings reflect price changes rather than shifts in the amounts purchased.”

However, now look at this: “Spending at restaurants and bars grew 0.5% in September from the prior month. But prices at restaurants grew 0.9% in the same month, according to a separate Labor Department report released Thursday, meaning that consumers are getting less for their spending.”

No, that’s not what this means.

If restaurant prices increase 0.9%, but restaurant sales only increase 0.5% it means you are selling/serving fewer customers. It doesn’t mean consumers getting less food, it means fewer consumers are eating at restaurants…. Which is caused by consumers having to prioritize their spending.

(WSJ) – […] Spending declined in categories linked to big purchases like cars, televisions, beds and golf clubs. Purchases at electronics and appliance stores declined 0.8% in September while spending at furniture stores fell 0.7%.

[…] Scott Brave, the head of economic analytics for Morning Consult, said consumers have started to pull back on optional purchases while still spending on the essentials. “They are having to make tough decisions,” he said. (more)