COMMENT: Mr. Armstrong;

What I have witnessed from your Socrates and the private blog the past two days, Nov. 29, 30, 2017, has got to be one of the most incredible man-made technological wonders ever created.

I am only a few years into your models but the past two days has left me stunned. The Socrates system and your blogs have captured, analyzed, and translated what I used to call the mood of the markets. I could for some time see underlying patterns and capture general ideas of trends by market fundamentals and of course political/investor influences, but how to analyze it all yet capture the actions of a human driven market to a precise time is nothing short of earth shattering (with a touch of “I told you so” if I may add).

There is a natural explanation captured within the Socrates analysis, which to me boggles my mind as most algorithms, codes, formulas are not at all natural. I recall reading the night when you said the outputs of your models “came to you”. The computer was giving answers but how to translate them was the key. That moment must have been like no other.

Your market skills were proven, then you set out to offer this public service, commercial free no less, which naturally has pissed off the ones that wanted an unearned advantage, credentials, and limelight. Strange how the pure-hearted always come out on top.

During my formal engineering career, I have had a nose for finding the best tool, system or person for the job, and finding your work crushes other analysts, those who are now, as you have put it so eloquently “getting their face smashed into the sidewalk.”

I want you to know that I am one of the little people you seem to want to help. One that relies on the savings over time and can now guide not only my own future but others as well. I am fortunate because I had to save on my own, employers don’t give benefit packages to cripples, because if they did I wouldn’t have got the job. At investing I wasn’t bad at nailing a few market trends but I had to learn on my own since nothing I came across made any sense to me, but learning your system is dominating knowledge. I want you to know that I study your writings a good sixty hours a week because I may not be the sharpest knife in the drawer but there’s no sense in not trying. I’m not that good yet but I can’t get enough.

You gave me this confidence sir, so as petty as this letter is, I just want you to know that this is one life that is bettered because of your generosity and those people in your organization who must be some of the best to offer such an incredible gift.

I owe you one;

RH

REPLY: The entire objective of what is behind my motives here is to demonstrate that we can manage the economy if we understand its true nature and how everything is linked together. Granted, perhaps only an international hedge fund manager has such an opportunity to see a world from a very high altitude, whereas a domestic fund manager just looks at the local headlines and the latest cryptic ramblings from the Fed. In the international arena, you have to pay attention to everything everywhere. When I was in Singapore, the election took place the night before in the neighboring country. I had to know what took place and who was involved. I cannot say, oh let me get back to you on that, and then go ask Google. We have to pay attention to politics everywhere because that implicates COUNTRY RISK – the #1 criteria on investment strategy.

REPLY: The entire objective of what is behind my motives here is to demonstrate that we can manage the economy if we understand its true nature and how everything is linked together. Granted, perhaps only an international hedge fund manager has such an opportunity to see a world from a very high altitude, whereas a domestic fund manager just looks at the local headlines and the latest cryptic ramblings from the Fed. In the international arena, you have to pay attention to everything everywhere. When I was in Singapore, the election took place the night before in the neighboring country. I had to know what took place and who was involved. I cannot say, oh let me get back to you on that, and then go ask Google. We have to pay attention to politics everywhere because that implicates COUNTRY RISK – the #1 criteria on investment strategy.

I have poured all my experience into training Socrates. I taught it HOW to analyze, and turned it loose upon the world. There is NOTHING out there like it. It cannot even be copied. It incorporates my personal trading experience of more than 50 years combined with my understanding of programming.

That said, my motive is to try to make a difference in this world for my own family in the future. This is not about making money for me. If that was my objective, I would be selling advertising and people’s names. We get a lot of requests to advertise on our sites. I reject that because people trust me and they might take that as some sort of endorsement. The best thing is not to accept advertising because I cannot stand behind what others are doing.

We will have an opportunity in 2032 to reshape society. It is my hope that the more people who witness Socrates will realize this is not me personally writing over 1,000 reports daily on instruments around the world. Then its accomplishments will prove that there is a hidden order behind the veil of chaos. When we run the Dow through our Chaos Models, a clear pattern is revealed confirming that this is no random walk. This is also why there are some who are desperate to prevent people from listening to Socrates or me. They want to keep the status quo. Others try to criticize me as if I was one of them and offering just personal opinion. They cannot get their head around that this is a computer that sees everything on a global scale, with the most sophisticated models in the world, and it can articulate completely on its own. It is something that will survive my death, which was my goal.

As they say, you can’t take it with you. So the answer — find a way to leave it behind!

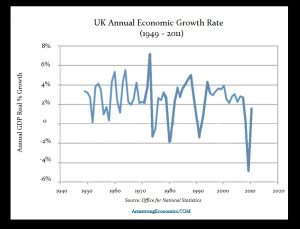

One of the reasons North Korea has such a large army is not patriotism. Those in the army are fed before everyone else. North Korea has always had a major problem — growing food. From a timing perspective, 72 years from the birth of the 38th parallel brought us to 2017. The War Cycle involving North Korea brings us to 2020.92. The 38th parallel of latitude was established on September 8, 1945 (1945.68). This arrangement proved to be the indirect beginning of a divided Korea that would lead to the Korean War (1950–1953). The war resulted in the Korean Demilitarized Zone (DMZ) and subsequent Cold War. However, the collapse of the Soviet Union in 1991 deprived North Korea of its main source of economic aid. Without Soviet aid, North Korea’s economy went into an economic freefall in 1992, which was pretty much in line with the Economic Confidence Model calculated from the birth of the 38th parallel.

One of the reasons North Korea has such a large army is not patriotism. Those in the army are fed before everyone else. North Korea has always had a major problem — growing food. From a timing perspective, 72 years from the birth of the 38th parallel brought us to 2017. The War Cycle involving North Korea brings us to 2020.92. The 38th parallel of latitude was established on September 8, 1945 (1945.68). This arrangement proved to be the indirect beginning of a divided Korea that would lead to the Korean War (1950–1953). The war resulted in the Korean Demilitarized Zone (DMZ) and subsequent Cold War. However, the collapse of the Soviet Union in 1991 deprived North Korea of its main source of economic aid. Without Soviet aid, North Korea’s economy went into an economic freefall in 1992, which was pretty much in line with the Economic Confidence Model calculated from the birth of the 38th parallel.