Armstrong Economics Blog/ECM

Re-Posted Feb 2, 2020 by Martin Armstrong

COMMENT: Marty, I have to respectfully disagree with the comment made by CR in the last blog, “The Dow & the Economic Confidence Model”. In the email he said, “Marty, I have to laugh. Only those who have followed you more 20 years understand you have discovered the hidden order behind the facade.” Not all of us that know have been around that long nor did it take us long to figure out.

I would say it would take one with their own mind, methods and models, and like you said someone willing to learn, that would be able to capture all of this and add what they already have to your model. There are those of us with a lot to bring to the game that haven’t been around that long but started to get it right away when we first started studying the model. I’m sure that was just a general statement focusing on themselves and their immediate group, but I found it inaccurate nonetheless.

Regardless, keep up the good work on your part.

EM

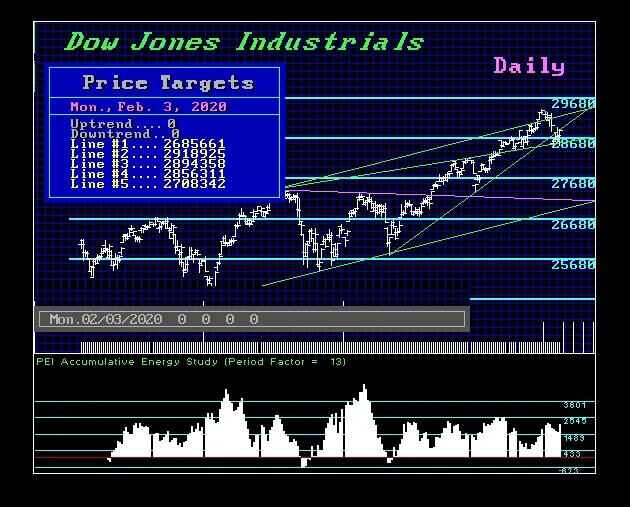

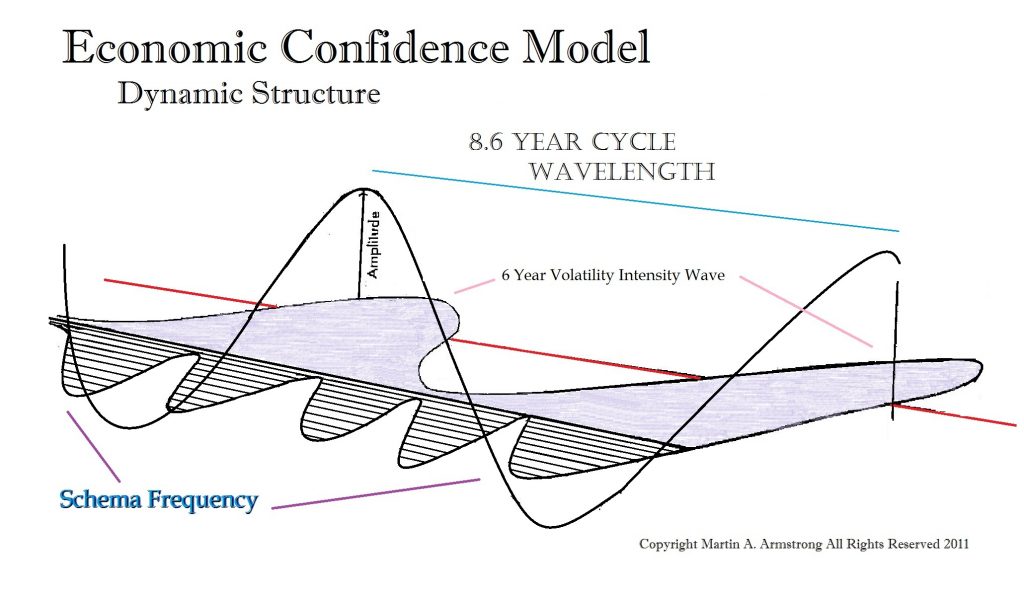

REPLY: I think what he really means is that I have had similar comments from people who have been followers only since 2012. What they have expressed is watching geopolitical events but this time the Dow peaked on the very day. Just comments distinguishing events from markets.

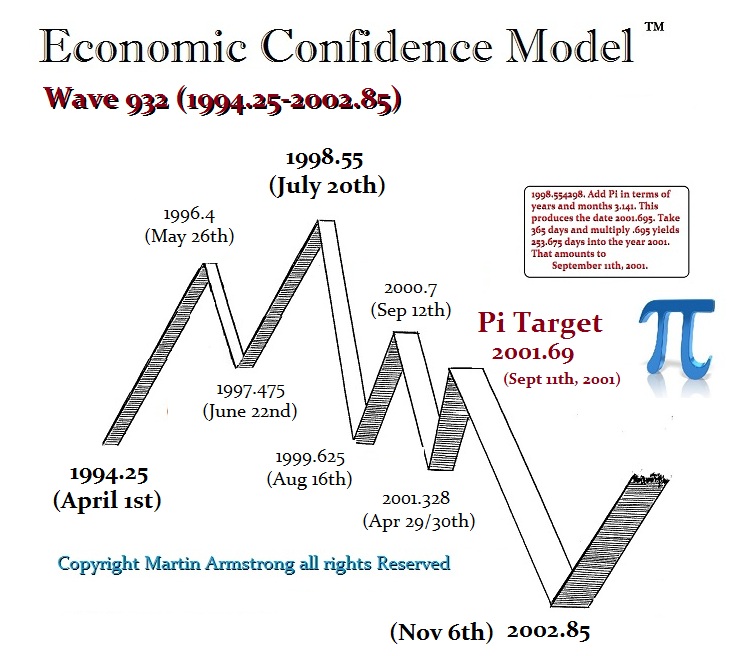

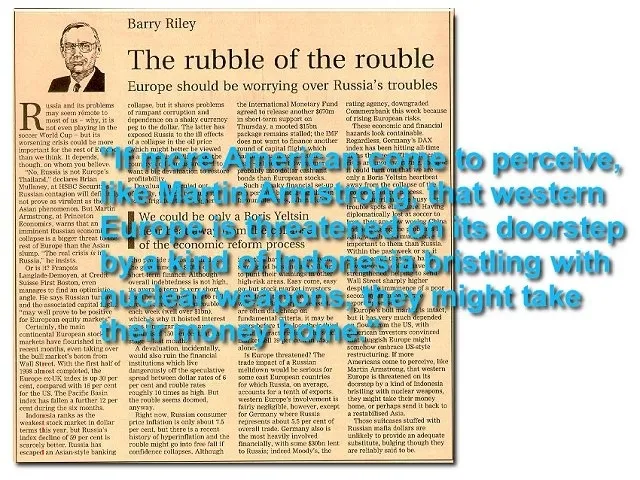

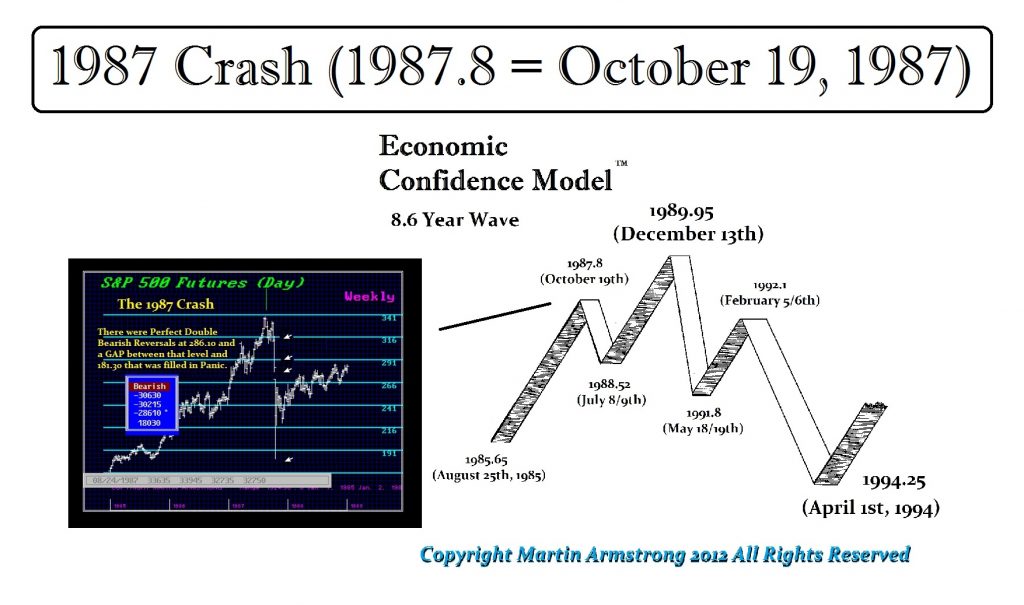

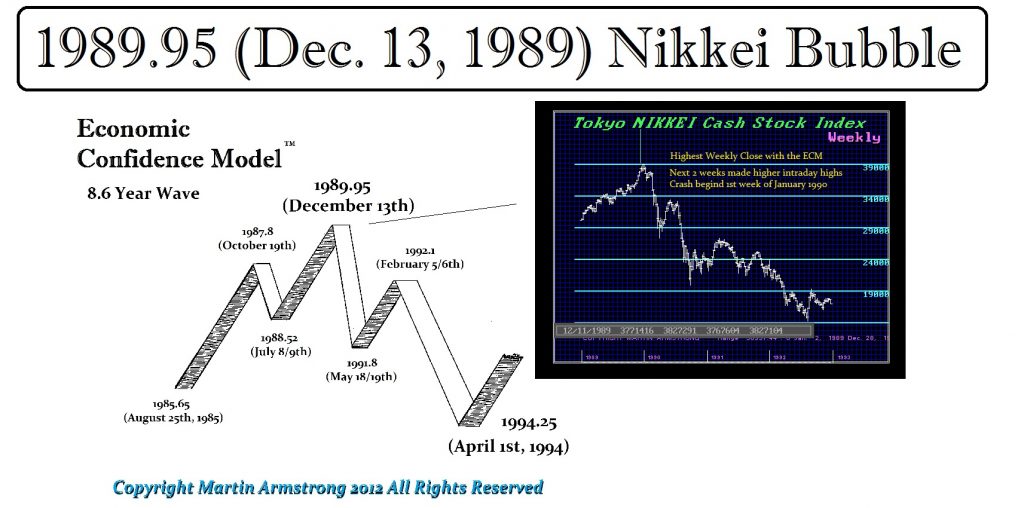

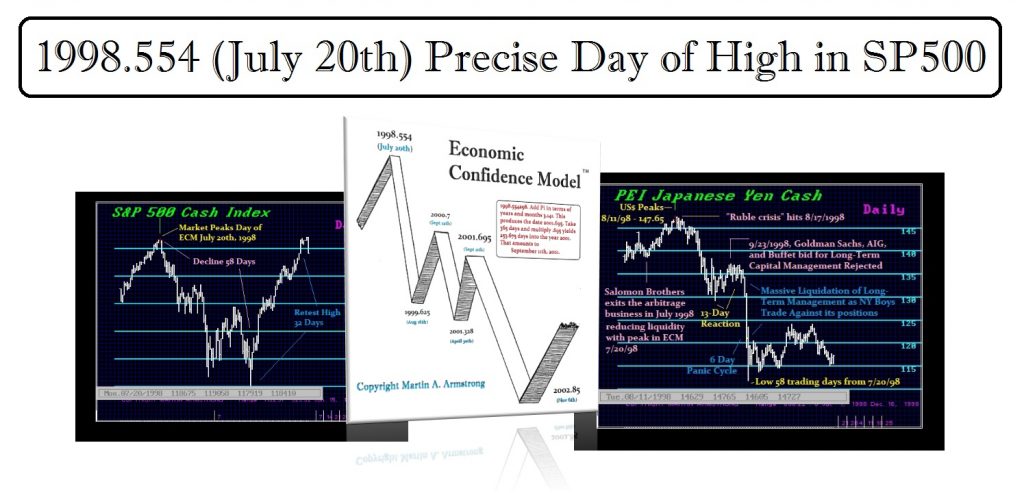

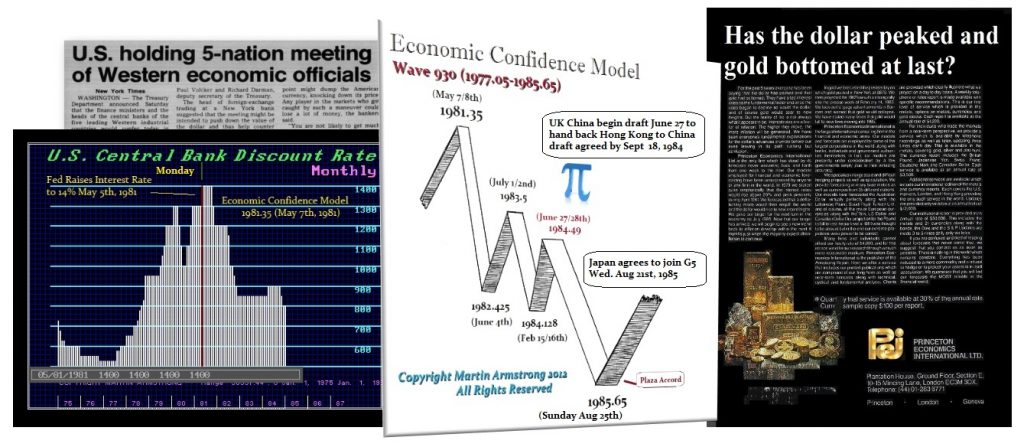

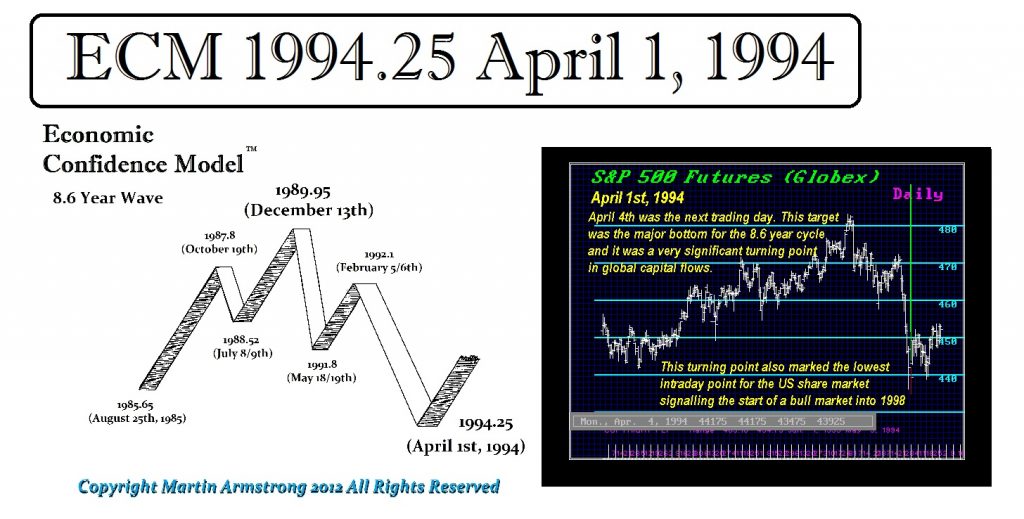

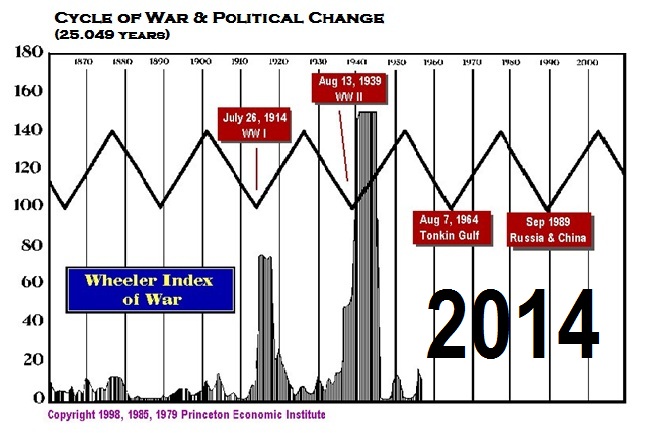

The Wave #932 saw so much from the precise day of the low in the US share market April 1st, 1994 to the high on July 20th, intermixed with the move in the dollar when it made its low in June 1997 and the Asian currency crisis hit in July. Of course, there was the Russian bond collapse which then set off a contagion that resulted in a massive liquidity crisis. Global markets were all collapsing because the “club” lost a fortune on Russia and their bribes being paid to the IMF to keep the loans going. When that manipulation failed, they had to start selling everything everywhere to raise cash even the collapse in the Japanese yen.

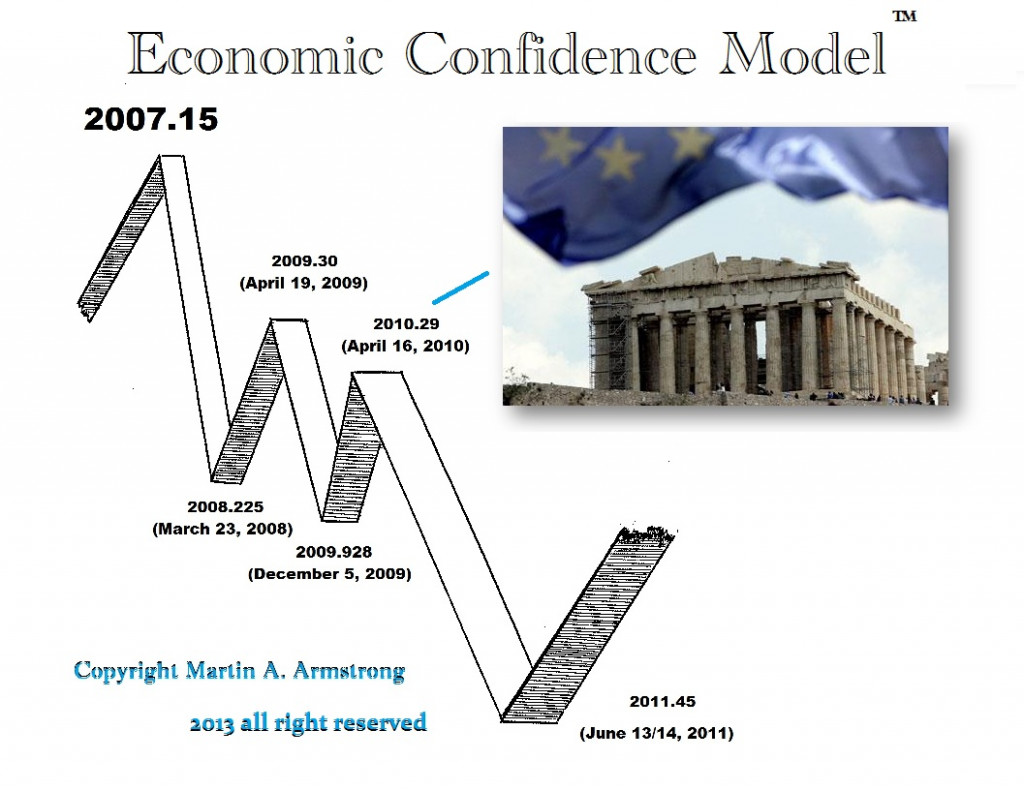

The peak not only marked the beginning of the Long-Term Capital Management Crisis forcing the Federal Reserve to step in for the first time to bail out a hedge fund but it marked the start of the Euro which was officially set on January 1st, 1999 and then at the bottom in 2002, that was the introduction of euro paper currency.

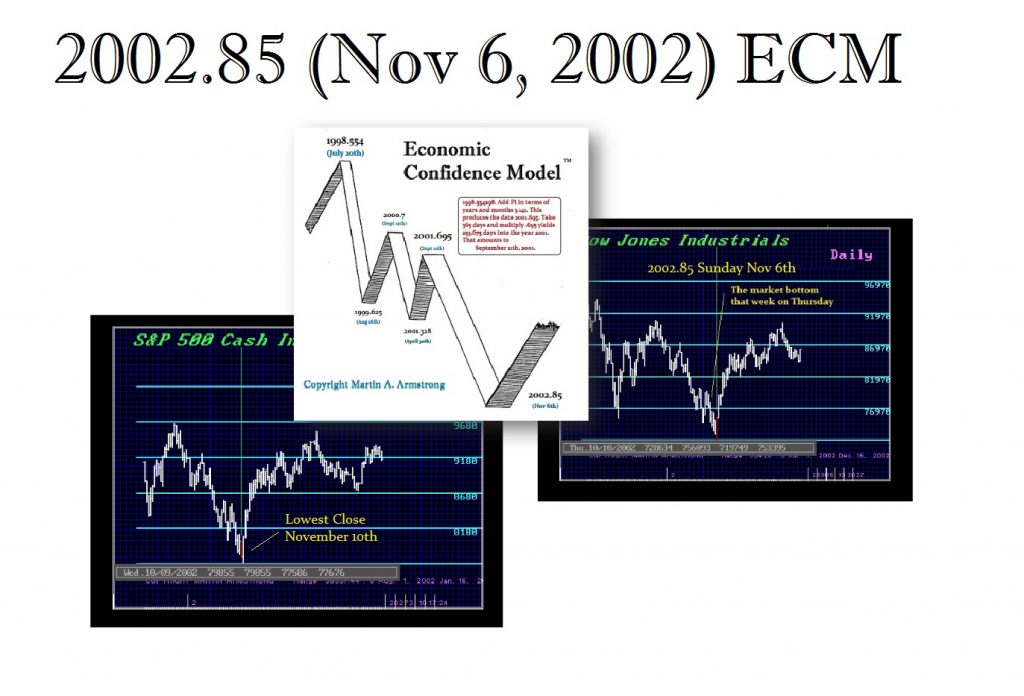

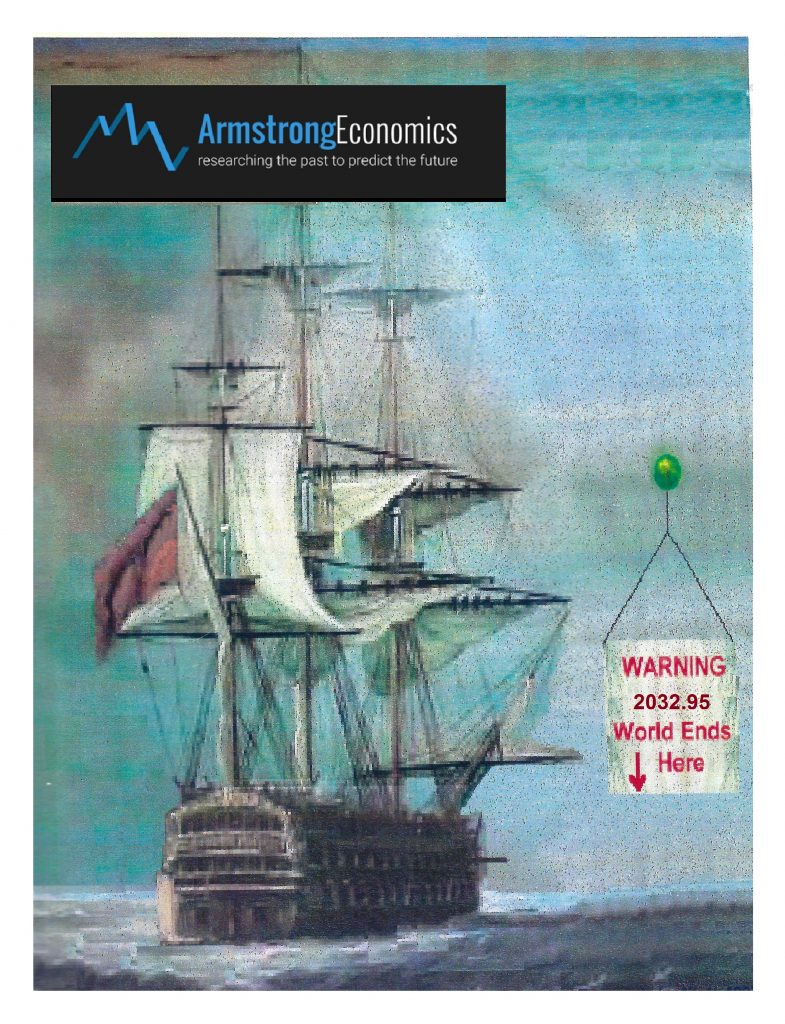

The Pi target marked precisely 911 which changed our world dramatically tp the day, and then 2002 was the bottom of the share market again. There are just so many events that take place with this model that it proves people who refuse to accept it are predetermined like those who refused to ever accept that the earth was not flat. All they do is try to disparage the messenger because they cannot explain why the message is wrong.

It takes some convincing, but not necessarily 20 years. I think what he meant was that after 20 years, they just expect it to work in this fashion.