Armstrong Economics Blog/Climate

Re-Posted Jan 23, 2020 by Martin Armstrong

QUESTION: Mr. Armstrong; What do you think about Harvard Professor Kenneth Rogoff who advocates a global carbon tax and then takes that money and hand it to China to subsidize them ending coal to generate electricity?

I think he has lost his mind.

HC

ANSWER: This is why major institutions have ZERO respect for academics. They have no concept of the real economy because they have never had to actually roll up their sleeves and deal with a crisis. They have never seen firsthand how capital actually moves. They also see people as an endless source of taxes. Just unbelievable.

When You Thought You Hit A Dog

Armstrong Economics Blog/Climate

Re-Posted Jan 23, 2020 by Martin Armstrong

QUESTION: You are wrong as usual. We just had the hottest decade. This is all about fossil fuels. There was never a CO2 problem until fossil fuels.

KJ

ANSWER: This entire climate change is nonsense! The first clean air act was passed by the Emperor Justinian in 535AD. Humans have burned wood long before coal. Perhaps you slept through science class, but burning wood produces CO2. This nonsense that the climate has changed ONLY because of humans and fossil fuels is ridiculous. They used fake data only since 1850, refuse to discuss the climate cycles pre-1850, and they fail to address the fact that we were coming out of the Little Ice Age for 200 years before the invention of automobiles and a 100 years before they invented trains.

Believe what you want to believe, but you are a victim of organized propaganda. You go right ahead and destroy Western society, lose your job, and live without heat or air conditioning. I will move to Asia where this nonsense is being rejected. And by the way, 1934 remains the hottest year on record with 1998 being number two.

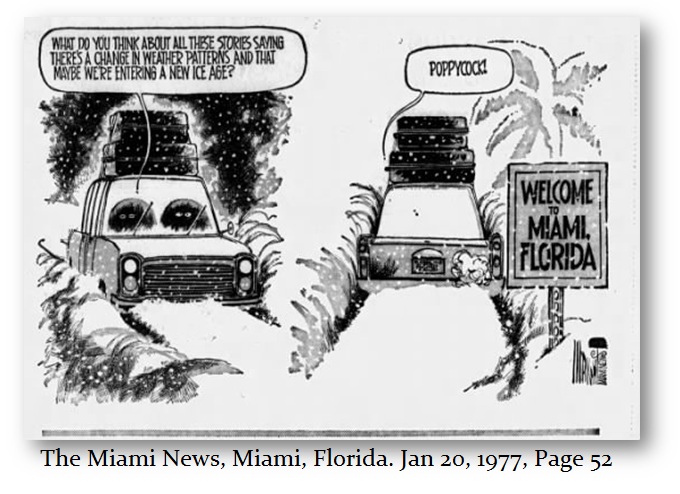

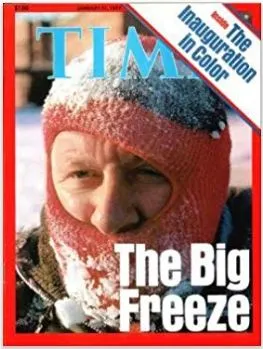

There just so happens to be a 43-year cycle. The year 1934 was a major cycle inversion and remains the record high. Then 43 years later, 1977, that was the Deep Freeze where it snowed in Miami and they were talking about climate change back then too turning back to an Ice Age. Again, 43 years later and it is back to the 40s in Miami and there are warnings about falling iguanas because it gets so cold they are still alive but pass out.

There just so happens to be a 43-year cycle. The year 1934 was a major cycle inversion and remains the record high. Then 43 years later, 1977, that was the Deep Freeze where it snowed in Miami and they were talking about climate change back then too turning back to an Ice Age. Again, 43 years later and it is back to the 40s in Miami and there are warnings about falling iguanas because it gets so cold they are still alive but pass out.

You people are taking credit for everything. The Australian fires and California droughts are all because of CO2? I hate to tell you that just because the press only wants to sell newspapers they are willing to print your garbage to get people talking about this nonsense. There have been droughts in California that have lasted more than 200 years! Nobody will address the cyclical evidence pre-1850.

The co-founder of Extinction Rebellion, Roger Hallam, in his Common Sense for the 21st Century, claims mass disruption, mass arrests, and mass sacrifice are necessary to prevent extinction. He calls for acts of civil disobedience, bypass political theory, and urges people to rise up to a non-violent revolution against society. He calls for the confiscation of private property. Your spokesperson is an outright communist. Nothing he has put forth proves anything. (see Spiegel, November 22, 2019)

So what you are saying is the Little Ice Age should be the norm and all this global warming is entirely because of fossil fuels? Enjoy yourself. Give up your car. Do not heat or air condition your home. If you cannot walk or ride a bike to work, quit! And how dare you use electricity to send me an email. If you want to be a climate activist, then adapt what you are yelling about instead of blaming everyone, of course, except yourself.

Interest Rates and the Great Global Crisis

Armstrong Economics Blog/Interest Rates

Re-Posted Jan 22, 2020 by Martin Armstrong

COMMENT: I attended your 2016 WEC and I thought you would be wrong that interest rates would rise and the whole big bang thing. Rates have risen only in the US, the pension crisis is clearly unfolding, and states have been going bust. Now there is the Repo Crisis and I did buy the report. I will return to the WEC this year. I realize that you are able to forecast long-term trends that nobody else can even see. Here in Australia, my God, it seems like the government has become occupied by Nazis who were also hunting money.

Good on ya!

PD

REPLY: Yes, most people have no idea that Hitler had passed similar laws that made it illegal to have a bank account outside the country. That prompted Switzerland to adopt its secrecy laws. Western governments are doing exactly as Hitler did. Oh yes, he killed a lot of Jews and others. But make no mistake about it, that was not just hatred. It was profitable. Hitler confiscated all their assets and then harvested even the gold in their teeth.

Just scan history and you will see a pattern. Henry VIII created the Church of England but confiscated all the assets of the Catholic Church. Constantine the Great adopted Christianity as the major religion and then confiscated the assets of the pagan temples. The only leader who confiscated assets of the Church without pretending he was adopting another religion was Napoleon. The Spanish Inquisition persecuted people, including the Jews and Arabs. However, that was also profitable for they confiscated their assets.

The rule of law in England at the time of the American Revolution had 240 felonies. The penalty was death so there too the king confiscated all your assets and threw your family out on the street. Just follow the money. Now they call it criminal to hide money from the government. It is money laundering to put cash in a safe deposit box — read the fine print — it can be confiscated! The criminal law is far too often used for the financial gain of the state.

As everyone knows, I turned out to be an institutional adviser. Consequently, the model that I developed had to be able to forecast the trend of all time levels. It was critical to be able to provide a reliable forecast out for 10 years when truly planning strategy for multinational corporations. That is why we had over $2.5 trillion under contract when the US national debt was just $6 trillion. We were by far the largest international adviser in the world.

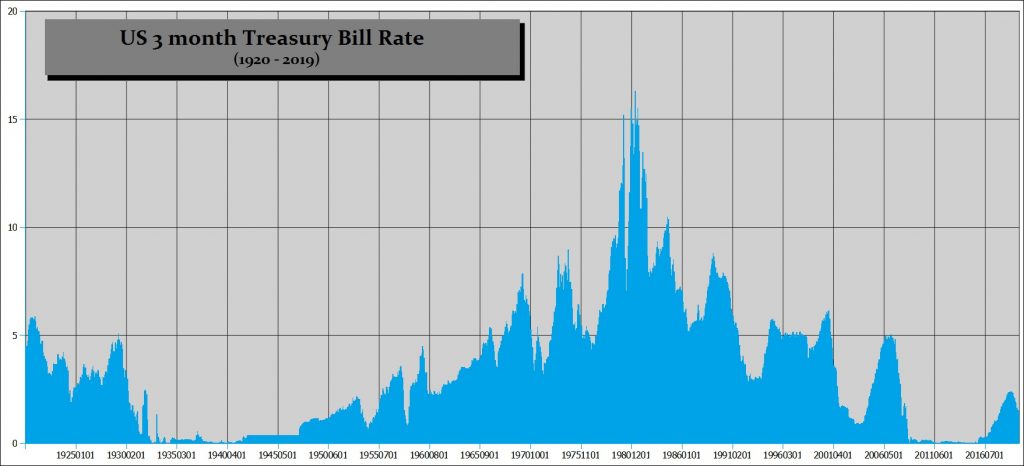

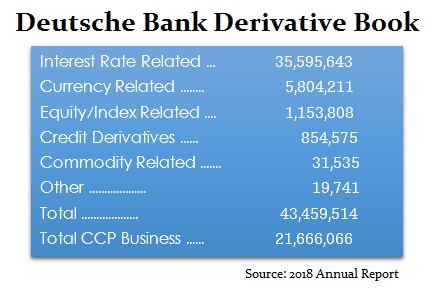

The disparity in the rates between the USA and those in Japan and Europe are all part of the crisis in both liquidity as well as international banking. The vast majority of derivatives out there are interest rate related. Europe has a major, major, major problem. An uptick in interest rates will be devastating in so many ways. It will not only cause major losses for the ECB portfolio of bonds with over $12 trillion in negative-yielding bonds, but then you have the derivatives market.

On top of that, to make derivatives safer, after 2007 the government insisted that all derivatives had to go through a central counterparty clearing house (CCP) agent. As you can see, the 2018 annual report showed that Deutsche Bank also acts as a CCP to which it guarantees another €21.6 trillion Euros of exposure.

This experiment with negative interest rates has created a nightmare from which we are desperately afraid to wake up because it could be very real.

Shanghai

This year we are holding three World Economic Conference events — Shanghai in May, Frankfurt in June, and then Orlando in November. Each will be focused on the local region within the scope of the global context. Many people have indicated they want to go to Shanghai and kick the tires personally. You can apply for a visa and then visit Beijing and the Great Wall as well as the Forbidden City. They are spectacular things to see while you can.

This year we are holding three World Economic Conference events — Shanghai in May, Frankfurt in June, and then Orlando in November. Each will be focused on the local region within the scope of the global context. Many people have indicated they want to go to Shanghai and kick the tires personally. You can apply for a visa and then visit Beijing and the Great Wall as well as the Forbidden City. They are spectacular things to see while you can.

You do not need a visa to visit Shanghai if you have an ongoing ticket to another city, not just a return. So fly to Shanghai, then to Hong Kong, and home. I believe you are allowed to stay for up to 7 days on that basis. Make sure you check yourself because things change. So if you want to see Beijing, just apply for a visa. It’s not a big deal.

The Frankfurt WEC will focus on the crisis in Europe. The Orlando WEC will be naturally focused on the world economy and we will have the results of the 2020 election in the USA by that time.

There will be special tickets for those attending all three events or just two.

A Technical Study in the Relationships of Solar Flux, Water, Carbon Dioxide and Global Temperatures, December 2019 Data

From the attached report on climate change for December 2019 Data we have the two charts showing how much the global temperature has actually gone up since we started to measure CO2 in the atmosphere? To show this graphically Chart 8 was constructed by plotting CO2 as a percent increase from when it was first measured in 1958, the Black plot, the scale is on the left and it shows CO2 going up a bit over 30.0% from 1958 to December of 2019. That is a very large change as anyone would have to agree. Now how about temperature, well when we look at the percentage change in temperature from 1958, using Kelvin (which does measure the change in heat), we find that the changes in global temperature (heat) are almost un-measurable. The scale on the right side had to be expanded 10 times (the range is 40 % on the left and 4% on the right) to be able to see the plot in the same chart in any detail. The red plot, starting in 1958, shows that the thermal energy in the earth’s atmosphere increased by .30%; while CO2 has increased by 30.0% which is 100 times that of the increase in temperature. So is there really a meaningful link between them that would give as a major problem? The numbers tell us no there isn’t.

The next chart is Chart 8a which is the same as Chart 8 except for the scales which are the same for both CO2 and Temperature. As you see the increase in energy, heat, is not visually observably in this chart hence the need for the previous chart 8 to show the minuscule increase in thermal energy shown by NASA in relationship to the change in CO2. Based to these trends, determined by excel not me, in 2028 CO2 will be 428 ppm and temperatures will be 15.0o Celsius and in 2038 CO2 will be 458 ppm and temperatures will be 15.6O Celsius. This is what the data shows no matter what the reasons are, so I have no idea how the IPCC gets to predict that the world will end in ten or even twenty years.

The full 40 page report explains how these charts were developed and why using NASA and NOAA data that are used without change to prove that The New Green Deal is not required and any attempt to complete that plan will be a worldwide disaster.

Click on the link below for the full report that you can download.

Climate Change & the 2020 ECM Turning Point

Armstrong Economics Blog/Climate

Re-Posted Jan 21, 2020 by Martin Armstrong

The climate change propaganda has become a major economic factor which is undermining the global economy and lowering the standard of living for the average person. Governments have embraced it simply because it is the perfect excuse to raise taxes. It is causing separatist movements such as in Alberta, Canada to the civil unrest in France.

The entire agenda has been orchestrated by real fanatics who are against the Industrial Revolution. Both Greenpeace’s Jennifer Morgan and Al Gore have pushed a very distorted theory using unsupported facts from a pretend 97% consensus on down to attributing the cyclical swing back from the Little Ice Age since the early 1800s to exclusively humans refusing to look at the historical cyclical record of climate.

Their push to enforce their theories by imposing higher taxes and regulations has set in motion the collapse of the German economy which is dooming the Eurozone as a whole. Al Gore and Jennifer Morgan have helped to instigate shutting down any dissent against their movement when we need serious investigations. To dissent is reminiscent of the witchhunts of McCarthy against Hollywood.

The insolvency of numerous European automobile manufacturers is now openly predicted by industry observers. Everything has to be subordinate to the change towards e-mobility and self-driving cars. The fact that electric cars are still not competitive is neglected, as is the question of whether citizens want to drive in vehicles controlled by technology groups.

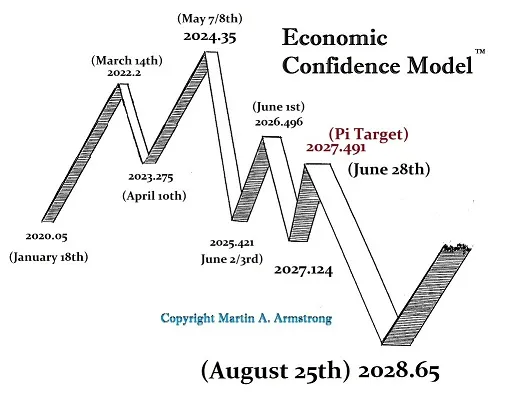

The turning point in 2020 will be a very profound event that will be viewed with hindsight as we now can see the importance of the change in trend at the top of the ECM — 2015.75.

NASA’s forecast for the next solar cycle reveals it will be the weakest of 200 years. Results show that the next cycle will start in 2020 and reach their maximum in 2025. It is very interesting how it has aligned with the ECM turning point on January 18th. If we begin to see a sharp rise in volcanic eruptions, two or three such eruptions of 6+ can create a volcanic winter that would feed into the commodity cycle sending food prices much higher.

The Coming Crisis – What to Watch?

Armstrong Economics Blog/Banking Crisis

Re-Posted Jan 20, 2020 by Martin Armstrong

QUESTION: Dear Martin – We owe your respect for what you are doing and I wanna say thanks for educating your followers like me. With the issue of this growing international crisis, are you able to provide ideas on what the triggers maybe when it begins to come out of the surface? What can we observe to identify the beginning, EU Bonds – you mentioned IGOV – the currency, what else? I guess all of your followers are highly interested in that.

Many thanks,

JH

ANSWER: The first was the inverted yield curve which led many to think we were heading into a recession last summer. Then the Repo Crisis hit and despite being touted as just a fluke due to taxes, after more than three months the Fed cannot get out of providing liquidity without stepping back and allowing the free markets to raise short-term rates.

The liquidity crisis has spread even to Japan. Here the Bank of Japan has stood up and announced it would buy government bonds without any limitation trying to also prevent interest rates from rising.

The ECB will have to deal with the whole negative interest rate crisis they have created. They will be forced to allow rates to rise or all member states will have to agree to allow the ECB to adopt the same policies as in Japan — buy all government debt without limit.

Keep an eye on Europe. I do not see any way of avoiding this crisis. Politicians are too busy with other things. The free market will push rates higher and the central banks will be unable to prevent the rise in rates ahead.

Volcanoes & the Risk During Solar Minimum

Armstrong Economics Blog/Climate

Re-Posted Jan 17, 2020 by Martin Armstrong

COMMENT: Dear Marty,

Thank you so much for warning all for what is coming !

Sorry to keep reflecting on details, you wrote :“The real issue is the threat of a VEI 6- 7 which could seriously alter the climate for a year or two resulting in a Volcanic Winter. The other risk is 5 to 6 small eruptions under VEI 6 but are VEI3 or greater.”

VEI is a logaritmic scale, so to create the same impact of one VEI 7, you need 10 VEI 6, 100 VEI 5, 10,000 VEI 4 or 100,000 VEI3. 5 to 6 small eruptions of VEI3 ? won’t do much, sorry hope attached table comes thru high VEI’s not only throw up more dust, ie VEI 6 does 0.003% of the stratosphere volume, VEI 7 0.032%, VEI 8 0.3% and VEI 9 3% high VEI’s do shoot much higher as well; VEI 5 may reach stratosphere; so the impact will not be limited to stratosphere only the frequency extrapolation does tell us a lot about how we can not imagine what could happen where VEI 5 would occur every 12 years, VEI 9 only once 27,000 years do not know where it ends, because it is an extrapolation BUT given the big mass extinctions come in cycles of multiples of 31.4 million years the event probably is much larger than that would it be a significant meteorite impact that triggers many quakes and eruptions ?

REPLY: You are absolutely correct. We do know that there were two volcanoes that erupted which produced the year without a summer. Evidence suggests that this event took place during the Solar Minimum and was predominantly the result of a volcanic winter event caused by the massive 1815 eruption of Mount Tambora in Dutch East Indies (now Indonesia) which was a VEI7. This eruption was probably the largest eruption since the 6th century AD which produced devastation between 535–536 AD. It is believed that the year without a summer was probably enhanced due to the 1814 eruption of Mayon in the Philippines which was VEI4.

You are correct that it would probably take a number of smaller eruptions because of the log scale. However, Tambora may not have been sufficient to alter the climate entirely by itself. It is hard to rule out that Mayon, which was only a VEI4, combined with the VEI7 to create the devastation.

However, evidence has been uncovered from around the world that the early Dark Ages of the 6th century AD was most likely triggered by an eruption around 535 AD, which was probably a VEI7+ event. There was a natural phenomenon of cataclysmic proportions that altered the world and even changed religion. This event created major political, economic and social changes that few people have ever bothered to connect the dots.

It has long been believed that there was probably an eruption from Ilopango in El Salvador. There was probably a second eruption perhaps in Indonesia and may have been Krakatoa.

There was a major volcanic explosion that was equal to more than 2000 Hiroshima size bombs. Human civilization was altered from the Mayan to Mongolia in the north to Constantinople and Southeast Asia. There were devastating plagues, famine, death, and great migration which caused people to move south. Empires and city-states collapsed including Teotihuacan in Mexico, the Anglo-Saxon victory over the Celts and invasions, and it contributed to the rise of Islam. Even in India, we see the Gupta Empire of Northern India collapsed by 543 AD as it too was overrun by the Huna during the mid-6th century. The Sasanian Empire in Persia also peaked during the 6th century.

The political, economic, and religious changes which took place because of this devastating 6th-century volcanic winter were profound. This is what might result from two VEI7s.

NOTE:

VEI km

3 frequency days =years %troposphere plume km km km3 delta

0 0.000001 0.000000003% 0.1 earth 31,879,029

1 0.00001 1 0.0 0.00000003% 0.3

2 0.0001 14 0.0 0.0000003% 1.0

3 0.001 90 0.2 0.000003% 3.2 troposphere 3 31,910,116 31,087

4 0.01 540 1.5 0.00003% 10

5 0.1 4,380 12 0.00032% 32 stratosphere 15 32,024,304 114,188

6 1 18,250 50 0.003% 100 mesosphere 50 32,381,370 357,066

7 10 182,500 500 0.032% 316 thermosphere 85 32,735,345 353,975

8 100 1,500,000 4,110 0.3% 1,000 exosphere 600 38,166,299 5,430,954

9 1,000 10,000,000 27,397 3.2% 3,162

10 10,000 90,000,000 246,575 32.2% 10,000

Carney of Bank of England Claims Climate Change Will Make Pensions Worthless

Armstrong Economics Blog/Pension Crisis

Re-Posted Jan 17, 2020 by Martin Armstrong

QUESTION: Mr. Armstrong; Is the head of the Bank of England Mark Carney using climate change to claim that pension funds will be worthless? He is just insane or a fraud using this to cover up the pension fund crisis?

SK

ANSWER: There is just no possible way that climate change has anything to do with pensions. We actually have major institutions asking us to generate a theoretical green portfolio that DOES NOT LOSE MONEY just so they can claim they have some “green” in their portfolio.

Any investment in “green” companies has resulted in major losses. So there is no logic to what Carney is saying unless it is a cover-up for the pension crisis that is unfolding. Governments have ordered pension funds to buy government debts and then they take interest rates down to negative. The governments, without climate change, are ensuring that pensions will be worthless. It seems that he is using climate change as the excuse for the pension system failure.

He is clearly demonstrating what the elites think of the people – just stupid!

Capital Flows & the Next ECM

Armstrong Economics Blog/Capital Flow

Re-Posted Jan 16, 2020 by Martin Armstrong

QUESTION: Sir,

You have advised us to avoid sovereign debt after the ECM date. I imagine that the crisis will affect nations unequally. It seems obvious that money would leave bonds in the more challenged, negative rate countries (EU and Japan). Might these flows come into US Treasuries, thereby stabilizing US rates, at least short-term? Could this be a trading opportunity (long) in our Treasuries? Thank you.

PK

ANSWER: So far, it appears that the capital flows will continue pointing to the USA going into 2022. Thereafter, we should expect a change in that trend in the same position of the ECM, which created the 1987 Crash also due to a capital flight from the dollar

Tax Proposals Rising in California Again

Armstrong Economics Blog/The Hunt for Taxes

Re-Posted Jan 16, 2020 by Martin Armstrong

Back in 2008, a California Socialist activist was gathering signatures in an attempt to impose a state wealth tax on the ballot that would have imposed a new 35% income surtax on top of the Federal income tax. He realized that people would flee the state, so the solution was to impose an exit tax, seizing 55% of assets exceeding $20 million that anyone possessed seeking to leave the state. On top of all of that, the proposed money raised would then buy controlling shares in large corporations operating in the state.

California is going broke and raising the income tax may present a problem. First, they are seeking to overrule Proposition 13 from 1978 which prohibited raising property tax rates. They are cleverly looking to overrule it by claiming that they should be allowed to raise taxes on business properties. That will open the door to raise property taxes on any property owned by a trust or any corporate structure. But the real concern is if the people vote for that on the 2020 ballot, the wording can be vague enough to allow property taxes to rise in economic difficulties.

Secondly, there is a proposal to introduce a wealth tax, which would circumvent the entire Proposition 13. This is just being talked about behind the curtain and would not be on the ballot in 2020. It is a proposed workaround because they cannot possibly reform and cut their own pensions