Posted originally on the CTH on April 29, 2023 | Sundance

There’s something sketchy afoot in the world of high finance. Following the collapse of Silicon Valley Bank, the most likely first contagion bank would have been First Republic Bank; both California banks carried similar vulnerabilities. However, once the Treasury Dept agreed to cover all deposits, even those unsecured deposits over the $250k FDIC insurance protection, suddenly First Republic Bank survived.

After the FDIC announcement, a group of 11 larger banks lent First Republic a tranche of money ($30 billion) to secure its holdings and help stabilize it. Approximately six weeks passed, suspiciously perhaps the burn rate for the tranche in combination with risk averse exits says I, and suddenly First Republic starts destabilizing again. [Insert Suspicious Cat here]

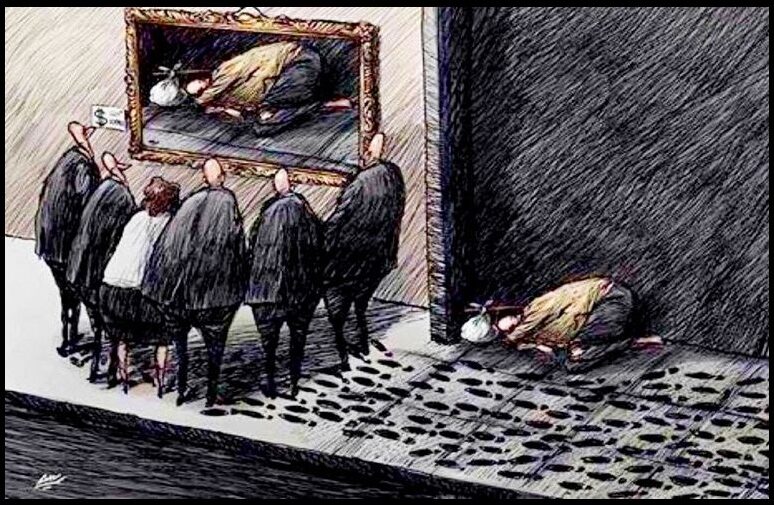

The First Republic stock value collapsed further last week, and the FDIC is now trying to get a takeover bid secured before government regulators are forced into a position of receivership. I’m not dialed in to the banking industry, but it looks to me like the six-week interim phase was an agreement to give the illusion of stability and afford time for highly exposed, ¹likely well connected, stakeholders to exit.

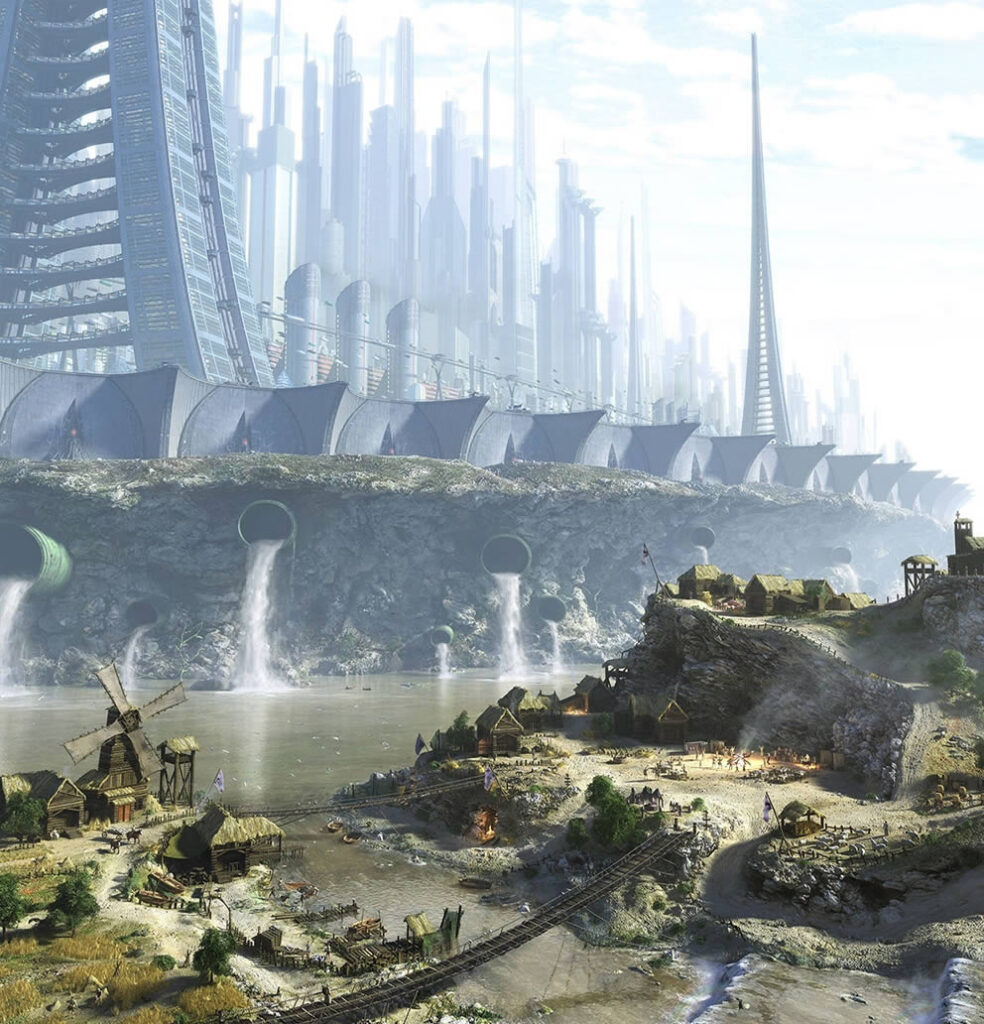

With the Treasury taking the prior SVB position, thereby securing all deposits regardless of scope, the FDIC is now on the hook if the collapse includes a govt takeover. The FDIC seems to be playing hot potato and looking for a buyer. Additionally, the FDIC is asking JP Morgan-Chase if they are interested. JPMorgan holds more than 10% of all deposit funds in U.S. banking. From a regulatory position, JPM cannot legally take any more institutional deposits. So, what gives? It is all sketchy, all of it.

(Bloomberg) — The Federal Deposit Insurance Corp. has asked banks including JPMorgan Chase & Co., PNC Financial Services Group Inc., US Bancorp and Bank of America Corp. to submit final bids for First Republic Bank by Sunday after gauging initial interest earlier in the week, according to people with knowledge of the matter.

The regulator reached out to some banks late Thursday seeking indications of interest, including a proposed price and an estimated cost to the agency’s deposit insurance fund. Based on submissions received Friday, the regulator invited some of those firms and others to the next step in the bidding process, the people said, asking not to be named discussing the confidential talks.

Spokespeople for JPMorgan, PNC, US Bancorp, Bank of America and the FDIC declined to comment. Bank of America is considering whether to proceed with a formal offer, one of the people said. Citizens Financial Group Inc. is also involved in the bidding, Reuters reported, citing people with knowledge of the matter.

The bidding process kick-started by regulators — after weeks of fruitless talks among banks and their advisers — could pave the way for a tidier sale of First Republic than the drawn-out auctions that followed the failures of Silicon Valley Bank and Signature Bank last month. Authorities are stepping in after a particularly precipitous drop in the company’s stock over the past week, which is now down 97% this year.

Unclear to some involved in the process is whether regulators might use a bid for a so-called open-market solution that avoids formally declaring First Republic a failure and seizing it. The stock’s drop — leaving the company with a $650 million market value — has made such a takeover at least somewhat more feasible.

[…] A group of 11 banks that deposited $30 billion into First Republic last month — giving it time to find a private-sector solution — have proved reluctant to band together on making a joint investment. A few proposals that surfaced in recent days called for a consortium of stronger banks to buy assets from First Republic for more than their market value. But no agreement materialized.

Instead, some stronger firms have been waiting for the government to offer aid or put the bank in receivership, a resolution they view as cleaner — and potentially ending with a sale of the bank or its pieces at attractive prices.

But receivership is an outcome the FDIC would prefer to avoid in part because of the prospect it will inflict a multibillion-dollar hit to its own deposit insurance fund. The agency is already planning to impose a special assessment on the industry to cover the cost of SVB and Signature Bank’s failures last month. (more)

¹This is pure speculation on my part, but if you were a well-connected California big fish and you had exposure in FRB, after the SVB collapse you might ask the govt to construct an exit plan to assist you.

$11 billion flows in, you make your quiet withdrawals, and after exit the delayed outcome proceeds accordingly.