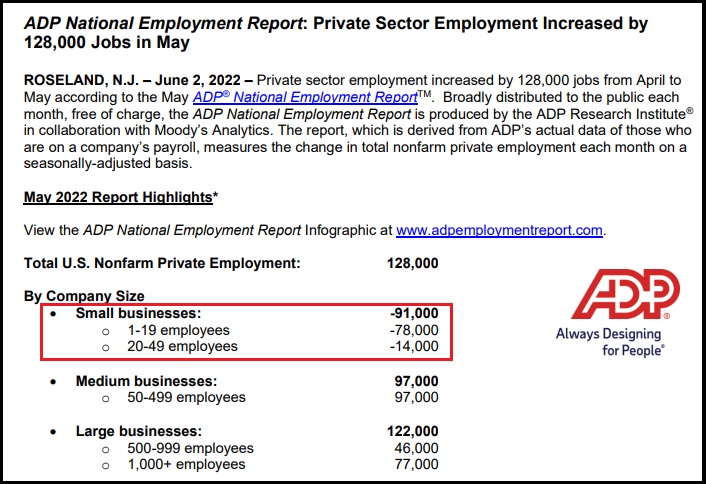

Posted originally on the conservative tree house on June 3, 2022 | Sundance

There was a really bizarre dichotomy on display today within the teleprompter script prepared for Joe Biden to use.

Dear Leader took to the microphones to brag about his economic accomplishments and remind Americans how all good thinking people should be feeling:

“Since I took office, families are carrying less debt; their average savings are up. A recent survey from the Federal Reserve found that more Americans feel financially comfortable than at any time since the survey began in 2013.”

[Source Transcript] – {Direct Rumble Link} WATCH:

Do you hear what he is saying? Americans have less debt, their savings are up, and they are more comfortable financially today than ever before.

If those remarks were based on reality, then why was the following segment stated exactly 52 seconds later in the same script?

…”one way we can make things a little better for families is by helping them save on other basic items their family needs on a monthly basis, like their utility bills, their Internet bills, their prescription drug bills, and other costs like housing. My goal is to make sure that at the end of the month families have a little more breathing room than they — than they have now.” (link)

These are not two different speeches; these are two paragraphs a few moments away from each other in the exact same speech. [Full Transcript Here]

This speech should ring massive alarm bells, not because of what is being said – but because the people behind Biden are just phoning in the propaganda now and not even trying to hide it or give the illusion of a president in control. No president, in command of the office and the issues, would read those two paragraphs of a prepared speech and not point out the literal hypocrisy his handlers were telling him to read.

Full Remarks, filled with denial, lies and some of the weirdest gaslighting to date.

.

Examples from speech:

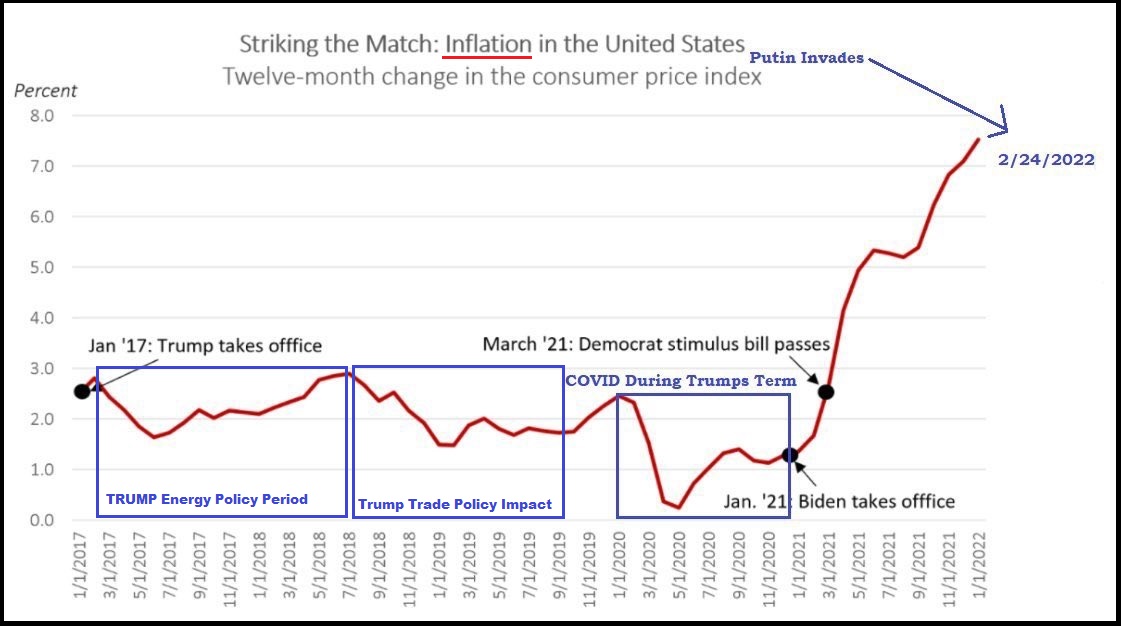

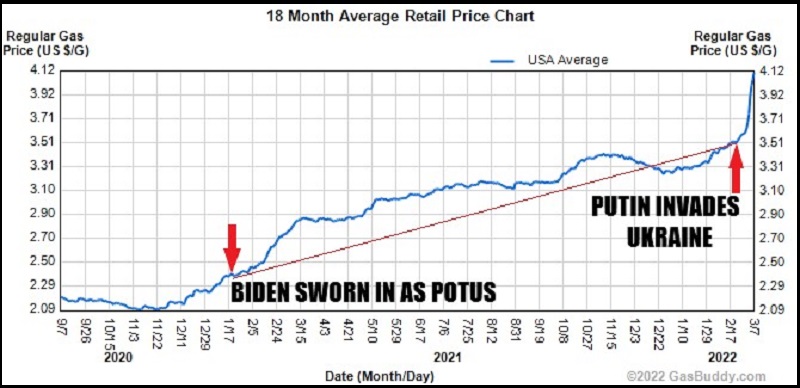

…”The price of gas is up $1.40 since the beginning of the year when Putin began amassing troops at the Ukrainian border. This is the “Putin price hike.”

Example #2:

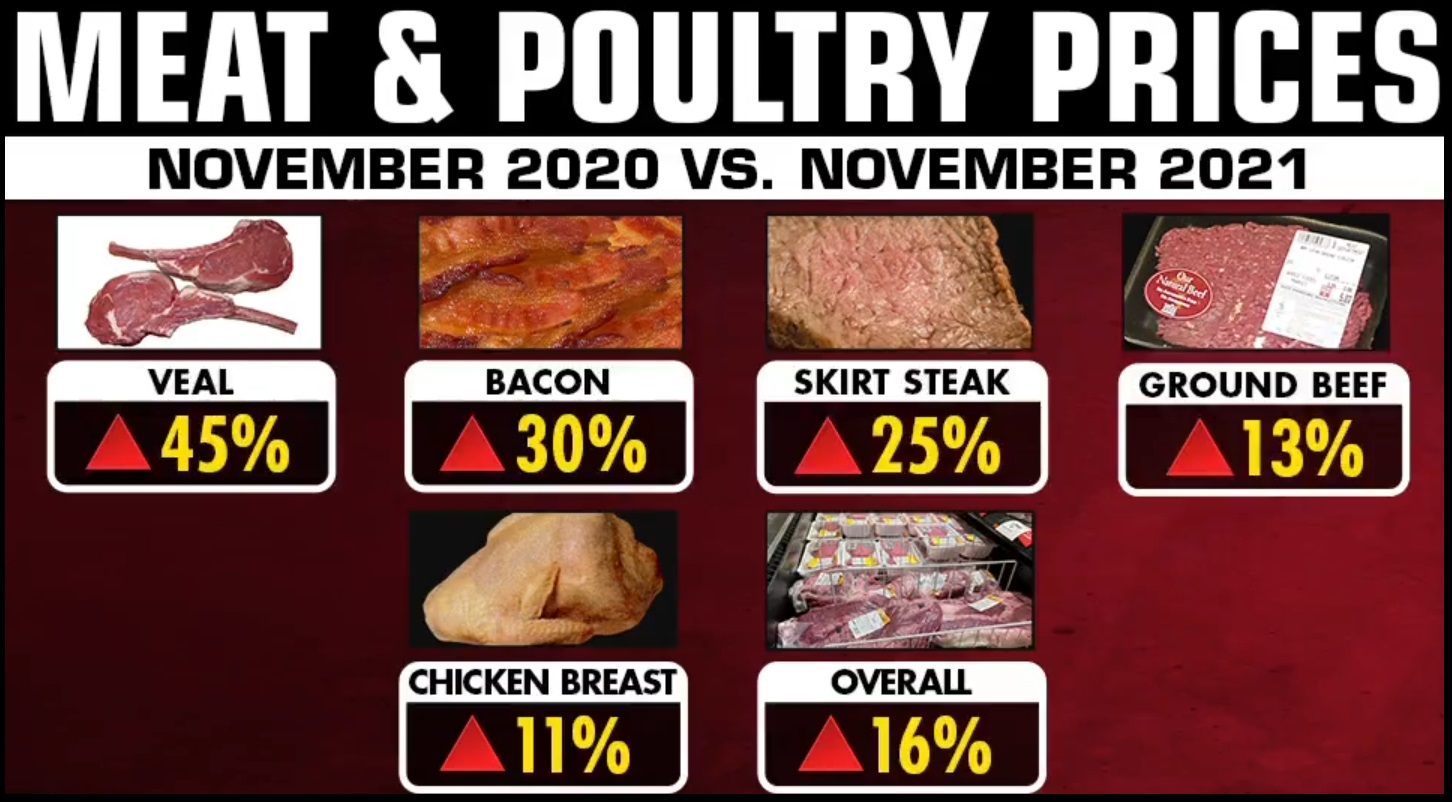

…”Putin’s war has raised the price of food because Ukraine and Russia are two of the world’s major breadbaskets for wheat and corn — the basic product for so many foods around the world.”