Posted originally on the CTH on February 21, 2023 | Sundance

First things first, history may not always repeat, but it always rhymes. Secondly, history tells us that only two things have ever pulled what we now call “western nations” out of a collective economic depression; (1) war, and (2) housing starts.

If you accept the WEF climate control agenda of a ‘managed transition‘, where economies are reduced in size to match lowered energy production, as generally speaking akin to a western economic depression.… then, you begin to ask the logical question. How do the managers avoid the consequences?

If global (non BRICS) economic contraction is akin to a western economic depression, I would argue the consequences are identical. Then, when major economies are in a state of shrinking and the citizens are feeling the horrible effects, something large is needed to change the economic equation.

With central banks raising interest rates to achieve the policy supporting contraction, the option for ‘housing starts’ to change the dynamic is removed. That leaves, ‘war’.

President Putin and Chairman Xi are not stupid men. They are big picture strategists.

♦DATA POINT – Russian President Vladimir Putin’s move to suspend his country’s involvement in the last remaining arms control treaty with the U.S. came as a disturbing surprise to multiple former officials who negotiated the pact and nonproliferation experts committed to ending the expansion of nuclear forces. (read more)

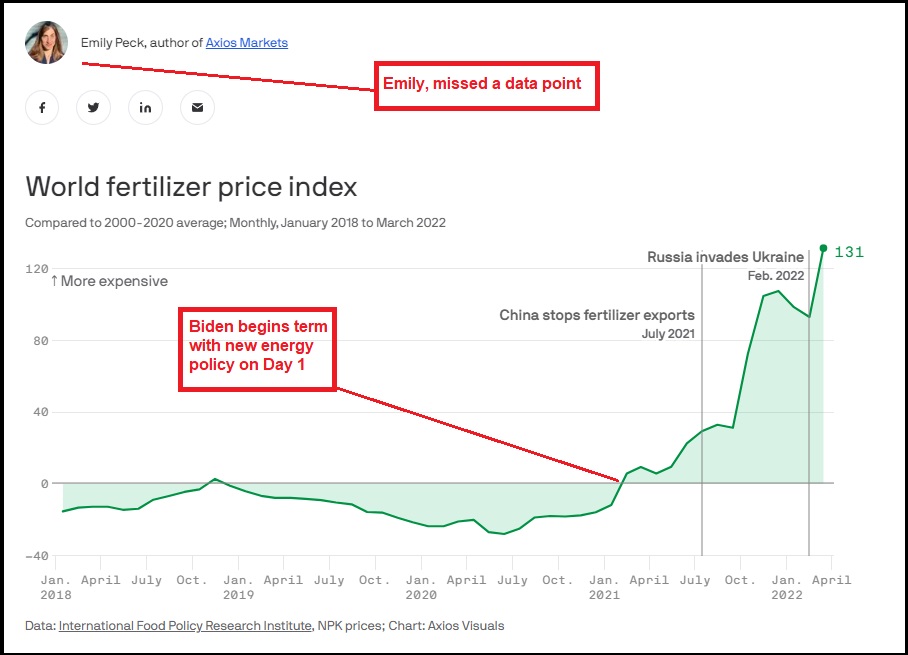

Can you blame him? The Western Alliance has already blamed Putin for the global food crisis they created by the World Economic Forum energy policy shift. The Western Alliance accepts no responsibility for advancing hostility -through NATO expansion- on to Russia’s doorstep. The Western Alliance has attempted to sanction Russia out of the global economy. With the same Western Alliance now positioning for war, why would Putin adhere to their limitations?

♦DATA POINT – Chinese leader Xi Jinping is preparing to visit Moscow for a summit with Russian President Vladimir Putin in the coming months, the Wall Street Journal reported on Tuesday, citing people familiar with the plan. (read more)

Can you blame them? Pay no attention to the Reuters narrative woven inside the article about China wanting to negotiate peace. To accept that narrative is to believe there is no dragon behind the panda mask. We are too far into the geopolitical awakening to say the dragon doesn’t exist and simultaneously hold its own interests (belt & road, and/or Taiwan) within the context. Ignoring the dragon behind the mask is really quite silly. BRICS exists as an economic alliance of like-minded nations for exactly this geopolitical dynamic.

♦DATA POINT – Shipping and logistics group A.P. Moller-Maersk (MAERSKb.CO) has agreed to sell its two logistics sites in Russia to IG Finance Development Limited, it said on Monday, nearly marking the end of its business activities in the country. […] After that, Maersk will not have any business in Russia. (read more)

The major multinationals always position themselves to avoid the consequences of war. Additionally, Moller-Maersk is already going to feel a major financial impact from the shrinking of the Western economies they generally service with their cargo transportation. Smaller economies = less cargo = less ships = less revenue. Moller-Maersk has to pick a side; they are aligned with the Western Alliance. Hence their exit from Russia. China/India will eventually fill the void. Again, BRICS.

These are data points just in the last 12 hours. In addition to these data points from today, the saber rattling from the DC foreign policy and war machine financial system is on display in the Biden policy as transmitted from Warsaw. Again, just today.

Like us, I’m pretty sure from watching his statements and eventual policies over the past several years, President Donald Trump views foreign policy through the prism of economics. If “economic security is national security,” then what is it when economic insecurity is an intentional design policy?

All of the economic data points have aligned toward direct military conflict between the Western Alliance and Russia that expands beyond the proxy war in Ukraine.

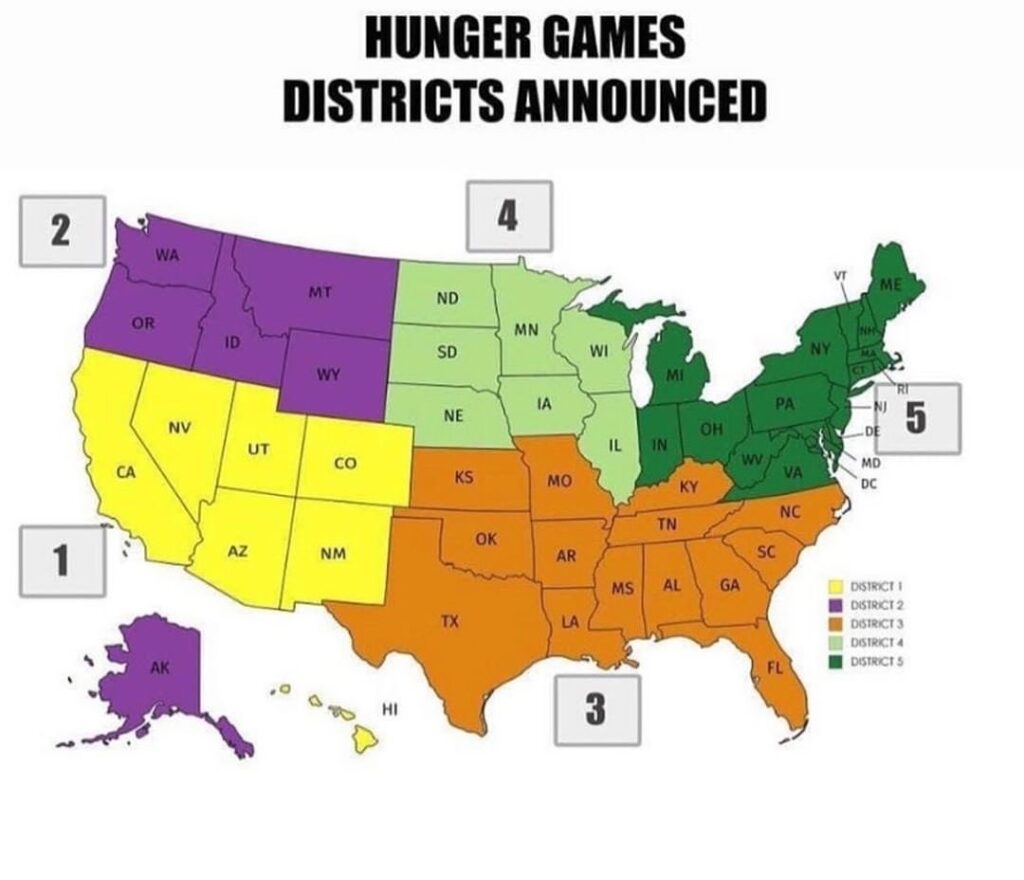

If the path is continued, this process eventually ends up with World War III. Which, not coincidentally, boils down to the Western Economic Alliance -vs- BRICS, with a few remaining neutral and the middle east as the unknown variable.

Sound familiar?

Look below, you might find a familiar visual reference:

Yep, history rhymes.

Any questions?