The Federal Reserve also established a U.S. Coin Task Force

Re-Posted from the Canada Free Press By Dr. Ileana Johnson Paugh —— Bio and Archives—July 22, 2020

As if the global economic disaster caused by the Chinese Covid-19 viral pandemic was not bad enough, the looming global “coin shortage” and the “unknown pneumonia” (Covid-20?) in Kazakhstan are here.

Why exactly do we have a coin shortage?

- Banks tell us that the Fed are not releasing enough coins.

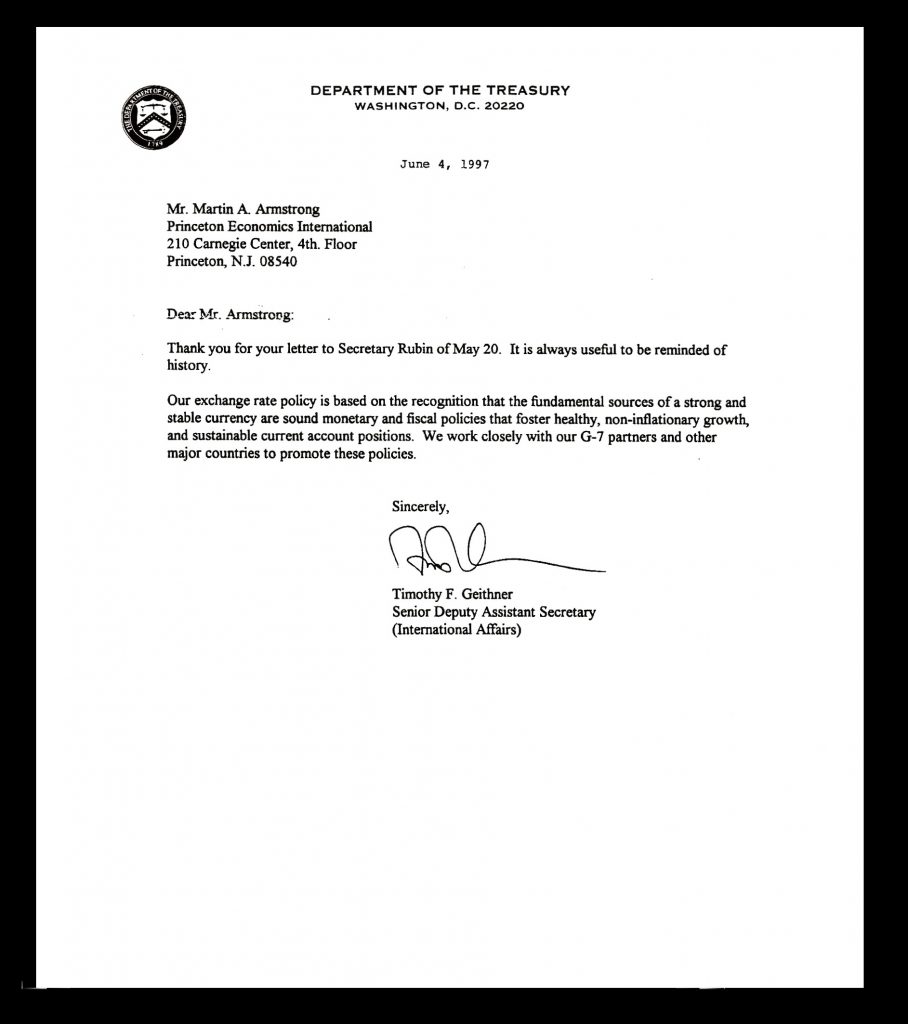

- Armstrong Economics wrote that faith in governments has been eroded. It sees governments as promoters of the idea that money is dirty, and the solution is to eliminate coins and paper money even though physical money as a medium of exchange has been in circulation for centuries.

- The U.S. Treasury reported a disruption in the coin supply chain and its velocity of circulation due to the lockdowns and the huge reduction in consumption in the last four months of forced lockdowns in all 50 states. People shopped mostly for food and avoided all other venues of direct commerce for fear of Covid-19 infection and because so many places were closed. Many shopped online or in large retailers like Costco, Target, Walmart, and Amazon.

- Allegedly, the U.S. Mint has minted less coins to protect employees from COVID-19. It is an interesting issue to ponder since minting coins and printing paper currency are highly automated operations, with expensive computers driving the printing and minting presses and requiring very few employees, mostly in checking roles to make sure the machines run properly and the mint/print are done correctly, as well as controlling the quality of each batch that is bound and packaged for distribution and circulation.

- Some central banks are sterilizing money with UV light to prevent the spread of viral infections.

- The Fed purportedly quarantined for ten days U.S. dollars returning from Europe and Asia.

The U.S. Treasury sees the current coin shortage in U.S. businesses as a decrease in velocity of various coins in circulation. The Treasury estimated the value of coins in circulation in April 2020 of $47.8 billion as an adequate coin supply, larger than last year’s supply of coins by at least half a billion. But the closing of retail shops, many permanently, bank branches, transit authorities, and laundromats due to Covid-19 fears, eliminated the typical places where coins enter circulation.

Nobody knows exactly if people are hoarding coins on purpose or if the businesses that have closed temporarily or permanently have cleared out all their cash registers of coins and paper currency.

On June 11, the Federal Reserve announced the Strategic Allocation of Coin Inventories which was a temporary coin order allocation in all Reserve Bank offices and Federal Reserve coin distribution locations effective June 15, 2020.

The Federal Reserve also established a U.S. Coin Task Force in early July to deal with disruptions to normal coin circulation. All interested parties participated – U.S. Mint, Federal Reserve, armored carriers, American Bankers Association, Independent Community Bankers Association, National Association of Federal Credit Unions, Coin aggregator representatives, and retail trade industry.

The Federal Reserve said that “it is confident that the coin inventory issues will resolve once the economy opens more broadly and the coin supply chain returns to normal circulation patterns, however, “it recognizes that these measures alone will not be enough to resolve near-term issues.”