Tag Archives: Waterfall event

The Humane Side Of Capitalism

Re-posted from Uncommon Knowledge by Russell Roberts Thursday, July 23, 2020

A lot of people reject capitalism because they see the market process at the heart of capitalism—the decentralized, bottom-up interactions between buyers and sellers that determine prices and quantities—as fundamentally immoral. After all, say the critics, capitalism unleashes the worst of our possible motivations, and it gets things done by appealing to greed and self-interest rather than to something nobler: caring for others, say. Or love. Adam Smith said it well:

It is not from the benevolence of the butcher, the brewer, or the baker that we expect our dinner, but from their regard to their own self-interest.

Capitalism, say its critics, encourages grasping, exploitation, and materialism. As Wordsworth put it: “Getting and spending, we lay waste our powers.” In this view, capitalism degrades our best selves by encouraging us to compete, to get ahead, to win in business, to have a nicer car and house than our neighbors, and to always look for higher profits and advantages. In the great rat race of the workplace, we all turn into rats. Is it any wonder so many want to kill off capitalism and replace it with something more just, more fair, more humane?

This urge to try something else seems to be on the rise. In a 2019 Gallup poll, 43 percent of respondents said socialism would be good for the country. A self-avowed socialist, Bernie Sanders, came closing to winning the Democratic nomination for president in 2020, finishing a close second as he had four years earlier.

One answer to this increased taste for socialism is that socialism has to be specified in order to compare it to capitalism. I think a lot of people are attracted to socialism because they believe it means capitalism without the parts they don’t like. How to get there from here is left unspecified. A second answer is that the American economic system is, in fact, a hybrid of capitalism and socialism. Some parts of the American economy are pretty free market, or what we might call capitalist: those parts where profit and loss determine success or failure, where prices and wages are mostly free to adjust to what the market will bear, and where subsidies are small or nonexistent. But other parts of the American economy, such as education, health care, and housing, are highly distorted—they are heavily subsidized or regulated in ways that make innovation and competition very difficult. They’re not fully socialist, but you can’t really call them free market, either.

Capitalism, somehow, gets blamed for anything that goes wrong. Consider health care—it is highly subsidized; its prices are distorted by those subsidies along with incredibly complex regulations; the supply and allocation of doctors are highly constrained by regulations; hospital competition is curtailed by certificate of need requirements; and finally, on top of that, a highly regulated private insurance business is tangled up with everything. And when outcomes go sideways, people claim it proves that markets don’t work for health care. One of the essential pillars of capitalism is people spending their own money on themselves. The essence of the health-care market is people spending other people’s money, often on other people.

People decry the high price of housing in New York and San Francisco, and some blame it on the greed of landlords. But greed is as old as humankind. What has changed in recent decades and driven prices upward is ever more restrictive zoning that has made it harder to build new rental units in cities where the demand is highest.

But let’s put aside the question of whether capitalism can fairly be blamed for the ills of health care in America or the high price of housing in certain American cities. Let’s look at the more basic charge of immorality.

Is capitalism good for us? Does it degrade us or does it lift us up? The critics are right that competition is an important component of the capitalist system, but the dog-eat-dog nature of that competition is greatly exaggerated. We call it competition, but it can also be thought of as the availability of alternatives. As Walter Williams likes to point out, I don’t tell the grocery store when I’m coming. I don’t tell them what or how much I want to buy. But if they don’t have what I want when I get there, I “fire” them. The existence of alternatives, choices of where to shop, and competition incentivizes the grocer to stock the shelves with what I want.

My cleaning crew speaks almost no English and has little or no formal education. Yet I pay them about double the legal hourly minimum. It isn’t because I’m a nice person. If I paid them only the minimum, they wouldn’t show up, because many other people are willing to pay much more to have their houses cleaned. Competition, not the minimum wage, is what protects my cleaning crew from the worst side of me and anyone else they work for.

Competition in sports is typically zero sum. The team with the higher score wins and the other team must lose. But economic competition is positive sum. Market share has to sum to 100 percent. When highly reliable Hondas and Toyotas showed up in the United States at very reasonable prices in the 1970s and 1980s, for example, they took market share from American companies. But the total number of cars sold wasn’t fixed. By making better and cheaper cars, the number of cars sold increased. And the quality wasn’t static, either. Spurred by Japanese competition, American car companies improved their products’ quality. And the American consumer was better off.

The essence of commercial life is positive sum. You hire me at a wage that makes it worthwhile for you to do so. I work for you because the wage is high enough to make me better off as well. Without both of us gaining, there’s no deal to be made.

Of course, some people have fewer or less attractive alternatives than other people. Why does Walmart pay what its critics claim are inadequate wages? It’s not because Walmart is especially cruel or greedy. (After all, I could make more on Wall Street than I do in academic life. That’s not because Goldman Sachs is kinder than Stanford University.) Walmart pays what it does because it can. And it can pay what it does because the people who choose to work there have unattractive alternatives. Otherwise, they’d take a job somewhere else.

Similarly, workers in overseas factories make very little relative to their American counterparts because their alternatives are much worse than those available to American factory workers. It’s not the cruelty of greedy international corporations that keeps the wages low. It’s the poor alternatives those workers have available to them. In fact, poor workers in poor countries typically line up for the opportunity to work for an international corporation. Wages there, while low by American standards, are much higher than in other parts of the economy.

Over time, the poorest workers in countries such as China have seen their wages rise dramatically. Again, this is not because of the compassion of corporate employers but because of the competition they face in attracting good workers. There are two positive ways to help both foreign workers and low-wage American workers at places such as Walmart: increase the demand for their services and find ways to help them increase their skills. That makes them more attractive to employers, who can pay them more because the workers are more productive.

Competition in a free-market system is about who does the best job serving the customer. Unlike traditional competition, there isn’t a single winner—multiple firms can survive and thrive as long as they match the performance of their competitors. They can also survive and thrive by providing a product that caters to customers looking for something a little different.

Finally, there is a great deal of cooperation in capitalism. One kind is obvious: investors cooperate with managers, who cooperate with employees to produce a great product or service. Many people find the opportunity to work with others in this way—to produce something of value for the consumer—deeply rewarding in ways that go beyond money. Part of the reason people start businesses is money, of course. But there is a large nonmonetary component: the experience of joining with others to create a great product or service that people value.

In the second Keynes-Hayek rap video I created with filmmaker John Papola, we tried to capture the best of this entrepreneurial side of capitalism:

Give us a chance so we can discover

The most valuable way to serve one another.

When Apple introduced the iPod in 2001, the 10GB model held two thousand songs, the battery lasted ten hours, and its price was $499. By 2007, the best iPod held twenty times that number of songs, the battery lasted three to four times longer, and its price was $299. Apple didn’t improve the quality and lower the price because Steve Jobs was a nice or kind person. Apple improved the iPod because its competitors were, as always, constantly trying to improve their own products. But I don’t think money was the only thing motivating improvement at Apple. Steve Jobs was happy to get rich. But he was also eager to keep his firm afloat in order to employ thousands of people at good wages and to work alongside those workers to create insanely great, ever better products. The money was nice. But it was not all (and maybe hardly at all) about the money.

Steve Jobs wanted to put what he called a dent in the universe. He wanted to make a difference. To do that, he needed to convince people of his vision, and then that vision had to be made real in a way that could profitably sustain an enterprise. Free markets gave Jobs the landscape where he could make his vision a reality.

You do have to pay the bills. The money that comes from consumers who value your product has to be sufficient to cover your costs. That’s the profit-and-loss criterion that underlies capitalism—you have to do as good or better than your competitors at serving your customers. But that’s not enough. You also have to do it at a price and pay a wage to your employees that result in a profit.

The other moral imperative of capitalism comes from repeated interactions between buyers and sellers. When there are repeated interactions, sellers have an incentive to treat their workers and their customers well—otherwise, they would put future interactions at risk. The safety of air travel, for example, is highly regulated. But cutting corners to save money and thereby putting passengers at risk are bad ideas for an airline that wants to exist past tomorrow. Crashes caused by negligence destroy an airline’s reputation. In markets, reputation helps insure honesty and quality. Being decent becomes profitable. Exploitation is punished by future losses.

None of the above rules out a role for government. You can defend free markets and capitalism without being an anarchist. Government plays a central role as the most effective enforcer of property rights and contracts. It administers the legal system. And it can and should restrict opportunities for people to impose costs on others. There’s nothing un-capitalist about making it illegal to dump your garbage into the air or water.

But what about the poor? How can we applaud the morality of capitalism if its gains go only to the richest Americans? Who wants to champion a system that gives the 1 percent the richest of chocolate cake and leaves everyone else with crumbs?

While there is evidence that supports this claim of the poor as bystanders who are left unchanged by decades of economic growth, this evidence typically looks at snapshots of workers at two different points in time, comparing changes in income or wealth of the top 1% to the to the standing of the top 1% decades later. The implicit assumption is that the people who were at the top in the past got much richer over time. This approach ignores economic mobility and falsely assumes that the top 1 percent are a fixed group. The people composing that 1 percent change; the same people do not simply get richer while everyone else treads water. The 1 percent includes people who once were much poorer but, now that they have reached the top, are richer than the people who previously were at the top. Similarly, the bottom twenty percent today are not the same people who were at the bottom in the past. When you follow the same people over time, rather than comparing group snapshots at two different points in time, all groups—poor, middle class, rich become more prosperous over time. A rising tide lifts all boats and not just the yachts. (I’ve explored these issues in videos and essays published elsewhere.)1

I would also point out that the guards in Cuba face south; they prevent Cubans from escaping the egalitarian paradise of Cuba for the unequal American economy. Poor people from all over the world risk their lives to come to the United States. Certainly they come here for opportunity for themselves and for their children. They expect—correctly, in my view—to share in the future growth of the American economy.

But I think poor people come here for more than just the financial opportunities of the American economy. They come for a chance for their children, and for themselves, to flourish, to use their gifts and skills in ways that bring meaning well beyond financial rewards. Money is pleasant, and not starving beats starving. But the real morality of capitalism and of the American system, with all its flaws, is that it gives people the chance to flourish through their work.

Not everyone has this chance in America today. But I believe that many of the challenges that the poorest among us face are not the fault of capitalism but the result of the breakdown of other institutions, which makes it hard for people, especially young people, to acquire the skills that would allow them to thrive. The US school system needs an overhaul. In particular, it could use more competition. The charter school movement is one part of a potential policy improvement. Even more competition—including private school options funded by scholarships—would go a long way toward allowing the poorest among us a chance to share in the American economic system, imperfectly capitalist that it is.

Milton Friedman Myths v Reality

Armstrong Economics Blog/Economics

Re-Posted Jul 25, 2020 by Martin Armstrong

The Coming Coin Shortage

The Federal Reserve also established a U.S. Coin Task Force

Re-Posted from the Canada Free Press By Dr. Ileana Johnson Paugh —— Bio and Archives—July 22, 2020

As if the global economic disaster caused by the Chinese Covid-19 viral pandemic was not bad enough, the looming global “coin shortage” and the “unknown pneumonia” (Covid-20?) in Kazakhstan are here.

Why exactly do we have a coin shortage?

- Banks tell us that the Fed are not releasing enough coins.

- Armstrong Economics wrote that faith in governments has been eroded. It sees governments as promoters of the idea that money is dirty, and the solution is to eliminate coins and paper money even though physical money as a medium of exchange has been in circulation for centuries.

- The U.S. Treasury reported a disruption in the coin supply chain and its velocity of circulation due to the lockdowns and the huge reduction in consumption in the last four months of forced lockdowns in all 50 states. People shopped mostly for food and avoided all other venues of direct commerce for fear of Covid-19 infection and because so many places were closed. Many shopped online or in large retailers like Costco, Target, Walmart, and Amazon.

- Allegedly, the U.S. Mint has minted less coins to protect employees from COVID-19. It is an interesting issue to ponder since minting coins and printing paper currency are highly automated operations, with expensive computers driving the printing and minting presses and requiring very few employees, mostly in checking roles to make sure the machines run properly and the mint/print are done correctly, as well as controlling the quality of each batch that is bound and packaged for distribution and circulation.

- Some central banks are sterilizing money with UV light to prevent the spread of viral infections.

- The Fed purportedly quarantined for ten days U.S. dollars returning from Europe and Asia.

The U.S. Treasury sees the current coin shortage in U.S. businesses as a decrease in velocity of various coins in circulation. The Treasury estimated the value of coins in circulation in April 2020 of $47.8 billion as an adequate coin supply, larger than last year’s supply of coins by at least half a billion. But the closing of retail shops, many permanently, bank branches, transit authorities, and laundromats due to Covid-19 fears, eliminated the typical places where coins enter circulation.

Nobody knows exactly if people are hoarding coins on purpose or if the businesses that have closed temporarily or permanently have cleared out all their cash registers of coins and paper currency.

On June 11, the Federal Reserve announced the Strategic Allocation of Coin Inventories which was a temporary coin order allocation in all Reserve Bank offices and Federal Reserve coin distribution locations effective June 15, 2020.

The Federal Reserve also established a U.S. Coin Task Force in early July to deal with disruptions to normal coin circulation. All interested parties participated – U.S. Mint, Federal Reserve, armored carriers, American Bankers Association, Independent Community Bankers Association, National Association of Federal Credit Unions, Coin aggregator representatives, and retail trade industry.

The Federal Reserve said that “it is confident that the coin inventory issues will resolve once the economy opens more broadly and the coin supply chain returns to normal circulation patterns, however, “it recognizes that these measures alone will not be enough to resolve near-term issues.”

Was Genoa the Best form of Government?

Armstrong Economics Blog/Economics

Re-Posted Jul 22, 2020 by Martin Armstrong

Genoa 1481

COMMENT: Dear Martin,

Thank you for your work.

It is not anymore about the economy but about surviving through the mayhem that is on the horizon.

Thank you for doing your part in sharing what you know, for being bold and for

not bending.

I was taught to go after ” independent thinking” and I have followed you for years because of that even though we have different political views.

I appreciate and listen to you because you are an independent thinker.

Send you a hug

Dr. FB from, Spain.

REPLY: Thank you. I believe you must question what is happening and you should NEVER presume the direction or outcome. Some people do not understand my position politically. I am neither Democrat nor Republican. There are aspects I agree and disagree with both. I understand the thinking of what went into the construction of the U.S. Constitution and the mistake the Founding Fathers made — they failed to consider human nature.

Much of the structure was based upon their misunderstanding of the Roman Republican era v Roman Imperial era. They presumed that monarchy was bad and ASSUMED that a Republic was better. They wrongly took the fake news of the day put out by Cicero, painting Julius Caesar as evil, when it was the Optimates led by Cato who were corrupt. Their misunderstanding of history and the true events of the time led even to the naming of the Cato Institute as if he really stood for the people.

The best form of government I have ever encountered was that of the Italian city of Genoa from which Christopher Columbus came. The city was ruled by a Doge (president), who was a member of one of the richest families. This position rotated among the families, but its duration was that of the old Roman Dictator who would be appointed for one year. BECAUSE the position rotated, no Doge would ever impose a draconian law since he and his family would be subjected to it the next year. There was no class warfare because they ran Genoa like a corporation, competing against Florence and Venice, and thus EVERYONE benefited.

This is also why I tend to trust Trump more than any other career politician of either party because he will return to the private sector. A career politician is simply taken care of for life and has nothing to return to. We are the lower class scum to be exploited and disrespected.

My bottom-line political philosophy is that the “We the People” should be in charge directly — not career politicians, EVER!. You have your bureaucrats who run the government who are accountable to the people directly. I do not support people like Soros or Bill Gates using their money to take over huge swaths of government. The office of Inspector General is only a symbolic gesture to the old Roman Tribunus plebis, tribune of the people, who could bring charges against any government official. That power should be restored. I do not support “Republics” nor career politicians that can be bought and paid for.

Hoarding Cash and the plan to Eliminate cash!

Armstrong Economics Blog/Economics

Re-Posted Jul 20, 2020 by Martin Armstrong

The reason there is a shortage of cash developing around the world is rather straight-forward. The trust in the government is collapsing. Italy has just lowered the legal amount someone can pay for anything in cash from €3000 to €2000. Australia made it a criminal act to pay for anything with A$10,000 or more (US$7,000). In Switzerland, the limit on cash you can withdraw from an ATM is CHF5,000. In Germany, the limitation is typically €1000. Greeks abroad will be able to withdraw up to 5,000 euros ($5,800) a month.

In the United States, the US Treasury says the pandemic has significantly disrupted the supply chain and circulation patterns of US coins. Additionally, the US Mint has been printing fewer coins to protect its employees from COVID-19. The World Health Organization (WHO) has not advised banning paper money, but it has stressed the need for handwashing after touching cash, which is a subtle caution that money should be limited. Some central banks are deploying measures to sterilize paper money with heat or UV light. Even the Fed began a seven to 10-day quarantine for United States dollars returning to the country from Europe and Asia.

It is very clear that governments are trying to paint money as dirty, and the solution is to eliminate physical money, despite the fact that it has been in use since about the 7th century BC. All of a sudden, it is a danger after 28 centuries. This plays nicely into the Socialist’s dream to control everything!

Milton Friedman – What is America?

The Legacy of Socrates for Humanity

Armstrong Economics Blog/Socrates

Re-Posted Jul 17, 2020 by Martin Armstrong

COMMENT: Dear Martin,

Thank you for spending your precious time to compose such a detailed blog post. The gems within your answer truly clarify this seemingly impossible situation for me. We *are* all connected and cycles are clearly human nature playing out. Greed, as you noted, is part of that equation. Socrates is the most important contribution to mankind that I can think of. Socrates can one day (finally) allow us to see our humanity and alter our course for the better.

Warm wishes,

J, Austin, TX

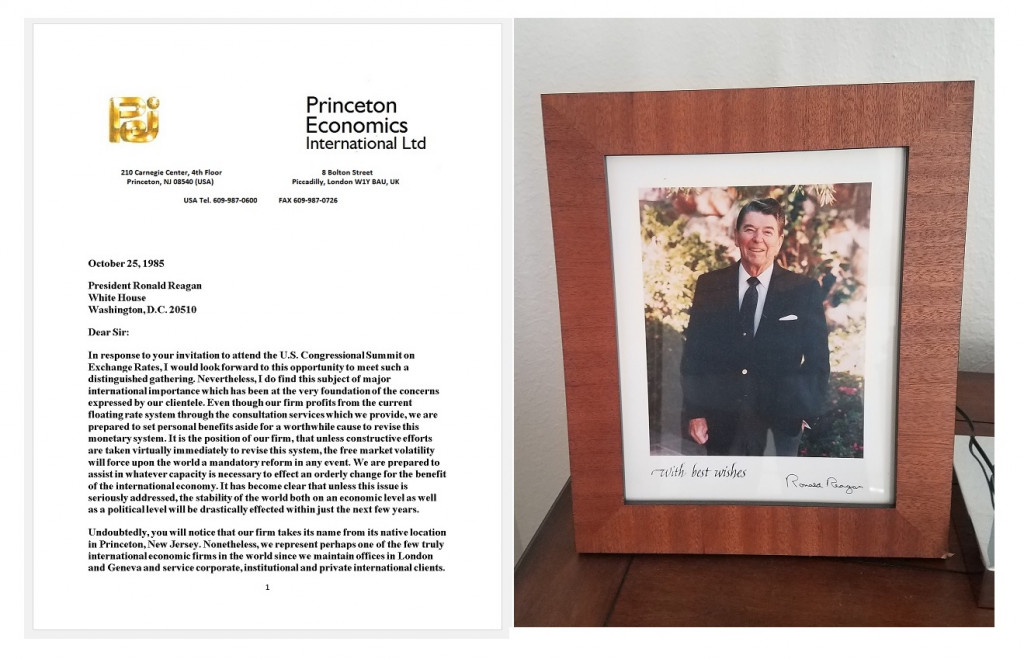

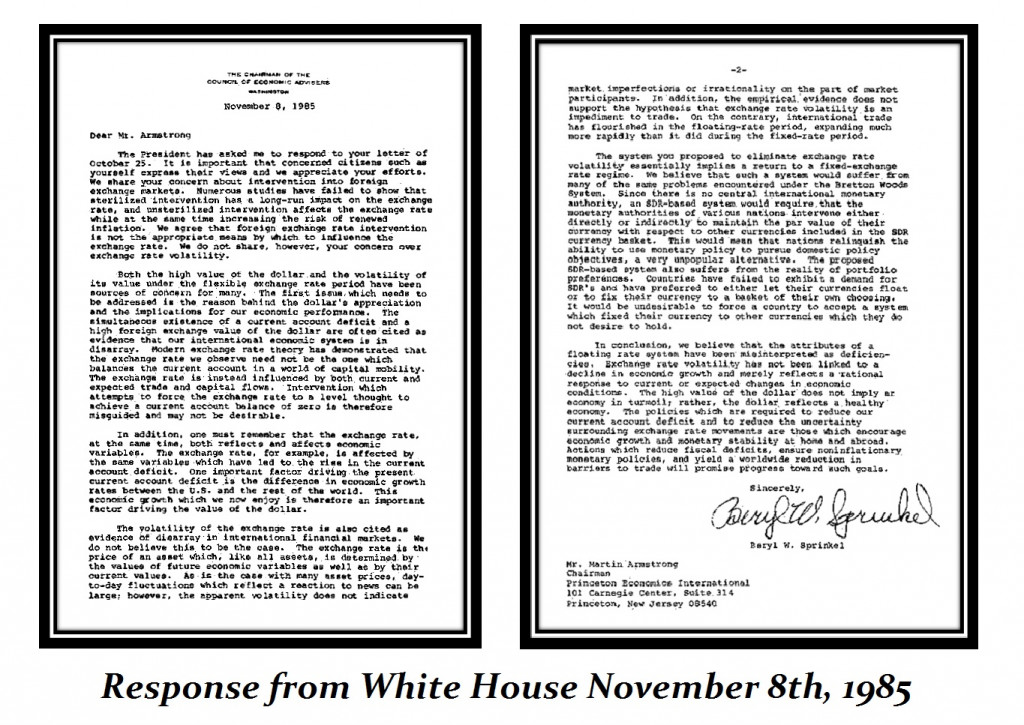

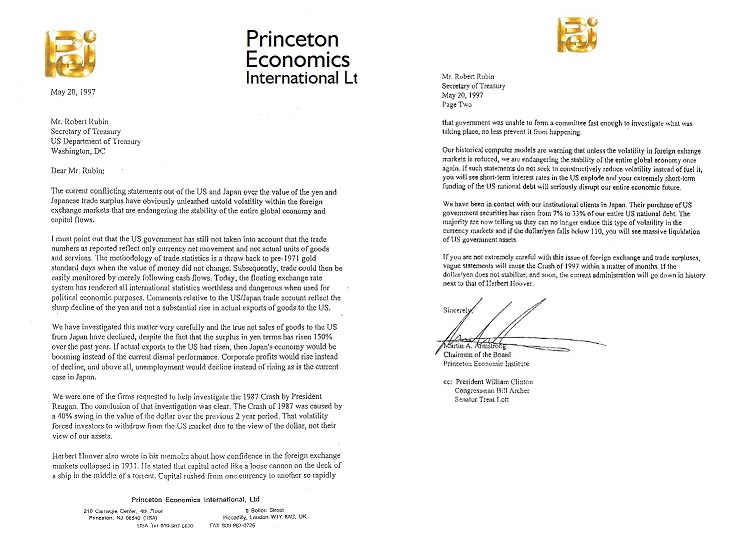

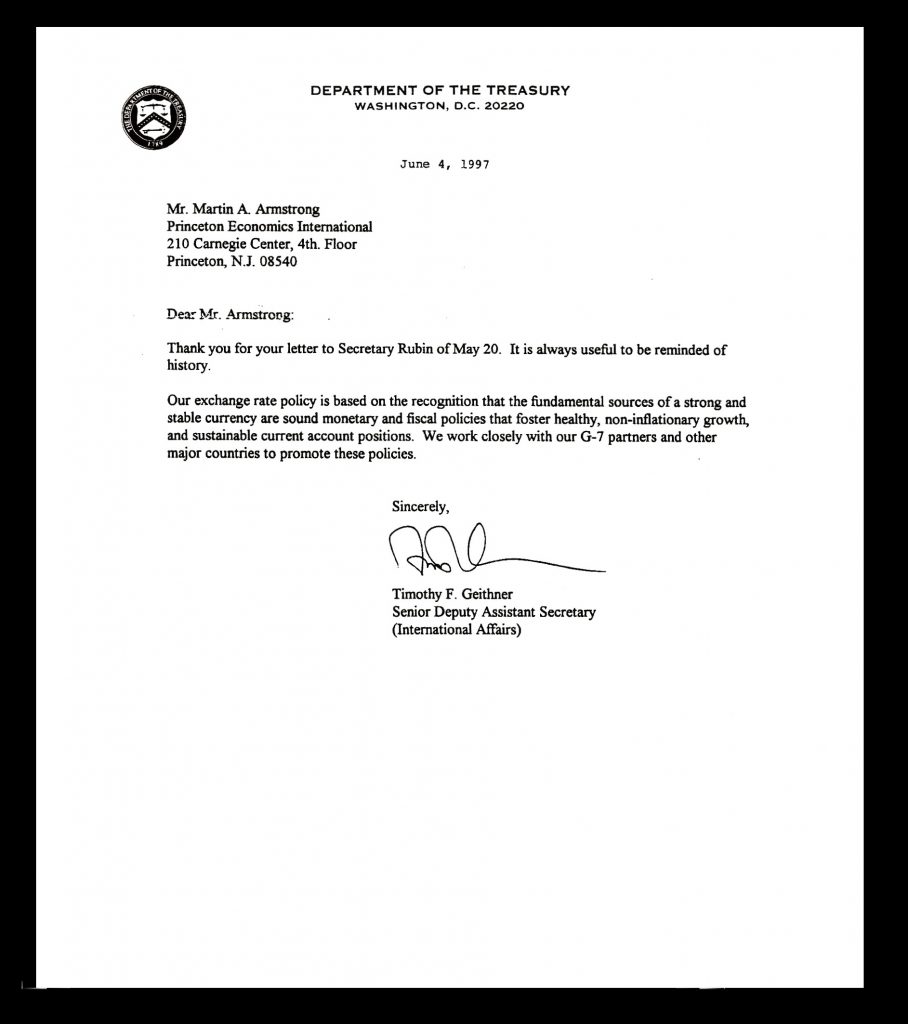

REPLY: Thank you. I have seen the world and how it functions. I’m extremely fortunate to have had a front-row seat from Europe to Asia, and even advising China during the 1997 Asian Currency Crisis. There are some things you can only come to understand by doing it. All the great economists who actually contributed something were traders who were not formally educated. Trading is the ultimate teacher, for it makes sure we must remain humble. Being called into China taught me something that should have been obvious, yet was never articulated.

I was taken to a secret installation in a motorcade that was surrounded by tanks and had three huge satellites on the roof. They were monitoring every commodity in the country, but they were not sintering. They were tracking 249 varieties of tea. They were fascinated that the same tea was selling for different prices in different cities. I had to explain transportation costs and human desire always mean something different from someplace else. Under communism, they were used to everything being the same price even it if cost twice as much to transport it across the country. I was there for the transition from communism to capitalism.

I have witnessed so many things around the world being called in to even the birth of the G5 (now G20) to the stock market and economic collapses. I have been called in by so many governments in times of crisis that it has taught me a variety of events and opened my eyes to the world economy and how we are all connected.

What I have witnessed is that we are all connected and it is IMPOSSIBLE for any head of state to stand up and promise some economic solution that requires global actions. The world economy has been destroyed from manufacture to food supply and distribution chains. What has been done is just beyond stupid. We cannot even imagine how world leaders were stupid enough to follow the advice of Neil Ferguson. It is my hope that Socrates will one day be consulted rather than this sort of unprofessional approach to something that is so damaging that it threatens, not just starvation, but world war.

ANYONE who bad-mouths me personally is trying to prevent anyone from discovering that a computer can do an unbiased job, which threatens some aspect of their income or they are being paid under the table to try to prevent any change to the status quo. Attacking me personally is like attacking your wife because you did not take out the trash. All I can do is hope that when I am gone, they will be left with the reality of just a computer — not me.

Trend in Interest Rates

Armstrong Economics Blog/Interest Rates

Re-Posted Jul 17, 2020 by Martin Armstrong

COMMENT: Marty,

Good morning. Repo rates have been creeping up ever so slightly and quietly. Points wise not much, but percentage-wise, numbers are getting bigger. Has everybody been lulled to sleep and looking the wrong way again?

Best,

E

REPLY: The shift from a Public to a Private wave is in full motion. We can see this in Moody’s AAA Corporate Bond Index. Note that the while chaotic swing in March ran right up to the top of the Downtrend Channel and then we have swung down and just closed below the bottom of the channel. We have an important turning point arriving in October. We show the next major turning point in the US 30-year bonds being September.

These governments imposing lockdowns again are acting political rather than in the best interest of the people. Locking people down results in a collapse of tax revenue. Many in the USA have been promised by the Democrats they will be bailed out if they win the White House right down to their pension funds. This is what is going on behind the curtain – cutting deals.

Clearly, these governments are not stupid. They have to realize how much revenue has collapsed and how much damage they have caused to the people and the economy. Our models are projecting HIGHER interest rates ahead and this reflects their high-risk gamble on trying to overthrow Trump. What they fail to grasp is that the private sector has lost all confidence in governments and as such, they have destroyed the old financial system of perpetual borrowing.

As fiscal mismanagement abounds, interest rates will rise to reflect credit risk. The central banks are powerless to prevent this rise. The Fed cannot buy all state debt any more than the ECB will be authorized to buy all sovereign debt in the Eurozone. We have reached the point of no return.

Socrates & its Forecast of Shortages in Food for this 8.6-Year Wave

Armstrong Economics Blog/Agriculture

Re-Posted Jul 13, 2020 by Martin Armstrong

COMMENT: Mr. Armstrong; I am beyond impressed with the forecast your computer puts out. More than a year in advance you forecast that this wave would be inflationary but due to shortages in food. I do not know how it makes such an interesting forecast, but nobody out there can even come close which is obviously why they try to mimic you while ignoring you and hope nobody lands on your site.

Thank you for bringing clarity to this chaos

All the best

DS

ANSWER: Yes, Socrates was projecting this would be a wave of inflation coming from SHORTAGES of food. We are already witnessing rising food prices. It was picking up all the subtle shifts in the world economy and I could see that something strange was in the development by last August 2019. Obviously, like war, it cannot forecast the precise person but it does reveal their actions. This is the same forecast ability. It was showing a shortage of food for this cycle, but it could not tell me it would be instigated by Bill Gates and the World Economic Forum trying to push their Great Reset.

Nevertheless, there are serious shortages of food on the horizon. Those who are attempting to destroy the economy so they can recreate it in their image are clueless about how the world economy functions. All they have looked at is their stupid models on CO2 when CO2 is 0.04% of the atmosphere. They have wiped out crops by destroying the food chain and either they are totally ignorant of their actions, or they have deliberately also tried to invoke starvation to reduce the population. Nobody will investigate either and I am sure they would claim to be ignorant of the impact on the food supply by pushing for lockdowns. There is ample evidence that this excuse is BS and they must know what they are doing which would bring up the question of crimes against humanity. They will then probably blame global cooling.