Posted originally on the conservative tree house on April 29, 2022 | Sundance

The Bureau of Economic Analysis (BEA) released March and first quarter (Q1) data today on personal income and outlays [DATA HERE]. The results show an increase in Q1 wages of 4.5%. However, inflation is running 6.6% on the items workers need to purchase. The net result on Main Street is unsustainable inside the economy. The U.S. stock market is responding negatively to this release.

It’s easy to get caught up in the esoteric weeds, so my effort here is to show just what is happening by putting an overlay of checkbook economics into the BEA release. If we take out the noise it is very easy to see the problem. I have modified TABLE-4 to put the results into simple understandable terms.

(Table 4, Source)

By looking at the far-right column (Q1 2022) you can see the problem. Wage growth at $268.00, minus taxes paid $51.40, leaves disposable income or take-home pay at $216.60. However, our expenses for living (shelter, food, utilities, energy, etc) cost $398.50, leaving a deficit for our income of $181.90. We either dip into our savings to cover our expenses, or we go into debt. This is not sustainable.

If you look at Q1 last year, you can clearly see where all of the inflation is coming from. That massive increase in income came from the federal COVID bailout and stimulus funds. $4 trillion directly pumped into the economy at a time when Biden justified massive bailout spending by saying they needed to offset the economic cost of prior COVID intervention (businesses and workers shut down). That is the primary source of current inflation.

If you take out that Q1 spend from the economic activity, the U.S. economy was already contracting. This is why CTH has continued to say our economy was in a state of contraction since June/July of 2021. Everything after that massive dump of money was false economic activity; the GDP growth was artificial. That bailout spending dried up in the fall and winter of last year and now we see the 2022 GDP going negative.

In essence the GDP contraction that we should have seen in 2021 was delayed by the massive infusion of cash in April of 2021. However, that massive infusion of cash created inflation. That inflation has been a crisis that grew from the summer of 2021 to its apex in the last month.

♦ So, what does all of this mean?

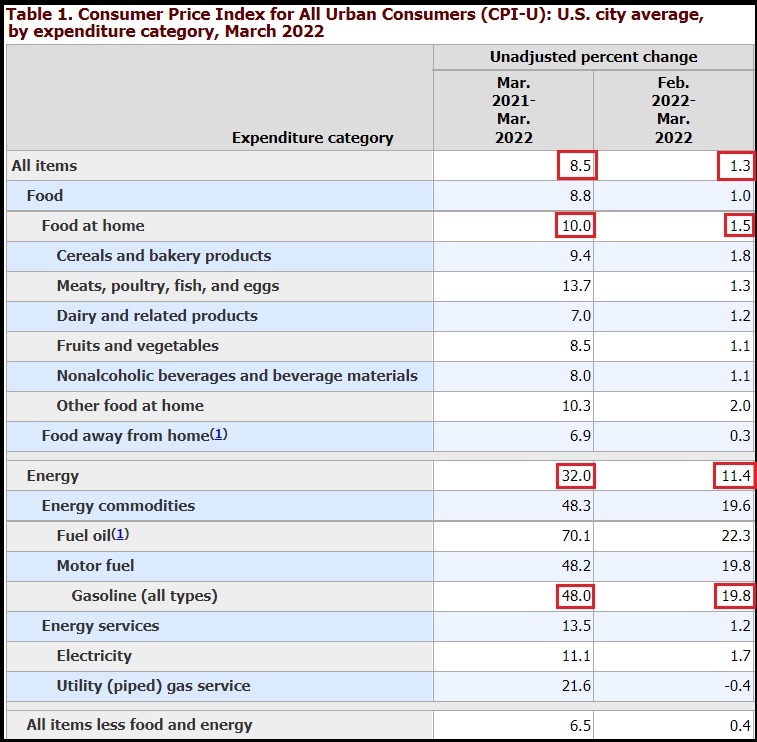

Let’s cut to the chase. As CTH accurately predicted previously, inflation comes in waves because supplier purchases are done in contract terms of 30, 60 and 90 days. As each contract for purchased goods expires, the new prices for future goods are changed. We see waves of inflation in roughly three-month increments, and while prices were rising faster on a daily and weekly basis, those wave cycles started in October of 2021.

Wave 1, came Oct/Nov/Dec 2021.

Wave 2, came Jan/Feb/March 2022.

We talked about each wave as it was coming and as it arrived. Ultimately, Wave-2 was bigger than Wave-1 as the cumulative increases the total supply chain and manufacturing flowed into the products we purchase.

♦ Where are we now? There are two sub-sets:

• Inflation on durable goods is now at the apex. The durable goods price flatlines right now as all production costs are embedded in the cost of the product. The prices of finished goods are now set; inflation has caught up to production; the prices of on-shelf and inbound deliveries are higher, but stable.

Now, we enter the phase where consumer demand becomes the dominant factor in price. Simultaneously, demand is contracting because the higher rate of inflation in highly consumable goods (energy, utility costs, housing, gasoline, food) is now a spending priority for consumers and eating a larger portion of wages. As a result, the price of durable goods is now dependent on the ability of the consumer to pay for them.

Sellers of durable goods are going to be chasing a smaller customer base who can afford them. Durable goods prices will remain static, and now durable goods prices will likely become part of the competitive equation. The businesses within the durable goods sector are going to have to find customers in order to stay in business. Incentives will show up this spring/summer as businesses need customers. If you are a wise, careful and smart shopper for durable goods you will find deals

• Inflation on consumable goods is not yet at the apex. It’s likely close to production parity, but prices pressures are still volatile in the upward direction. The price of gasoline and transportation overall will be a big factor in current prices of highly consumable goods. We should see oil, gas and energy prices stabilize first.

Rents will likely increase for another three to six months, then stabilize (and, in my opinion start to fall late summer).

Housing overall is far more challenging as mortgage rates are climbing. Refinancing as a method to bridge the income gap between wages and expenses is a big problem now in this phase. There is going to be a period of massive fluctuations and instability in the housing market depending on region and employment stability as the recession phase of the total economy is going to bite hard.

For most regions with mixed blend underlying economies (products and services) macro housing prices have peaked in the last 15 days. For ordinary housing purchases, not institutional investments, we should start to see price decreases again as the customer base for high prices shrinks. Obviously, this is driven by inventory and regional specifics; however, I am talking in the aggregate within the macro housing situation.

Food prices still have some upward pressures through Memorial day. Then a period of stability will settle, before the third wave of food inflation hits later in the summer/fall of this year; that’s when the increases in farming costs will reach the fork.

Late summer and fall food prices will likely be 15 to 20 percent higher than current prices at the supermarket. The fresh foods will be on the upper side of the future price wave, and the processed foods on the lower end; however, both will increase.

The last factors in the food price are far more challenging to predict…. Supply? Any problems within the food production cycle that impacts supply will drive prices, beyond what we already expect. If there are major shortages, the prices will go even higher.

This food environment is unfortunately the best time for Big Agriculture, the Wall Street multinationals, to make the most profit. The Big Ag multinationals will exploit every possible angle within inventory, supply and harvest controls to maximize their profit equation. There are a great deal of unknown global variables right now that could impact U.S. food prices later this year. The only certainty is that prices will further increase.

Joe Biden sucks.

.

Footnote, pray for good weather and stability this summer. If it is an active hurricane season, gasoline, oil exploration and refinery issues will make matters worse. The southern coastal areas, especially Florida, Louisiana and Texas need a non-dramatic summer.