Posted originally on the conservative tree house on October 21, 2021 | Sundance | 235 Comments

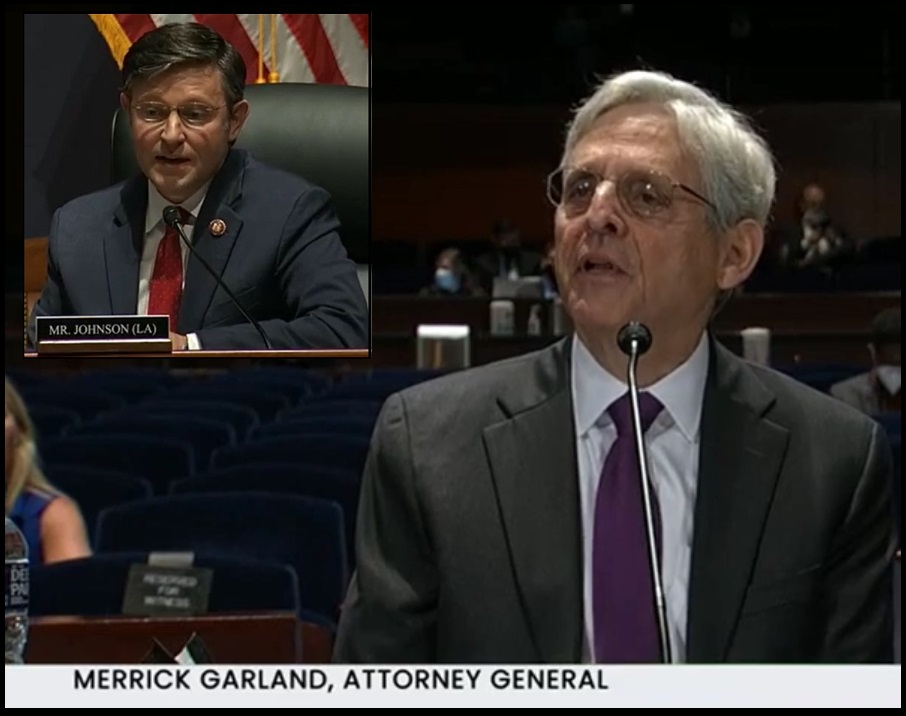

Representative Mike Johnson (R-LA) questioned U.S. Attorney General Merrick Garland about his clear conflict of interest today surrounding the Attorney General’s instructions for FBI agents to investigate parents who question school board curriculum. Merrick Garland’s daughter is married to the co-founder of the Critical Race Theory educational material being purchased by the school boards. The exact CRT material being directly challenged by the parents Garland has instructed the FBI to investigate.

In a clear conflict of interest, Merrick Garland is using his office to protect the income and investments of his son-in-law’s business. However, when questioned about this conflict today, Merrick Garland says he will refuse to accept any ethical review of his conduct. WATCH:

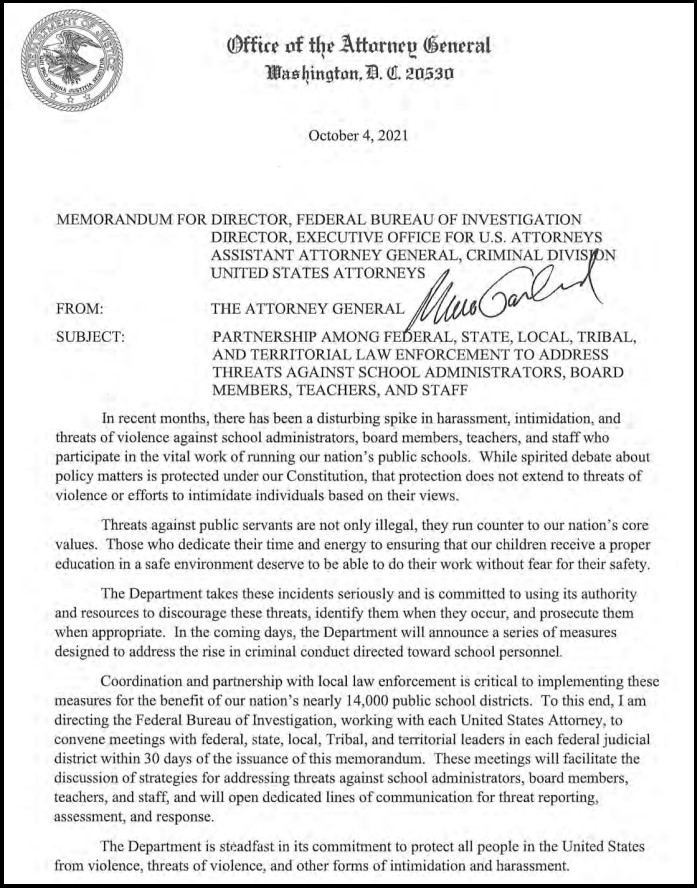

BACKGROUND – U.S. Attorney General Merrick Garland recently instructed the FBI to begin investigating parents who confront school board administrators over Critical Race Theory indoctrination material. The U.S. Department of Justice issued a memorandum to the FBI instructing them to initiate investigations of any parent attending a local school board meeting who might be viewed as confrontational, intimidating or harassing.

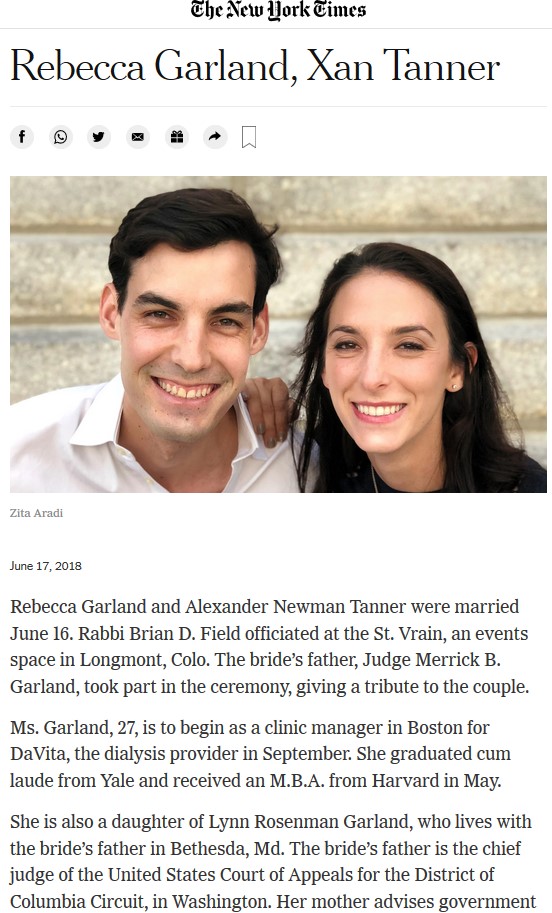

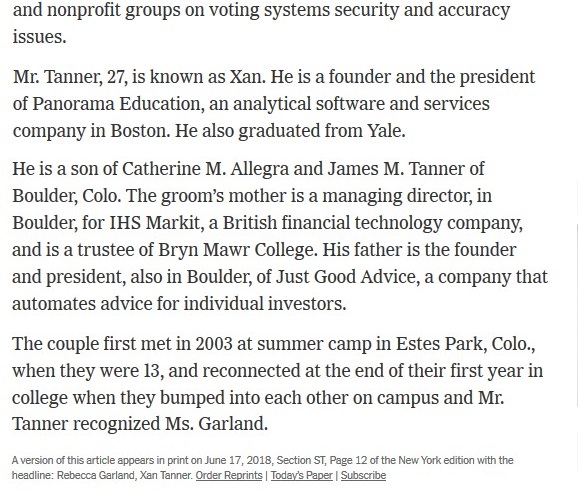

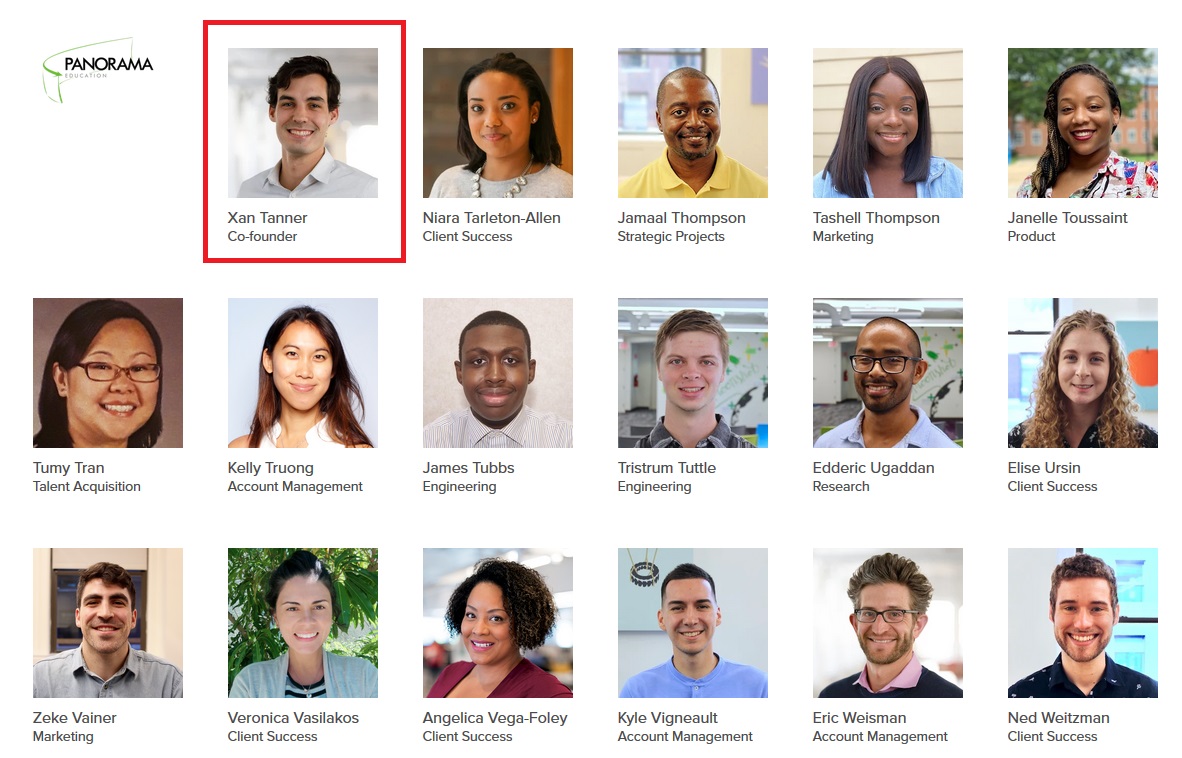

Attorney General Merrick Garland’s daughter is Rebecca Garland. In 2018 Rebecca Garland married Xan Tanner [LINK]. Mr. Xan Tanner is the current co-founder of a controversial education service company called Panorama Education. [LINK and LINK] Panorama Education is the “social learning” resource material provider to school districts and teachers that teach Critical Race Theory.

“By asking students to reflect on their experiences of equity and inclusion in school, education leaders can gather actionable data to understand and improve the racial and cultural climate on campus.” ~ Panorama Education, Xan Tanner Co-founder

Conflict of interest much?

Yes, the Attorney General is instructing the FBI to investigate parents who might pose a financial threat to the business of his daughter’s husband.

Screen-grabs and citations below:

(Panorama Education Services Link)

(Panorama, Social Learning Link)

Yes, Merrick Garland’s daughter is married to the founder of the company who helps schools, teachers and staff deal with the modern challenges of “systemic racism” by “reimagining” the way to social learning “through an equity lens”. As you have seen in the linguistic judo presented by the education material providers in the past, that’s exactly what CRT education materials are about.

Last month Garland’s son-in-law raised money, at least $60 million, to expand their business operation.

September 2021 – Panorama Education, which has built out a K-12 education software platform, has raised $60 million in a Series C round of funding led by General Atlantic.

Existing backers Owl Ventures, Emerson Collective, Uncork Capital, the Chan Zuckerberg Initiative and Tao Capital Partners also participated in the financing, which brings the Boston-based company’s total raised since its 2012 inception to $105 million.

Panorama declined to reveal at what valuation the Series C was raised, nor did it provide any specific financial growth metrics. CEO and co-founder Aaron Feuer did say the company now serves 13 million students in 23,000 schools across the United States, which means that 25% of American students are enrolled in a district served by Panorama today.

Over 50 of the largest 100 school districts and state agencies in the country use its platform. In total, more than 1,500 school districts are among its customers. Clients include the New York City Department of Education, Clark County School District in Nevada, Dallas ISD in Texas and the Hawaii Department of Education, among others.

Since March 2020, Panorama has added 700 school districts to its customer base, nearly doubling the 800 it served just 18 months prior, according to Feuer. […] Former Yale graduate students Feuer and Xan Tanner started the company in an effort to figure out the best way for schools to collect and understand feedback from their students (read more)

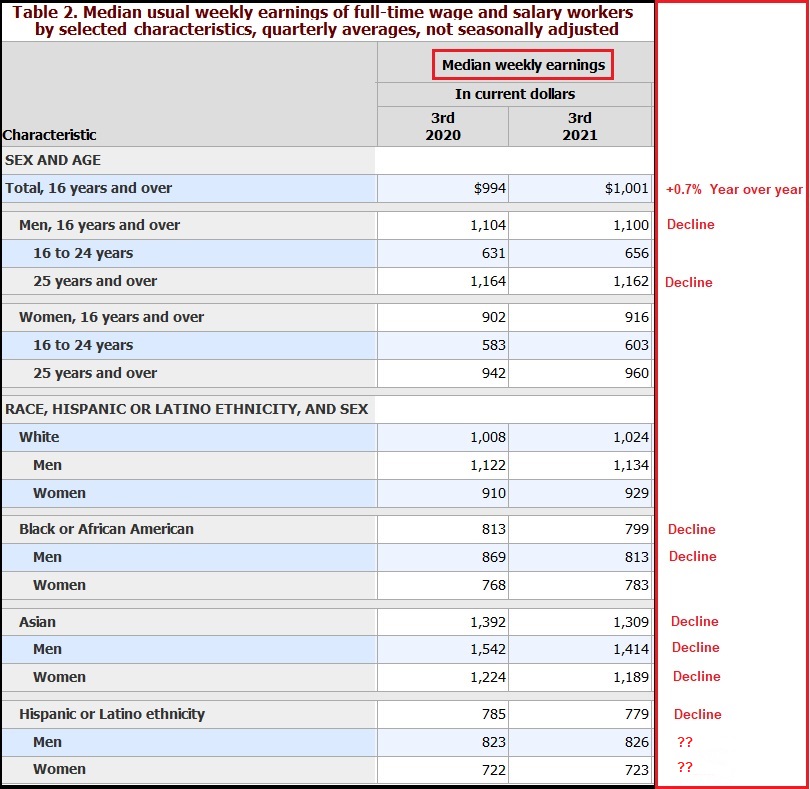

September 2021, Panorama Education, Xan Tanner, raised $60,000,000 to expand operations. October 4, 2021, Xan Tanner’s father-in-law, U.S. AG Merrick Garland, tells the FBI to investigate any potential parental interference/disruption that might impede his son-in-law’s business interests….