Armstrong Economics Blog/North America Re-Posted Dec 8, 2021 by Martin Armstrong

Companies are rapidly fleeing to Texas. Governor Greg Abbott has stated that Texas will soon become “the home of semiconductor manufacturing.” He would like to discontinue outsourcing the manufacturing of essential supplies and incentivize businesses to relocate. “The country made a mistake over the past one or two decades to farm out manufacturing of all these essential supplies, whether it be now semiconductors or could be health care supplies that we needed during the time of COVID, whatever the case may be, we need to not depend upon China or other countries for our essential needs, for things like semiconductors,” Abbott told reporters at Fox News.

South Korea’s Samsung Electronics Co. plans to build a $17 billion semiconductor facility in Taylor, Texas, which makes it the largest foreign direct investment in the state’s history. The plant will create 2,000 jobs alone. Increasing semiconductor production is crucial to combat the worldwide shortage and will help to smooth the overall supply crisis. Texas Instruments is also seeking to invest $30 million into semiconductor production.

Elon Musk reported that he plans to relocate Tesla’s headquarters to Texas as well after receiving a less than warm welcome in California. In the first eleven months of the year, over 70 businesses have relocated their headquarters to the southern state, meaning a new company relocates to Texas around every five days. Businesses are keen on more than just the tax breaks. Abbott boasted that Texas has “no mandates infringing upon individual liberty,” and has actively fought against any mandates. “The only mandate that applies is my executive order saying that nobody in the state of Texas can be mandated to take a vaccine shot,” Abbott said, noting that a COVID vaccine is “available for anybody who wants it, but there can be no mandates infringing upon individual liberty.”

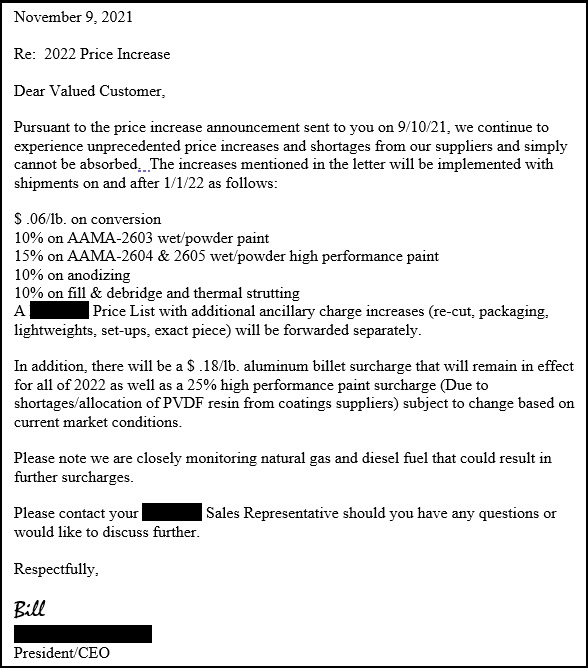

Vaccine mandates are bad for business. The states imposing harsh restrictions do not understand the economic impact, while other states will see a lucrative benefit to fighting for human liberties.