Posted originally on the conservative tree house on August 6, 2022 | sundance

Every once in a while, you come across an article that seems like one thing but is actually another thing entirely. The NPR story of how “The U.S. made a breakthrough battery discovery — then gave the technology to China“, is one such article.

Several people sent this to us for opinion and review; however, the background of the article reveals something quite different. Then again, perhaps that’s exactly why NPR wrote it.

It is important to read the story as presented by NPR, because it is oddly written as if someone is trying to use the outlet to get out ahead of something else.

The issue surrounds a new product technology called a vanadium redox flow battery. Essentially the U.S. government funded scientists to develop an advanced battery that could store energy without degrading. After success, the technology was then sent to China for manufacturing. China then invested heavily in the product and used the technology to mass manufacture the battery for the global market. The United States is now behind in the product development and manufacture.

As the story is told in NPR, “the Chinese company didn’t steal this technology. It was given to them — by the U.S. Department of Energy. First in 2017, as part of a sublicense, and later, in 2021, as part of a license transfer.” Except that’s not what happened at all. There is some major ‘ass-covering’ in that false narrative.

The lead scientist working on the vanadium redox flow battery project was a man named Gary Yang. Mr. Yang was born in China and emigrated to the U.S. becoming a U.S. citizen. Yang worked with U.S. scientists to develop the technology and was funded by a multi-million research grant from the Dept of Energy.

After their initial success, according to NPR, “in 2012, Yang applied to the Department of Energy for a license to manufacture and sell the batteries.” The Dept of Energy license was granted, and Yang launched UniEnergy Technologies as the parent company to develop the commercial application of the product.

It’s 2012 and Gary Yang was now looking for investors and manufacturing in the commercial sector to produce the battery.

Here’s where it gets interesting…. According to Yang, “he couldn’t persuade any U.S. investors to come aboard. “I talked to almost all major investment banks; none of them (wanted to) invest in batteries,” Yang said in an interview, adding that the banks wanted a return on their investments faster than the batteries would turn a profit.” This is Yang’s justification for what he did next.

After he couldn’t find U.S. investors (which I will say up front seems like an excuse), Yang then took the technology to China to have them manufacture the product.

The Chinese embraced the technology, created entire manufacturing eco-systems around it and now corner the market on the technology behind vanadium batteries. However, giving the technology to China for manufacturing and development is a violation of the license Chang was given.

Yang even admits he knew it was not allowed. “Yang’s original license requires him to sell a certain number of batteries in the U.S., and it says those batteries must be “substantially manufactured” here. In an interview, Yang acknowledged that he did not do that.” Now we start to look a little more skeptically at the claims by Gary Yang, because a whole bunch of stuff just doesn’t add up.

As noted by NPR, five years after getting the license from the Dept of Energy, “in 2017, Yang formalized the relationship and granted Dalian Rongke Power Co. Ltd. an official sublicense, allowing the company to make the batteries in China.”

After China had fully developed the technology, they obviously no longer needed Gary Yang to go global with the product. As a result of what can only be considered as ‘getting cut out’, Yang -still holding the original DoE license- then turned to Europe.

Gary Yang not only sublicensed Chinese manufacturing, supposedly without DoE notification, in 2021 he sold the license to the Netherlands.

“In 2021, Yang transferred the battery license to a European company based in the Netherlands. The company, Vanadis Power, told NPR it initially planned to continue making the batteries in China and then would set up a factory in Germany, eventually hoping to manufacture in the U.S., said Roelof Platenkamp, the company’s founding partner.

Vanadis Power needed to manufacture batteries in Europe because the European Union has strict rules about where companies manufacture products, Platenkamp said. “I have to be a European company, certainly a non-Chinese company, in Europe,” Platenkamp said in an interview with NPR.”

Before moving on, let me recap because things are going to start making sense about why this story has some major ramifications. Also, don’t overlook the timing of events and keep in the back of your mind what you know about Hunter Biden (remember, ‘energy sector’ with no experience) and Biden’s deals with China being made in/around this same timeframe.

♦ 2006 – Pacific Northwest National Laboratory original grant. “It took six years and more than 15 million taxpayer dollars for the scientists to uncover what they believed was the perfect vanadium battery recipe.“

♦ 2012 – The lead scientist, Gary Yang, asks the Dept of Energy for a license. He then creates UniEnergy Tech.

♦ 2013/2014 – Unable to find investors in the U.S., Gary Yang enters a manufacturing and development agreement with China.

♦ 2017 – Gary Yang officially grants a sublicense to Dalian Rongke Power Co. Ltd in China.

♦ 2021 – Gary Yang then sells his license to Vanadis Power in the Netherlands.

Tell me again how this NPR sentence makes sense: “the Chinese company didn’t steal this technology. It was given to them — by the U.S. Department of Energy. First in 2017, as part of a sublicense, and later, in 2021, as part of a license transfer.”

Do you see anywhere in this reformatted outline where the U.S. Dept of Energy gave the technology to anyone, except Gary Yang?

The only entity responsible for transferring the technology to China was Gary Yang.

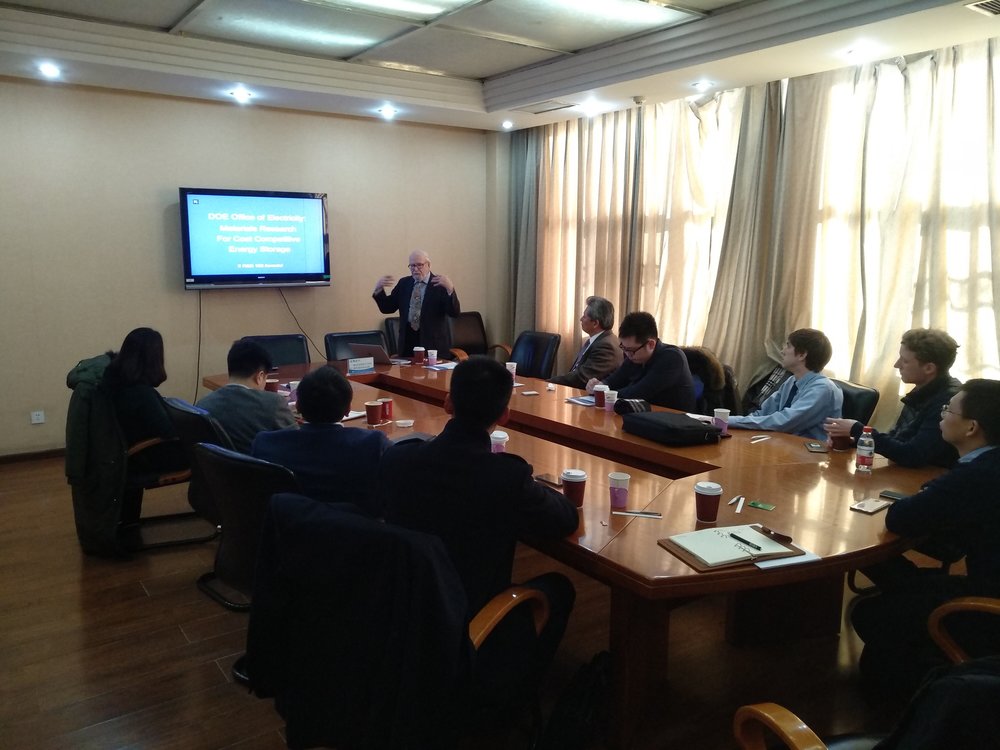

Now, with all that in mind, check out the date on the picture that NPR uses in their article:

2015

Keep the guy on the left, Imre Gyuk, in mind as we move forward. Note the date of “2015” with Imre Gyuk and Gary Yang. They are standing together.

Remember in the NPR article, the baseline for why Yang took the technology to China was that he couldn’t find investors to manufacture in the United States.

The vanadium battery license in question would have come from Imre Gyuk’s office. Now, in addition to being the Director of Energy Storage Research in the Office of Electricity, of the Dept of Energy, Gyuk also held another role: “As part of the program he also supervises the $185M ARRA stimulus funding for Grid Scale Energy Storage

Demonstrations” {Citation}

The ARRA funds referenced were the Obama-era stimulus funds; the American Recovery and Reinvestment Act funds; the shovel ready jobs funds. Yet, Gary Yang cannot find investors?

Citation from 2014: “It’s not a given that lithium-ion batteries are the best batteries for electric cars, or for electrical grid storage. Other types of batteries today show promise, most of which you’ve never heard of: vanadium redox flow, zinc-based, sodium-aqueous and liquid-metal. Businesses looking to invest in batteries are deciding between these technologies and more. Market players will weigh the different technologies’ cost of manufacture, durability, usefulness.” {Citation} But Gary Yang couldn’t find U.S. investors?

Citation from 2014: “The forever battery.” A Silicon Valley startup run by old-school technologists has invented an energy storage device that could take an entire neighborhood off the grid. This magic box is called a Vanadium redox flow battery. {Citation} But Gary Yang couldn’t find U.S. investors.

Citation from 2016: “Cost-effective, reliable, and longer-lived energy storage is necessary to truly modernize the grid,” said Dr. Imre Gyuk, energy storage program manager for DOE’s Office of Electricity Delivery and Energy Reliability, of UET’s system. “As third-generation vanadium flow batteries gain market share, it is essential to increase our understanding of storage value and optimization to accelerate adoption of integrated storage and renewable energy solutions among utilities.” {Citation} But Gary Yang couldn’t find U.S. investors. {Here’s another Citation}

Citation from 2018: “On January 23, 2018, the Chinese Academy of Sciences hosted a meeting on energy storage with distinguished guests Dr. Imre Gyuk, director of energy storage research at the United States Department of Energy, and Dr. Gary Yang, CEO of UniEnergy Technologies. Dr. Gyuk and Dr. Yang were met by China Energy Storage Alliance Chairman and the Chinese Academy of Sciences Institute of Engineering Thermophysics Deputy Director Chen Haisheng, China Energy Storage Alliance Deputy Chairman and Beijing Puneng General Manager Huang Mianyan, and CNESA Standing Council Representative and general manager of State Grid Electric Vehicle Service Company Wang Mingcai.” (image below)

[SOURCE]

This meeting is important because Imre Gyuk and Gary Yang are together, in China in 2018. The year after the Dept of Energy license given to Gary Yang was unlawfully sublicensed to the Chinese.

NPR is correct in that U.S. taxpayers funded six years of research and development for vanadium redox flow batteries (2006-2012), and once the product was successful the technology was transferred to China (2014-2017) as part of the commercial manufacture. However, it was Gary Yang who gave it to them, and by all appearances he did so unlawfully.

There is going to be much more to this story…. Much more. We have only just begun to dig.

.