QUESTION: Marty; first I want to thank you for Socrates. It called the crash in stocks, gold, currencies, and Bitcoin when everyone else was foaming at the mouth. The rumor was that $16 billion in gold was dumped. Was this just trying to crush the goldbugs, or was this more what you said at the WEC about this would be like the LTCM crisis of 1998? Does the coronavirus have any real impact or is this just the excuse for the 20% correction you forecast at the WEC in October coming in January?

GS

ANSWER: I won’t mention your name, but your initials are not for Goldman Sachs. The market was ready for the crash. The Coronavirus is really just the excuse. It would have been whatever. The markets were going down. It was like our forecast that a third-party candidate could win in 2016 when we made that back in 1985. That was just the timing. It was not a forecast of who it would be. The fundamental seems to emerge to fit the timing.

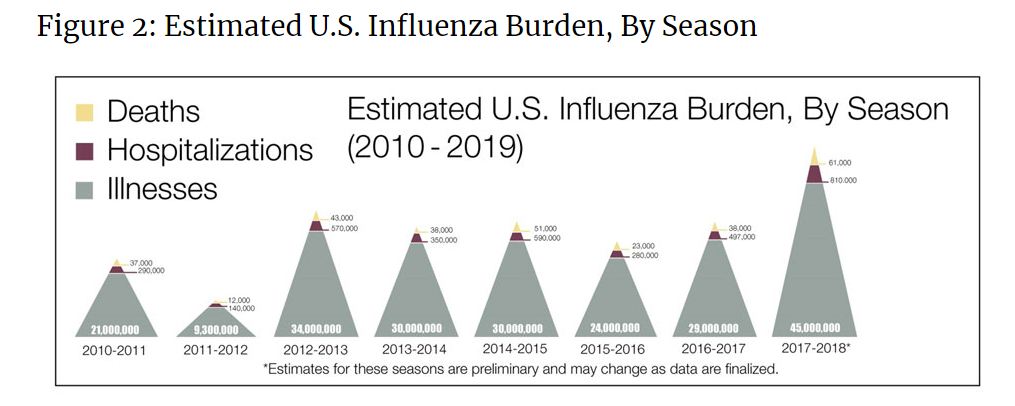

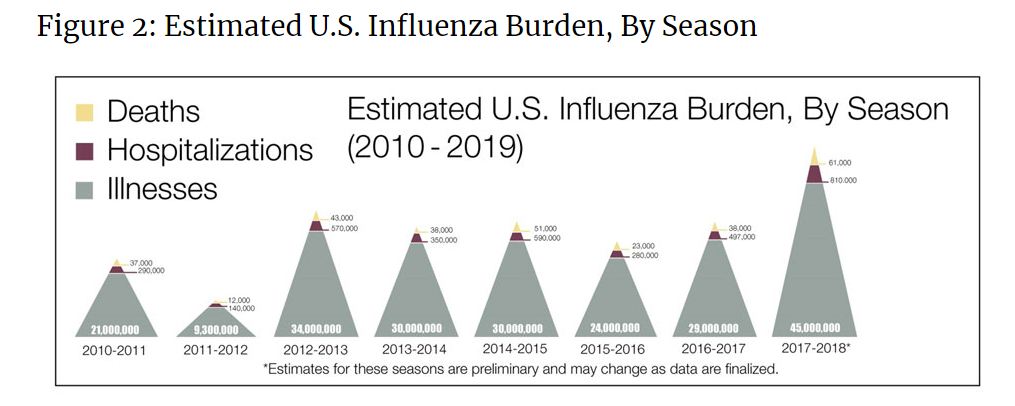

As far as Coronavirus is concerned, it is just an excuse. December to February the 2018-2019 flu season according to CDC, they estimated that 16.5 million people went to a health care provider last year for the flu and more than 34,000 people died. That was 5% of the American population. The proportion of outpatient visits for influenza-like illness increased slightly to 1.7%, which is below the national baseline of 2.2%.

The flu has results generally in 9.3 million to 49 million illnesses each year in the United States since 2010. That means that 5% up to 20% of the United States population gets the flu. Why all this craziness over the Coronavirus seems to be fed to people who love to spread conspiracy theories for the wilder this gets, like 911, the government can justify more power. In Germany, the finance minister is proposing to NATIONALIZE companies because the rules do not allow bailouts. So are these people knowingly spreading these conspiracies and creating a major panic deliberately, or are they being fed a story the Deep State knows they will use to paint the end of the world? To what purpose? If the death rate is 2% or 7%, so what? Biological weapons like Antrax have a death rate of 60%+ and the Black Plague killed 50% of the population. We are not at such a dire level yet they have scared the hell out of everyone. Others are trying to use this to overthrow Trump. Why? Are they closet Communists?

This is the 7th flu season since the low of 2011. We have 156,000 infected and 5800 deaths, but not everyone seeks medical attention. The press which hates Trump is already blaming him to try to influence the election from Vanity Fair to the Washington Post. You can see that those eager to blame Trump are clearly political critics and others just think that if the world crashes and burns, they will be rolling in wealth because they have gold or Bitcoin even if there is no power grid. It’s like trying to flee a hurricane in a Tesla with no hope of plugging in your car.

It is estimated that the flu results in 31.4 million outpatient visits and more than 200,000 hospitalizations each year. The 2017-2018 flu season was one of the longest in recent years, and estimates indicate that more than 900,000 people were hospitalized and more than 80,000 people died from flu. The 2017-2018 flu season saw children dying whereas the 2018-2019 flu season took the greatest toll on adults age 65 years and older. About 58 percent of the estimated hospitalizations occurred in that age group.

I fail to understand why these people must always paint the worst possible scenario. They seem to be the same people touting gold and Bitcoin. Are they spreading this information hoping to illegally benefit from creating fake of exaggerated reports? In equities, that is jail time under the SEC. You cannot talk up your own book.

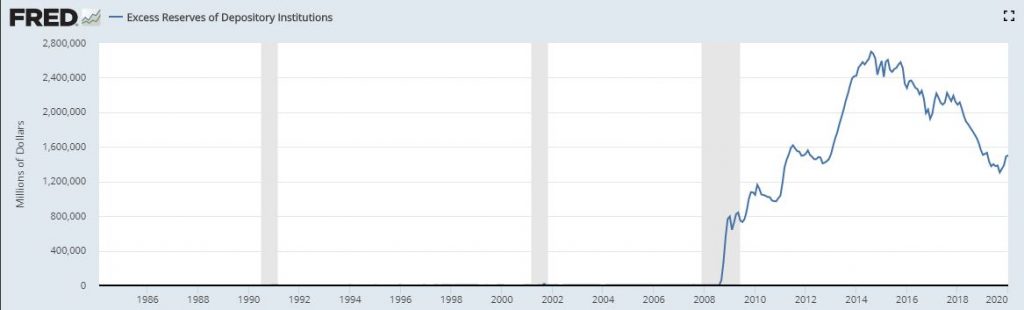

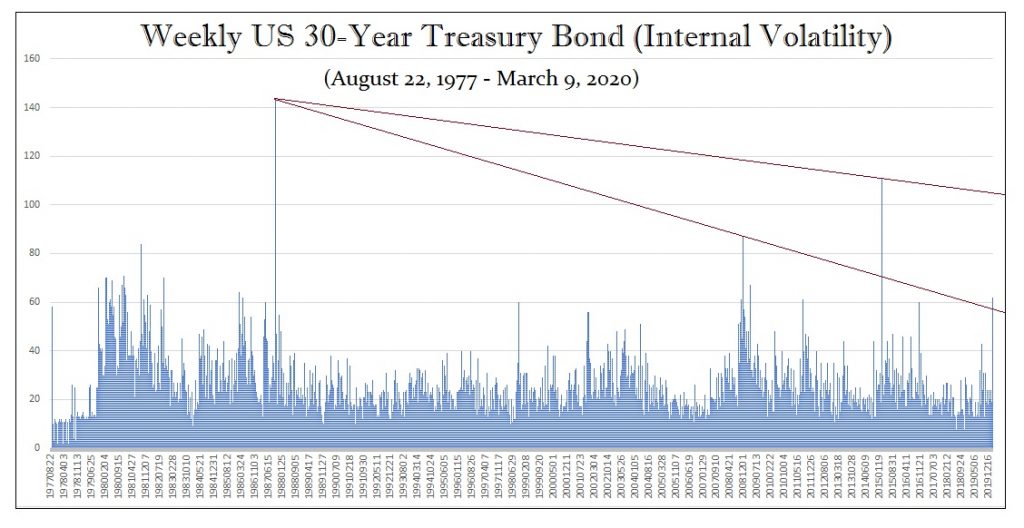

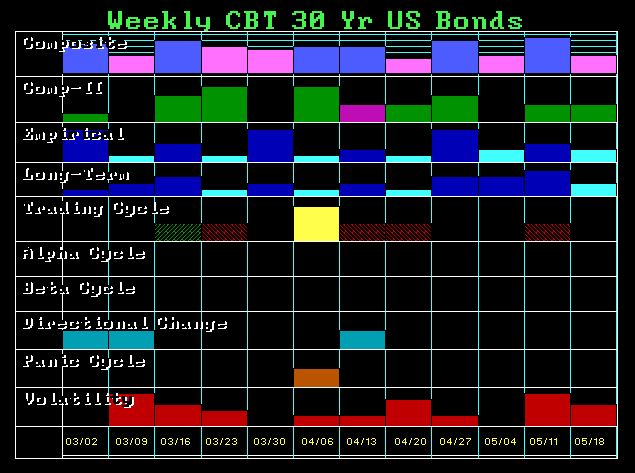

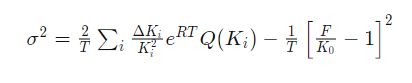

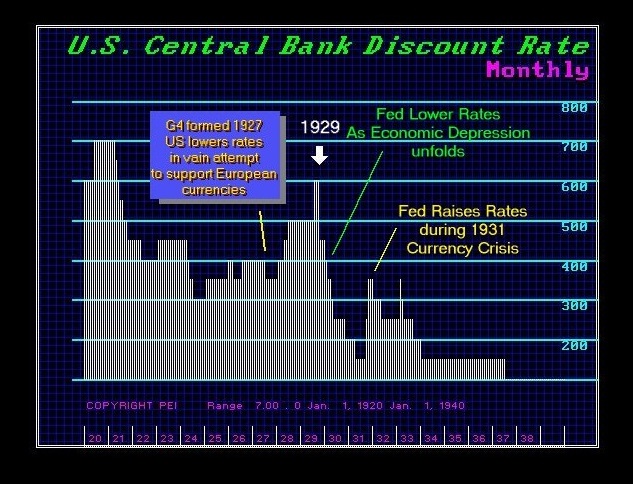

As far as the dumping of gold and Bitcoin, yes, this is what I was talking about that this crisis would be a combination of 2008 & 1998. Here the problem is not mortgage-backed securities, but hedge funds were buying piles of US Treasuries and selling the derivatives trying to lock in guaranteed trades as always. The spread has reversed and we have seen massive selling of off-the-run Treasuries which are the older issues. The market is not as deep for the older issues and they normally trade at a slight discount to the current benchmark. Here, they crashed and were trading at 25bp below. This was reflecting panic selling to raise cash.

This is what I meant about a revisit of 1998. Hedge funds get trapped and start selling everything. They tend to group together on the same trades. Hence, those who thought gold was the safe haven were caught on the wrong side of the Quantity Theory of Money philosophy and discovered that “cash is [not] trash”, but KING! Yes, the rumor is one fund lost $32 billion last week. People would not deal with one bank out of fear they had exposure to a certain hedge fund. That forced the bank to come out and announce it had no such exposure.