Posted originally on the conservative tree house on November 24, 2022 | sundance

There is a significant lag in all data within the housing market. That said, the third quarter (July, Aug, Sept) data reflects a significant drop in institutional investment within the housing market.

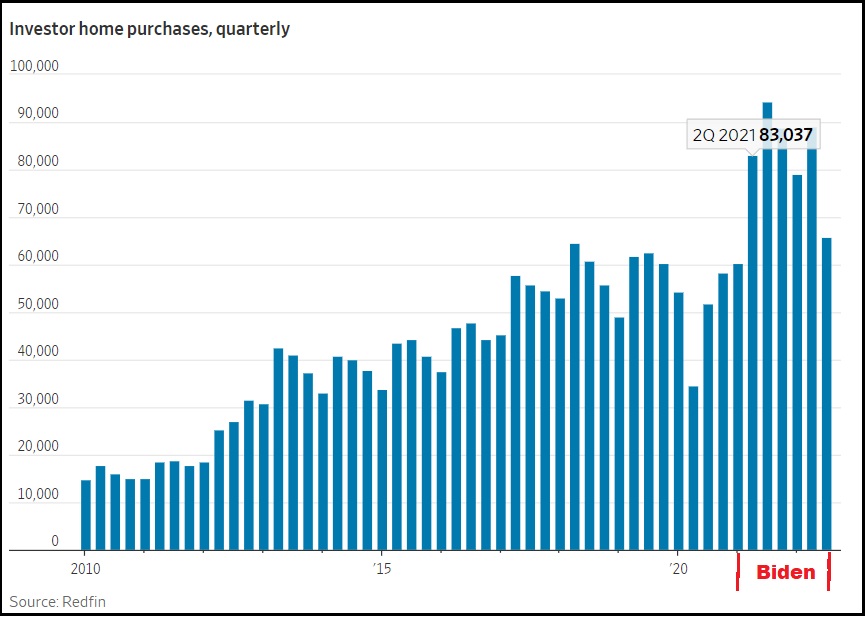

If you look closely at the timing (keep in mind the data reporting lag) what you will notice is that financial institutions began a big surge in purchasing hard assets, specifically real estate, as soon as Joe Biden took office (Jan ’21), and the economic policy became evident. Intangible financial instruments became an immediate risk as the professional financial control groups recognized energy policy would drive inflation (supply side) and devalued money would fuel it (demand side).

As an offset to predictable inflationary policy (the insiders’ game), institutional money (Blackrock, Vanguard etc) was moved into hard assets with tangible value. This shift in asset allocation, institutional sales, helped fuel a false surge in home prices and their valuations. CTH was writing about this in 2021, and sounding alarms as it took place. 25% of all real estate purchases were being made by institutional investors.

The dynamic was predictable. The Biden administration economic policy, energy policy and monetary policy, was going to cause massive inflation. CTH was shouting about it in early 2021 and warning everyone to prepare for waves of price increases that would naturally surface first on high-turn consumable goods, and then embed into longer-term durable goods.

Despite claims to the contrary, this 2021 inflationary explosion had nothing to do with the pandemic or supply chain shortages. It is entirely self-created by western governmental policy; the collective ‘Build Back Better’ agenda. You can see now from the background moves within the financial sectors, they too knew the reality and their money shifts reflected that despite their ‘transitory’ pretending they were mitigating their own exposure.

We the People were yet again going to be victims of specifically intended monetary, regulatory, energy and economic policy.

The investment class rulers of the WEF assembly shifted assets to avoid the pain that we would feel. We “would own nothing and be happy,” and their shifts would position them to own everything and be in control.

Overall govt spending and regulatory controls drove inflation for these past two years. The ‘demand side’ was blamed, despite the lack of demand. I will be proven right when history is concluded with this. Interest rates were raised by central banks in an effort to support the policies that are driving ‘supply side’ inflation, not demand side.

Energy policy was/is crushing the consumer by driving up the cost of all goods and services. To support the overall goal of changing global energy resource and development (a false and controlled global operation), central banks raised interest rates. Various western economies, including our own, have been pushed deeper into a state of contraction by central banks crushing consumer demand, and eliminating investment via increased borrowing costs.

In short, the goal was/is to lower energy consumption by shrinking the economic activity. This, according to the BBB plan, was needed at the same time as energy development was reduced. These economic outcomes are not organic, they are all being controlled by collective western government agreement.

Within this control dynamic, there was always going to be a point where the reaction of the people to their economic reality means the financial control elements need to shift direction. They will always maximize profit and minimized risk, while knowing what the larger objective remains.

Just like every other durable good, housing demand contracts as prices and costs become unaffordable. The loss of equity within your home is damaging to your own value or ability to borrow against it. From the perspective of an institutional asset, that same equity drop is an investment loss. Thus, just as a consumer would exit the housing market, so too will institutional investment groups now control the slow dumping of the asset to remove the equity they pumped into it.

Much of the investment housing will be retained as rental housing, with the monthly rents being part of the returns on the investments. However, as this dynamic unfolds further purchases of houses stop, because the asset overall is declining in value.

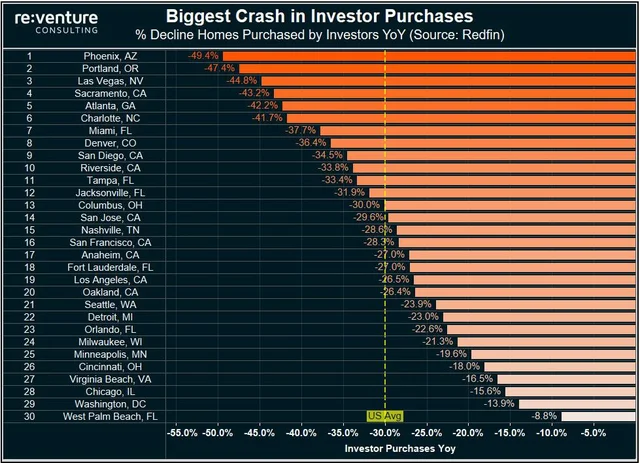

(Via Wall Street Journal) – Investor buying of homes tumbled 30% in the third quarter, a sign that the rise in borrowing rates and high home prices that pushed traditional buyers to the sidelines are causing these firms to pull back, too.

Companies bought around 66,000 homes in the 40 markets tracked by real-estate brokerage Redfin during the third quarter, compared with 94,000 homes during the same quarter a year ago. The percentage decline in investor purchases was the largest in a quarter since the subprime crisis, save for the second quarter of 2020 when the pandemic shut down most home buying.

The investor pullback represents a turnaround from months ago when their purchases were still rising fast. These firms bought homes in record numbers last year and earlier this year, helping to supercharge the housing market.

Now, investors are reducing their buying activity in line with the decline in overall home sales, which have slumped with mortgage rates rising fast. (more)

At a macro level, if you bought a home in the last 18 months, or refinanced your home to pull out equity, you still have significant downside exposure. Home prices will continue dropping until they plateau on the downside at the price that existed in roughly June of 2021.

The drop in value is directly related to the regional purchases by the institutions. In areas where higher percentages of overall home sales were made by institutional investors, the subsequent drop in value will be larger (see chart above). In areas where actual people purchased homes to live in, the drop in value will be less significant.

I keep getting this buying question, so with the above in mind I will answer it in the most brutally honest way I can present…..

At a macro level, if you are going to purchase a home on this downslope, look at the historic valuation of that property (or a comparable property) in/around approximately the spring of 2021. Start there, and put your offer in that vicinity, then hold firm without any emotional attachment to it. Do not purchase another groups loss.