Posted originally on the conservative tree house on January 11, 2022 | sundance | 202 Comments

The snowball effect of cumulative inflation is going to be on display tomorrow when the BLS inflation data from December is released. We have previously discussed the unavoidable price increases as noted within the November data Here, and within the producer price data Here.

While the data being released tomorrow is backward looking, we are in the eye of the inflation storm right now. The consumer prices at end of January and through February are all reflecting new purchase order prices and contract prices to wholesalers, buyers and retailers. As a result, the December reports will be the precursor to what will be much more damaging data in Feb and March.

White House spokesperson Jen Psaki began trying to get ahead of the consumer price release with a short briefing to the traveling press pool earlier today. A short audio-only soundbite reflects the political problem the White House knows they will soon be dealing with. LISTEN:

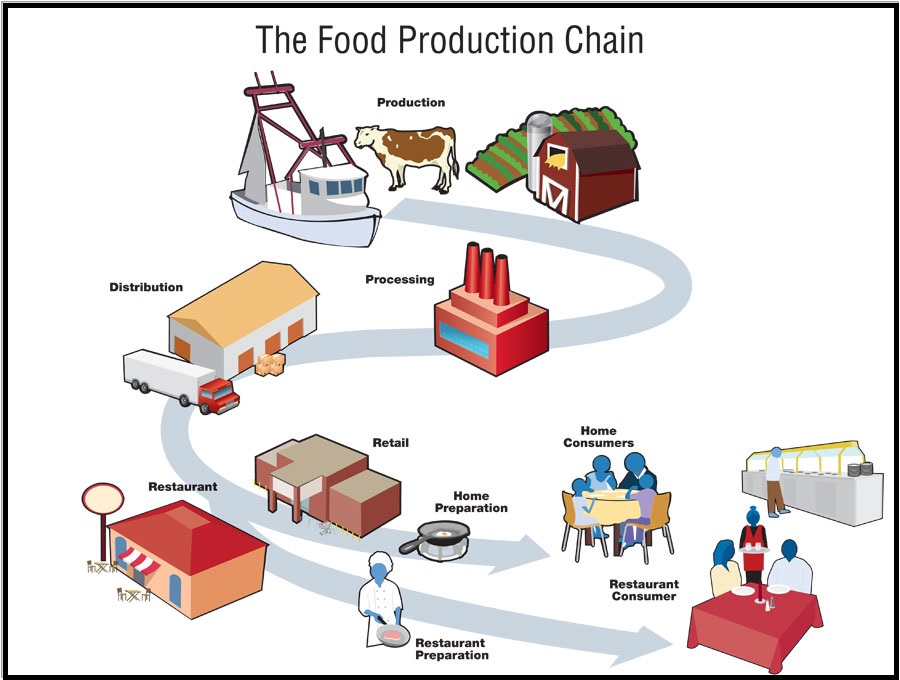

As the BLS accurately (albeit briefly) noted in their November release, the inflation data reflected the cumulative increases in costs of products and services at all stages in the supply chain. Raw materials cost more (extraction, regulation impact), processing costs more (energy impact), transport costs more (fuel impact), final goods assembly costs more and handling costs more. From field-to-fork or mining-to-showcase, the total cost to create stuff costs more. [AP Interactive Chart]

Yes, the inflation data is backward looking. Meaning, it is looking back toward the previous period to compare costs. However, despite the White House protestations to the contrary, that’s not a good thing, because it is going to get worse.

The contracted price for goods delivered (depending on sector) are net terms in 30, 60 or 90 days. Meaning, the purchase price on final goods wholesalers were receiving in November, 2021, were agreed upon months before. Those terms for current arriving goods in Q4 are no longer valid. The new Q1 2022 terms (purchase orders) carry higher costs, and as an outcome, higher prices to consumers are still coming.

The AP chart above shows the ascending spike in inflation overall. Do you see that little plateau (mid spike)? That’s June and July of 2021, when we noticed the economy overall appeared to have stalled out. As we highlighted {Go Deep}, that brief plateau corresponded with a gear change internally in the macro economy as productivity dropped by 5% very quickly in the third quarter.

Immediately following that two-month plateau around 5%, the next few months of data showed that American consumers, writ large, were reacting to inflation by changing their spending habits. That’s when future contracts for new housing starts stalled out. Immediately thereafter, up to today, all the data indicated working class U.S. consumers are hunkering down with less disposable income and prioritizing spending on essentials: housing, rent, gasoline, food. Everything else is of lesser importance.

In the service sector, specifically hospitality and venue employment, overall demand for services slowed, but the employment data (showing the contraction) remained hidden, because we were climbing out of the COVID lockdown hole.

It appeared the service sector was gaining back jobs; but the backward to last year comparison was clouding an actual slowdown in services, because the data was comparing itself to 2020 when services were shut down. Demand for services was down, but we couldn’t really see it.

All of this inflation is being driven by policy. •[1] Energy policy (oil, gas leases nullified & pipelines cancelled) in combination with regulations targeting environmental impacts (CA ports emissions rules) is driving up energy costs. CORE inflation results from this. •[2] Fiscal policy by White House and legislature has been spending like drunken sailors, and that adds to a storm of •[3] monetary policy, with the Fed buying back the debt created by spending, and as a consequence devaluing the dollar currency.

The cost of exporting products is less, because China and the Euro benefit from lower U.S. dollar values. However, more export of raw materials means higher prices domestically in what little remains of the supply/demand influence. The multinationals are making out like bandits, Wall Street is happy, and the middle class of America is once again a victim of economic policy.

First, the DC politicians delivered the “rust belt” to us as an outcome of their favoring Wall Street over Main Street, and now they are wiping out our checking accounts with massive inflation. Remember the oft repeated -and infuriating- catch phrase, “The U.S. is a service driven economy?“, said by both wings of the UniParty? Well, put another way… first they off-shored our jobs, now they off-shore our wealth. This is not an accidental outcome of flawed policy, they are doing this intentionally.

We are being gutted from the inside.

You don’t accidentally stop pipelines, cancel oil leases, shut down refining capacity, change port regulations and then act surprised by saying: ‘whoopsie’ gasoline seems to be costing more? Duh! It’s a feature not a flaw. Many of the people behind Joe Biden are stupid, but they ain’t *THAT* stupid. They know what they are doing, but they have to pretend not to know things in order to avoid the tar and feathers.

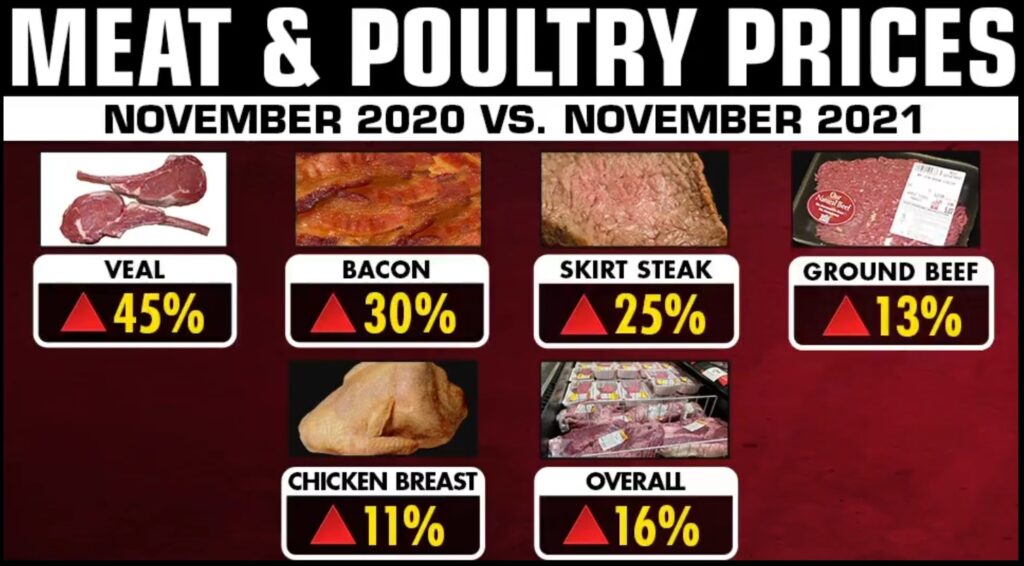

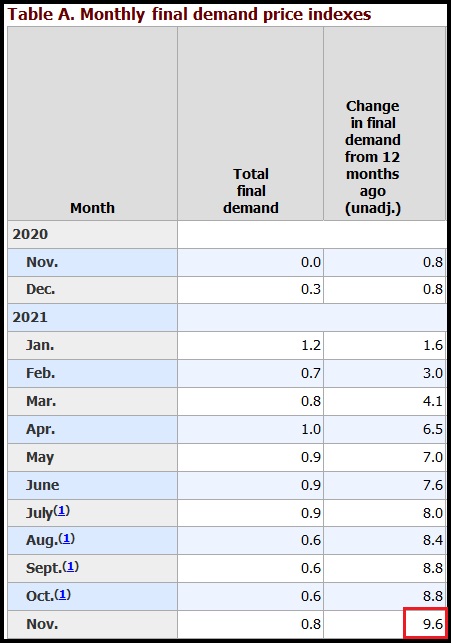

Table-1 gives us a good snapshot of how the sector specific prices were rising in November [data here]:

If you want to go even deeper into the categories, check out Table-2 HERE.

Again, this was backward looking data, and there’s nothing visible right now to give any optimism that prices will not continue rising yet again in the next few months. Exactly the opposite is true. As we noted at the time, there is clear evidence prices will go up again in December, January and February based on the current situation. The evidence of future price increases was clear in the Producer Price Index.

The “Producer Price Index” is essentially the tracking of wholesale prices at three stages: Origination (commodity), Intermediate and Final.

The final product inflation rate in July (reported in August) was alarming at 7.8%. However, we warned it would get worse. The Bureau of Labor and Statistics (BLS) then released stunning price data for October [DATA Here], showing an even more dramatic 8.6% price increase in final demand. More intense warnings shared.

By the time we got to the November BLS Result [DATA Here], released in December 2021, unfortunately the results showed what was expected.

The cumulative costs of massive increases in energy prices are building into the supply at an astonishing rate. The November data showed a rate of wholesale final goods inflation at 9.6%, the largest single month comparative rate increase in history.

The bureau even went back and revised/increased the August price index from 7.8 to 8.4 percent, and revised/increased the October figure from 8.6 to 8.8 percent. The average monthly price increase is almost a full percent… every month. It looks like the BLS backward revisions were an attempt to smooth down the rate of increase.

When you see the wholesale level of prices almost double the increase in consumer level inflation rate, you can predict that consumer prices will likely go even higher.

Future finished goods, at a retail level, will carry the current wholesale price increase.

Stuff costs a lot now… and because the inbound stuff to make the finished goods is still climbing in price…. stuff is about to cost even more.

You can see from Table A (above) that finished good prices are still climbing. That’s the higher price inflation you are feeling when you buy a product.

What will change this scenario is an actual drop on the demand side, as U.S. consumers see their income values wiped out. Unfortunately, that appears to be part of the policy agenda for the White House.

If they can reduce demand by making things unaffordable, they can claim victory over inflation (mid/late 2022) and proclaim their economic policies a success. The prices will never drop, but the percent of change will stall out.

The downside of the White House achieving what they call “success” is unfortunately, by the time we reach that point we will have nothing left; we’re broke. Prices will finally level off, but the savings of Americans will have been depleted and wage growth will then take years to catch up.

FUBAR. All by design.