Posted originally on the CTH on December 29, 2023 | Sundance

I’m very serious when I share with people that almost everything we understand about the geopolitical purposes and impacts of sanctions against Russian economic interests is entirely fabricated. However, because the scale of the propaganda against us is so effective, breaking the mental/cognitive barrier is almost impossible.

It’s not that situations are ‘shaped’ or information is ‘manipulated,’ like would be the definition of the term “disinformation.” But rather that the entire construct of reality regarding the economic issues -as presented- is fabricated, created by massive financial interests, and flat-out lies; I mean, total unadulterated nonsense. Complete fiction.

This latest article from Reuters, and the accompanying graphic from ZeroHedge, only scratches the surface.

[SOURCE]

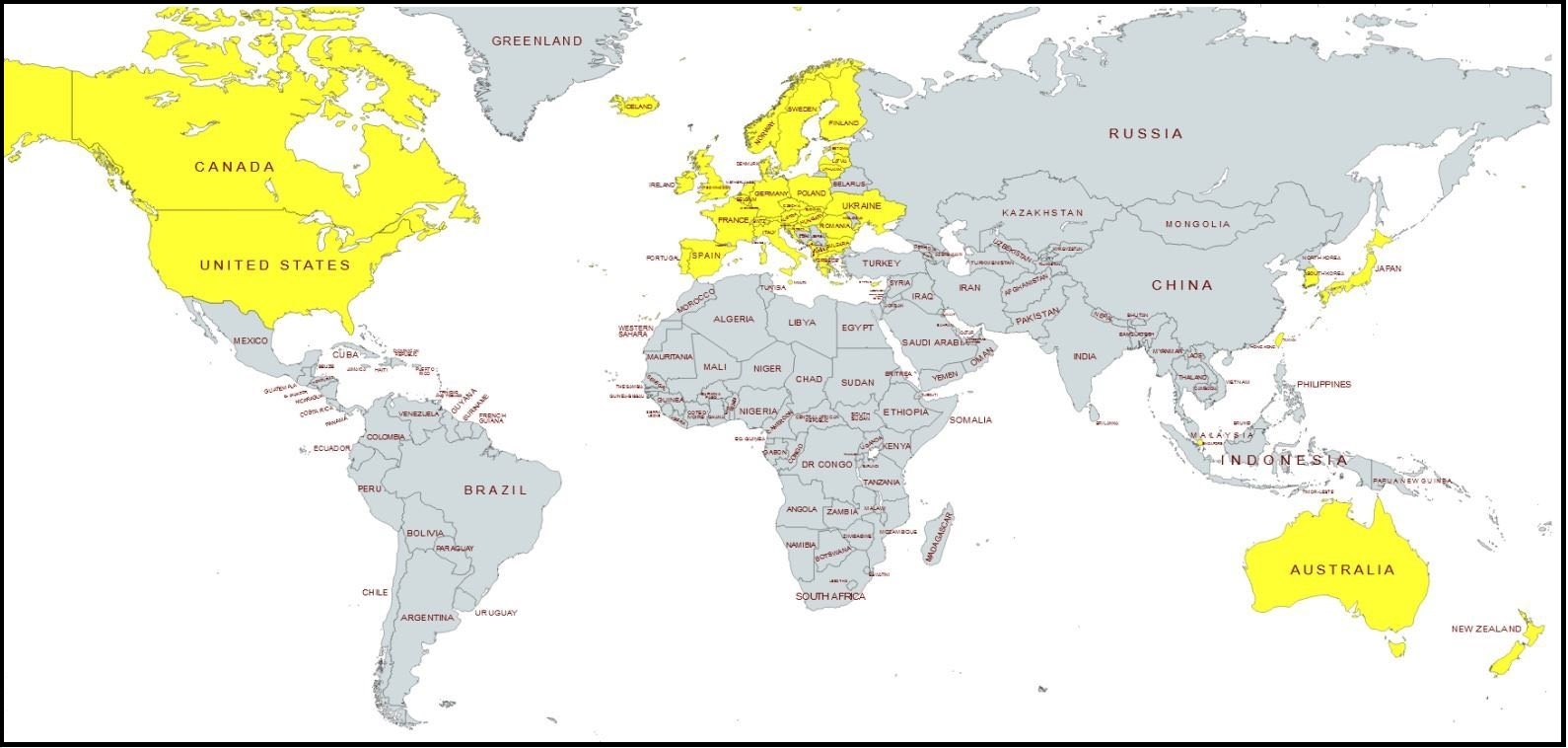

We are through the looking glass folks. Literally captive to the narrative as sold by our Western government officials, and there’s a huge one-way mirror; beyond which, massive segments of the grey zone are looking at us as if we are pathetic victims of professional propaganda.

The worst part of this dynamic is how the USA looks insufferably weak, because we are playing this massive game of pretending that only the Yellow Zone is participating in.

MOSCOW, Dec 27 (Reuters) – Almost all of Russia’s oil exports this year have been shipped to China and India, Deputy Prime Minister Alexander Novak said on Wednesday, after Moscow responded to Western economic sanctions by quickly rerouting supplies away from Europe.

Russia has successfully circumvented sanctions on its oil and diverted flows from Europe to China and India, which together accounted for around 90% of its crude exports, Novak, who is in charge of the country’s energy sector, told Rossiya-24 state TV.

He said that Russia had already started to forge ties with Asia-Pacific countries before the West introduced sanctions against Moscow following the start of the conflict in Ukraine in February 2022.

“As for those restrictions and embargoes on supplies to Europe and the U.S. that were introduced… this only accelerated the process of reorienting our energy flows,” Novak said.

He said that Europe’s share of Russia’s crude exports has fallen to only about 4-5% from about 40-45%. (read more)

What Alexander Novak shares is stunningly accurate, only the ramifications are far more serious. This is why I am spending so much time trying to break the issue down into digestible portions.

Russia and Iran are now trading oil (and other things) in their own national currencies, not the petrodollar. This is the epicenter of a process initially triggered by the BRICS economic alliance and is now taking place in real time while the proverbial WEST pretends it is not happening. Now, it might sound esoteric, as if it is a disconnected or academic issue that doesn’t have real substantive ramifications, but that’s not true.

I can literally see how global trade is now cost-shifting as the dollar starts to weaken (become less used) as a trade currency. Again, like our domestic social issues, this de-dollarization process is “slowly at first,” but eventually this is going to come all at once.

As USA consumers we cannot see it yet, because we are inside an economic system that is entirely dependent on dollars. However, as the devaluation of the dollar continues slowly to happen, outside our dollar-based economy, the cost of goods, products and stuff in the ordinary life of people within the GREY ZONE is now stunningly less. It’s not showing up in currency markets (dollar -vs- fill_in_blank), because the currency trades are not part of the trade/cost dynamic outside the YELLOW ZONE.

Go into the grey zone and compare the price of “product X” to what you would pay in the United States for “product X”, and you will see the difference in the end consumer price is starting to widen faster. Identical goods in the USA cost much more than goods outside the “west.”

As the de-dollarization continues (mostly driven by the lessening of oil sold using the petrodollar), the disparity in price will get even more stark. As a result of this dynamic, wages in the USA (or the “west”) must necessarily rise faster; however, that’s only part of the issue.

If I took $200 into a Russian supermarket, buying only consumable food products, I would end up with about 3 shopping carts full of food. Take that same $200 into the average USA supermarket and you get one shopping cart or less. This is the scale of what is likely to happen in durable goods. The “cleaving” is underway.

Let me say that again, the “cleaving” of dollar-based price/value is underway.

Starbucks pulled out of Russia. The building still exists, the furniture still there, the equipment still there, just a different name, “Star Coffee” lolol. Starbucks is roughly $6 for whatever, the StarCoffee is $1. Same stuff. A cab/uber ride in USA might be $25, or in EU might be €30, but outside the yellow zone around $6 to $10/max. It’s getting crazy how big the difference is.

Now, the price disparity is not in everything, only in the products that do not originate from inside the yellow zone. The increased price of the yellow zone goods transfers into the grey zone when the product is moved. However, if the yellow zone and grey zone both produce an identical product (or service), that’s when you see the massive difference in price. [And no, this is not a lower cost labor issue]

Conversely, prices of goods originating from the grey zone shipped to the yellow zone will be far less than the comparable product created from within the yellow zone.

What is going to happen?

I suspect we are going to import even more products from the grey zone at a greater rate, because there’s a lower origination price and greater opportunity for profit. Wait and see.

China needs energy, Russia needs computer chips and tech. They are trading thusly. Now watch… if the sanctions are ever lifted, we will start importing Russian made electronic goods, because less expensive. It’s nuts.

Remember, our ‘western’ government is doing this to us on purpose.