Posted originally on the conservative tree house on July 29, 2022 | Sundance

People often wonder why few solutions are presented for the significant challenges we face. Perhaps it is worth reminding everyone what the biggest challenge really is, and it has nothing to do with Joe Biden or our political system abusers.

The biggest problem we face as a nation is our unwillingness to admit our current condition is the result of purposeful action.

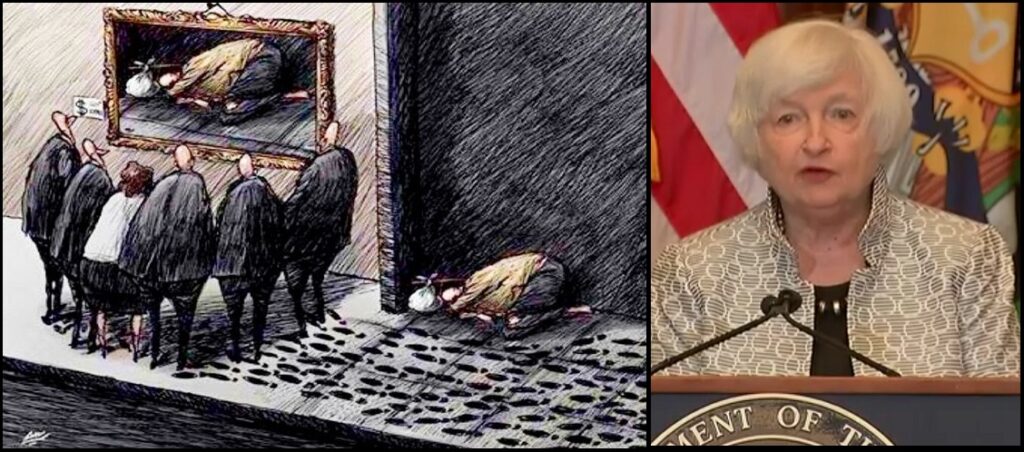

Cue example # [you_fill_in_the_ blank], a visual demonstration:

The central banks did not “fail to spot” the source of inflation. The monetary policy makers did not make mistakes. The hands that guide the economic system did not screw it up, make mistakes or fail to recognize the consequences of the policy they put into place.

When they meet together at Davos for collective discussions around opportunities presented by the pandemic, the guidebook known as Build Back Better did not just organically materialize. Nor did all the western governing central bankers all make a mistake when they followed the agreed consensus. They knew from the outset the climate change agenda would be a radical transformation of the global energy system, and as a result, the global economy.

The central banks did not collectively “fail to spot” the inflation they were creating by lowering energy production, disincentivizing energy investment, limiting energy development, shifting policy away from new production, and generally breaking the traditional energy system finances. They knew precisely what they were doing, and they did it -and continue to do it- with forethought and purpose.

This is where people mistakenly view ‘prior justifications‘ as ‘mistakes.’ When they said inflation was transitory, they were not lying about what they created. They were, however, obfuscating the length of the term “transitory.” Inflation is transitory, from where and when it started in 2021, all the way to where and when windmills, solar panels and clean energy will take over on (fill_in_date_). That is the “transition.”

These bankers, bureaucrats and political leaders are not stupid, and factually their intelligence has absolutely nothing to do with the situation.

These governing officials are ideologues, the worst kind of abuser you could ever encounter because they believe they are doing everything for your own good. Their collective truth is all that matters.

You the citizens within the nations they govern, are not smart enough to know what is best for you.

You, the people who take their magnanimous policies for granted, are not thoughtful enough to understand how to save the planet.

You, the person using resources without caring about the planet, are not bright enough to see how your long-term interests are made better by their short-term actions.

These psychological outlooks are inherent traits of ideologues and abusers.

Once you realize your opinion in their plan means nothing, then you can understand why actions contrast against your opinion of that action are difficult to reconcile.

The actions of the ideologues seem hypocritical only because you are projecting a motive toward them, they do not carry. You think they are making mistakes; they are not. You think they made the wrong assumptions in their policies, they did not. You think they are screwing up the economy, they are not; at least not according to the plan they have.

They met, discussed, planned, organized and collectively came to the decision that they would all act in synergy. Each individual taking the actions within his/her sphere of influence that would assist the larger agenda. Each government leader steering his/her internal policy in a direction that befits the larger collective need, regardless of domestic opinion. None of this was done by mistake.

The western central bankers all show up to the same conferences, symposiums and discussions; and they all follow the exact same approach. Yet somehow, we reconcile their collective and intentional outcomes as if they are making mistakes that they will soon correct. Then we sit puzzling over our puzzlers wondering why the correction is not happening.

The biggest problem we face is our inability to accept what is done, and instead we project justifications that are nonexistent. We are suffering from battered citizen syndrome.

We reconcile our economic collapse by saying they are getting the policies wrong. No.

Just stop.

They are executing the policies exactly as they were planned from the outset. Your financial abuse is a feature, not a flaw, of your abusers’ behavior. The policies are working exactly as intended.

The Central Banks did not “fail to spot” anything. They knew what was causing inflation (energy policy) and they needed to ignore it (still do). They pretend higher costs are now some weird demand-side construct, despite no one buying much, in order to support the global Build Back Better climate change policy objective that will save future generations of mankind. The operational timeline is decades, not weeks or months.

The word “transitory” was used purposefully, in order to hide and obfuscate their prior knowledge. The bankers knew when they said it, that a transition was exactly what the BBB program called for, which was to delay any monetary rate increase as long as possible allowing energy policy inflation to structurally embed.

Once the bankers, ideologues, globalist WEF guides and bureaucrats, got the fully supported climate change energy program (BBB) to take hold globally as an economic control mechanism (no new production), then -and only then- did they modify their policy to support the second phase.

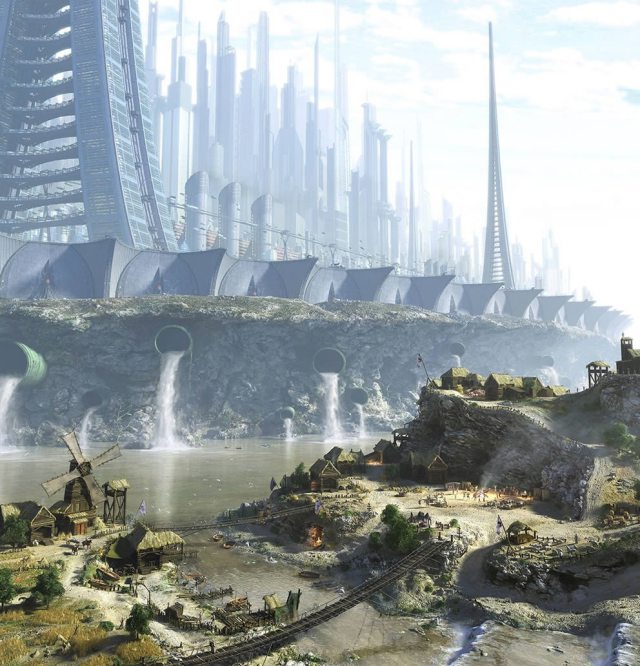

Phase-2 is to reduce global economic activity to match the 2021 deficit in energy production. That phase began in March 2022:

We are in phase 2 now. The U.S. Federal Reserve and the various central banks now raising interest rates to lower all western economic activity.

The goal in phase-2 is to lower energy demand to offset the massive increases in price, due to *nonproduction* of the energy in phase-1.

Put simply, bring energy use down by raising rates and lowering the economic activity.

This “managing the transition” is being done purposefully and collectively. This is exactly what the Build Back Better agenda called for. They did not get anything wrong. They did not make mistakes. Our current economic state, and/or the pain you feel, is the exact outcome of the plan they followed.

Now, I fully understand why the Wall Street financial pundits and global news corporations do not outline this reality. After all, this type of elitist behavior is exactly what revolutions are born from. However, it is very frustrating that smart people on the pragmatic and practical side cannot see or accept the political roadmap for what it is.

This is being done on purpose. They are not making mistakes.

I don’t care what you want to call it: Build Back Better, Green New Deal, The Great Reset, whatever. I simply don’t care about the labels. But the truth of a coordinated approach to manage the western economies into useful decline must be admitted *BEFORE* we can expect to change things.

As long as our codependency facilitates our abuse…. As long as denial of intent is a comforting mechanism, allowing us to avoid confronting the abuse we are suffering…. No corrective action is possible.

It starts by changing our thinking.

Brazil, Mexico, and more recently Japan, have started pushing back against the climate change ideologues. We must do the same.

Act, or be acted upon.