Now more then ever we need your help keeping this channel producing REAL content for REAL people

https://www.paypal.me/ConservativeRes… The Day California Died Even as the 2018 midterms were a rather mixed bag for the GOP nationwide, it’s only natural that one of the few bright areas for the Democratic Party was in the progressive utopia of California. Despite some hype over internal polls suggesting a close race for governor, or a contentious push to repeal a recently enacted gas tax, the California Republican Party once again fell short, even of its own meager expectations. One Step Forward, Two Steps Backward Whatever small consolations California Republicans can take away from election night were overwhelmed by more losses, as the Democratic tide inevitably engulfed them. There is currently only one undecided race that the California GOP was hoping to flip. In the State Assembly’s 60th District, located in Riverside, Republican Bill Essayli was hoping to oust Democratic incumbent Sabrina Cervantes. With a lot of votes still left to be counted over the next few days, the race is a literal dead heat: At the time of writing this, Cervantes leads by just three votes—26,731 to Essayli’s 26,728.

Unfortunately, other hotly contested races in the lower chamber (Districts 32, 44, 65, and 66) were all tenaciously defended by their Democratic incumbents. In addition, the Democrats made two flips of their own, taking seats from outgoing moderate Republicans Marc Steinorth in San Bernardino’s 40th District and Rocky Chavez in Orange County’s 76th District. Thus, the overall net change in the Assembly is D+1, slightly expanding their supermajority. The state senate was even worse, with both losses for the GOP coming from the San Joaquin Valley. In the 12th District, Democrat Anna Caballero managed narrowly to defeat Republican Rob Poythress for the seat being vacated by another moderate Republican, Anthony Cannella, and in the process won the seat that she narrowly lost to Cannella in 2010. But in a more shocking result, the neighboring 14th District saw a sizeable Democratic upset against the popular incumbent Republican Andy Vidak, who was defeated by Democrat Melissa Hurtado. With these two flips, the Democrats erased the minimal gain made by the Republicans’ successful recall of Democrat Josh Newman in Orange County in June, and once again brought this year’s net change to D+1.

This gives the Democrats another supermajority in the upper chamber after it was briefly taken from them with Newman’s loss. While Republicans managed to defend most of the open U.S. House races, there were still three devastating losses, two in neighboring Orange County districts and one in Los Angeles. In the 48th, the senior-most Republican congressman in the state of California, Dana Rohrabacher, narrowly lost his re-election bid to radical Democrat Harley Rouda. In the race to succeed outgoing Republican Darrell Issa in the 49th District, Bernie Sanders-endorsed progressive Mike Levin handily defeated Republican Diane Harkey. And in the Los Angeles-based 25th, incumbent Steve Knight was defeated by Democratic challenger Katie Hill. Not only did the Republican delegation to Congress shrink by three, but it did so by losing two of the longest-serving Republicans in the state. Dominant Democrats The poor performance in local races was a clear result of the Democrats’ usual routing of Republicans at the statewide level. In state races, every single office was won by Democrats in the double digits, with some margins easily as high as 20 percent.

This included the top race of governor, with ultra-liberal Lt. Governor Gavin Newsom besting former Illinois businessman John Cox by almost the same margin of victory by which his predecessor Jerry Brown beat his Republican challenger, Neel Kashkari. Even in the unusual race for insurance commissioner, despite strong support for Republican-turned-Independent Steve Poizner, Democrat Ricardo Lara apparently managed to eke out a narrow win. This is by far the closest Democrats have come to losing a statewide contest since 2006, yet it is still telling that in order to get that close, the popular Poizner had to change his registration to “no party preference,” Republican being too toxic a word in California.

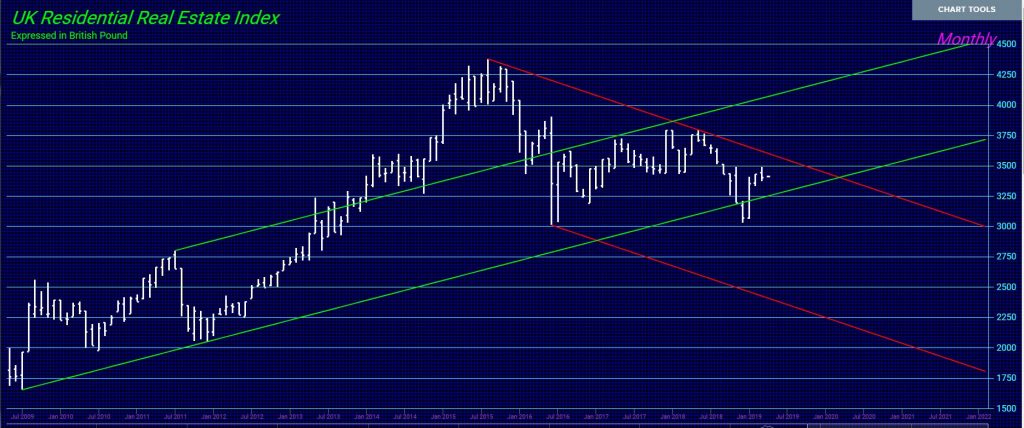

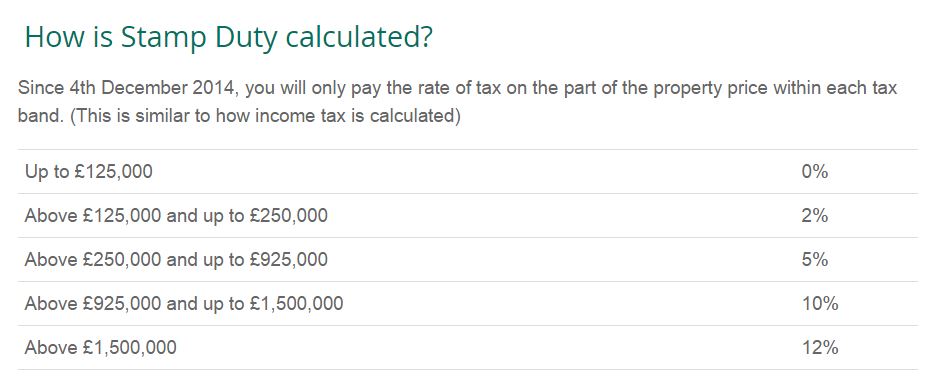

REPLY: The biggest problem with London real estate has been the change in taxation to supposedly make the property more accessible. That means that the government deliberately wanted to create a bear market. The stamp duty was really abusive. It is hard to see where London property could survive after that.

REPLY: The biggest problem with London real estate has been the change in taxation to supposedly make the property more accessible. That means that the government deliberately wanted to create a bear market. The stamp duty was really abusive. It is hard to see where London property could survive after that. The London housing market sales began to crash from the peak in the Economic Confidence Model 2015.75 as reported in

The London housing market sales began to crash from the peak in the Economic Confidence Model 2015.75 as reported in