Armstrong Economics Blog/ECM Re-Posted Apr 17, 2023 by Martin Armstrong

COMMENT #1: On April 10th the IMF released UNICOIN, est Voila! Zee beginning of zee end?

Lawrence

COMMENT #2: Marty, the ECM target was way too much. The Pentagon Papers was one thing, but precisely April 10th is when the IMF announced its new currency to dominate the world. Your ECM is just incredible. Why so many things of great importance take place on this model is proof that there is a hidden order behind everything.

TJ

COMMENT #3: Marty, As you know, I was there at your 1987 conference for the Crash which was caused by the G5 manipulation of the currency that began in 1985. That culminated in the collapse of communism and the Japanese crash of 1989. Here we have once again the IMF announcing on the very day of the ECM April 10th, that they are releasing their new currency to replace the dollar. This looks like it will impact the entire world economy and the war you have been warning about post-2024.

I don’t know how this model works even to the precise day. It is easy to see why they tried to kill you thinking it was just your opinion and influence. They refuse to consider that perhaps there is something much more at stake than anyone’s opinion.

Thank you for this eye-opening discovery.

EK

REPLY: I do not know why this will work to the price day in wave after wave. Even the 2007 target was the very day of the crash in the mortgage-backed market. They were calling it Armstrong’s Revenge on the floor. They locked me up but it still was working as scheduled proving it was never my “influence” that they were so convinced about. There is something there, and it is about time we acknowledge it.

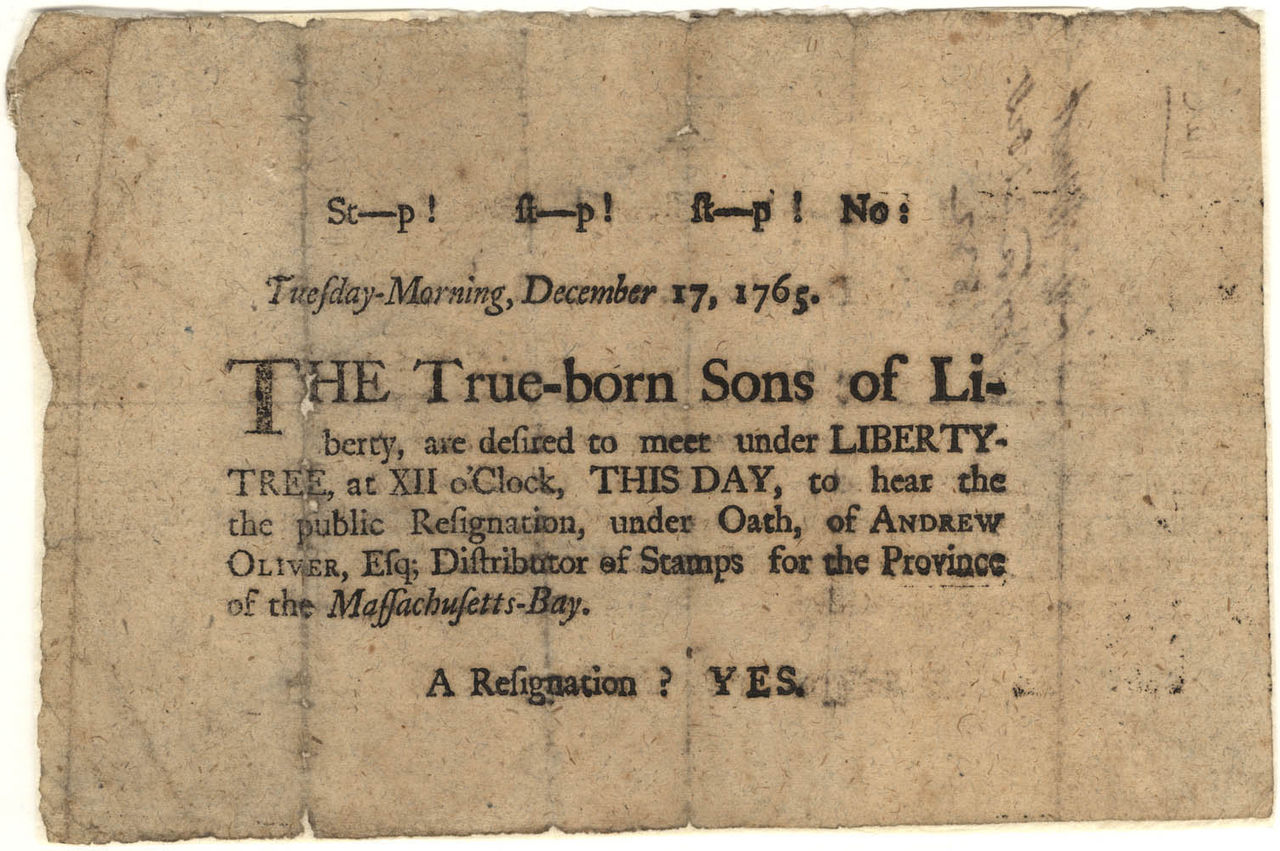

The government was furious when the New Yorker wrote about this model and called it the Secret Cycle. I believe that caused the journalist a lot of trouble. If there is a hidden order, that means the government cannot manipulate society as it thinks it can. This is why we are headed into 2032. They are fighting for their survival. They are pushing for digital currency, will terminate all paper money, and then you will see that they will restrict us from buying or selling anything they do not approve

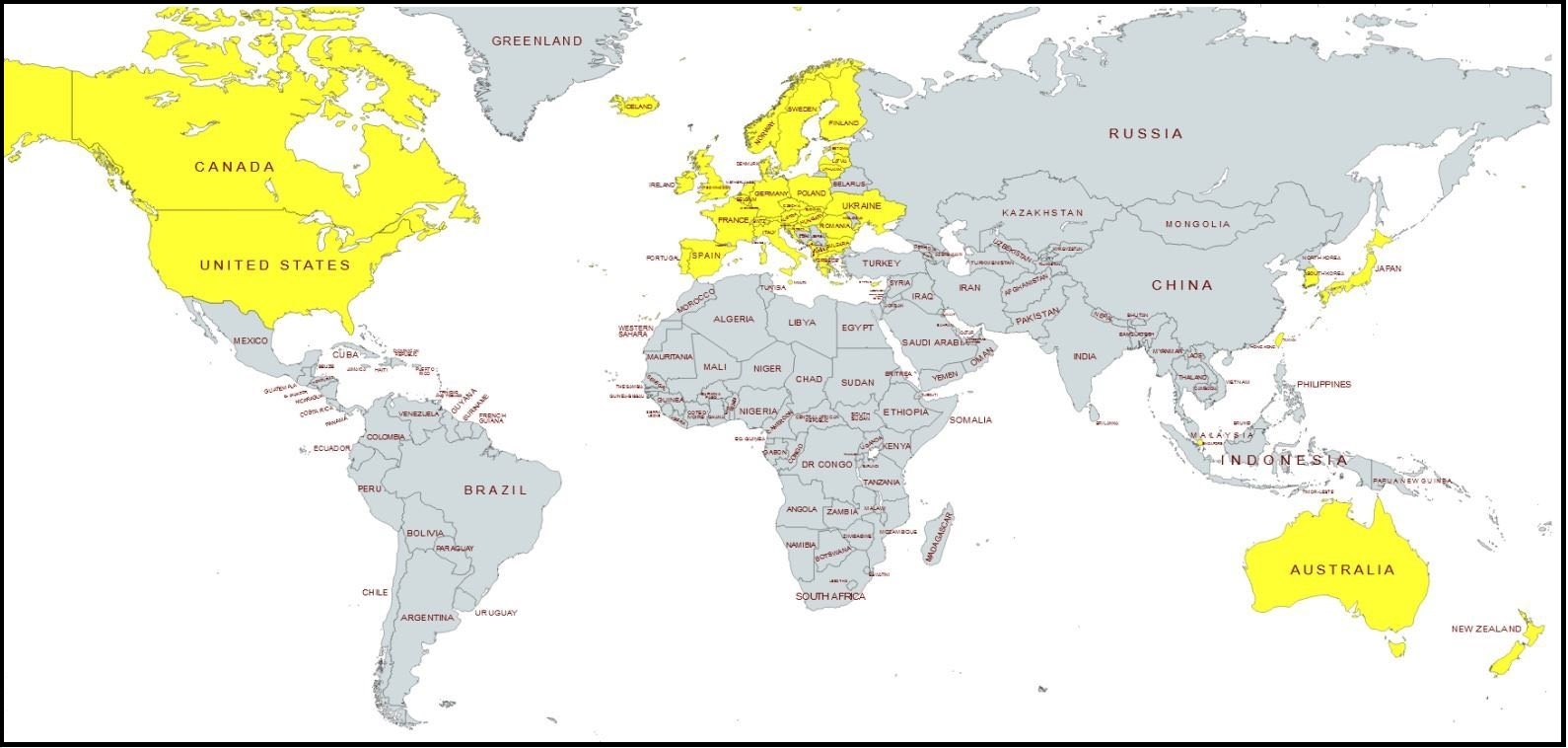

Welcome to the 21st century of Economic Slavery. This is also the Third Millennium of the Anno Domini or Common Era in the Gregorian calendar spanning the years 2001 to 3000 (21st to 30th centuries). As I have warned, reactions are always TWO or THREE units of TIME and everything is FRACTAL. We are in the same position on a grand scale as April 10th, which was 2.15 years into this cycle. We are approaching the 2150 years target and our republican forms of government globally will not survive.

I am working long days to finish this book on the ECM. I promise it will be an eye-opener as you have said.