QUESTION: Angkor Wat was abandoned and the whole society seems to have vanished. I saw somewhere that this was due to climate change and the drying up of their canal system. Is this something that shows in Socrates?

Best regards

MU (Sweden)

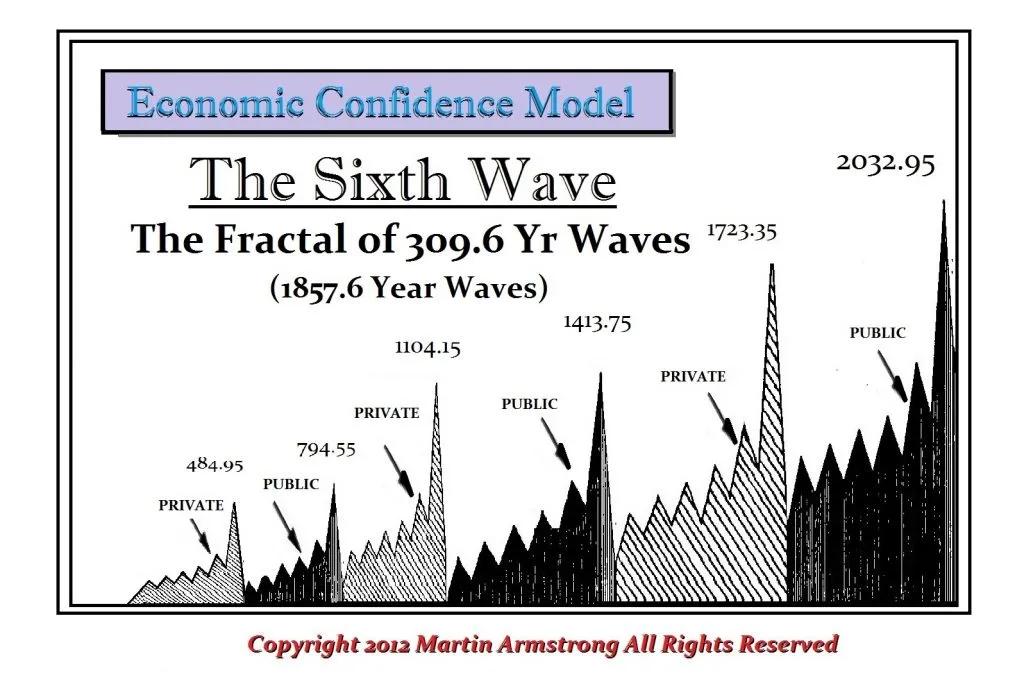

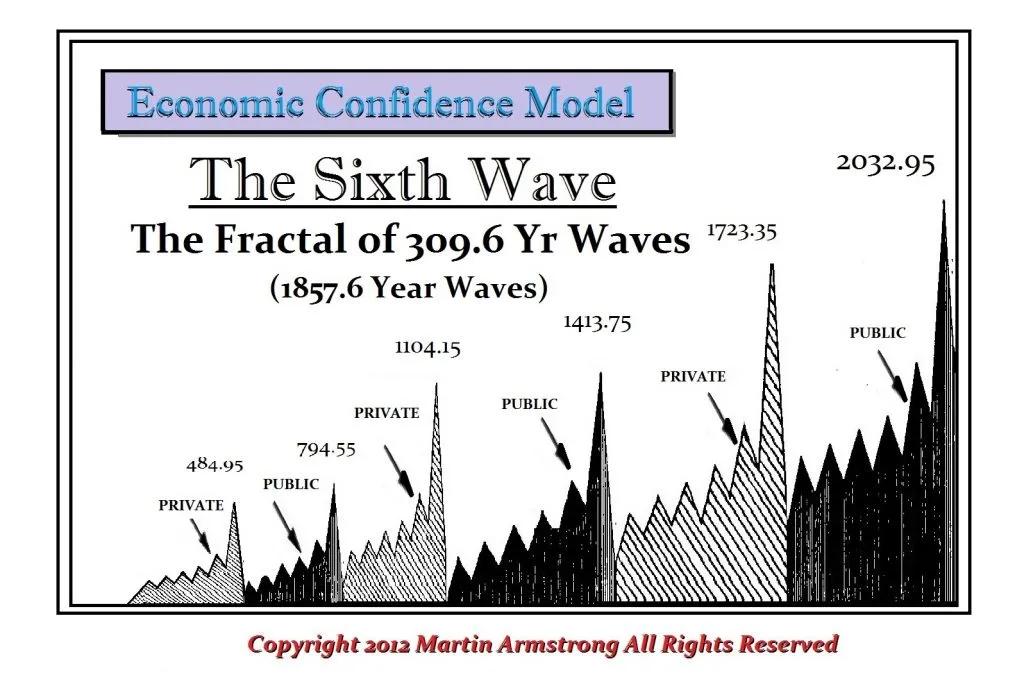

ANSWER: The fall of Angkor Wat was attributed to climate and abuse, but that is just wrong. The real story about the Angkor civilization primarily involves religion and the shift from a Private to a Public Wave marking its collapse. The Angkor civilization was established in 802 AD, which interestingly came at the beginning of the third wave in the current group of 309.6-year intervals. That wave group will ultimately peak in 2032, bringing major change to the world economy, which may even involve religion as well.

The Angkor civilization’s heartland and capital city was on the banks of the Tonle Sap Lake in northwest Cambodia. The Angkorian state was founded and grew during a period of favorable climate with abundant rainfall. This much is true as with most civilizations during warming periods. At its height, Angkorian rulers probably controlled a large portion of mainland Southeast Asia.

The Angkor civilization peaked the early 1100s, completing one wave of 309.6-years in 1104 AD. This was when the construction began on the Angkor Wat temple site. But we must look closely here for religion also came into play. The temple was constructed as a re-creation of the Hindu universe. There were five sandstone towers that rose above the four temple enclosures. This represented the peaks of Mount Meru, the center of the universe. The temple complex is surrounded by a very large moat which symbolizes the Sea of Milk from which “amrita,” an elixir of immortality, was created.

The peak in the culture took place around 1104 in conjunction with the peaks of the Economic Confidence Model. That is when there was a shift in culture. Indeed, by the end of the 13th century, numerous changes were taking place. The last Sanskrit inscription dates to 1295. The last inscription in Khmer, the language of Cambodia, appears a few decades later in 1327. As the ECM shifted from a Private to a Public wave, not only did society become more regimented, but the religion began to change as well. There was a shift from Hinduism, which was the theme of the Temple, to the region-wide adoption of Theravada Buddhism.

Buddhism and Hinduism agree on karma, dharma, moksha, and reincarnation. They are different in that Buddhism rejects the priests of Hinduism, the formal rituals, and the caste system. Buddha urged people to seek enlightenment through meditation. Therefore, this religious shift brought the caste system to an end. The Private Wave represented the rise in individualism and the anti-government sentiment we see even today. The priests of Hinduism were overthrown, which interestingly corresponded with the shift in the ECM.

This religious shift had a profound disruption on the culture and included political changes. No longer was there state-sponsored stone temples nor was there a royal bureaucracy. This was all rejected and overthrown. Everything shifted to community-based Buddhist pagodas that were now constructed from wood. Part of this religious shift to Buddhism took place simultaneously with an increase in maritime trade with China. This shift in the economic structure combined with the religious shift from Hinduism to Buddhism meant that the entire facade of Angkor Wat was no longer religiously acceptable.

With trading shifting to maritime, the capital was relocated further south, near the modern capital of Phnom Penh. With international trade becoming more important, moving the capital to the south allowed rulers to expand their economic powers. Clearly, the abandonment of Angkor Wat was primarily due to religion and the expansion of international trade.

With trading shifting to maritime, the capital was relocated further south, near the modern capital of Phnom Penh. With international trade becoming more important, moving the capital to the south allowed rulers to expand their economic powers. Clearly, the abandonment of Angkor Wat was primarily due to religion and the expansion of international trade.

Insofar as climate is concerned, claims that global warming destroyed the city are not valid. The Paleoclimate research in the region clearly reveals that there was a region-wide environmental change in climate because climate is always changing. There was a series of decades-long droughts, but these were also interspersed with heavy monsoons. The impact of this in agriculture no doubt sparked the development of international trade.

Other claims that the Thai invaded and sacked the city of Angkor Wat by the 15th century. The capital had already been moved which meant that Angkor Wat was easy prey and no longer economically important in Cambodia.

Therefore, the shift that truly undermined Angkor Wat was the one which saw Buddhism rise, making the entire complex an antiquated religious place that was no longer respecte