Posted originally on the conservative tree house on June 13, 2022 | Sundance

They might even hold hearings on it….

They might even hold hearings on it….

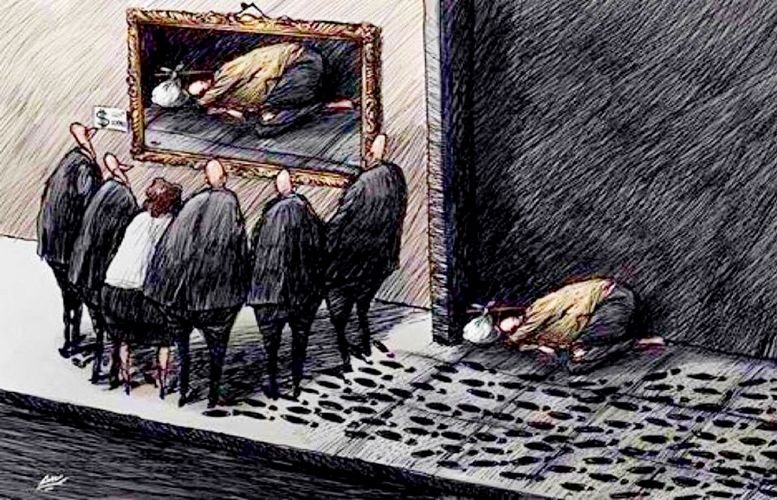

The Bureau of Labor and Statistics has released the May inflation report [DATA HERE] showing a 1.0% increase in the month of May, bringing the rate of inflation to 8.6 percent. The highest rate of inflation in over 40 years.

This month of inflation data is particularly important because it cycles through the May 2021 calendar comparison from last year when the first wave of massive inflation first triggered. The current year-over-year 8.6% rate of inflation now lands atop twelve months of massive increases in prices.

The data clearly shows how energy costs are the dominant factor hitting every aspect of consumer purchasing. Gasoline increased 4.1% for the month, 48.7% year-over-year. Fuel Oil increased 16.9% in May, 106.7% year over year.

The energy sector is crushing the ability of consumers to spend on anything else. Real wages declined in May 0.6% as paychecks are being eaten up by massive inflation. On an annual basis wages have declined by 4% year-over-year [BLS DATA].

Unfortunately, there is no forward optimism for any change in energy policy from the Joe Biden White House, that means energy costs will continue skyrocketing as the ideologues in control of the administration push their climate change Green New Deal policies.

Additionally, we still have the third wave of massive food price increases to look forward to later in the summer as the big increases in field costs start to reach the supermarket. Those food store increases will average around 20 to 30% more than current.

Table-2 gives you a great breakdown of the price increases in specific sectors within each of the larger categories. [SEE HERE] Eggs increased 5% in May, that’s a 60% annualized rate of inflation for eggs, which are already 32% more than last year. Chicken is exceeding 30% inflation and growing.

A CNBC media report is below, as Wall Street laments the Fed response. However, the Fed cannot do anything to stop this inflation because what’s needed is a total reversal of U.S. energy policy.

[CNBC] – ““It’s hard to look at May’s inflation data and not be disappointed,” said Morning Consult’s chief economist, John Leer. “We’re just not yet seeing any signs that we’re in the clear.”

Some of the biggest increases came in airfares (up 12.6% on the month), used cars and trucks (1.8%), and dairy products (2.9%). The vehicle costs had been considered a bellwether of the inflation surge and had been falling for the past three months, so the increase is a potentially ominous sign, as used vehicle prices are now up 16.1% over the past year. New vehicle prices rose 1% in May.

Friday’s numbers dented hopes that inflation may have peaked and adds to fears that the U.S. economy is nearing a recession.

The inflation report comes with the Federal Reserve in the early stages of a rate-hiking campaign to slow growth and bring down prices. May’s report likely solidifies the likelihood of multiple 50 basis point interest rate increases ahead.

“Obviously, nothing is good in this report,” said Julian Brigden, president of MI2 Partners, a global macroeconomic research firm. “There is nothing in there that’s going to give the Fed any cheer. … I struggle to see how the Fed can back off.”

With 75 basis points of interest rate rises already under its belt, markets widely expect the Fed to continue tightening policy through the year and possibly into 2023. The central bank’s benchmark short-term borrowing rate is currently anchored around 0.75% -1% and is expected to rise to 2.75%-3% by the end of the year, according to CME Group estimates. (read more)

We are in an abusive relationship with government…

The Securities and Exchange Commission (SEC) is warning investors against popular “meme stocks.” Yet, they have gone too far by offering direct trading advice. Specifically, the SEC produced a video (see below) about GameStop (GME) that has retail investors reeling.

GameStop was certainly trading in volatile territory during Q1 2021. A group of online retail investors promoted the stock and allegedly were partially responsible for causing Melvin Capital hedge fund to lose 53% of its capital in January. The short squeeze seems to be highly exaggerated and the four largest asset managers in the world owned 39% of GameStop at the time. Those who traded properly, or simply got lucky, profited off of the volatility, but, obviously, that is not recommended for the amateur investor.

The problem here is that the SEC is trying to deter the retail investor to protect the hedge funds. The SEC should not be telling the public which stocks to avoid and I do not believe the shareholders of GME or other “meme stocks” will be happy with this advice.

Inflation does not discriminate based on income. According to a new Bloomberg report, over one-third of Americans earning at least $250,000 annually are living paycheck to paycheck. Only 5% of the nation earns over $250,000 per year, and this is who the politicians would call “the rich.” One in ten noted that they struggled to cover their household expenses in April.

This is especially true for Millennials who lack decades of savings and were forced to purchase housing and other big-ticket items at the historically high price levels. Among those earning $250,000 or more per year, 55.4% of Millennials reported living paycheck to paycheck compared to 26% of Boomers. In the $100,000 to $150,000 income range, 63% of Millennials reported an inability to save compared to 26% of Boomers.

Living paycheck to paycheck comes with the risk of slipping into debt. The Federal Reserve recently reported that 78% of Americans believed they were living comfortably financially, but they may be seeing the situation through rose-colored glasses. One in nine respondents from the same Fed survey admitted that they could not afford a mere $400 emergency expense. In this current economy, the wise are reassessing their spending as inflation is not expected to decline anytime soon.

QUESTION: Marty; I have been a follower for years. Your model has correctly forecasted every major trend from civil unrest to disease. But your forecast that this wave would be commodity inflation based on shortages years in advance, proves that you deserve the Noble Prize. Absolutely no analyst did that although many now pretend they are forecasting this trend. I have to ask. Why is the government refusing to use your model?

HK

ANSWER: The entire economic field sells itself as the solution. They reject the idea of any defined business cycle BECAUSE that means there can be no manipulation. Just look at Schwab and his World Economic Forum, which will be one day cast as the evil emperor in some future version of “Planet of the Manipulators.” If they listened to this model and followed it, they would reject Schwab’s obsession with Marxism. As long as the economy is random, then they can manipulate it. Following my model strips them of that power.

There are still people in the former Iron Curtain countries that miss communism. Why? It is the same in prison. You become institutionalized and have no responsibilities, including taxes. Someone hands you a broom, you sweep the street, and it takes not a single mental thought of how to actually do the job. You can’t even be fired.

QUESTION: Marty, Your forecast for the Panic Cycle here in Australian politics was correct and it beat all the polls as you did in BREXIT. Our new leader is a full-on board with the WEF climate agenda and will have all cars electric by 2030. As you say, in war you take out the power grid first. I guess this makes the power grid even more of a first-strike target.

I want to thank you for Socrates. It is great to have something that provides a non-emotional forecast. The forecasts you publish on so many things around the world are amazing and accurate.

So my question is this. You were correct that rates would rise, or Socrates was, and you said that there would be shortages with a commodity cycle mixed with war rising and civil unrest. So now that the central banks are in a state of panic, what do you expect with the panic cycle in 2023 in the Fed?

ANSWER: You are correct. Too many people attribute everything to just me as if I have a crystal ball. The forecasts are from the model. Nobody could be forecasting so many things for 40 years on a gut feeling and be correct. The odds of humanity are against that.

People tend to forecast what they want to happen. It is just an inherent human flaw. But it is also what drives markets. The majority of people are influenced by the direction of the trend. So a rising market makes people feel bullish and a declining market makes people more pessimistic. That is just a fact of life. So the ONLY hope for an accurate forecast MUST come from a non-emotional source. Staring into 2023 just looks like total chaos.

I do get the occasional email asking me how I cope with my own forecasts. I look at it this way. If I said here comes my fist, I’m going to punch you in the face. Do you just stand there and smile or do you dodge the punch, or defend against it? Isn’t it better to know something is coming to prepare?

It is more like an out-of-body experience for me personally because these forecasts are the computer and I have to stand here and watch as well as live through them. It is a different experience to forecast these events years in advance and live through them myself.

I am concerned that when you look around the globe, so many things have serious targets and panic cycles in 2023. Even in the war cycle, the computer has the highest aggregate bar for 2023. The central banks are unable to prevent inflation because this is a shortage crisis, not a speculative boom where raising interest rates will reduce the buying.

While the Central Bankers think this is clear sailing, they have entered uncharted waters. The risks of the markets discovering they cannot control the economy anymore will raise the crisis to extreme levels as we head into 2023.

We often talk about the disconnect between Wall Street (globalists) and Main Street (nationalists), and their influence in economic policy. Today, Jason Furman, a former Chair of the White House Council of Economic Advisors, appears on CBS News to discuss his Harvard-Kennedy School impression of the U.S. economy.

There’s a particular point in the interview [Transcript Here] that encapsulates the moonbat perspective of the globalists. Listen at 01:20 and you will hear this:

FURMAN: “Look, we’ve seen a remarkable thing. Consumers, if you survey them, are very pessimistic and negative about the economy. When they vote with their wallets, we saw- we got the consumer spending data for April and it was way up. Consumer spending on just about everything has been booming. Over the next 6 to 12 months, I’m not super worried about a recession. After that is where I start to get worried because that’s where the Fed’s policy will start having more of an effect.”

Put another way: Our policies have made prices skyrocket (inflation). Consumers are forced to spend more money to sustain themselves (food, housing, fuel, energy); ergo consumer spending is booming. Brilliant, our plan to increase consumer spending by raising their prices is working. That’s the way these people think. WATCH:

We force you to pay more, then turn around and claim economic victory because you are paying more…. “consumer spending is booming.”

By the way, he’s at the World Economic Forum where this perspective is actually cheered inside the echo-chamber.

Comrades, American consumers are overjoyed with gasoline because they are spending so much more money on it.

Gasoline sales are booming, so everyone must be happy.

Brilliant!

QUESTION: Marty, You were named hedge fund manager of the year in 1998 for producing the highest return during the Long Term Capital Management collapse over the Russian bond crisis. At the WEC in Orlando, you said in 2019 that we were facing a liquidity crisis that would be similar to that event. Well, the Federal Reserve has now warned of deteriorating liquidity conditions across key financial markets amid rising risks from the war in Ukraine, monetary tightening, and high inflation in their semi-annual report. It appears that the forecast of a liquidity crisis distinguishing this crisis from 2007 to 2009 is unfolding. Would you elaborate on this current crisis headed into 2023?

JF

PS, a short interim virtual WEC may be warranted. Just mentioning. People take what you say, call it their own, and pretend you never existed.

ANSWER: What distinguished that ’98 Liquidity Crisis was that the “Club” of bankers and hedge fund guys were all on the same trade as they always did. The capital flows began to sift in 1994 as SE Asia peaked. The bear market that unfolded went largely unnoticed until the Asian Currency Crisis where the “club” then attacked the currency pegs. But the capital had begun to move back in anticipation of the coming Euro.

The 99.9% of fund managers lost their shirts on that capital shift because they were too busy bribing politicians and people in the IMF to look at the markets. They completely misjudged the world economy thinking like Marx and Keynes that they could control it. The shift in capital and attacking the SE Asian currencies led to the idea that all emerging markets were risky. With the Euro coming, the herd of little investors shifts their capital away from the funds heavily trading emerging markets. They were not “traders” but people who were engaged in trying to rig the game.

What they failed to understand was that the world economy is a financial sea of capital. When there is a high tide and capital is flowing in, they expect it will never end. The tide changes and you then move to low tide and the capital retreats outward. This was the first part of the liquidity crisis that would look at Russia as they did SE Asia emerging markets.

Consequently, when it is low tide, capital is retreating on a global level and that is when the liquidity crisis emerges. Thus, were the serious investors and pension funds behind to lose money in SE Asia, and they began unloading emerging markets elsewhere as well. Because all the hedge funds and bankers who try to rig the markets because they are not traders because they were all on the same trade of Russian debt when they tried to sell, there was NO BID. They began selling every position elsewhere which included the Japanese yen. It was a LIQUIDITY CRISIS so they needed to raise money to cover their losses and if Russian bonds were unsalable, all they could do was sell everything else. Thus, a LIQUIDITY crisis defies fundamentals because they are selling this ONLY because they need the money elsewhere. So the fundamental analysis provides no security for everything is connected in the global see of capital.

Edmon Safra of Republic National Bank put on a fancy dinner for the IMF. I was invited and it was all about trying to convince me that they had the IMF in their pocket and that would rescue the day. The pitch was Russia had all these nukes so no way would the IMF allow Russia to just collapse. This created a serious yet difficult situation for the Russian government. What was going on was that Russia had been running a huge budget deficit to pay for public services. They had borrowed $40 billion by issuing three-month ruble Treasury bills. This is what the “club” was bought for they were paying 30% interest to attract buyers. Bribing the IMF to prevent a default, they were all on this trade expecting free money. I refused to join and warned them that my computer projected this was going to collapse. They did not want to hear that. They were CONVINCED paying bribes would create that GUARANTEED TRADE.

The liquidity crisis this time is COMPLICATED. This time we do not have the traditional speculative boom which has produced inflation. This time we have shortages and there is NO WAY a central bank can prevent this type of inflation by raising interest rates. If anything, it will only propel the shortages so we have the ironic situation that economic decline is unfolding into 2023, but the shortages will get worse causing even higher inflation ahead.

Hence, capital is retreating out of confusion creating a period of low tide. But the standard impact is DEFLATION but that means demand is declining relative to supply. Now we have a decline in supply because of the regulations and war. Consequently, prices will rise even in a recession because it is a shortage of supply, not a decline in demand. It is this lack of understanding that is creating the liquity crisis.

As far as people taking my explanations, it is impossible to reach such conclusions unless you lived there and participated in those events.

Sorry, Democrats, but Americans are more outraged that they cannot afford to live than whether others should be able to terminate pregnancies. A poll by Rasmussen Reports found that both Republicans and Democrats are far more concerned with inflation than any other issue. Nearly 94% of Republicans, 84% of Democrats, and 83% of Independents cited rising prices as their top concern.

Abortion outrage is actually low on the list. Among all voters surveyed, 83% are concerned about violent crime that has increased throughout the country amid relaxed laws and defunded police agencies. Sixty-nine percent are worried about illegal immigration and the absence of border security. Across all political beliefs, inflation is the main concern. It is something that all Americans must grapple with on a daily basis. The Democrats have only exacerbated the problems concerning most Americans by avoiding major issues entirely. At this point, even the most die-hard liberal cannot say with a straight face that we are better now than we were under Trump.

The Democratic Party has become tone-deaf. People fear that they cannot maintain their current standard of living, pay for housing, or feed their families. They feel outraged every time they go to the gas pump or grocery store and only see darker days ahead. Leaking the Supreme Court decision on Roe v. Wade was a FAILED attempt to redirect the public’s attention before the midterm elections.

We went from a booming economy to staring down the next recession. Inflation has reached 8.3%, and most Americans are troubled that they will no longer be able to afford their standard of living. According to the latest Gallup poll, 52% reported that they are fearful about maintaining their standard of living. Some may say, “So what? The rich will have to sell off one mansion and fly commercial!” The people who will feel the brunt of this economic downturn are lower-income earners.

Among those earning under $40,000 annually, 73% said they no longer believe they can afford basic living necessities, up from 56% a year prior. About 65% of lower-income Americans worry about having enough money to pay their monthly bills, while 59% say they fear they’ll no longer be able to afford housing. In fact, more lower-income renters should be concerned about the rising cost of housing because landlords will pass their increased costs on to their tenants at a time when rental costs are already at an all-time high.

Medical bills, the leading cause of bankruptcy, are of the utmost concern. Seventy-two percent of lower-income earners said they cannot afford an emergency medical event, and 62% cannot afford basic medical care. These fears are not unfounded and we are looking at a major crisis on the horizon.

I have created this site to help people have fun in the kitchen. I write about enjoying life both in and out of my kitchen. Life is short! Make the most of it and enjoy!

De Oppresso Liber

A group of Americans united by our commitment to Freedom, Constitutional Governance, and Civic Duty.

Share the truth at whatever cost.

De Oppresso Liber

Uncensored updates on world events, economics, the environment and medicine

De Oppresso Liber

This is a library of News Events not reported by the Main Stream Media documenting & connecting the dots on How the Obama Marxist Liberal agenda is destroying America

Australia's Front Line | Since 2011

See what War is like and how it affects our Warriors

Nwo News, End Time, Deep State, World News, No Fake News

De Oppresso Liber

Politics | Talk | Opinion - Contact Info: stellasplace@wowway.com

Exposition and Encouragement

The Physician Wellness Movement and Illegitimate Authority: The Need for Revolt and Reconstruction

Real Estate Lending