Posted originally on the CTH on December 6, 2023 | Sundance

Having spent time doing the legwork, I have a completely different perspective on the issues.

If you choose to live in the world of pretending, or if you trust the expressed justifications and motives of the USG as outlined by the DC proletariat, this is not going to be a read that retains your comfort. However, if you want to boil it all down to the real reasoning, read on.

Top line – JPMorgan Chase CEO Jamie Dimon wants cryptocurrencies banned in the USA.

(Newsmax) – JPMorgan Chase CEO Jamie Dimon on Wednesday suggested bitcoin currency should be banned.

Dimon was speaking during a Senate Banking, Housing and Urban Affairs Committee hearing on Capitol Hill.

“I’ve always been deeply opposed to crypto, bitcoin, etc.,” Dimon said in response to a question from Sen. Elizabeth Warren, D-Mass. “The only true use case for it is criminals, drug traffickers … money laundering, tax avoidance because it is somewhat anonymous, not fully, and because you can move money instantaneously. “If I was the government, I would close it down.” (read more)

Bottom line, the non-pretending reasoning. The US Treasury has set the financial system on an almost unreversible path to a U.S. Central Bank Digital Currency. Crypto is a threat to the establishment of that objective.

The leftists and Marxists who now control the various institutions we associate with the United States Government, together with the DC UniParty apparatus that controls the Potemkin village we call congress, are in full alignment with the control objective. What and who is their target for control? Us.

I’m going to be brutally honest and seemingly radical, but here is the Occam’s razor.

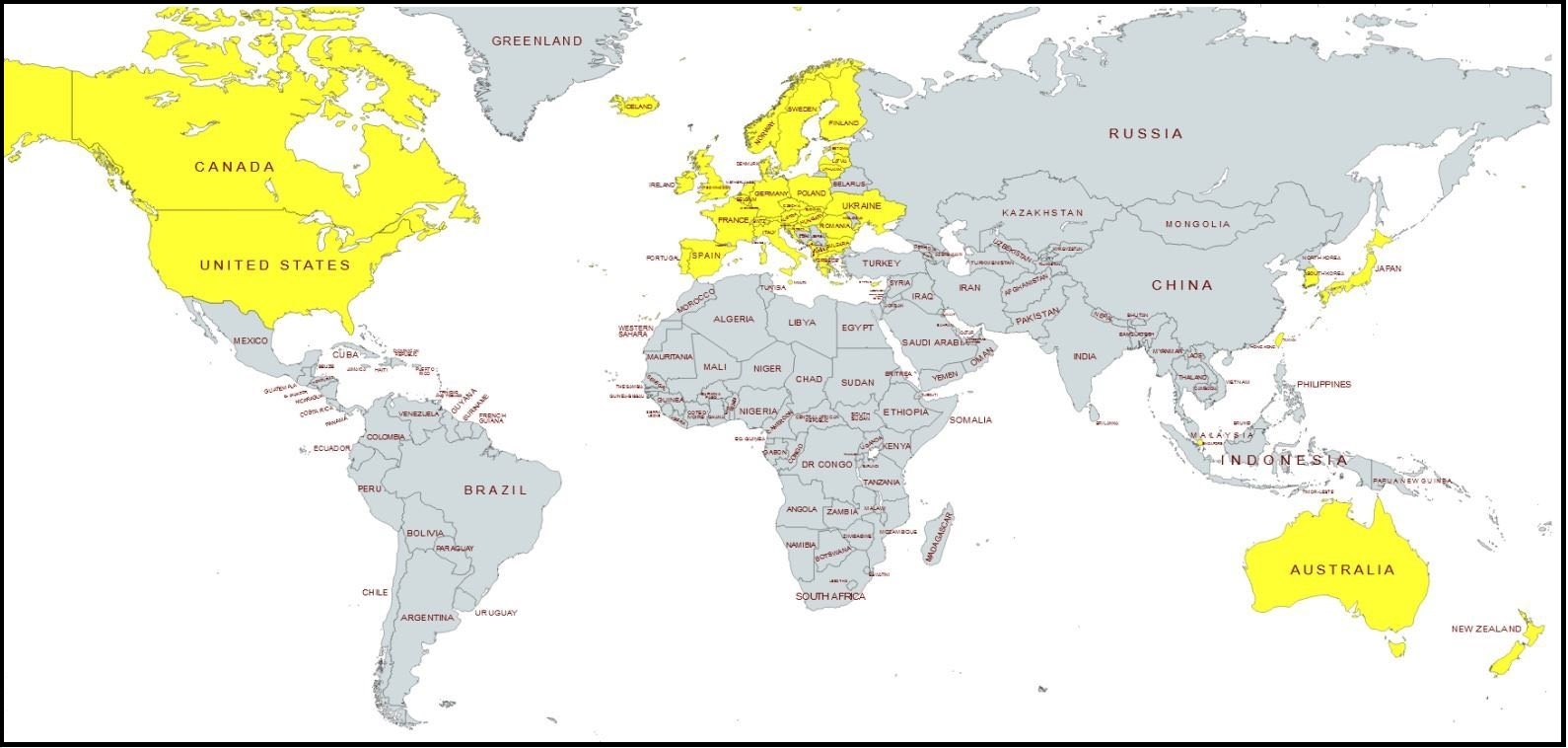

If you have ever wondered why Hillary Clinton could hold a reset button with a visit to Russia, expressing a direct interest in improved relations. Then, if you have ever wondered why Barack Obama would tell Russian President Medvedev he just needed to get through the 2012 election to have “more flexibility,” again expressing an interest in improved relations with Russia; then seemingly all of that is dispatched in 2016 to make Russia the #1 threat…. keep reading.

What happened?

How did the Obama administration go from all efforts to be on good relations with Russia 2009 through 2015, then suddenly pivot to the exact opposite with the Trump-Russia collusion conspiracy, the Russian election interference nonsense, the expulsion of Russian diplomats in Dec/Jan 2017 and suddenly Vladimir Putin as the archvillain for the world? Apparently, few have ever really asked how that happened.

Here’s the big picture, as seen through the prism of the EU and the non-pretenders in Eastern Europe.

The Marxists in the Obama admin needed a boogeyman in order to pull off their domestic heist and secure the “fundamental change.” The CIA and State Dept were deployed to utilize Ukraine in 2014 to create the boogeyman, Russia. Ukraine would be the stick to poke Russia. The USA needed a proxy; they created one and made the participants rich.

Provoked, Russia fell into the trap and took control of Crimea as they perceived the NATO expansion and likely control of the Black Sea as a threat. The Crimea move gave the CIA and State Dept the exact response they intended.

The Russia boogeyman was created.

But why? Why would the effort of the U.S. Government be to provoke and create this crisis?

In the biggest of big pictures, the domestic fundamental change needed it. We needed a reason to put walls around the U.S – not to keep Russia out, but to keep Americans locked in. Conflict with Russia became the Obama version of Bush’s conflict with Iraq. Putin now cast to play the role of Bin Laden.

The Patriot Act was never intended to stop foreign terrorists from attacking the USA. The Patriot Act was intended to create the DHS surveillance system for domestic control. It succeeded. The Russian sanctions were never intended to sanction Russia (and they don’t). The Western sanctions against Russia were intended to build walls around the U.S. financial system.

Ostracizing the world’s global trade currency, the dollar, from the global trade system was/is a necessary step in controlling domestic currency. If there is a threat, the government needs to respond. That’s how the crisis is created and not wasted.

Yes, what I am saying is there was a longer and deeper play afoot, a ‘trillions at stake’ game by those who control money and power, using foreign threat as the justification for something that just would not be possible without it. That’s why Trump was never allowed to breathe for a moment, whenever Russia or Vladimir Putin was mentioned. The control forces needed Trump to be adversarial to Russia, regardless of whether the threat was real. After all, it was supposed to be a willfully blind Hillary Clinton in place during this phase.

Conflict with Russia created the opportunity for the USA to create a sanctions regime that doesn’t truly sanction Russia, instead it controls the world of USA finance. At the end of that control mechanism is a digital dollar, a Central Bank Digital Currency…. and by extension full control over U.S. citizen activity. The Marxist holy grail.

That moment is closer than most can fathom, and that is exactly why the counterforce of a cryptocurrency, a rebellious mechanism for free people to exchange payment for goods and services, must be stopped by the same USG that is triggering the CBDC. Crypto is a threat. Jamie Dimon, along with all the major banks and financial institutions, is one key beneficiary that CBDC (a transactional player for fees therein) so long as JPMorgan stays on task.

JPMorgan CEO Jamie Dimon opposes cryptocurrency.

Democrats, really Marxists, oppose cryptocurrency.

Republicans, really financial beneficiaries of the largesse, oppose crypto currency.

The narrative…. Only criminals, that means those who would be defined as domestic terrorists like pesky remnants of our nation who demand freedom and liberty, would support cryptocurrency. Criminals, tax cheats, bad people support crypto. Don’t be a bad person comrade citizen. Insert vote, pull lever, get pellet, go back to sleep. You will own nothing and be happy comrade.

Yes, that’s the bigger picture.

Can it be stopped? I laugh, look in the mirror, think about the reality of how many people think this is an absurd conspiracy theory, and respond with…. How many people even know about the thing you are asking to oppose?

How many people would believe the Western sanctions against Russia were really the USG building a cage to keep us in. How about we start there. That’s my answer.

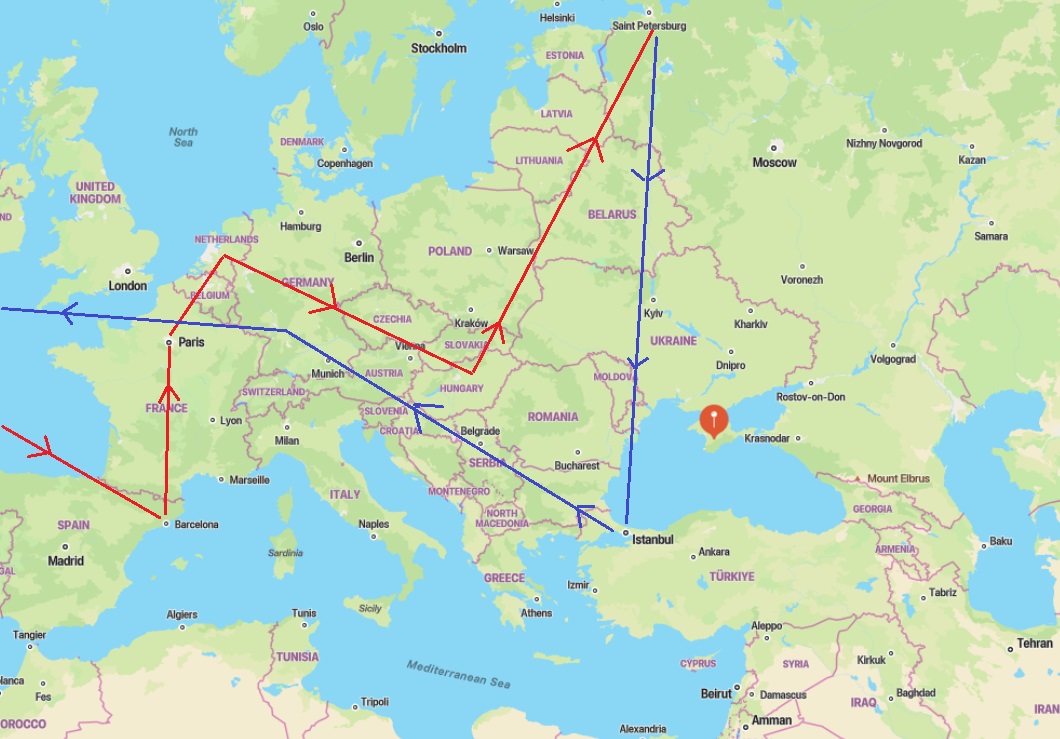

You can travel to Russia. Wait, what?

Yes, you can travel to Russia without issue. The Russians don’t care. The process for getting an entry visa into Russia is the same now as it was five years ago. Ask Russia for a VISA. The paperwork has not changed. Show your passport, give them pictures to create the visa (it’s a full page sticker added to your passport), show your hotel reservation printout, show your travel destination, drop off the paperwork, go back on your appointment date and get the visa.

It’s hard and takes longer from the USA, but it’s not impossible – it’s just easier from the EU. It’s the booking of a flight into Russia (best done in the EU), the payment for a hotel given the sanctions, the stuff created by the USA that is the roadblock. From the Russian side of the dynamic, nothing has changed – they don’t care.

How do I know? The friendly people at the Russian consulate in Budapest walked me through the process. So, find a way to pay for the hotel in Russia (there are many options), travel to the intermediary airport that has flights into Russia (like Istanbul, Barcelona, Budapest) go to the second smaller terminal in the major airport, hop in the flight and fly in. Russians don’t care. Go have a good time. Leave the same way you came in. [If by train or road, just have the VISA ready for review]

Scared about travel? Why?

The same people who tell you where to be scared traveling as an American, are the same people who told you Trump was colluding with Russia.

Da comrade!

lolol

P