Posted originally on the conservative tree house on May 27, 2022 | Sundance

Have you ever seen egg prices at $1 per egg range, or $12/doz? Hold on a few months and perhaps you will. That is the context for the scale of food price increases the USDA is now starting to predict. The highest predicted change in food costs in well over 40 years, that’s the USDA warning in their revised May “Food Price Outlook”. [DATA HERE]

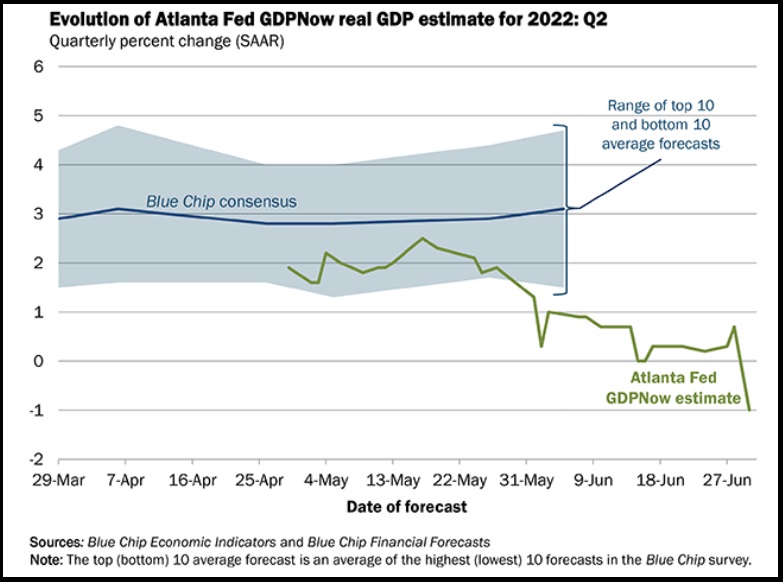

This month the USDA just re-re-revised the forward price outlook, and things are grim. It likely doesn’t come as a surprise to many CTH readers because we have been discussing the convergence of events since October of 2021, when we first were able to predict Wave-1 (Dec/Jan), and Wave-2 (March/Apr) inflation. However, the underlying data for Wave-3 is double the prior two phases.

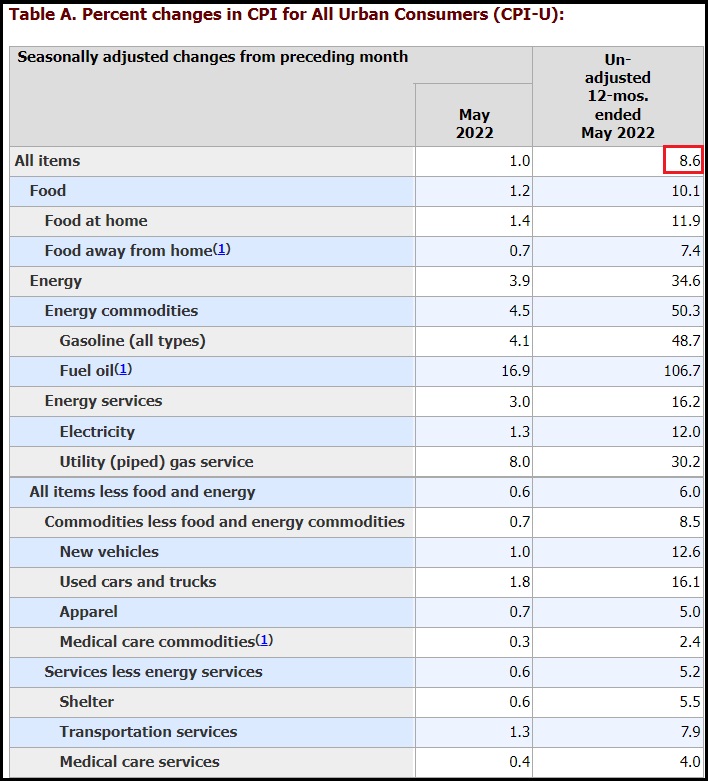

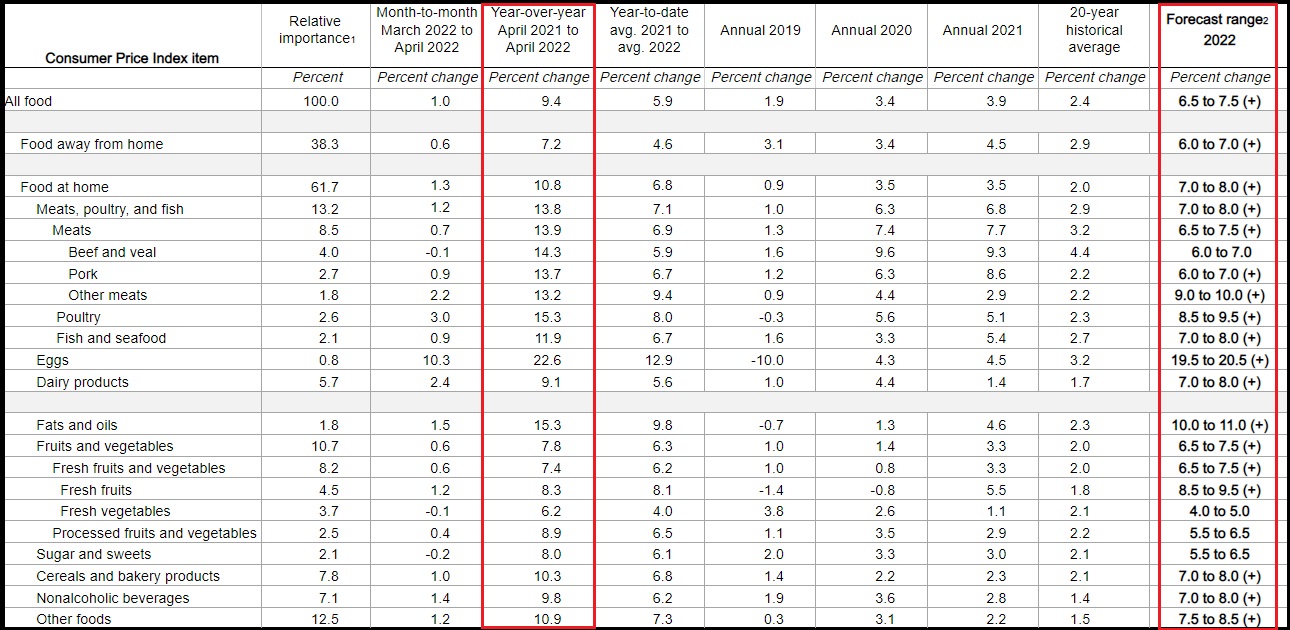

Keep in mind the data is national & skewed toward low estimations as represented by (+).

When the USDA predicts egg prices increasing by 19.5 to 20.5% (from where those prices are now), there will be regions with much higher retail increases than estimated.

Just two months ago, USDA had egg inflation at 2.5%-3.5% range, year over year. Again, that’s the scale of change; from a 3.5% forward outlook to a 20.5% forward outlook effective right now.

Food at home (grocery store) prices: up 7% to 8% in this monthly review, versus the April outlook of a rise of 5% to 6%. That means the USDA is predicting the highest grocery store price rise since 1980 when prices rose 8.1% (prices rose 7.2% in 1981). There is no reason to think the USDA forecast will not rise again in June.

[Click graphic to expand – Data Set Here]

If you have not taken food price stability seriously before now, please take proactive measures to secure your family. We are talking about future retail food prices that were simply unfathomable last year.

You know how much prices at the supermarket have increased in the last six months. Double that, and there’s your estimation for food prices later this fall.

Behind all the datasets, statistics, BEA, BLS, USDA and analysis of these things, there are real people living paycheck-to-paycheck that are likely to be in serious food insecurity position for the first time in their lives.

I’m not talking about poor people, I’m talking about solid upper middle-class working families with kids who are already being hit hard by gasoline, energy, housing and grocery store increases. Another twenty percent increase in food costs can easily become a crisis.

The core issue is this snowball of production costs inside the field to fork supply chain. Diesel prices, fertilizer prices, energy prices, seed and feed prices, all of it has doubled and tripled in less than a year.

Add in transportation and distribution costs that have doubled, and all of that cumulative impact is going to flow through the food supply chain from the field to the processor (wholesaler), and into the supermarket. Fresh foods, especially in the produce section, will catch many people off guard.

Not all news associated with this is bad news. As you read this you have information that allows you to take control and be proactive. YOU will not be part of the national population that is stunned in September and October. YOU know what is coming. With that in mind, do what you can today, tomorrow, this week, to be proactive and offset the impact. Taking action reduces stress.

Perhaps shop proactively for your holiday shelf stable food items now. Look at the circulars and on-line for coupons, not for then – but for use now. Perhaps learn to make some of the foods you would normally purchase already prepared. Small proactive seeds, kept in mind while carrying on day-to-day life.

I know from reading comments that many of you have planted ‘victory gardens’ this year. Those harvests are worth 50% more now they were three months ago. That’s the way to look at it. Every amount of saving matters…. and yes, grandma carefully washed the aluminum foil and reused it for a reason.