QUESTION #1: Hi Mr. Armstrong,

Might the current correction be the set up for the long awaited slingshot move?

Regards,

BE

COMMENT #1: I just wanted to say thank you. I sold out on the ECM and bought puts on the market. You just paid off my mortgage.

God bless you!

HJ

COMMENT #2: Marty, you are the only person who has the guts to make forecasts in the middle of a panic up or down. Your calls are beyond belief. No wonder the big boys call you.

KE

COMMENT #3: Hi Martin. Do you think the Fed and other Central Banks will cut rates due to the coronavirus and/or the market decline?

Socrates really helped me avoid this correction and even make some money.

Thank you.

AG

COMMENT #4: Hi Martin,

I don’t recall you ever commenting on the NYSE Composite Index. Just in case you don’t know. The all time high for the NYSE Comp Index is January 17, 2020. Right in sync with the ECM turn on Saturday Jan. 18. Most peoples focus is on the indexes that are tradable. So it is understandable that most people do not know the NYSE Comp index synced up perfectly with the ECM.

Perhaps you could mention this on your blog when commenting on the US stock market monthly closing today.

This weeks BIG down move will only increase your legendary status as the worlds top financial adviser.

Thank you so much for the private blog post last Sunday giving everyone a big warning of what was about to happen this week. The high for the week in the SP500 futures was last Sunday night at the 6 pm open.

Big Time Move Martin. Thank you from the bottom on my heart.

Sincerely,

DP

REPLY: The #1 golden rule is simple: What goes up, also comes down! Experience is something we gain through life. It is not easily acquired. We must make mistakes in order to gain knowledge. If someone wants to become an analyst, you must be in the game a long time to learn the twists the markets will always throw at you.

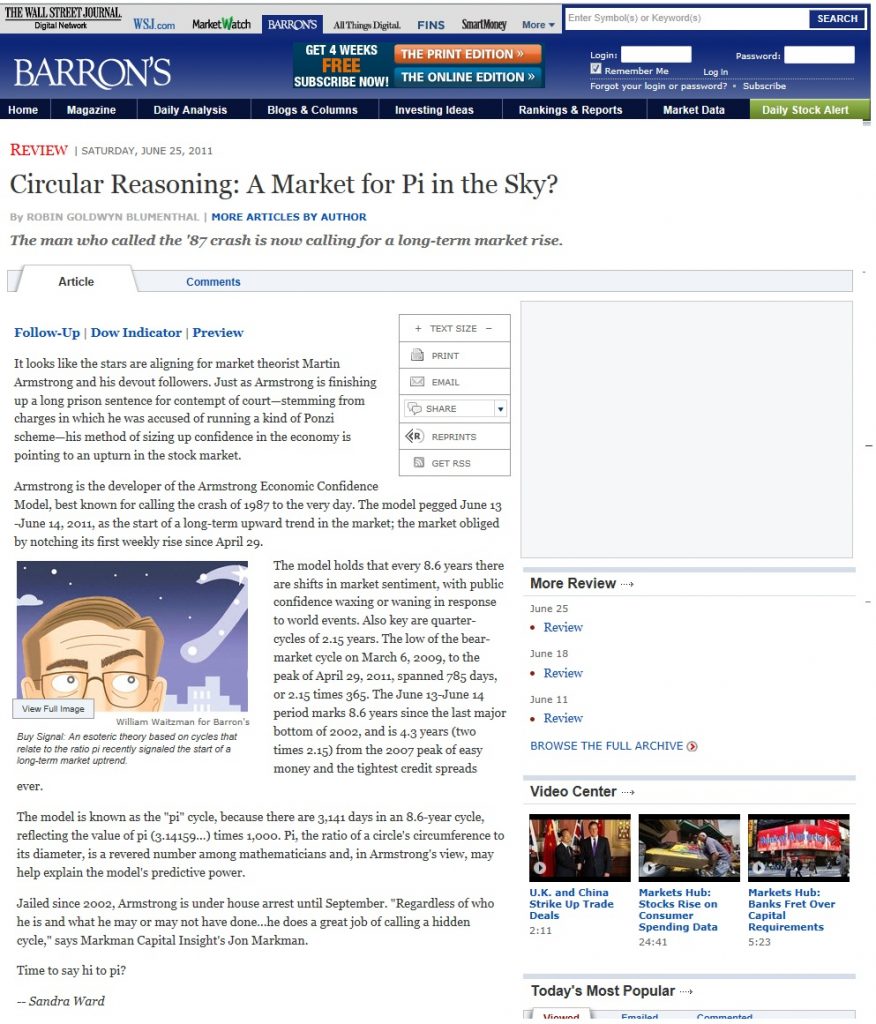

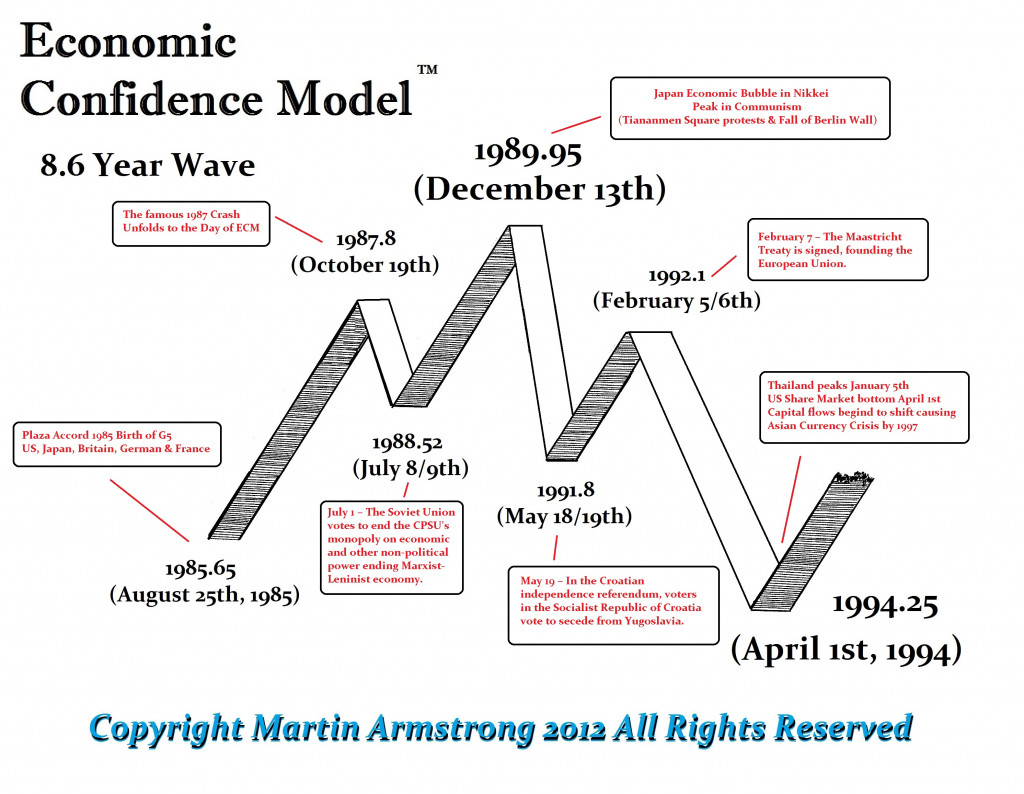

In the New Yorker Article on me back in October 2009, they wrote: “Armstrong remembers him coming out of his office in September 1998, two months after he’d got short in front of the ruble crisis. Monica Lewinsky was on TV. ‘My oscillators just turned,’ Armstrong announced. He booked his profits, pulled out of the market, and went to his beach house, on the Jersey Shore.” The 1998 turn saw the S&P 500 peak the very day of the ECM. That warned me that there would be a serious crisis and that became the Long-Term Capital Management debacle when the Fed bailed out a hedge fund. The currencies peaked 8/17 and the games began in September.

Here we had the NYSE, and even the Dow peaked on the ECM, but the Dow followed the NASDAQ into its high which was due in February. Our Panic Cycles were due this week into March. What I have learned over the years is the real opponent is not the market — it is yourself! People always want to blame someone else for their loss. They will be the sort of people who are incapable of ever mastering the markets because they are incapable of ever learning from their mistakes. Always remember, you are battling against your own emotions.

I have come to LEARN that the harder it is to do a trade, the more likely it is absolutely correct. That statement in the New Yorker that I went to the beach after closing my short positions was not a celebration. It was discipline, for it was very hard to cover shorts and flip to a long position emotionally when the entire world says there will be no tomorrow.

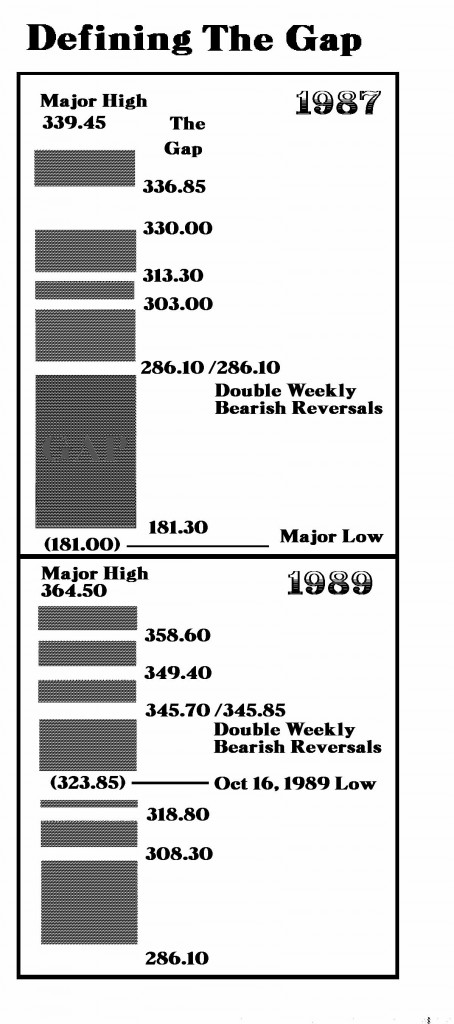

The entire purpose of the Reversal System is to provide definitive levels in a market that is NOTdependent upon human emotion — mine or yours!

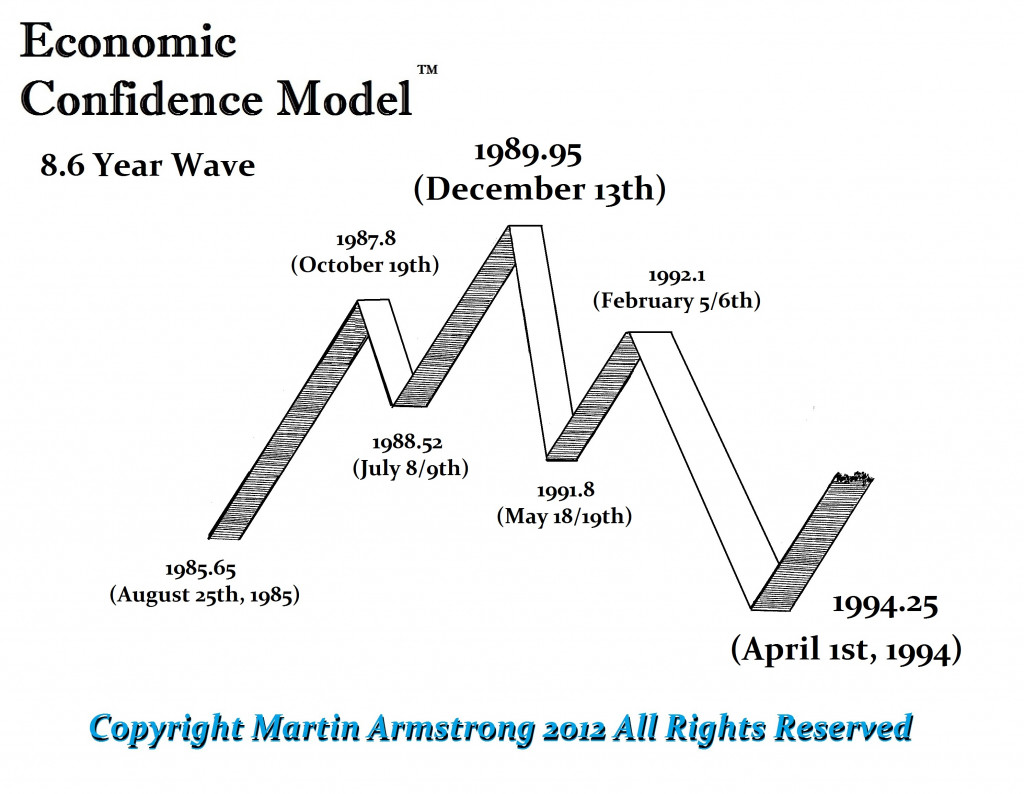

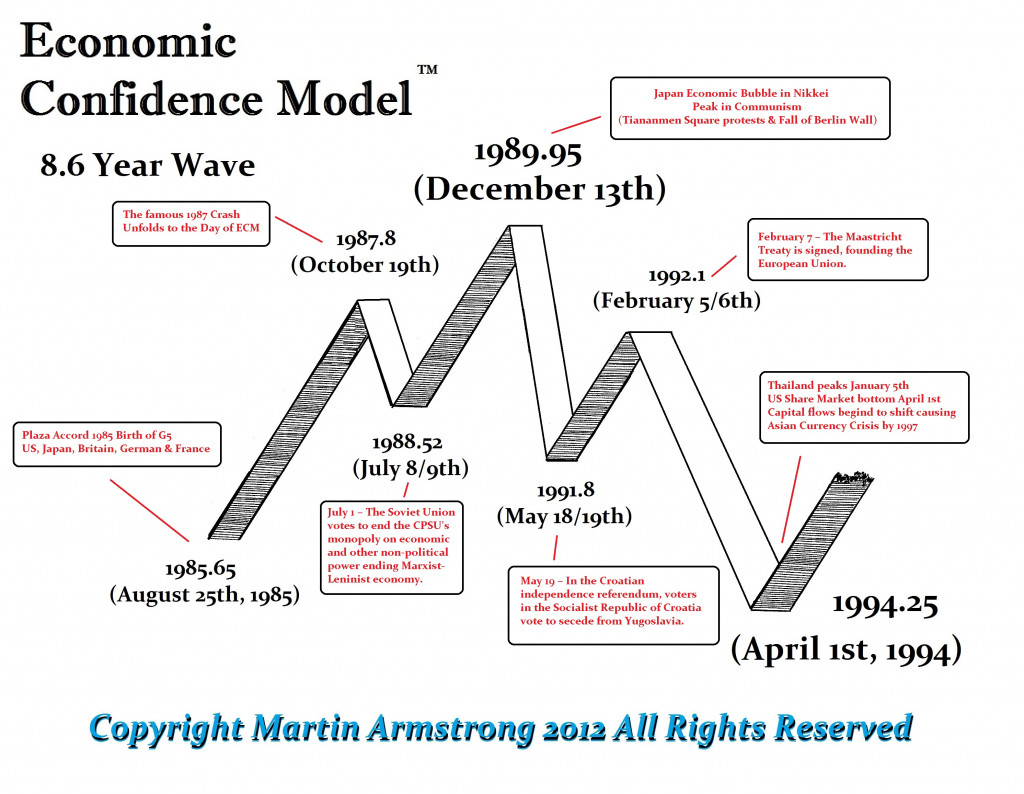

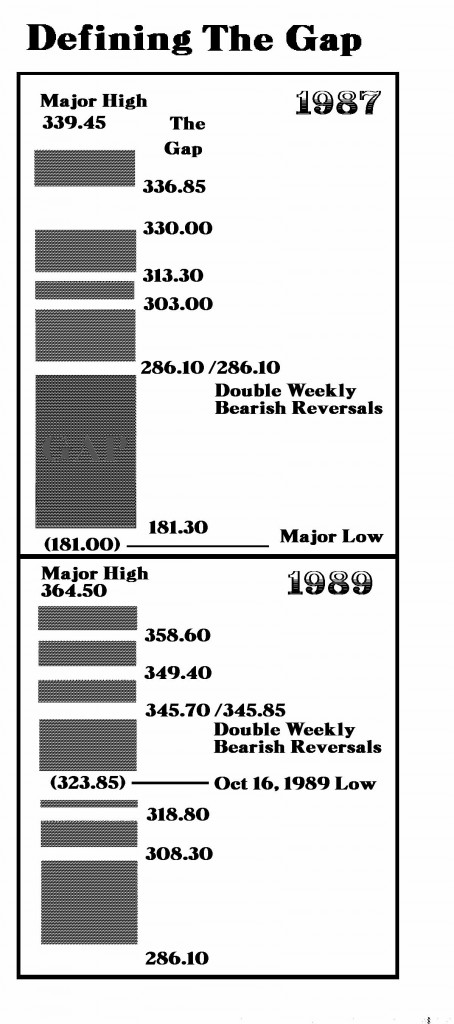

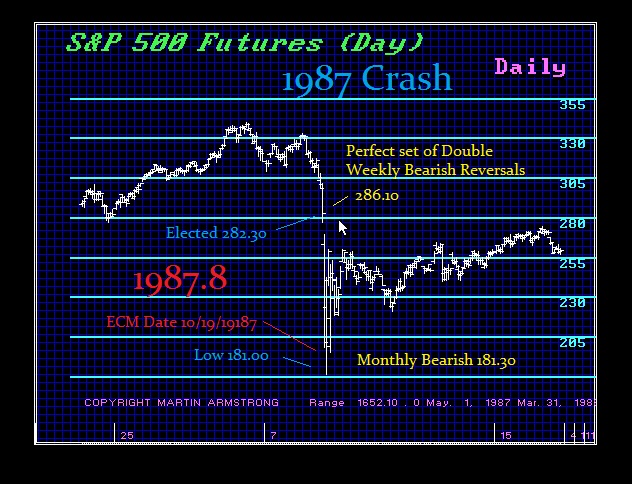

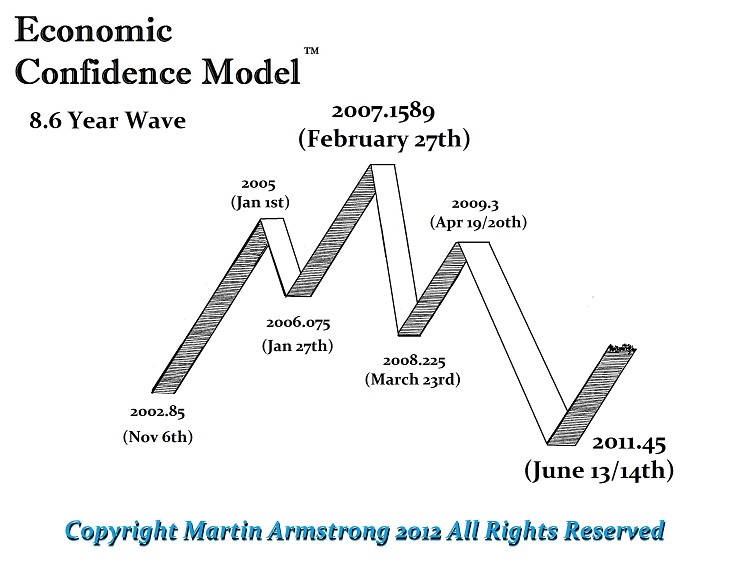

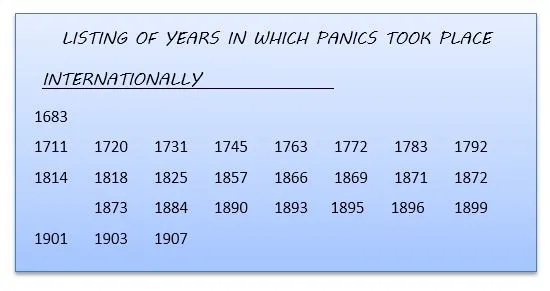

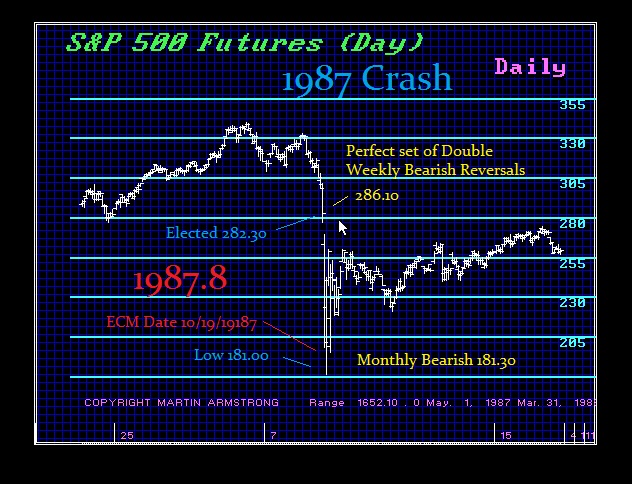

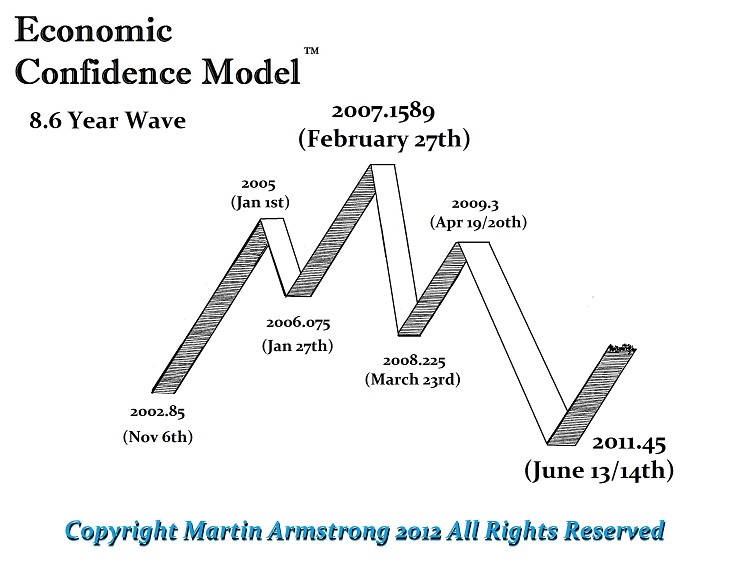

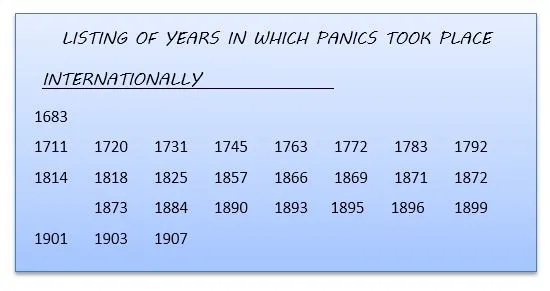

It does not matter if we are looking at 1987, 1998, 2007, or 2020. The numbers are the numbers. In the case of the 2007 ECM, the very day of the panic began on February 27, 2007. I have explained many times that I discovered the frequency from a list of international panics between 1683 and 1907 spanning 224 years with 26 events. The high in 2007 came intraday on October 11, 2007, which was 26.2 intervals of 8.6 days, or in other words it was fractal. However, the highest daily closing was two days before on 10/09, which made it precisely 224 days.

There are people who are so desperate to discredit the Economic Confidence Model and that remains a mystery to me. Are they the Flat Earth types that simply refuse to consider anything? Or are they paid for by “The Club” who are desperate to make money trading against the people and manipulating them at will? I really do not know. All I can do is say, “Hey look at the interesting order!” This proves the world is not just random chaos. There is a Secret Cycle or hidden order behind the curtain.

Insofar as the pressure on the Federal Reserve, we can see that pressure has been building in the form of the Repo Crisis into February. There is a Directional Change here with February and we should expect higher volatility in April/May where we have a turning point and a Directional Change. The entire Repo Crisis may begin to cause a severe crisis of confidence by the time we reach May/June.

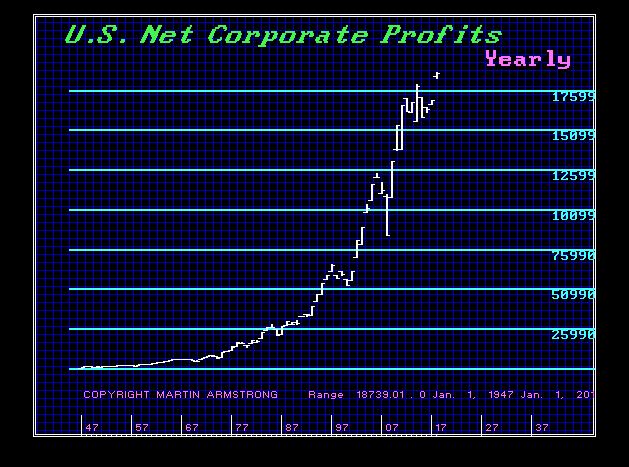

Yes, this appears to be the beginning of a slingshot move