Posted originally on CTH on July 27, 2025 | Sundance

Office of Management and Budgets (OMB) Director Russ Vought appears on CNN to discuss the problems noted with the Federal Reserve (FED) as the organization viewed their ‘independent’ status as meaning beyond accountability. The FED has been operating without any oversight until President Trump and Russ Vought began a baseline review of how they spend taxpayer funds.

As noted by Director Vought, the FED can have independence and yet they must be held accountable to the American people. President Trump is that accountability piece and the FED were not familiar with scrutiny. They are now.

.

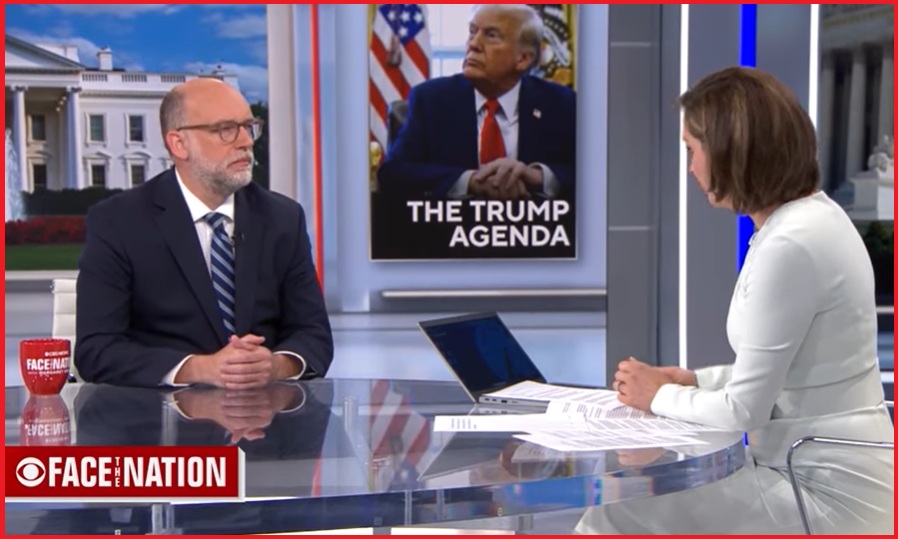

Russ Vought also appeared on Face the Nation to receive questions from the insufferable and ever-pontificating Margaret Brennan. Video and Transcript Below:

[Transcript] – MARGARET BRENNAN: We begin today with the director of the White House Office of Management and Budget, Russell Vought, welcome to ‘Face The Nation.’

DIRECTOR OF THE OFFICE OF MANAGEMENT AND BUDGET RUSSELL VOUGHT: Thanks for having me.

MARGARET BRENNAN: There’s so much to get to with you. Let’s start on what’s going on with the Federal Reserve. If you take the president at his word, he does not intend to fire the Federal Reserve Chair, Jerome Powell- though he’s still criticizing him. What is the President seeking in a successor when his term ends in May 2026?

VOUGHT: Well, I think he’s looking for a chairman that’s not continually too late to the developments in the economic marketplace. And I think what we’ve seen with Chairman Powell, he was very late in the Biden administration to raise rates, to articulate the concern with regard to the Biden administration’s spending. We all knew on the outside- even Larry Summers knew that we were going to have an issue with regard to inflation. And we saw, you know, recent, historical inflationary levels that we hadn’t seen before. And now he is too late to lower inflation rates and so that is the kind of thing that we want to see in the next chairman of the Federal Reserve. And one of the reasons why is–

MARGARET BRENNAN: –More of a focus on inflation?

VOUGHT: –want an ability to recognize the developments in the economic marketplace. In this case, we want to be able to see lower rates and to have an ability to get the economy going. And one of the things we saw with Powell is that one of the reasons he was so late was because he didn’t understand that inflation is largely a monetary phenomenon. He kept saying that inflation was transitory. He didn’t tackle the problem, and now he’s, again, too late, and you marry that with fiscal mismanagement at the Fed. It’s a huge problem that we’re trying to raise the country’s awareness level with.

MARGARET BRENNAN: But as you know, the Fed is structured in a way where he doesn’t have unilateral control. There’s a governing board. Others weigh in. You did work on Project 2025, and we went back and looked at what they said in there about the Fed. As people may know, that’s a Heritage Foundation product that got a lot of scrutiny during the campaign. the chapter on the Fed called for Congress to overhaul the Fed’s focus and powers. Is that what you’re looking to do in 2026?

VOUGHT: I don’t even know what that chapter says. All I know, in terms of the President, the President has run on an agenda. He’s been very clear about that. All that we’re doing is- in this administration is running on- is implementing his agenda.

MARGARET BRENNAN: You don’t want to overhaul the Fed?

VOUGHT: We want an economic system that works for the American people, that includes the Fed. And the President has been very clear that all he’s asking from the Fed is lower interest rates, because he thinks it’s important. When you look at across the across the globe, and you have countries lowering rates, and yet we don’t see that in this country, given all of the positive economic indicators that we’re seeing. And then we have fiscal mismanagement at the Fed with regard to this building renovation that I’m sure you will ask me about. Those are the kinds of things that we want to see from the Fed. This is not part of an existential issue with regard to the Federal Reserve.

MARGARET BRENNAN: Well, the Fed is indicating that they are trending towards a rate cut, though probably not as soon as this week. We mentioned those renovations at the top of the program, but I do want to ask about spending, or lack thereof, that the Trump administration is trying to direct. The White House said they will actually release the remaining $5 billion in education, funds that had been withheld from public schools until recently. There were 10 Republican senators very worried about this, and came out and said, your claim that the money goes to radical left wing programs was wrong. What changed your mind? What made you release this money?

VOUGHT: Well, we had been going through a programmatic review with these funds. These are programs that, as an administration, we don’t support. We’ve called for the elimination of them in the President’s budget for precisely the reasons of which they flow to often left wing organizations. Thankfully, the President came into office, put an executive order that said it can’t- these funds can’t go to these types of initiatives. I’ll just give you one example, English language acquisition was flowing to the New York school public education system to go into illegal immigration advocacy organizations. Preschool development grants doesn’t actually go to preschoolers. It goes to the curriculum for putting CRT into the school system for people as young- children as young as four years old.

MARGARET BRENNAN: Well, these senators said it goes to adult learners working to gain employment skills and after school programs.

VOUGHT: And what we–

MARGARET BRENNAN: So you deemed it is necessary?

VOUGHT: We believe that it’s important to get the money out right now, but we have taken an extended time frame to be able to make sure it doesn’t go to the types of things that we saw under the Biden administration.

MARGARET BRENNAN: Because, you know, Senator Lindsey Graham told the Washington Post, the administration is looking at considering clawbacks from the Department of Education. This, you know, rescissions process. Is that the plan? Are you seeking to claw back education funds in a rescissions package? And if so, when are you sending that up?

VOUGHT: We may be, we’re always looking at potential rescission options. This is an- this is a set of funding that we wanted to make sure it got out. We did our programmatic review. We wanted to make sure it got out before the school year, even though it’s multi-year funding. This is not funding that would expire at the end of this year. We are looking to do rescissions package. We’re always gauging the extent to which the Congress is willing to participate in that process, and we’re- be looking at a lot of different options along those lines, but certainly have nothing to announce here today. But we’re thrilled that we had the first rescissions package in decades, and we’ve got the process moving again.

MARGARET BRENNAN: So no rescissions package before September?

VOUGHT: Not here to say that. We’re looking at all of our options, we will look at it and assess where the Hill is, what are the particular funding opportunities that we have, but nothing that we’re going to announce today,

MARGARET BRENNAN: Because some of the funds that do expire in September have also been held up on the health front. Senator Katie Britt of Alabama, 13 other Republicans, came out with a letter saying that you’ve been slow in releasing funds for the National Institute of Health for research into cardiovascular disease, cancer. Are those funds going to be released?

VOUGHT: Again, we’re going through the same process with the NIH that we did with the education. I mean–

MARGARET BRENNAN: But there’s a time cost here.

VOUGHT: –$2 million for injecting dogs with cocaine that the NIH spent money on, $75,000 for Harvard to study blowing lizards off of trees with leaf blowers. That’s the kind of waste that we’ve seen at the NIH. And that’s not even getting to the extent to which the NIH was weaponized against the American people over the last several years, with regard to funding gain of function research that caused the pandemic. We have a- we have an agency that needs dramatic overhaul. Thankfully, we have a great new head of it, but we’re going to have to go line by line to make sure the NIH is funded properly.

MARGARET BRENNAN: Are you going to release the cancer funding research? And the cardiovascular disease research funding?

VOUGHT: We’re going to continue- we’re going to continue to go to the same process that we have gone through with regard to the Department of Education, that every one of these agencies–

MARGARET BRENNAN: Before September, that money will be released?

VOUGHT: –and we will release that funding when we are done with that review.

MARGARET BRENNAN: Because, as you know, there’s concern that you’re withholding the money, hoping it just won’t be spent. I mean, if you look at the White House budget, it does call for a 26% cut to HHS, $18 billion cut to NIH. Is this just a backdoor way to make those cuts happen?

VOUGHT: Well, I don’t want to speak to any specific program with regard to what we might do with regard to rescissions throughout the end of this fiscal year, but we certainly recognize that we have the ability and the executive tools to fund less than what Congress appropriated, and to use the tools that the Impoundment Control Act, a bill we’re not- a law that we’re not entirely thrilled with, gives us to- to send up rescissions towards the end of the fiscal year.

MARGARET BRENNAN: So just for our viewers, the Impoundment Control Act is the legal mechanism for the President to use to delay or avoid spending funds appropriated by Congress. You seem to want to have an argument, or Democrats think you want to have an argument, over the power of the purse and who holds it. Do you want that to go to the Supreme Court?

VOUGHT: Well, look, for 200 years, presidents have the ability to spend less than the congressional appropriations. No one would ever dispute, and our founders didn’t dispute that Congress has the ability to set the appropriation ceiling. But 200 years of presidents, up until the 1970s had the ability to spend less, if they could find efficiencies, or if they could find waste that an agency was doing.

MARGARET BRENNAN: — That sounds like a yes?–

VOUGHT:– We lost that ability in the 1970s. The president ran on restoring that funding authority to the presidency, and it’s vital. If you look at when we started to lose control fiscally, it was right around the time of the 1970s.

MARGARET BRENNAN: Well, many senators, Republican senators, are very uncomfortable with the tactics that you are using. Senator Murkowski, Senator Collins, that chair of the appropriations committee that is really running this- this funding process. And Senator Collins said you’re pushing the limits of what the executive can do without the consent of the- of the legislative branch. You need to work with her to get your budget through. And in fact, you need to also be able to get Democrats on board to get to that 60-vote threshold to pass any kind of government funding to avoid a government shutdown at the end of September.

VOUGHT: I have a great relationship with Senator Collins. I appreciate the work she does. She is the chairman of the Appropriations Committee, so obviously we’re going to have differences of opinion as to the extent to which these tools should be used. I mean, she had concerns with the rescissions package. The rescissions package was a vote that Congress had to make these cuts permanent–

MARGARET BRENNAN: — Under- on a party line vote, she says, you want to go do these clawbacks. You do it through regular order, and you can put- you can put rescissions into an appropriations bill–

VOUGHT: –But that was in fact, under regular order. That’s the challenge, is the appropriators want to use all the rescissions, they want to put them in their bills, and then they want to spend higher on other programs. We act- we’re $37 trillion in debt, Margaret. We actually need to reduce the deficit and have a dollar of cut go to $1 a deficit reduction. That’s not what the appropriators want, and it’s not news that the Trump administration is going to bring a paradigm shift to this town in terms of the business of spending.

MARGARET BRENNAN: You would acknowledge that you just added to the debt and to the deficit with this–

VOUGHT: — No, I would not acknowledge that. We reduced–

MARGARET BRENNAN: — The spending and tax bill that just passed?

VOUGHT: Correct.

MARGARET BRENNAN: Where you lifted the debt ceiling.

VOUGHT: The debt ceiling is an extension of the cap on what’s needed to pay your previous bills. In terms of the bill itself, it is $400 billion in deficit reduction, $1.5 trillion in mandatory savings reforms, the biggest we’ve seen in history.

MARGARET BRENNAN: Well, I want to make sure I get to the rest of this before I let you go here, because we’re running out of time. You said, a few weeks ago, that the appropriations process needs to be less bipartisan. You only have 53 Republicans. You do need Democrats to get on board, here. Is saying something like that intended to undermine negotiations? Do you actually want a government shutdown?

VOUGHT: No, of course not. We want to extend the funding at the end of this fiscal year. We understand, from a math perspective, we’re going to need Democrats to do that–

MARGARET BRENNAN: Well, what does less bipartisan mean?

VOUGHT: Well, Margaret, the whole week, the Democrats were making the argument that if you pass the rescission bill, that you were undermining the bipartisan appropriations process. So, if Brian Schatz and every other appropriator is making that argument for a week–

MARGARET BRENNAN: –The chair of the Senate Appropriations Committee is who said that–

VOUGHT: –you have to be able to respond and say, if you’re going to call a rescissions package that you told us during the month of January and February that we should use to do less spending, if you’re going to say that is undermining the bipartisan appropriations process, then maybe we should have a conversation about that. That is all it was meant to convey.

MARGARET BRENNAN: But, the alternative to this process is another continuing resolution, these stop-gap measures. Are you open to that, because that would lock in Biden-era funding? What is your alternative here? If you want a less bipartisan process, how do you solve for this? Because it sounds like you’re laying the predicate for a shutdown.

VOUGHT: We are not laying the predicate for a shutdown. We are laying the predicate for the fact that the only thing that has worked in this town- the bipartisan appropriations process is broken. It leads to omnibus bills. We want to prevent an omnibus bill, and all options are on the table to be able to do that.

MARGARET BRENNAN: All options are on the table?

VOUGHT: We need an appropriations process that functions. We’re going to go through the process. We’re going to work with them, and we’re going to do everything we possibly can to use that process to have cheaper results for the American taxpayer.

MARGARET BRENNAN: I’m told we’re out of time. Russell Vought, thank you for your time today.