Published on Nov 23, 2018

Tag Archives: progressives

Goldman Sachs Going Down on the Pi Target?

Armstrong Economics Blog/Corruption

Re-Posted Nov 23, 2018 by Martin Armstrong

The Abu Dhabi sovereign wealth fund sued Goldman Sachs on the Pi Target, Wednesday, November 21st, 2018, for allegedly conspiring against the Middle Eastern fund to further a criminal scheme by Malaysia’s scandal-plagued 1MDB. The suit, filed in a New York court on behalf of Abu Dhabi’s International Petroleum Investment Company (IPIC), names Goldman Sachs as well as former Goldman officials who were charged by the US Justice Department in indictments unsealed earlier this month. “This action seeks redress for a massive global conspiracy on the part of the defendants to defraud and injure plaintiffs,” said the lawsuit, which also named former executives from IPIC and its subsidiary Aabar Investments.

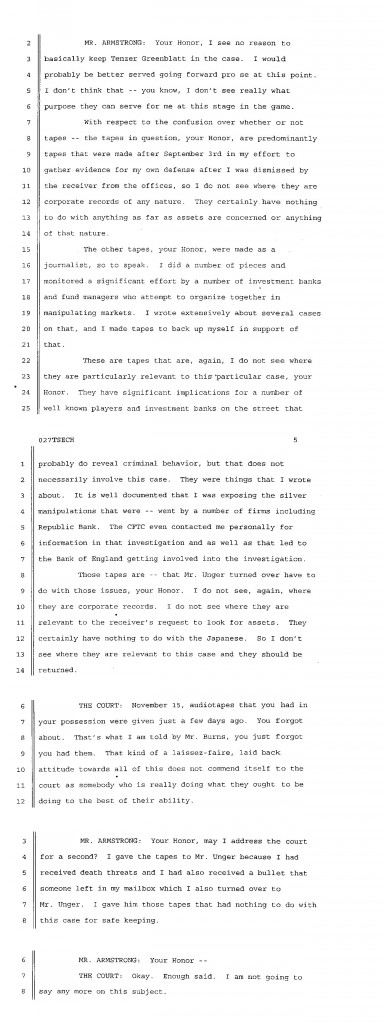

It was Alan Cohen who I believe was in charge of reviewing all deals as head of Global Compliance at Goldman Sachs and now he is at the top of the SEC. I believe he was given the job at Goldman Sachs because he threatened my lawyers to turn over all tapes I had of conversations with the various bankers including Goldman Sachs’ metal desk. It is now only logical that the Abu Dhabi sovereign wealth fund should also name Alan Cohen given he was the head of Global Compliance.

It was Alan Cohen who I believe was in charge of reviewing all deals as head of Global Compliance at Goldman Sachs and now he is at the top of the SEC. I believe he was given the job at Goldman Sachs because he threatened my lawyers to turn over all tapes I had of conversations with the various bankers including Goldman Sachs’ metal desk. It is now only logical that the Abu Dhabi sovereign wealth fund should also name Alan Cohen given he was the head of Global Compliance.

Here are just a few tapes that I found copies of. The bulk the SEC claimed were all destroyed in the 911 attack. There have continually been questions of the ethics inside Goldman Sachs. The entire crash in the world economy due to the Mortgage Back Securities were designed by Goldman Sachs. The major product they sold the day of the high of the ECM back in 2007 was widely touted as “Abacus 2007-AC1: Built to fail.”

As the Financial Post wrote: “Goldman has often been criticized for selling billions of dollars of debt securities, called credit default obligations (CDOs), filled with mortgages that the bank itself allegedly thought were overvalued.”

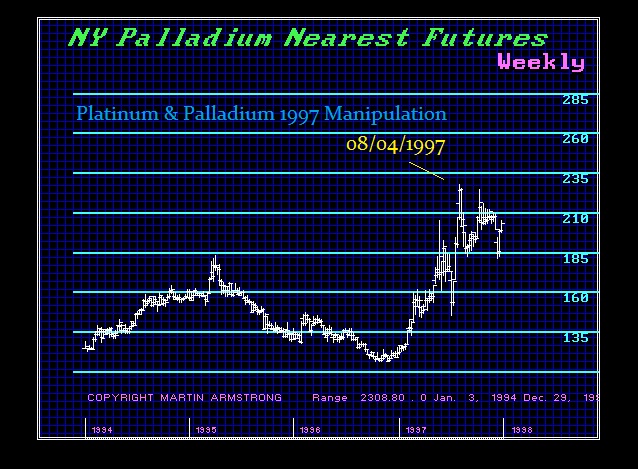

I believe it was Goldman Sachs who paid bribes to Russian politicians to recall Platinum from the market and temporarily stop sales to allegedly take an “inventory” of their stockpile. This sent prices soaring back in 1997. Russia stopped all shipments of Platinum and Palladium in December, was expected to resume exports. The hedge fund Tiger Management, a New York hedge fund back then, announced it sell some of its palladium holdings which it was believed held about one-fifth of the annual world supply of palladium (1.5 million ounces). This was followed by the silver manipulation in 1998 with most of the same firms involved.

I believe it was Goldman Sachs who paid bribes to Russian politicians to recall Platinum from the market and temporarily stop sales to allegedly take an “inventory” of their stockpile. This sent prices soaring back in 1997. Russia stopped all shipments of Platinum and Palladium in December, was expected to resume exports. The hedge fund Tiger Management, a New York hedge fund back then, announced it sell some of its palladium holdings which it was believed held about one-fifth of the annual world supply of palladium (1.5 million ounces). This was followed by the silver manipulation in 1998 with most of the same firms involved.

The charging documents, unsealed in federal court on November 1st, 2018 refer to an unidentified Goldman executive as an unindicted co-conspirator who approved of the alleged bribery. The street rumor is that happens to be the executive Andrea Vella, who was Goldman’s co-head of Asian investment banking. Interestingly, Goldman Sachs suspended him the very same day that prosecutors unsealed the criminal complaints. It was also Andrea Vella was had to respond to cross-examination from Philip Edey QC, who was a lawyer acting on behalf of yet another government accusing Goldman Sachs of questionable dealings. That was the Libyan Investment Authority, which claims the investment bank took advantage of its financial illiteracy back in July 2008.

Let us not forget Goldman Sachs’ role in blowing up Greece and instigating the beginning of the Euro crisis. The crisis was created by a deal Greece struck with Goldman Sachs, that was engineered by Goldman’s CEO, Lloyd Blankfein. Blankfein and his Goldman team helped Greece hide the true extent of its debt, and in the process almost doubled it. The speculation back in 2015 was that Greece would file a lawsuit against Goldman Sachs for creating that debt crisis. There were the personal meetings between Greece and Gary Cohn to do that deal. When the client is a government, it ALWAYS involved the top people.

In 2001, Greece was looking for ways to disguise its mounting financial debt in order to just get into the Eurozone. The Maastricht Treaty required all Eurozone member states to show improvement in their public finances. Greece was heading in the wrong direction and Goldman Sachs came to the rescue. They arranged a secret loan of €2.8 billion and disguised it as an off-the-books “cross-currency swap” that was a complicated transaction in which Greece’s foreign-currency debt was converted into a domestic-currency obligation using a fictitious market exchange rate. They made 2% of Greece’s debt magically vanish from its national accounts. Goldman Sachs charged €600 million euros which was about 12% of Goldman’s revenue for 2001 giving them a record sales year.

Then the deal turned sour in the aftermath of 9/11 attacks when bond yields plunged. They resulted in a huge loss for Greece because of the formula Goldman had crafted to their benefit dictating the country’s debt repayments under the swap. By 2005, Greece owed almost double what it had put into the deal and thus we see the European debt crisis unfold.

Until 2008, European Union accounting rules allowed member nations to manage their debt with these so-called off-market rates in swaps. In the late 1990s, JPMorgan enabled Italy to hide its debt by swapping currency at a favorable exchange rate, thereby committing Italy to future payments that didn’t appear on its national accounts as future liabilities. However, what Goldman did to Greece made Italy look like child’s play.

Goldman Sachs’ share price is going down hard into 2019. The 159 level will be critical on a closing basis for the year. If that is breached, then we could see very major implications for the firm whereby it may no longer survive. There is technical support between 174 and 164. From a cyclical perspective, Goldman Sachs has peaked as an institution as of 2017. It was founded in 1869 and 17.2 x 8.6 = 147.92. That means, in fact, the 2017 closing was the all-time high for Goldman Sachs and this incident is its Death knell. Goldman Sachs may be going down for the count.

- August 2003 – Goldman Sachs creates Mortgage Back Securities & AIG Insures them

- February 2006 – AIG Stops writing CDS on subprime mortgages

- December 2006 – Goldman turns bearish on mortgage/real estate market

- July 2007 – Goldman Sachs demands $1.8 billion in insurance from AIG

- August 2007 – AIG posts $450 million as collateral

- November 2007 – AIG posts $2 billion with Goldman on $3 billion demand

- March 2008 – Goldman Sachs demands $6.6 billion from AIG

- March 2008 – Bear Stearns collapses on 13th

- August 2008 – Goldman Sachs takes a bearish view on AIG on 18th

- September 2008 – Gov’t Bails out Fannie Mae on 7th

- September 2008 – Lehman Brothers files for bankruptcy on 15th

- September 2008 – Treasury Hank Paulson bails out AIG to save Goldman 16th

- September 2008 – Paulson emails Congress with TARP 20th

- September 2008 – Goldman Sachs & Morgan Stanley become banks 21st

- October 2008 – Congress passes TARP on 3rd

- October 2008 – Goldman Sachs demand another $1.3 billion from AIG

- November 2008 – Federal Reserve creates Maiden III for Toxic Assets

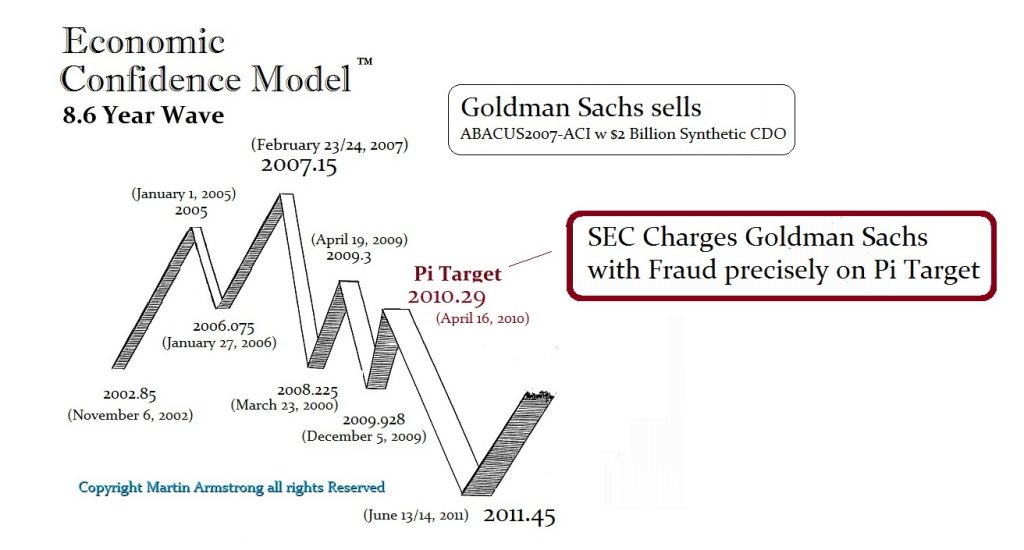

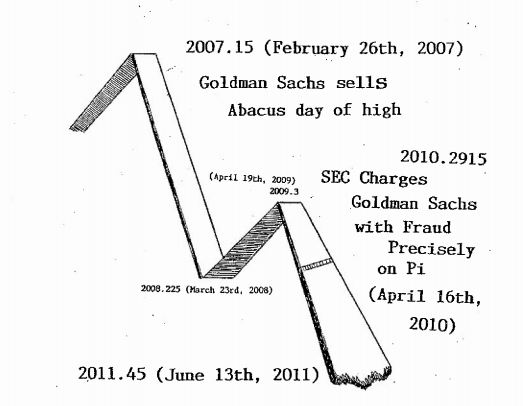

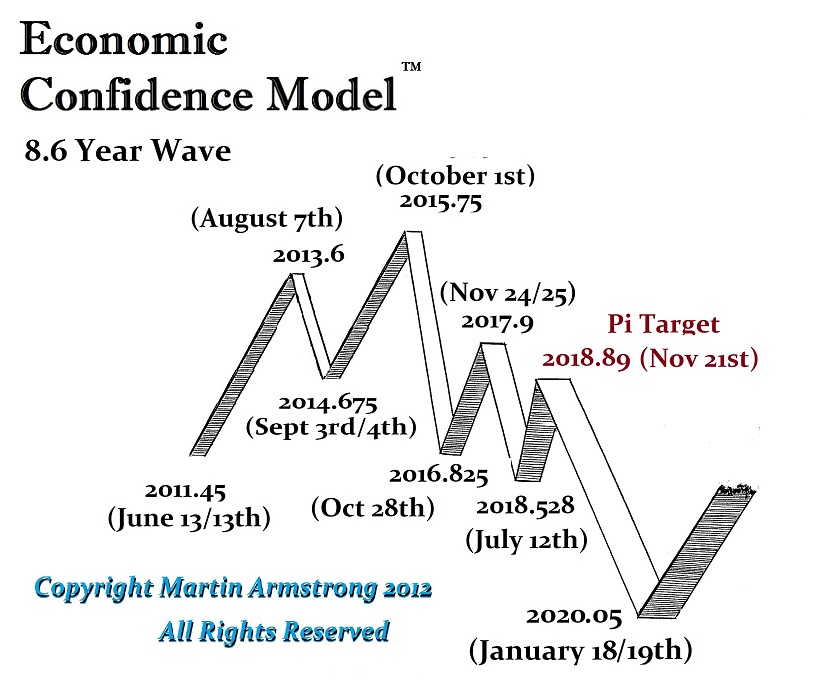

Here we have 2007.15 when Goldman Sachs sells precisely at the top of the ECM back in 2007 ABACUS2007-ACI which was a $2 Billion Synthetic CDO. It was then on the Pi Target when the SEC charged Goldman Sachs with fraud back on April 16, 2010, for that very transaction. Any small firm is imprisoned and stripped of its license. But Goldman Sachs has the SEC and the DOJ in its back pocket along with the judges and politicians. Now again on the precise Pi Target Abu Dhabi filed a lawsuit against Goldman Sachs Wednesday (Nov 21) for allegedly conspiring against the Middle Eastern fund to further a criminal scheme by Malaysia’s scandal-plagued 1MDB.

Here we have 2007.15 when Goldman Sachs sells precisely at the top of the ECM back in 2007 ABACUS2007-ACI which was a $2 Billion Synthetic CDO. It was then on the Pi Target when the SEC charged Goldman Sachs with fraud back on April 16, 2010, for that very transaction. Any small firm is imprisoned and stripped of its license. But Goldman Sachs has the SEC and the DOJ in its back pocket along with the judges and politicians. Now again on the precise Pi Target Abu Dhabi filed a lawsuit against Goldman Sachs Wednesday (Nov 21) for allegedly conspiring against the Middle Eastern fund to further a criminal scheme by Malaysia’s scandal-plagued 1MDB.

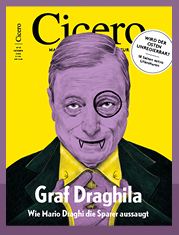

Because we have 3 countries now bringing charges and/or suits against Goldman Sachs, it appears that this will mark the beginning of the end for the firm. When the Euro cracks, they will also be blamed for their role in Greece and the rest of Europe. Don’t forget that Mario Draghi is also ex-Goldman Sachs. When the Euro cracks, there will be a microscope applied to every communication that was ever carried out between Draghi and Goldman Sachs. Every trade they have pulled off will be inspected with its tentacles into the European bond market.

Because we have 3 countries now bringing charges and/or suits against Goldman Sachs, it appears that this will mark the beginning of the end for the firm. When the Euro cracks, they will also be blamed for their role in Greece and the rest of Europe. Don’t forget that Mario Draghi is also ex-Goldman Sachs. When the Euro cracks, there will be a microscope applied to every communication that was ever carried out between Draghi and Goldman Sachs. Every trade they have pulled off will be inspected with its tentacles into the European bond market.

After the government took down Solomon Brothers back in 1991 for manipulating the US Treasury Auctions, Goldman Sachs began a program of buying protection. They allegedly began aggressively funding politicians and then began stuffing their people in key places of government. They have been known as “Government Sachs” among dealers and they have held a power-house political hand in their back pocket. Our model, at least, warns that day is NOW OVER!!!!!!

The computer would have shorted Goldman Sachs if it could. The Global Market Watch has pinpointed a high and it warned this stock was moving into a Waterfall on the Monthly Level. This is one stock to get out of. We will see major new lows next year.

Abu Dhabi file suit Against Goldman Sachs for Criminal Fraud

Armstrong Economics Blog/Corruption

Re-Posted Nov 22, 2018 by Martin Armstrong

The real curious thing is that the Abu Dhabi sovereign wealth fund filed a lawsuit against Goldman Sachs precisely on the Pi Target Wednesday (Nov 21) for allegedly conspiring against the Middle Eastern fund to further a criminal scheme by Malaysia’s scandal-plagued 1MDB. So here we have the suit filed precisely on the Pi Target and precisely at the top of the ECM back in 2007, that is when Goldman Sachs sold ABACUS2007-ACI which was a $2 Billion Synthetic CDO. The SEC charged Goldman Sachs with fraud back in 2007 for that transaction, but of course, did nothing criminal because Goldman Sachs controls the SEC. Now the top adviser in the SEC is Alan Cohen who was head of Global Compliance and would have signed off on the Malaysian deal.

Them, on the Pi Target from the previous 8.6-year wave, April 16th, 2010, that is when the SEC charged Goldman Sachs with fraud with regard to the ABACUS2007 product. Here we now have Abu Dhabi filing suit for criminal fraud against Goldman Sachs precisely on the Pi Target of November 21, 2018.

We may FINALLY be witnessing the decline and fall of Goldman Sachs. Will do a more detailed report tomorrow – Black Friday

Clergy and the Caravan

I would like to believe that these left-leaning rabbis, ministers, and imams had good intentions, joining together to meet the caravan of migrants and provide them with food, clothing and solace, but their logic is deeply flawed. Whatever their intent, it is unconscionable and immoral for them to presume that they have the authority to offer the United States of America, home to more than 325.7 million American citizens, to any foreign hordes. In breaking the law, they are setting themselves above the law, which is something expressly forbidden in Judaism and Christianity.

Some of the rabbis used the Holocaust as false justification for the men’s trek to the north (95% of the lot are men), but theirs is a misplaced spirit of humanitarianism. They have drawn an unsuitable equivalence between the European Jews who were forced to flee their homes in fear for their lives with the Central Americans who were lured by the promise of welfare. This sense of social justice is peculiarly selective, inasmuch as the rabbis were silent when “Palestinian” youths were propelling incendiary kites and balloons over Israel for more than a half year, burning thousands of acres of precious land and life; silent during these years of firing rockets and mortars into Israel, killing, crippling, and destroying; silent when Jews are attacked on the streets of Israel, France, Sweden, and Brooklyn; and silent when jihada and anti-Semite, Linda Sarsour, rants her hatred against Jews and President Trump. Heck, they didn’t even show up to support the establishment of the US Embassy in Jerusalem, yet they managed to arise in support of an invasion into America by unknown, lawless thousands!

The leftist clerics are not entitled to overlook the possibilities that this migration is no different from the present-day Islamic migration (hijra) into Europe, creating havoc with their acts of rape, violence and destruction, bent on conquest by population. We know that Bartolo Fuentes, former Honduran congressman and one of the marches’ coordinators, established the caravan on March 12, 2017, and the small number grew to thousands as they passed through Guatamala, El Salvador, and Mexico. We cannot wait for recognizable uniforms, tanks, bazookas and cannons before calling it a threat. The firing pin has been pulled, the gun powder ignited, and these are the “bullets,” which, by their sheer number, are meant to be the overpowering human projectiles – and now guided by a misguided clergy.

Mexico was not able to stop these bullets, and her offer of asylum was rebuffed, proving that the marchers are not really seeking sanctuary. Mexicans agree with our President Trump, that this is an invasion, a “tsunami,” as the intruders continue north, waving their own flags and burning our Stars and Stripes – surely a sign of disrespect and haughty bravado, not humility.

Further, the hordes have shown their ingratitude by rejecting our food offerings, saying the meals are not “fit for pigs.” Such behavior, which expresses no appreciation or veneration for our country, warrants no compassion. What it does warrant is our understanding that they are not the “tired, poor, hungry masses.” They have thus far been well fed, clothed, and tended along their journey by socio-political progressives and the United Nations. If permitted entry, our shifting population would throw us into economic turmoil, with more taxes imposed on the middle class to pay for the non-working poor. Once again, this is the redistribution of wealth, the goal of “global justice,” such as fueled by the Occupy movements of 2011, and the heavy taxation and unemployment of the Obama years.

If not for President Trump’s strong support for our military and police forces that had been allowed to deteriorate during the “eight years,” we would now be in the throes of invasion, no borders, no sovereignty, and in rampant chaos. These clerics may well be of the same academic era that continues to weaken our male students, to intentionally destabilize our country, to have kept them ignorant of our history and what it took to establish these United States. They may not understand the goals of Progressivism/Communism and Islamism, but naïveté is inexcusable in leadership positions. If they are even partly responsible for the potential of unbridled disaster to our nation, they will have blood on their hands – and they would also succumb.

This is like no war we have ever fought. It is global as well as within our nation. The tactics differ as do the levels of progression and intensity, but the war is a certainty. How it is allowed to escalate is still up to us.

by Tabitha Korol

https://tinyurl.com/y7e6z63d

Entirely Predictable – Tech Stock Devaluations Sink U.S. Aggregate Stock Market…

November 20, 2018

CTH has pointed, repeatedly, toward a very specific economic and financial dynamic because President Trump is uniquely focused on Main Street’s “real economy“.

Everything happening in/around the financial markets is very predictable when you focus on understanding the principles of Main Street MAGAnomics and how those basic principles diverge from Wall Street’s “paper economy” (currently weighted by tech stocks).

Everything is happening in a very predictable sequence. Few understand the MAGAnomic reset and what was predicted to happen in the space between disconnecting a Wall Street economic engine (globalism and multinationals) and restarting a Main Street economic engine (nationalism/America-First). In 2016 CTH explained where we would be today. With current Wall Street events, perhaps it is worthwhile remembering the CTH forecast.

Originally outlined far more than a year ago. Reposted by request on Oct 11th.

President Trump’s MAGAnomic trade and foreign policy agenda is jaw-dropping in scale, scope and consequence. There are multiple simultaneous aspects to each policy objective; however, many have been visible for a long time – some even before the election victory in November ’16. What is happening within the financial markets should not be a surprise.

If we get too far in the weeds the larger picture is lost. Our CTH objective is to continue pointing focus toward the larger horizon, and then at specific inflection points to dive into the topic and explain how each moment is connected to the larger strategy.

Today, as a specific result of a very predictable stock market contraction, we repost an earlier dive into how MAGAnomic policy interacts with multinational Wall Street, the stock market, the U.S. financial system and perhaps your personal financial value. Again, reference and source material is included at the end of the outline.

If you understand the basic elements behind the new dimension in American economics, you already understand how three decades of DC legislative and regulatory policy was structured to benefit Wall Street, Multinational corporate interests, and not Main Street USA.

If you understand the basic elements behind the new dimension in American economics, you already understand how three decades of DC legislative and regulatory policy was structured to benefit Wall Street, Multinational corporate interests, and not Main Street USA.

The intentional shift in economic policy is what created distance between two entirely divergent economic engines to the detriment of the American middle-class.

REMEMBER […] there had to be a point where the value of the second economy (Wall Street) surpassed the value of the first economy (Main Street).

Investments, and the bets therein, needed to expand outside of the USA. hence, globalist investing.

However, a second more consequential aspect happened simultaneously. The politicians became more valuable to the Wall Street team than the Main Street team; and Wall Street had deeper pockets because their economy was now larger.

As a consequence Wall Street started funding political candidates and asking for legislation that benefited their multinational interests.

When Main Street was purchasing the legislative influence the outcomes were -generally speaking- beneficial to Main Street, and by direct attachment those outcomes also benefited the average American inside the real economy.

When Wall Street began purchasing the legislative influence, the outcomes therein became beneficial to Wall Street. Those benefits are detached from improving the livelihoods of main street Americans because the benefits are “global”. Global financial interests, multinational investment interests -and corporations therein- became the primary filter through which the DC legislative outcomes were considered.

There is a natural disconnect. (more)

As an outcome of national financial policy blending commercial banking with institutional investment banking something happened on Wall Street that few understand. If we take the time to understand what happened we can understand why the Stock Market grew and what risks exist today as the financial policy is reversed to benefit Main Street.

President Trump and Treasury Secretary Mnuchin have already begun assembling and delivering a new banking system.

President Trump and Treasury Secretary Mnuchin have already begun assembling and delivering a new banking system.

Instead of attempting to put Glass-Stegal regulations back into massive banking systems, the Trump administration is creating a parallel financial system of less-regulated small commercial banks, credit unions and traditional lenders who can operate to the benefit of Main Street without the burdensome regulation of the mega-banks and multinationals. This really is one of the more brilliant solutions to work around a uniquely American economic problem.

♦ When U.S. banks were allowed to merge their investment divisions with their commercial banking operations (the removal of Glass Stegal) something changed on Wall Street.

Companies who are evaluated based on their financial results, profits and losses, remained in their traditional role as traded stocks on the U.S. Stock Market and were evaluated accordingly. However, over time investment instruments -which are secondary to actual company results- created a sub-set within Wall Street that detached from actual bottom line company results.

The resulting secondary financial market system was essentially ‘investment markets’. Both ordinary company stocks and the investment market stocks operate on the same stock exchanges. But the underlying valuation is tied to entirely different metrics.

Financial products were developed (as investment instruments) that are essentially wagers or bets on the outcomes of actual companies traded on Wall Street. Those bets/wagers form the hedge markets and are [essentially] people trading on expectations of performance. The “derivatives market” is the ‘betting system’.

♦Ford Motor Company (only chosen as a commonly known entity) has a stock valuation based on their actual company performance in the market of manufacturing and consumer purchasing of their product. However, there can be thousands of financial instruments wagering on the actual outcome of their performance.

There are two initial bets on these outcomes that form the basis for Hedge-fund activity. Bet ‘A’ that Ford hits a profit number, or bet ‘B’ that they don’t. There are financial instruments created to place each wager. [The wagers form the derivatives] But it doesn’t stop there.

Additionally, more financial products are created that bet on the outcomes of the A/B bets. A secondary financial product might find two sides betting on both A outcome and B outcome.

Party C bets the “A” bet is accurate, and party D bets against the A bet. Party E bets the “B” bet is accurate, and party F bets against the B. If it stopped there we would only have six total participants. But it doesn’t stop there, it goes on and on and on…

The outcome of the bets forms the basis for the tenuous investment markets. The important part to understand is that the investment funds are not necessarily attached to the original company stock, they are now attached to the outcome of bet(s). Hence an inherent disconnect is created.

Subsequently, if the actual stock doesn’t meet it’s expected P-n-L outcome (if the company actually doesn’t do well), and if the financial investment was betting against the outcome, the value of the investment actually goes up. The company performance and the investment bets on the outcome of that performance are two entirely different aspects of the stock market. [Hence two metrics.]

♦Understanding the disconnect between an actual company on the stock market, and the bets for and against that company stock, helps to understand what can happen when fiscal policy is geared toward the underlying company (Main Street MAGAnomics), and not toward the bets therein (Investment Class).

The U.S. stock markets’ overall value can increase with Main Street policy, and yet the investment class can simultaneously decrease in value even though the company(ies) in the stock market is/are doing better. This detachment is critical to understand because the ‘real economy’ is based on the company, the ‘paper economy’ is based on the financial investment instruments betting on the company.

Trillions can be lost in investment instruments, and yet the overall stock market -as valued by company operations/profits- can increase.

Here’s the critical part – Conversely, there are now classes of companies on the U.S. stock exchange that never make a dime in profit, yet the value of the company increases.

This dynamic is possible because the financial investment bets are not connected to the bottom line profit. (Examples include Tesla Motors, Amazon and a host of internet stocks like Facebook and Twitter.) It is this investment group of companies, primarily driven by technology stocks in the “tech sector” that stands to lose the most if/when the underlying system of betting on them stops or slows.

Specifically due to most recent U.S. fiscal policy, modern multinational banks, including all of the investment products therein, are more closely attached to this investment system on Wall Street. It stands to reason they are at greater risk of financial losses overall with a shift in economic policy.

That financial and economic risk is the basic reason behind Trump and Mnuchin putting a protective, secondary and parallel, banking system in place for Main Street.

Big multinational banks can suffer big losses from their investments, and yet the Main Street economy can continue growing, and have access to capital, uninterrupted.

Bottom Line: U.S. companies who have actual connection to a growing U.S. economy can succeed; based on the advantages of the new economic environment and MAGA policy, specifically in the areas of manufacturing, trade and the ancillary benefactors.

Meanwhile U.S. investment assets (multinational investment portfolios) that are disconnected from the actual results of those benefiting U.S. companies, highly weighted within the tech sector, and as a consequence also disconnected from the U.S. economic expansion, can simultaneously drop in value even though the U.S. economy is thriving. THIS IS EXACTLY what is happening!

.

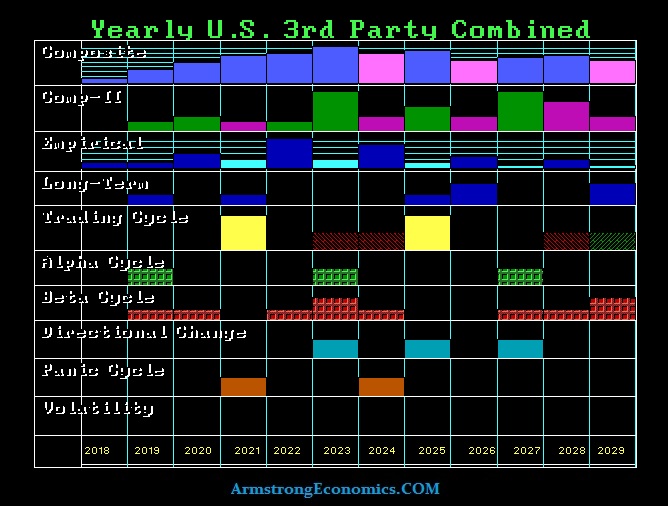

Rising 3rd Party Trend

Armstrong Economics Blog/Politics

Re-Posted Nov 20, 2018 by Martin Armstrong

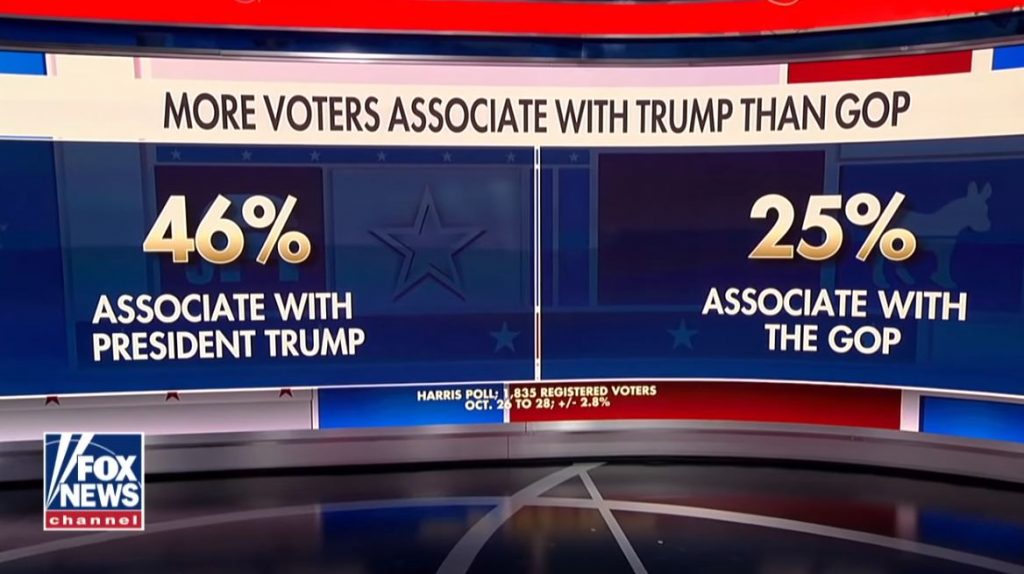

Although the recounts have been going on, the Republicans still seem to be winning both governorships and the Senate. The Blue Wave fizzled out and their victory in the House still produced fewer seats than they held before.

That FOX poll that reported 46% of Republicans identified with Trump rather than the GOP clearly shows that our computer has been correct in not merely forecasting a Trump victory in 2016 and no Blue Wave here in 2018 that would take the Senate and House, but that Trump really is an outsider and interestingly enough is the closest thing there is to a 3rd Party candidate,

The Democratic victory in the House at least placate them from the violence they have been threatening if they lost. But that decorum will not last long. They will turn up the violence into 2020 and as out computer is showing, we may see a significant rise into 2023/4 with more and more people becoming independent. In the end, the question becomes: Is there a Third Party Solution

November 21st, 2018 Pi Target

Armstrong Economics Blog/ECM

Posted Nov 19, 2018 by Martin Armstrong

There are so many things happening in the political world it is next to impossible to figure out what is going to be the focal point for the Pi target since perhaps it could be a combination. The lastest hat being thrown into the ring is the European Commission is planning to enter their sanctions against Italy. As it stands currently, they have proposed disciplining Italy under EU fiscal rules on November 21st, 2018, unless the country’s government agrees to change its draft budget plan according to EU dictates. This could set in motion a drop in Italian debt which may force the ECB to buy more Italian debt or stand back and watch rates go crazy. This may also be the starting point of sending Italy into an exit position from the EU. In the weeks and months from now, we will be able to see that this was the turning point if this takes place.

Broward Counts Wrong Ballots – Supervisor Brenda Snipes Blames Criticism on Racism…

November 17, 2018

Let it not be said this wasn’t transparently predictable. After missing the deadline for reporting the official machine ballot count, the hand-count in Broward County had to be halted when officials noticed the staff were counting the wrong ballots today. This comes on the heels of Broward County Supervisor of Elections claiming her critics were racist.

It’s how she rolls along; year, after year, after year…. and no-one ever puts a stop to her consistent lack of competence, because racism. Yup, you can’t make this stuff up folks.

FLORIDA – […] On Saturday, the volunteers started sorting about 22,000 undervotes and overvotes in the contentious contest for Florida Commissioner of Agriculture.

That came to a grinding halt when lawyers found thousands of overlapping ballots which clearly showed a vote in the agriculture race but were fuzzy in the Senate race. (read more)

This happens the same day SoE Brenda Snipes claims any criticism of her performance, amid years of consistent Broward County election mistakes and chaos, is due to racism:

FLORIDA – […] On Friday, with a hand count of votes under way, about two dozen protesters continued their vigil in a car park outside Snipes’s headquarters. Some claimed without evidence that she had missed the deadline deliberately because the results she oversaw boosted Scott’s overall lead.

In a short interview, Snipes, 75, said: “You know, the protesters have been claiming stuff all week so whatever they’re doing, that’s what they’re doing. That’s what they feel like they need to do.”

Asked if she felt it was racially motivated, the supervisor replied: “Probably. Probably.” She declined to elaborate.

Snipes had promised “100%” in a CNN interview earlier this week that Broward county, a Democratic stronghold, would complete its machine recount on time. It appeared to do so with just under 15 minutes to spare before Thursday’s 3pm deadline. The recount showed Scott, currently the Republican governor of Florida, down 606 votes from the first count and Nelson down 1,385 – a net gain for Scott of 779 votes.

But mysteriously, Snipes only sent the results to the Florida secretary of state at 3.02pm on Thursday, rendering the entire exercise a waste of time and money. (read more)

Illinois Thinking About Imposing a Stiff Exit Tax to Leave?

Armstrong Economics Blog/The Hunt for Taxes

Re-Posted Nov 17, 2018 by Martin Armstrong

The politicians in Illinois after destroying the state economically, want to now impose an EXIT tax for anyone who dares to think about leaving the state. This is the problem we face. They will never look at the long-term impact of their decisions. Such a tax may make others decide NOT to move to the state and then watch property values really crash.

All they think about is just to survive to the next election. There are those in the ranks who want to impose taxes on every trade in Chicago. Talk about no taxation without representation. So anyone trading on a Chicago exchange from around the world has to be taxed by Illinois without a right to vote?

Cryptography

Armstrong Economics Blog/Cryptocurrency

Re-Posted Nov 17, 2018 by Martin Armstrong

COMMENT: Mr. Armstrong, I have to say that Bitcoin has crashed again because the IMF says each country should create its own cryptocurrency. That would kill all the cryptocurrencies and you were right again. Governments will never surrender their power to Bitcoin.

COMMENT: Mr. Armstrong, I have to say that Bitcoin has crashed again because the IMF says each country should create its own cryptocurrency. That would kill all the cryptocurrencies and you were right again. Governments will never surrender their power to Bitcoin.

Thank you for your realistic perspective

DT

REPLY: I really do not get these people. They are dreamers. Of course, governments will not surrender. Their own pensions are at stake. The majority of transactions are already electronic. You just take a picture of your check and deposit it electronically without having to go to the bank. Separate the technology from power